Highlights of Economic Survey 2024-25

Union Finance Minister, Nirmala Sitharaman, presented the Economic Survey 2024-25 on 31 January 2025.

Economic Survey 2024-25 has following thirteen chapters.

| 1. State of the Economy: Getting Back into the Fast Lane | 2. Monetary and Financial Sector Developments: The Card and the Horse |

| 3. External Sector: Getting FDI Right | 4. Prices and Inflation: Understanding the Dynamics |

| 5. Medium-Term Outlook: Deregulation Drives Growth | 6. Investment and Infrastructure: Keeping it Going |

| 7. Industry: All about Business Reforms | 8. Services -New Challenges for the Old War Horse |

| 9. Agriculture and Food Management: Sector of the Future | 10. Climate & Environment: Adaptation Matters |

| 11. Social Sector -Extending reach and driving empowerment | 12. Employment and Skill Development: Existential priorities |

| 13. Labour in the AI Era: Crisis or Catalyst? |

|

Chapter-wise highlights of Economic Survey 2024-25 are given below.

Chapter 1. State of the Economy: Getting Back into the Fast Lane

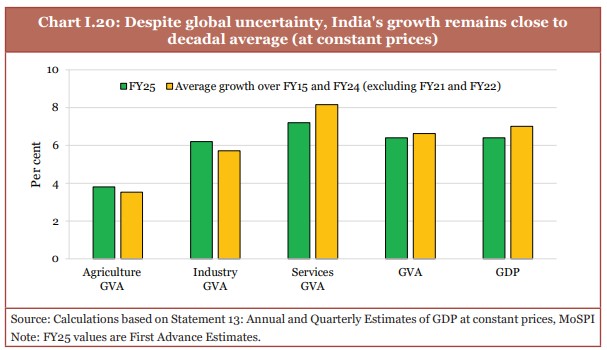

- India's real GDP and gross value added (GVA) both are estimated to grow by 6.4 per cent in FY25 (as per first advance estimates of national income).

- The real GDP growth in FY26 will be between 6.3 and 6.8 per cent.

(Source: Economic Survey 2024-25)

- Retail headline inflation has declined from 5.4 per cent in FY24 to 4.9 per cent in April –December 2024.

- Capital expenditure grew from FY21 to FY24.

- During July –November 2024, capital expenditure grew YOY by 8.2 per cent.

- India's share in global services exports is seventh-largest.

- Non-Petroleum and non-Gems & Jewellery exports increased by 9.1 per cent during April to December 2024.

- Global economic growth on an average was 3.3 per cent in 2023.

(Source: Economic Survey 2024-25)

Chapter 2. Monetary and Financial Sector Developments: The Card and the Horse

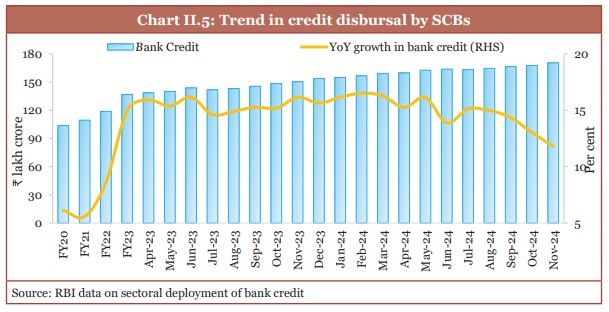

- Bank credit has grown at a steady rate.

- Credit growth improved faster than nominal GDP growth for two continuous years.

- The credit-GDP difference became less wide to (-) 0.3 per cent in Q1 of FY25 from (-) 10.3 per cent in Q1 of FY23.

(Source: Economic Survey 2024-25)

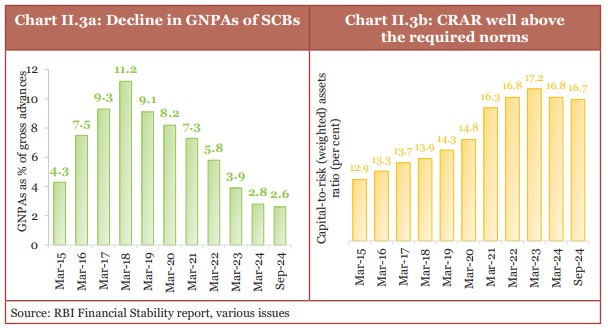

- Profitability of Scheduled Commercial Banks improved.

- There has been an increase in capital to risk weighted asset ratio (CRAR).

- The gross non-performing assets (GNPAs) of Scheduled Commercial Banks fell to a 12-year low level of 2.6 per cent of gross loans and advances at September 2024-end.

(Source: Economic Survey 2024-25)

- BSE stock market capitalisation to GDP ratio was 136 per cent at December 2024-end.

- This ratio was greater than China (65 per cent) and Brazil (37 per cent).

- In India, total insurance premiums grew by 7.7 per cent in FY24 and reached ₹11.2 lakh crore.

- In India's pension sector, total number of pension subscribers grew by 16 per cent (YoY) as of September 2024.

- RBI’s Financial Inclusion Index improved from 53.9 in March 2021 to 64.2 by March 2024.

- Number of demat accounts increased by 33% at December 2024-end on a YoY basis.

- Number of unique mutual fund investors doubled from FY21 to 5.6 crore as of December 2024.

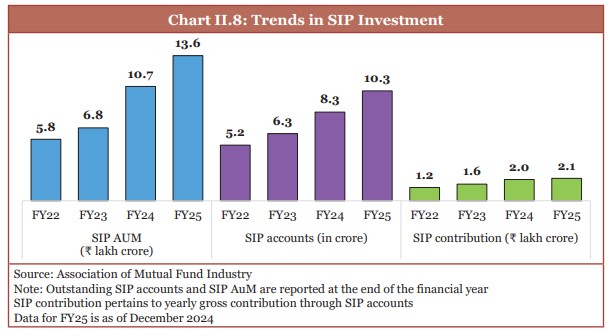

- Monthly average gross SIP flows more than doubled in the last three years from FY22 to ₹0.23 lakh crore as of December 2024.

(Source: Economic Survey 2024-25)

Chapter 3. External Sector: Getting FDI Right

- In the first nine months of FY25, India's merchandise and services exports growth: 6 % (YOY)

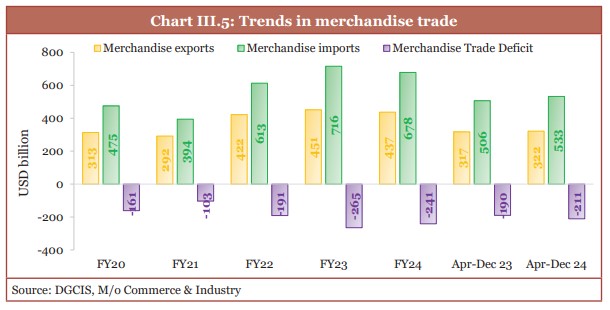

- The merchandise trade deficit widened to USD 210.8 billion in April-December 2024.

- Faster rise in merchandise imports compared to exports contributed to this widening.

(Source: Economic Survey 2024-25)

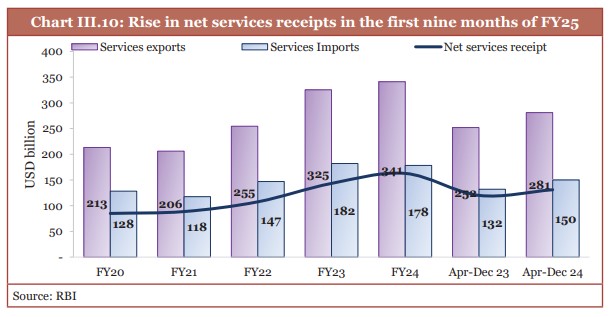

- During April–November FY25, India’s services export growth increased to: 12.8%

- India's share in global export market in ‘Telecommunications, Computer, & Information Services’: 10.2%

- Services sector exports grew at 11.6 per cent in the first nine months of FY25.

(Source: Economic Survey 2024-25)

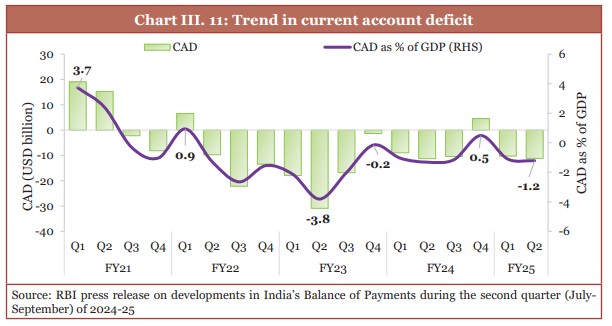

- India’s current account deficit (CAD) in Q2 of FY25: 1.2% of GDP

- The recent increase in the CAD can be said to be the result of a rise in the merchandise trade deficit.

- The increasing net services receipts and rise in private transfer receipts softened the effect of rise in the merchandise trade deficit.

(Source: Economic Survey 2024-25)

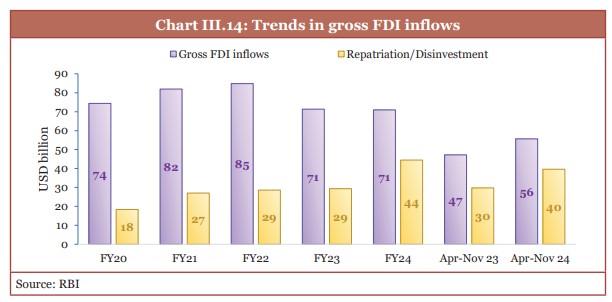

- Gross foreign direct investment (FDI) inflows signaled revival in the first eight months of FY25.

- Net FDI inflows declined relative to April-November 2023 because of an increase in repatriation/disinvestment.

- FDI inflows into India have reached over the USD 1 trillion level from April 2000 to September 2024.

- In first eight months of FY25, Gross Foreign Direct Investment (FDI) inflows in FY25 increased to: USD 55.6 billion (YoY growth of 17.9%)

- Services sector leads FDI inflows with 19.1% share in H1 FY25.

- Services sector is followed by technology, trading and non-conventional energy.

- Consultancy services (3.2%), Automobile industry (3.2%) and Hospital & diagnostic centers (3.1%) came at last.

(Source: Economic Survey 2024-25)

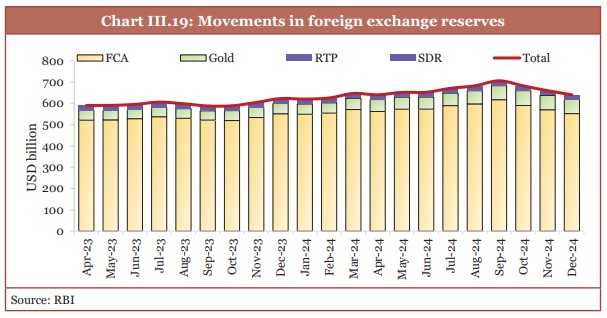

- As of the end of December 2024, India’s FOREX reserves were at USD 640.3 billion.

- These were enough to cover approximately 90 per cent of the country’s external debt.

- The external debt to GDP ratio stood at 19.4 per cent at September 2024-end.

(Source: Economic Survey 2024-25)

Chapter 4. Prices and Inflation: Understanding the Dynamics

- As reported by the IMF, the rate at which a fall in the value of money and a general increase in prices happens at global level became less extreme from peak of 8.7% in 2022 to 5.7% by 2024.

- India's retail inflation declined from 5.4 per cent in FY24 to 4.9 per cent in FY25 (April-December 2024), with the decrease believed to be the result of a decline in input prices.

(Source: Economic Survey 2024-25)

- RBI has forecasted that headline inflation will be 4.2 per cent in FY26.

- RBI and IMF have forecasted that India’s consumer price inflation will steadily and continuously change towards Government of India's official inflation target of around 4 per cent in FY26.

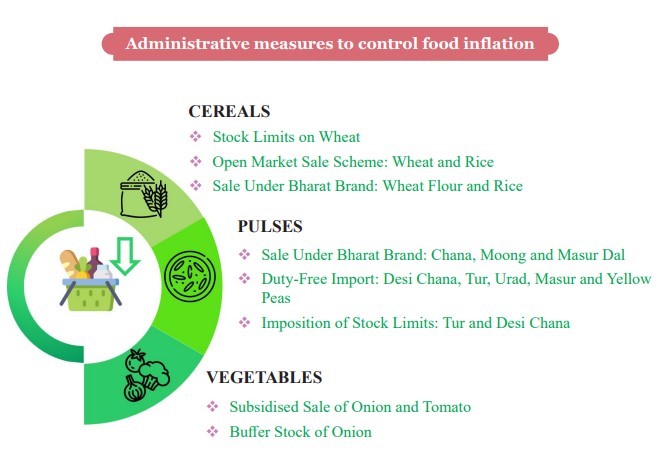

- Headline and food inflation driven by few food items such as vegetables and pulses.

- Vegetables and pulses contributed 32.3% to the overall inflation in FY25 (April to December).

(Source: Economic Survey 2024-25 Highlights)

Chapter 5. Medium-Term Outlook: Deregulation Drives Growth

- To be a Viksit Bharat by 2047, India needs a growth rate of around 8% at constant prices, on average, for about a decade or two.

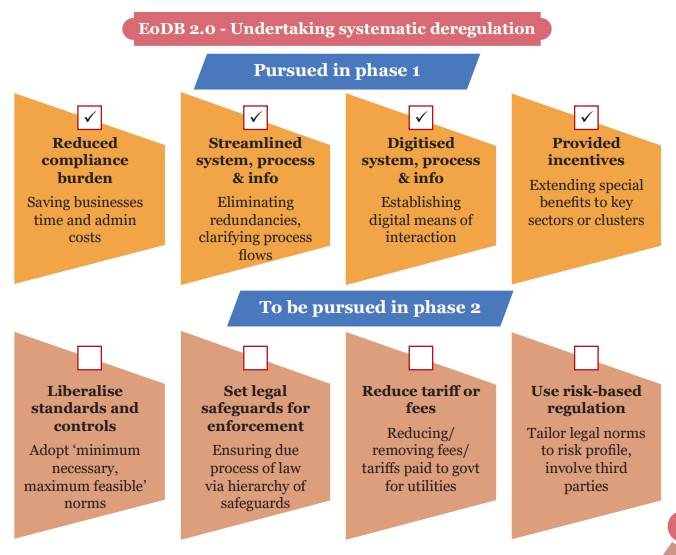

- India to focus on systematic deregulation. Economic survey 2024-25 calls for enhanced deregulation for micro, small and medium enterprises.

- Deregulation raises investment efficiency. And deregulation gives more economic freedom to individuals and enterprises.

- The survey adds that the Union Government has undertaken deregulation.

- The survey highlights that Ease of Doing Business (EoDB) 2.0 should be a state government-led initiative.

(Source: Economic Survey 2024-25 Highlights)

Chapter 6. Investment and Infrastructure: Keeping it Going

- Union government’s capital expenditure (capex) on major infrastructure sectors has shown 38.8 per cent growth rate from FY20 to FY24.

- Between April and October 2024, 17 new pairs of Vande Bharat trains were added to railway network.

- 5853 km of National Highways was added to road infrastructure in FY25 (April-Dec).

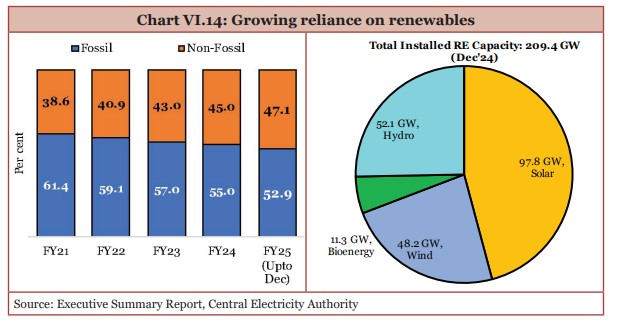

- Renewable energy capacity of solar and wind power increased by 15.8 per cent year-on-year by December 2024.

- Renewable energy’s share in India’s total installed capacity is now 47 per cent.

(Source: Economic Survey 2024-25)

- Under Phase II of the Swachh Bharat Mission-Grameen, 1.92 lakh villages were incrementally declared ODF Plus under the model category during April to November 2024.

- This increased the total number of ODF Plus villages to 3.64 lakh.

- Jal Jeevan Mission has provided piped drinking water to over 12 crore families since its launch in 2019.

(Source: Economic Survey 2024-25 Highlights)

Chapter 7. Industry: All about Business Reforms

- The industrial sector grew by 6.2 per cent in FY25.

- Although production of capital goods fluctuated between FY20 and FY23, it has shown a robust growth in FY24.

(Source: Economic Survey 2024-25)

- Government is promoting Smart Manufacturing and Industry 4.0, supporting Smart Advanced Manufacturing and Rapid Transformation Hub (SAMARTH) Udyog centres establishment.

- Indian automobile domestic sales grew by 12.5% in FY24.

- Pharmaceuticals turnover grew by 10.1% in the last five years.

- Domestic electronic goods production grew by 17.5% from FY15 to FY24.

- 99% of smartphones are manufactured domestically.

- India is presently world’s second largest cement producer after China. India is near self-reliance in cement production.

- Indian pharmaceutical industry is currently the world’s third-largest by volume.

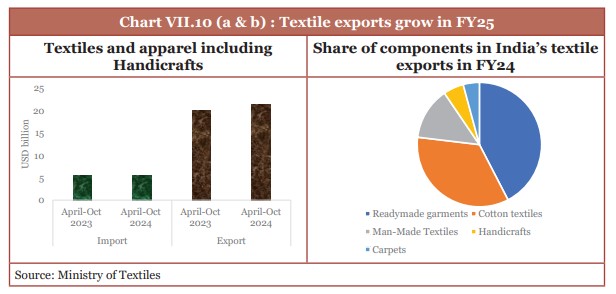

- The textile industry accounts for about 11 per cent of India’s manufacturing GVA.

- India ranks second globally in cotton, silk, and man-made fibre production.

(Source: Economic Survey 2024-25)

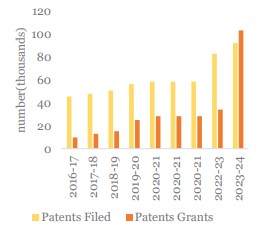

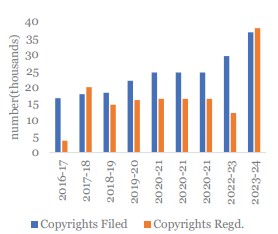

- India ranks sixth among top 10 patent filing offices globally.

- Patent filing increased by more than 2-fold since 2014-15.

- Domestic educational institutes’ patent filings have tripled from 2021-22 to FY24.

- Women applicants’ patent filings grew from 15 in FY15 to 5183 in FY24.

- There is a more than 17-fold increase in patent grants from 2014-15.

- India's Global Innovation Index ranking improved from 81st position in 2015 to 39th in 2024 among 133 economies.

(Source: Economic Survey 2024-25)

Chapter 8. Services -New Challenges for the Old War Horse

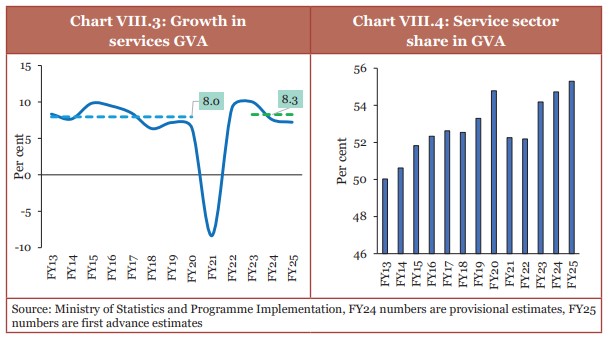

- The share of services in India’s GVA has increased from 50.6% in FY14 to 55.3% in FY25 (FY2024-25).

- It provides employment to nearly 30% of the workforce.

- Services sector’s average growth rate increased slightly from 8% in the pre-pandemic years (FY13 -FY20) to 8.3% in post-pandemic period (FY23–FY25).

- During decade (FY13–FY23), growth rate of information and computer-related services was 12.8% and their share in total GVA grew from 6.3% to 10.9%.

(Source: Economic Survey 2024-25)

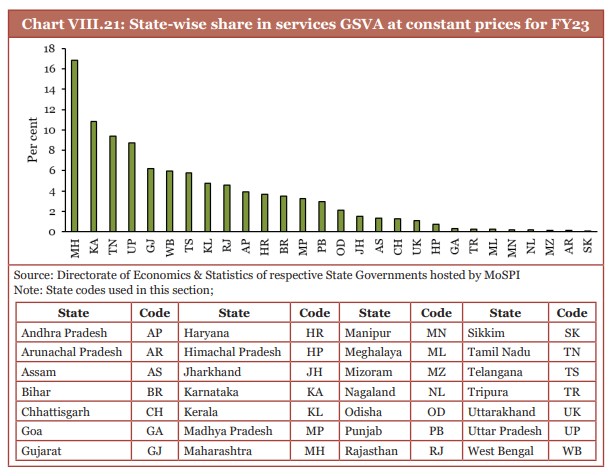

- For FY23, Karnataka and Maharashtra are more than one fourth part of the total service sector GSVA of all the states.

- For FY23, Karnataka and Maharashtra, Tamil Nadu, Uttar Pradesh, and Gujarat together share more than 50 per cent of the total service sector GSVA.

- Maharashtra (Mumbai), Tamil Nadu, Gujarat (GIFT City), and Karnataka account for over half of the financial services GSVA, indicating a strong concentration of financial services at these places.

(Source: Economic Survey 2024-25)

- India’s share in global services exports has increased from 1.9% in 2005 to 4.3% in 2023.

- From FY14 to FY23, services export grew at rate of 11% at constant prices.

- Approximately 70 percent of India's services exports are business and computer services.

- The credit growth to the services sector was 13% year over year.

- The service sector has been in the expansionary zone for 41 consecutive months since August 2021, as per HSBC's India services PMI.

- In FY23, tourism sector’s share in GDP again came at its pre-pandemic level of 5%.

- India is the fastest-growing aviation market globally.

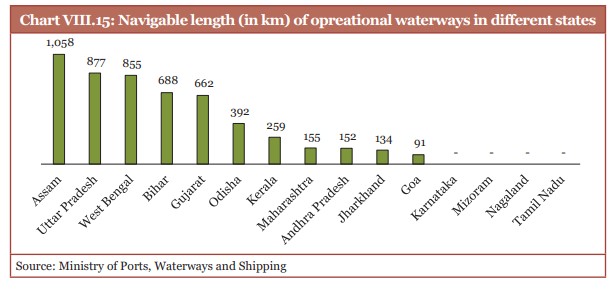

- The total navigable length of India’s waterways is nearly 14,850 km.

- As of October 2024, India has 26 operational waterways with over 4,800 km.

(Source: Economic Survey 2024-25)

Chapter 9. Agriculture and Food Management: Sector of the Future

- The ‘Agriculture and Allied Activities’ sector accounts for approximately 16% of India’s GDP for FY24 (PE) at current prices.

- The ‘Agriculture and Allied Activities’ sector supports about 46.1% of the population.

- In recent years, India’s agriculture sector growth averaged 5% annually from FY17 to FY23.

- Highest compound annual growth rate (CAGR) has been seen in fisheries sector (8.7%), followed by livestock (8% CAGR).

- The share of non-institutional credit has reduced from 90 per cent in 1950 to around 25.0 per cent in FY22.

- Share of institutional credit increased to 75% in FY22.

(Source: Economic Survey 2024-25)

Chapter 10. Climate & Environment: Adaptation Matters

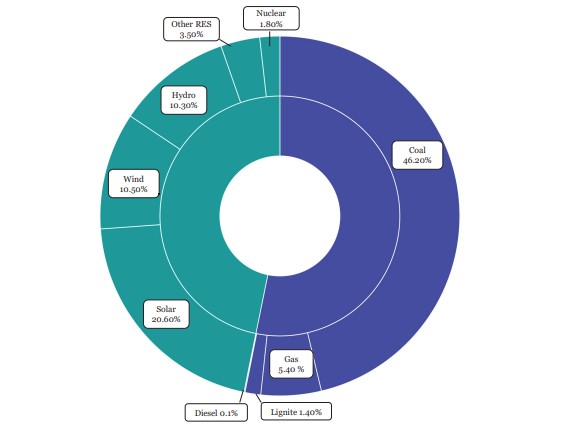

- India’s installed electricity generation capacity accounts for 46.8 percent of the total capacity as of 30 November 2024.

- By 2030, Lifestyle for Environment (LiFE) measures are estimated to save consumers around USD 440 billion globally.

- Latest Forest Survey of India 2024 estimates India to have overall carbon sink of 30.43 billion tonnes of CO2 equivalent in 2023, as compared to 2005.

- In 2005, carbon sink was estimated to be 28.14 billion tonnes of CO2 equivalent.

- India’s NDC target is to raise carbon sinks by 2.5 to 3 billion tonnes of CO2 equivalent by 2030.

India’s Installed Generation Capacity (fuel-wise) (30-11-2024) (Source: Economic Survey 2024-25)

Chapter 11. Social Sector -Extending reach and driving empowerment

- The social services expenditure by central and state governments grew at a compound annual growth rate (CAGR) of 15% from FY21 to FY 25.

- Expenditure on education increased at a CAGR of 12 per cent from FY21 to FY25.

- Expenditure on health increased at CAGR 18 per cent from FY21 to FY25.

- Gini coefficient is a measure of inequality in consumption expenditure.

- For rural areas, Gini coefficient fell from 0.266 in 2022-23 to 0.237 in 2023-24.

- For urban areas, Gini coefficient declined from 0.314 in 2022-23 to 0.284 in 2023-24.

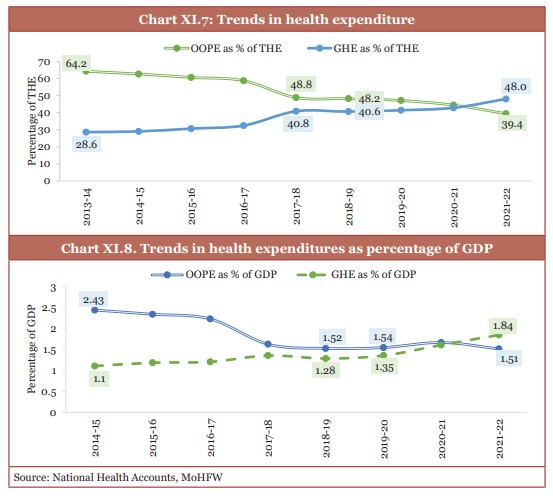

- Share of government health expenditure (GHE) in total health expenditure increased from 29.0 per cent to 48.0 per cent between FY15 and FY22.

- Share of out-of-pocket expenditure (OOPE) in total health expenditure fell from 62.6 per cent to 39.4 per cent between FY15 and FY22.

(Source: Economic Survey 2024-25)

Chapter 12. Employment and Skill Development: Existential priorities

- Unemployment rate has fallen from 6.0 per cent in 2017-18 (July-June) to 3.2 per cent in 2023-24 (July-June).

- Economic Survey says as per NITI Aayog, the gig workforce is projected to reach 23.5 crore by 2029-30.

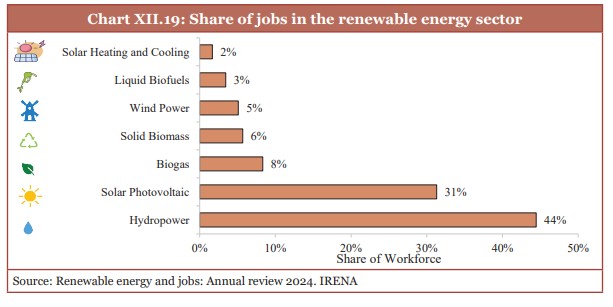

- Sectors offering vast potential for creating high-quality jobs are the digital economy and renewable energy.

- It is projected that India’s digital economy will surpass USD one trillion by 2025.

- The largest employer in India’s renewable sector is hydropower.

- It accounts for 20% of the global total and ranks second only to China.

(Source: Economic Survey 2024-25)

Chapter 13. Labour in the AI Era: Crisis or Catalyst?

- Developers of Artificial Intelligence (AI) promise to usher in a new age.

- The future revolves around 'Augmented Intelligence'.

- In Augmented Intelligence, both human and machine capabilities are integrated.

- Global corporate investments in all types of AI stood at USD 761 billion between 2021 and 2023.

- Annual global private investments in Generative AI increased from approximately USD 3 billion in 2022 to USD 25.2 billion by the end of 2023.

- As per estimates of International Labour Organisation, about 75 million jobs globally are at complete risk of automation due to AI.

- As estimated by NASSCOM, Indian AI market growth will be in the range of 25 to 35 per cent CAGR by 2027.

Latest

Latest

Comments