1. RBI provides regulatory benefits to all banks

- Under the Special Liquidity Facility for Mutual Funds (SLF-MF) scheme, the regulatory benefits have been provided to all banks by the Reserve Bank of India.

- In order to ease liquidity pressure on Mutual Funds, RBI has announced ₹ 50,000 crore SLF-MF scheme.

- The scheme has been launched in the wake of the decision by Franklin Templeton Mutual Fund to shut down various schemes.

- The banks which are meeting their liquidity requirements through any of the given below ways are eligible to claim regulatory benefits under this scheme:

- Extending loans

- Undertaking outright purchase of repos against the collateral of investment grade corporate bonds, commercial papers, debentures, certificate of deposits held by Mutual Funds

2. National e-commerce marketplace ‘bharatmarket’ to be launched soon

- Confederation of All India Traders (CAIT) will soon launch a pan-India e-commerce platform ‘bharatmarket’.

- The platform will be of traders, by the traders, for the traders and consumers.

- The national e-commerce platform will be launched in collaboration with various technology partners.

- The platform will provide end-to-end logistics services, deliveries at home, etc.

- The aim of the portal is to bring 95% of the retail traders together to run the portal.

- CAIT is an apex body of the Trading Community of India at the National level. Its headquarters is located in New Delhi. The National President of CAIT is Mr. B.C Bhartia.

3. 200 new mandis join e-NAM platform

- 200 new mandis from seven states viz. Rajasthan, Tamil Nadu, Uttar Pradesh, Gujarat, Odisha, Andhra Pradesh, Karnataka, have joined e-NAM platform.

- Karnataka has been included in the list of e-NAM states for the first time.

- The total number of e-NAM mandis now become 785.

- These new mandis will be able to use technology for marketing their agricultural produce.

- e-NAM is a national electronic trade portal that was launched in 2016. It helps in better price discovery and facilitates online trading for farmers, traders and buyers.

4. Lockdown 3.0 announced till May 17

- The lockdown has been extended beyond May 3 till May 17 so as to deal with COVID-19.

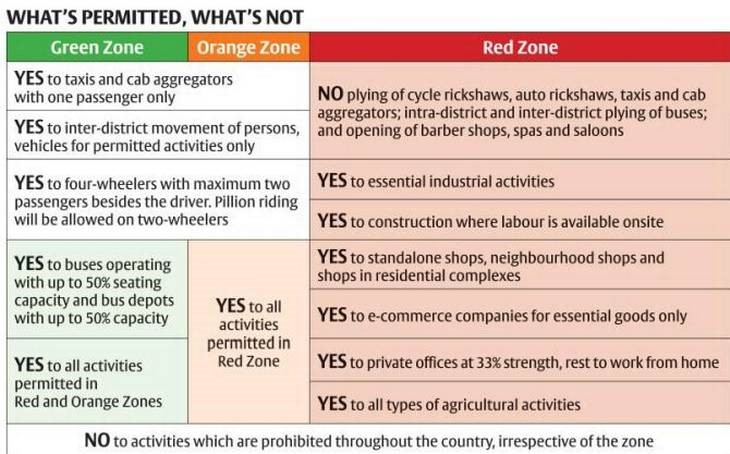

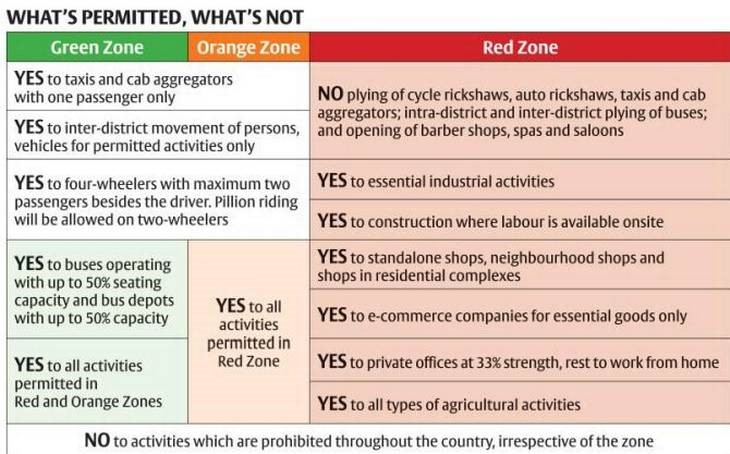

- Lockdown 3.0 will be effective from May 4 with some relaxations zone wise viz. Green Zone, Orange Zone, Red Zone.

- Green Zones are the districts with zero confirmed cases or no confirmed case in the last 21 days.

- Red Zones are the districts identified based on the total number of active cases, doubling rate of confirmed cases, extent of testing, etc.

- Orange Zones are the districts that are neither in the red nor green zone.

- At present, 319 districts are in green zone, 284 in orange zone and 130 in red zone.

- There will be a sort of curfew from 7 pm to 7 am nationwide i.e. non-essential activities will be prohibited during this time.

(Source: The Hindu Business Line)

5. IDFC First Bank to raise funds

- IDFC First bank plans to raise funds around ₹2,000 crore through preferential allotment of shares and increase in authorized capital.

- The shares will be allotted to five investors on a preferential basis. These five investors are IDFC Financial Holding Company Ltd, ICICI Prudential Life Insurance, Dayside Investment, Warburg Pincus group HDFC Life Insurance and Bajaj Allianz Life Insurance.

- The infusion of capital will increase the capital adequacy to 15.5%.

- IDFC First Bank is headquartered in Mumbai. MD & CEO of the bank is V Vaidyanathan.

Previous

Previous

Latest

Latest

Comments