Topic: MoUs/Agreements

1. NPCI International Payments Ltd has signed a MoU with Greece-based Eurobank S.A.

- The purpose of MoU is to enhance cross-border UPI payments.

- With an emphasis on expediting remittances from Greece to India, the agreement aims to revolutionize the international money transfer process.

- As a result, Greece will be among the first nations in Europe to allow its residents who are from India to send money home quickly and easily using UPI.

- Transactions for foreign inward remittances from Greece to India will be made possible by the agreement.

- In the relevant jurisdictions, it will support the management of fund settlement, reconciliation, and dispute resolution.

- NPCI International Payments Ltd (NIPL) is a subsidiary of National Payments Corporation of India (NPCI). Ritesh Shukla is the CEO of NIPL.

Topic: Banking System

2. Growth in bank credit slowed to 16.2% in January 2024.

- In January 2024, bank credit growth slowed to 16.2% year over year (y-o-y) from 16.7% the previous year.

- This is a result of the industry, services, and personal loan sectors showing relatively mild credit growth.

- According to RBI data on Sectoral Deployment of Bank Credit, the only sector that demonstrated improvement in credit growth was agriculture and allied activities.

- In January 2024, the loan growth for the agriculture and allied activities sector was 20.1% year over year, up from 14.4% the previous year.

In January 2024, credit to industry expanded by 7.8% year over year, compared to 8.7% in the same month the previous year.

- Among the main industries, credit growth (y-o-y) to textiles and food processing surged in January 2024.

- RBI said growth in credit (y-o-y) to basic metal and metal products and chemicals and chemical products declined.

- Credit growth to services sector slowed to 20.7% y-o-y in January 2024 as compared 21.4% a year ago.

- RBI said growth in credit (yoy) to trade improved in January 2024 compared to January 2023.

- It said growth in credit to NBFCs declined in January 2024 compared to January 2023.

- Personal loans growth declined to 18.4% (y-o-y) in January 2024 from 20.7% a year ago.

- Retail loans issued by banks increased at a compound annual growth rate (CAGR) of 25.5% between September 2021 and September 2023.

- Over the same time period, unsecured retail lending increased by 27.0%.

Topic: Banking System

3. On 29 February 2024, NEFT has processed highest-ever 4.1 crore transactions per day.

- This is the highest number of the transactions that have ever been processed in a single day.

- In terms of volume, the NEFT and RTGS systems have grown by 700% and 200%, respectively, over the last 10 years (2014–23).

- During the last ten years (2014-23), NEFT and RTGS have registered growth of 670% and 104%, respectively, in terms of value.

- On 31 March 2023, the RTGS system had processed its largest ever volume of 16.25 lakh transactions in a day.

- National Electronic Funds Transfer (NEFT) system is the retail payments system managed by the Reserve Bank of India.

- RBI also manages Real Time Gross Settlement (RTGS) system.

- RBI manages NEFT and RTGS to settle retail and wholesale payments, respectively.

- The NEFT system became operational on a 24x7x365 basis from December 16, 2019. RTGS started from December 14, 2020.

Topic: Regulatory Bodies/Financial Institutions

4. Policybazaar has now become a composite insurance broker after receiving final approval from IRDAI.

- Policybazaar Insurance Brokers has become a composite insurance broker.

- IRDAI has given the certificate of registration to the company.

- Earlier, it was categorized as direct insurance broker (general and life insurance).

- By becoming composite insurance broker, Policybazaar will enter reinsurance products selling.

- The IRDAI Certificate of Registration as a composite broker has become effective from 28 February 2024.

- Recently, PB Fintech declared that IRDAI had granted in-principle approval for Policybazaar to work as a composite insurance broker.

- Policybazaar Insurance Brokers is a wholly owned subsidiary of PB Fintech.

Topic: Taxation

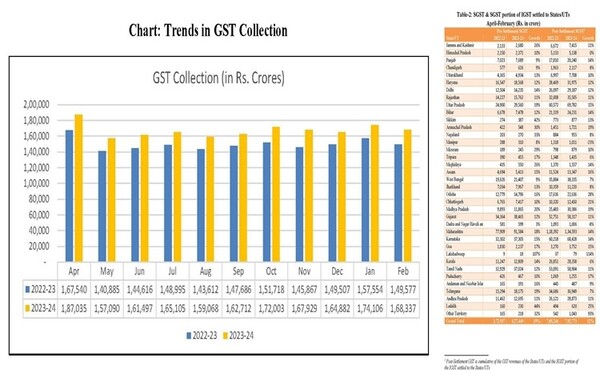

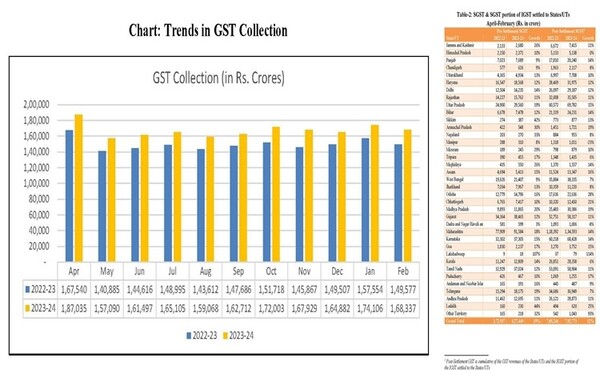

5. Gross GST collections increased 12.5% to Rs 1.68 lakh crore in February 2024.

- In February 2024, gross GST revenue of 1,68,337 crore rupees was collected.

- When compared to the same month previous year, this represents a significant 12.5% growth.

- A 13.9% increase in GST from domestic transactions and an 8.5% increase in GST on goods imports were the main drivers of this growth.

- For February 2024, the GST revenue net of refunds is 1.51 lakh crore rupees.

- This is an increase of 13.6% from the same time period of previous year.

- The entire gross GST revenue for the current fiscal year is 18.40 lakh crore rupees as of February 2024.

- Compared to the collection for the same period in 2022–2023, this is 11.7% more.

- For 2023-24, the average monthly gross collection stood at 1.67 lakh crore rupees.

- This is higher than the collection of 1.5 lakh crore rupees in corresponding period of previous year.

(Source: News on AIR)

Topic: Reports and Indices

6. In February 2024, the manufacturing PMI increased to 56.9 points.

- Production increased in the month at its quickest rate in the previous five months.

- Sales increased as a result of this at the quickest pace since September of last year.

- For 21 months, this resulted in the largest increase in new export orders.

- February saw a resurgence in the manufacturing sector, driven by increased output and improved sales.

- There was minimal change in manufacturing employment in India despite the acceleration of growth momentum.

- The lowest increase in input costs in more than three and a half years was reported in the PMI survey.

- The responses of 400 organizations' purchasing managers serve as the basis for the preparation of this index.

- A figure greater than 50 indicates growth, whilst a figure less than 50 indicates contraction.

Topic: Awards and Prizes

7. King Charles III of the United Kingdom has bestowed an Honorary Knighthood upon Sunil Bharti Mittal.

- Sunil Bharti Mittal has become the first Indian citizen to receive the award.

- Mr. Mittal has received the title of Knight Commander of the Most Excellent Order of the British Empire as a result of the award.

- His achievements to developing closer business relations between India and the UK are recognised by this award.

- An honorary Knighthood is one of the greatest honors bestowed upon civilians by the British Sovereign.

- Foreign nationals receive it as a token of appreciation for their outstanding accomplishments.

- Sunil Bharti Mittal is founder and chairman of the Bharti Enterprises.

Topic: Indian Economy/Financial Market

8. In January 2024, the growth rate of eight core industries fell to 3.6%, a 15-month low.

- Coal, steel, cement, electricity, natural gas, and crude oil production all saw increases in January 2024.

- The growth rate of the steel sector decreased to 7% in January 2024 from 14.3% in January 2023.

- Similarly, the growth rate in the electricity sector decreased from 12.7% in January 2023 to 5.2% in January 2024.

- In January 2024, the coal industry experienced an increase of 10.2% year over year.

- Following a -1.1% contraction in January 2023, the crude oil sector expanded by 0.7% in January 2024.

- The natural gas sector experienced growth from 5.2% growth in January 2023 to 5.5% growth in January 2024.

- The growth of refinery products decreased by 4.3% in January. It expanded by 4.5% in January 2023.

- In January 2024, the fertilisers industry experienced a contraction of 0.6%.

- Eight core industries are cement, coal, crude oil, electricity, fertilizers, natural gas, refinery products and steel.

Topic: Indian Economy/Financial Market

9. India’s GDP growth increased to 8.4% in the third quarter of Financial Year 2024.

- India's GDP grew by 4.3% during the same time period of the previous year.

- In Q2 of Financial Year 2024, the GDP expanded by 7.6%.

- The GDP is estimated at Rs 43.72 lakh crore in Q3 of 2023–24 at constant (2011–12) prices.

- In Q3 of 2022–2023, it was valued at Rs 40.35 lakh crore.

- In the Financial Year 2024, the construction sector experienced double-digit growth of 10.7%.

- The manufacturing sector has grown at a rate of 8.5%, after the construction sector.

- In the Financial Year 2024, there was a 7.6% growth in the real GDP.

- For the third year in a row, growth has been 7% or above.

- Strong manufacturing and robust services sector growth in Q3 of Financial Year 2024 is one of the causes of the high GDP growth in Financial Year 2024.

- Private consumption has provided steady support to GDP growth.

Topic: Banking/Financial/Govt Schemes

10. Union Cabinet approved ₹75,021-crore package for the PM-Surya Ghar: Muft Bijli Yojana.

- “PM-Surya Ghar: Muft Bijli Yojana” (PM Free Electricity scheme) will promote rooftop solar (RTS) installations in India.

- Under this scheme, 300 units of “free electricity” will be provided to 1 crore households.

- The government will bear 60% of the cost of installing 2 kW (kilowatt) systems and 40% of the cost of systems with a 2-3 kW capacity.

- The government will provide ₹30,000 subsidy for 1 kW systems, ₹60,000 for 2 kW systems and ₹78,000 for 3 kW systems or higher.

- The households will have to apply for subsidies through a central portal.

- Households will also get a collateral-free loan of around 7% at present for installation of the residential RTS systems up to 3 kW.

- The solar electrification scheme will depend on solar panels and systems made in India.

- Urban Local Bodies and Panchayati Raj Institutions will also benefit from incentives for promoting RTS installations in their areas.

Previous

Previous

Latest

Latest

Comments