Topic: Banking System

1. UPI Safety and Awareness Week and Month has been announced by NPCI.

- NPCI and UPI ecosystem have announced the UPI Safety and Awareness initiative in order to raise consumer awareness.

- The National Payments Corporation of India (NPCI) and its ecosystem of leading banks and fintech companies will observe UPI Safety and Awareness Week from February 1 to 7.

- Entire month of February 2022 will be observed as 'UPI Safety and Awareness Month'.

- Under this initiative, NPCI encourages all consumers to adopt the UPI Safety Shield concept, which was developed by the company to educate customers about UPI payments.

- National Payments Corporation of India (NPCI):

- It was formed in 2008 by the Reserve Bank of India (RBI) and the Indian Banks’ Association (IBA).

- It is a “Not for Profit” Company headquartered in Mumbai.

- Its MD & CEO is Dilip Asbe.

Topic: Indian Economy

2. Finance Minister Nirmala Sitharaman presented the Economic Survey 2021-22 in Parliament.

- Agile approach is the central theme of the Economic Survey 2021-22.

- The Preface of Economic Survey 2021-22 takes a bird’s eye view of evolution of the Economic Surveys presented since the first Survey in 1950-51.

- In recent years, the Economic Survey used to be presented in the form of two volumes.

- This has been changed in this Economic Survey to a single volume and a separate volume for the Statistical Appendix.

- The highlights of the Economic Survey are as follows:

- State of the Economy:

- GDP will grow by 8- 8.5 % in 2022-23 and 9.2 % in 2021-22. In 2021-22, export and import will grow by 16.5 % and 29.4 % respectively.

- In 2021-22, agriculture and allied sectors will grow by 3.9 %, and the industry and service sectors will grow by 11.8 % and 8.2 % respectively.

- Consumption will grow by 7.0 % and Gross Fixed Capital Formation (GFCF) will grow by 15 %.

- Fiscal Developments:

- During April to November 2021, Gross Tax Revenue increased by 50 % and revenue receipts of the Central Government increased by 67.2%.

- In 2020-21, the Central Government debt increased from 49.1 % of GDP to 59.3 % of GDP.

- External Sectors:

- India’s external debt rose to US $ 593.1 billion by September 2021 and Foreign Exchange Reserves touched the US $ 633.6 billion till 31 December 2021.

- At present, India has the fourth largest forex reserves after China, Japan, and Switzerland.

- Prices and Inflation:

- In 2021-22 (April to December), Food inflation averaged at a low of 2.9 %. Wholesale inflation rose to 12.5 % during 2021-22.

- The average headline CPI-Combined inflation remain 5.2% in 2021-22 (April-December).

- Sustainable Development and Climate Change:

- India’s overall score on the NITI Aayog SDG India Index and Dashboard has reached 66 in 2020-21 from 60 in 2019-20.

- India ranked third globally in increasing its forest area during 2010 to 2020. India has the tenth largest forest area in the world.

- Industry and Infrastructure:

- IIP has grown by 17.4 % as compared to last year.

- Service Sector GVA is expected to grow by 8.2 % in 2021-22.

- India has become 3rd largest start-up ecosystem in the world after US and China.

- Social Infrastructure and Employment:

- Expenditure on social services by center and state has increased by 6.2 % in 2014-15 to 8.6% in 2021-22.

- Total Fertility Rate (TFR) came down to 2 in 2019-21.

- As per Economic Survey 2021-22, National Land Monetisation Corporation (NLMC) has been incorporated as 100% Government of India owned entity with an initial authorized share capital of 5000 crores rupees and subscribed share capital of 150 crores rupees.

Topic: Indian Economy

3. Union Budget for 2022-23 presented by Finance Minister Nirmala Sitharaman.

- Union Budget for 2022-23 has been presented by Finance Minister Nirmala Sitharaman on 01 February 2022. This was her second successive paperless budget.

- The capital expenditure will increase by 35.4% from Rs 5.54 lakh crore in the current year to Rs 7.50 lakh crore in 2022-23. It will be around 2.9% of GDP.

- Finance Minister said that India’s nominal GDP is expected to grow by 11.1% in the financial year 2022-23 over 2021-22.

- In Union Budget 2022-23, the government has earmarked 68% of capital procurement budget for the domestic defence industry.

- In the Budget Estimates 2021-22, total expenditure was projected at 34.83 lakh crore rupees. Revised Estimate of total expenditure is 37.70 lakh crore rupees.

- The Revised Estimate of capital expenditure is 6.03 lakh crore rupees. In the Budget Estimates, total expenditure in 2022-23 is estimated at 39.45 lakh crore rupees.

- The total receipts other than borrowings are estimated at 22.84 lakh crore rupees.

- Edible oil, wearable electronics, imitation jewellery, polished diamond will be cheaper. Tax relief has been announced to persons with disabilities. There is no change in personal income tax rates.

- In the Railway sector, the government will popularize One Station-One Product concept.

- National Tele Mental Health Programme will be launched. Two lakh Anganwadis will be upgraded to Saksham Anganwadi. Special Economic Zones Act will be replaced with new legislation.

- Finance Minister Nirmala Sitharaman proposed to extend the Emergency Credit Line Guarantee Scheme (ECLGS) till the end of March 2023.

- Government will roll out Raising and Accelerating MSME Performance (RAMP) programme with an outlay of Rs 6,000 crore.

- The Reserve Bank of India (RBI) will issue Digital rupee backed by blockchain technology in FY 2022-23.

- The government proposed to reduce the minimum alternative tax (MAT) for cooperative societies from the current 18.5 % to 15 %.

- At present, the cooperative societies pay MAT at the rate of 18.5 %, while the companies pay at the rate of 15 %.

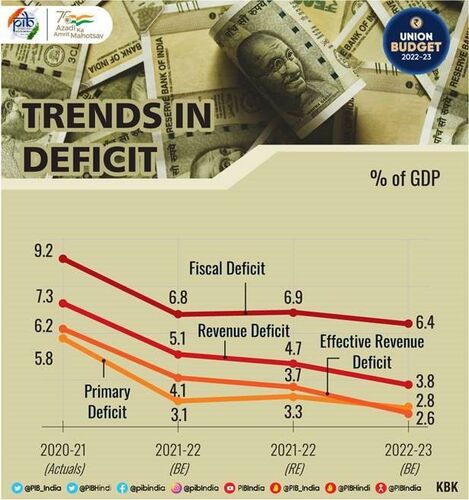

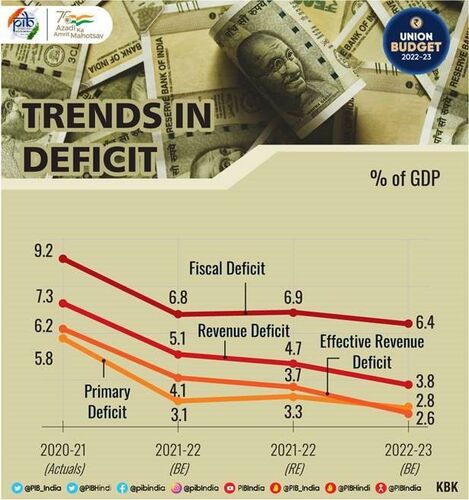

- Union Finance Minister Nirmala Sitharaman announced that the fiscal deficit is estimated to be 6.4% of GDP in 2022-23.

- The government has set a target to reach a fiscal deficit level below 4.5% by 2025-26. The Revised Fiscal Deficit in the current year is estimated at 6.9 % of GDP.

(Source: News on AIR)

Topic: Miscellaneous

4. India’s EXIM Bank and Government of Sri Lanka sign a $500 million Line of Credit agreement.

- India’s Export Import (EXIM) Bank and Government of Sri Lanka have signed a $500 million Line of Credit agreement.

- The agreement is aimed at helping Sri Lanka cope with its fuel shortages.

- Line of Credit is for fuel imports by Sri Lanka from India Sri Lankan government will invite bids from Indian suppliers soon to finalise its import.

- Sri Lanka’s persisting dollar crisis has severely affected its ability to import fuel.

- Export-Import Bank of India (EXIM Bank):

- Export-Import Bank of India (Exim Bank) was established in 1982. Its headquarters are located in Mumbai.

- It is wholly owned by the government of India and was set up to finance, facilitate and promote India’s international trade.

Topic: RBI

5. RBI places restrictions on Indian Mercantile Cooperative Bank Ltd, Lucknow.

- RBI has placed restrictions on Indian Mercantile Cooperative Bank Ltd, Lucknow on 28 January 2022.

- RBI has also placed a limit of ₹1 lakh on withdrawals from all savings bank or current accounts or any other account of a depositor.

- RBI has said that restrictions will remain in force for six months from the close of business on January 28, 2022.

- RBI has imposed a monetary penalty on the banks given below.

- Navbharat Co-operative Urban Bank Ltd., Hyderabad, Telangana.

- Dharamvir Sambhaji Urban Co-operative Bank Ltd., Pune

- National Co-operative Bank Ltd., Mumbai

- Hutatma Sahakari Bank Ltd., Walwa, Sangli

Topic: Indian Economy/Financial Market

6. $300 million Formosa bonds listed by SBI on India INX.

Topic: Reports and Indices

7. LIC is strongest and largest brand in India with a valuation of USD 8.656 billion.

- As per the brand valuation report, LIC is the strongest and largest brand in India with a valuation of USD 8.656 billion (around Rs 64,722 crore). LIC is the third strongest insurance brand globally.

- As per Brand Finance, LIC’s market value will become Rs 43.40 lakh crore or USD 59.21 billion by 2022, and Rs 58.9-lakh crore or USD 78.63 billion by 2027. Brand Finance is a brand consultancy based in London.

- LIC’s brand value rose in overall global brand rankings by 32 places to become the world's 206th most valuable brand in 2021, from 238th place in 2020.

- LIC is also the 10th most valued insurance brand globally. It is the only insurance company in top 10 list. Five Chinese companies are present in top 10 list.

Topic: Banking System

8. Co-branded contactless credit cards launched by PNB and Patanjali Ayurved.

- Co-branded contactless credit cards have been launched by Punjab National Bank (PNB) and Patanjali Ayurved in partnership with NPCI.

- Co-branded contactless credit cards are available on National Payments Corporation of India’s RuPay Platform.

- They are being offered in two variants, PNB RuPay Platinum and PNB RuPay Select.

- PNB RuPay Platinum and PNB RuPay Select cardholders will get a bonus of 300 reward points on activation.

- The cards offer a hassle-free credit service to purchase day-to-day Patanjali products, along with cash backs, loyalty points, insurance cover etc.

Previous

Previous

Latest

Latest

Comments