Topic: Appointments

1. Ajay Kumar Srivastava took charge as the MD & CEO of Indian Overseas Bank.

- He has become the MD and CEO of the bank for three years with effect from January 1, 2023.

- In September 2022, the Centre promoted Srivastava as MD and CEO of Indian Overseas Bank (IOB).

- He has replaced Partha Pratim Sengupta as MD and CEO.

- Indian Overseas Bank is a nationalized bank headquartered in Chennai. It is a public sector bank. It was founded in 1937.

Topic: RBI

2. RBI released fifth volume of Reserve Bank history (1997-2008) on 19 December 2022.

- The fifth volume covers the 11-year period from 1997 to 2008.

- The process of preparation of this volume was started by RBI in 2015 under guidance of an Advisory Committee.

- Dr. Narendra Jadhav, former Member of Parliament and former Principal Adviser & Chief Economist of the Reserve Bank chaired this committee.

- A team of writers led by the economic historian Dr. Tirthankar Roy has prepared the volume.

- Other members of the team were K. Kanagasabapathy, N. Gopalaswamy, F. R. Joseph and S.V.S. Dixit.

- It covers the tenures of three Governors. It covers the latter part of Dr. C. Rangarajan’s tenure, the complete tenure of Dr. Bimal Jalan and a major part of Dr. Y. V. Reddy’s tenure.

Topic: Indian Economy/Financial Market

3. India's unemployment rate risen to highest level in the last 16 months.

- According to the data from the Centre for Monitoring Indian Economy (CMIE), the overall unemployment rate has increased from 8% in November to 8.3% in December.

- The urban unemployment rate has increased from 8.96% in November to 10.09% in December.

- The rate of rural unemployment has decreased from 7.55% in November to 7.44% in December.

- The unemployment rate had decreased to 7.2% in the July-September quarter.

- The unemployment rate has risen to 37.4% in Haryana, followed by 28.5% in Rajasthan and 20.8% in Delhi.

Topic: Reports and Indices

4. India's manufacturing output reached to a 13-month high.

- India’s manufacturing sector activity hit to a 13-month high in December.

- S&P Global India Manufacturing Purchasing Managers’ Index (PMI) was at 57.8 in December, it was up from 55.7 of November.

- PMI data for December points towards an improvement in overall operating conditions for the 18th continued month.

- As per the survey, Advertising, product diversification and favourable economic conditions supported sales growth.

- For the third quarter of the current fiscal year, the PMI average was recorded highest in a year.

- The output of eight core sector industries grew by 5.4 percent in November.

- The cost pressures remained relatively low in December and the overall inflation rate was the second slowest since September 2020.

- PMI is a survey-based indicator of business conditions. It includes measures of business output, new orders, employment, costs, selling prices, etc.

- In PMI, score below 50 indicates contraction while score above 50 indicates expansion.

- The S&P Global India Manufacturing PMI is compiled by S&P Global.

Topic: Corporates/Companies

5. Indian state-run companies will remain exempt from the minimum public shareholding (MPS) norm according to a government notification.

- MPS norm requires listed companies to maintain a 25% public shareholding.

- However, the exemptions granted will be valid for a specified period even in case of change in ownership or control after the exemption is granted.

- Extending the exemption granted to the state-run companies in case they are privatised may attract investors to purchase a stake in government companies.

Topic: Taxation

6. Gujarat AAR has ruled food-beverages prepared in a restaurant will attract 5% GST.

- Gujarat’s Authority for Advanced Ruling (GAAR) has ruled that 5% GST is irrespective of whether they are consumed inside the restaurant or part of takeaway.

- If the beverage is not prepared in restaurant but served over the counter will attract GST of individual items.

- AAR rulings are applicable on applicant and jurisdictional tax official concerned. But they can be relied upon in similar matters.

Topic: Banking System

7. SBI, ICICI, and HDFC Bank remained systemically important banks.

- The top three Indian lenders - State Bank of India, ICICI Bank, and HDFC Bank continue to be domestic systemically important banks (D-SIBs).

- RBI places these banks in appropriate buckets upon their Systemic Importance Scores (SISs).

- ICICI Bank and HDFC Bank have been placed in the first bucket while the SBI has been placed in the third bucket.

- ICICI Bank and HDFC Bank have to maintain additional CET1 at 0.20 per cent of their RWAs.

- SBI has to maintain Additional Common Equity Tier 1 (CET1) at 0.60 per cent of its Risk Weighted Assets (RWAs).

- The additional CET1 requirement for D-SIBs has become fully effective from 1 April 2019.

- In 2014, RBI had issued the framework for dealing with Domestic Systemically Important Banks.

- RBI is required to disclose the name of the bank designated as D-SIB under the D-SIB framework.

- SBI and ICICI Bank had become D-SIBs in 2015 and 2016. HDFC Bank was also classified as a D-SIB in 2017.

- SIBs are perceived as ‘Too Big To Fail’ and their functioning is critical for essential banking services in the Indian Economy.

Topic: Miscellaneous

8. Supreme Court upheld Centre's decision of demonetization of 500 and 1000 rupees.

- A five-judge constitution bench dismissed 58 petitions challenging the central government's demonetisation decision.

- The bench headed by Nazeer said that this decision is of the economic policies of the government, so it cannot be changed.

- Delivering the verdict on the basis of majority, Justice B.R. Gavai said that the decision of the central government is correct, because before this there was a consultation between the government and the Reserve Bank.

- Justice S. Abul Nazir, B.R. Gavai, A.S. Bopanna, V.P. Ram Subrahmanyam and B.V. Nagaratna's five-judge constitution bench was hearing several petitions challenging the Centre's decisions.

- Justice Nagaratna dissented from the judgment.

- The government had told the court in an affidavit that the objective of demonetisation was to curb circulation of fake currency, black money, tax evasion and funding of terrorist activities.

- Government had decided to demonetise ₹500 and ₹1,000 currency notes through a gazette notification on November 8, 2016.

Topic: Taxation

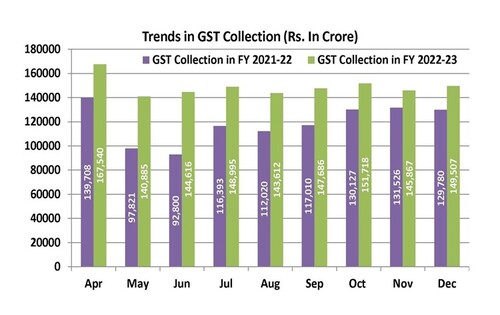

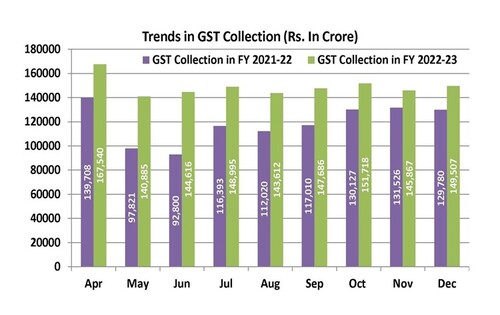

9. The government collected nearly one lakh 50 thousand crore rupees as GST revenue in December 2022.

- As per Finance Ministry, GST revenues in December 2022 are 15% higher than the GST revenues in December 2021.

- During December 2022, revenue from the import of goods was 8% higher than revenue from the import of goods during December 2021.

- During December 2022, revenue from the domestic transaction was 18% higher than the revenue from the domestic transaction during December 2021.

- As per the Ministry, the total revenue of the Centre is 63,380 crore rupees and the States is 64,451 crore rupees after regular settlements in December, last year.

(Source: News on AIR)

Topic: Miscellaneous

10. International Year of Millets (IYM) - 2023 began with focused activities.

- The Government of India under the leadership of the Prime Minister had submitted the proposal for the International Year of Millets (IYM) - 2023, which was accepted by the United Nations General Assembly (UNGA).

- Apart from this, Prime Minister Shri Narendra Modi has also shared his vision to establish India as a 'Global Hub for Millets' as well as to make IYM-2023 a 'Jan Andolan'.

- Several evidences for the consumption of millet during the Indus Valley Civilization suggest that it was one of the first crops to be cultivated in India.

- Millet is currently produced in more than 130 countries.

- Earlier in April 2018, millet was promoted as a "nutritional grain".

- After this, the year 2018 was declared the National Millet Year.

- The global market for millets is estimated to grow at a CAGR of 4.5 percent during the forecast period, 2021-2026.

Previous

Previous

Latest

Latest

Comments