Topic: Indian Economy/Financial Market

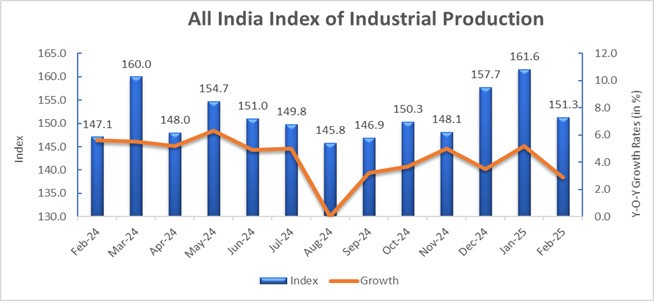

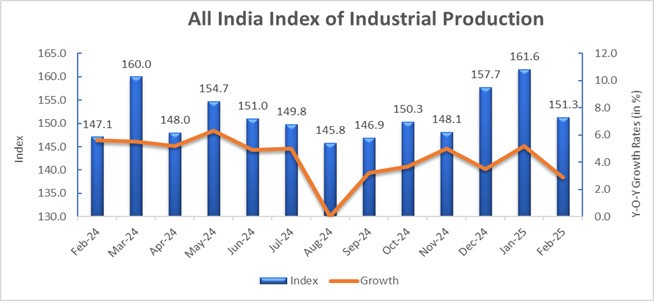

1. In February 2025, IIP stood at 2.9%.

- This was 5% as per quick estimates of January 2025.

- Mining, Manufacturing and Electricity grew at 1.6%, 2.9% and 3.6%, respectively for February 2025.

- IIP for these sectors stood at 141.9, 148.6 and 194.0 respectively for February 2025.

- Quick estimates of IIP stand at 151.3. They stood at 147.1 in February 2024.

(Source: PIB)

Topic: RBI

2. RBI has allowed NPCI to increase UPI transaction limit for person-to-merchant (P2M) payments.

- The limit for Person-to-Person (P2P) transaction has not be changed. It remains at ₹1 lakh.

- As per RBI’s permission, NPCI can revise limit for person-to-merchant (P2M) transactions based on use cases and needs of users.

- For P2M, the limit is up to ₹2 lakh or ₹5 lakh in use cases like healthcare, payments of credit card bill, education etc.

- Internal limits can be established by banks within range set up by NPCI.

- RBI will issue harmonized and updated regulatory guidelines for gold loans.

Topic: Appointments

3. Dr. Neelam Dhungana Timsina is the Deputy Governor of Nepal Rastra Bank.

- She has been appointed as the acting governor of the bank.

- Nepal Rastra Bank has not had a governor since April 6.

- Mahaprasad Adhikari’s term ended on that date.

- The appointment of a new governor has been delayed.

- This delay is due to disagreements between the ruling coalition parties.

- Government spokesperson confirmed that a selection committee has been formed for this.

- It will propose three candidates for the governor's position. The government will choose one of them to lead the central bank.

- Nepal Rastra Bank is the central bank of Nepal.

(Source: News on AIR)

Topic: Reports and Indices

4. PLFS 2024 report: Rural unemployment sees marginal decline, urban labour participation rises.

- On 9 April, the latest annual report of the Periodic Labour Force Survey from January to December 2024 was released by the Ministry of Statistics and Programme Implementation.

- According to the latest PLFS data, India's unemployment rate for persons aged 15 and above saw a slight decline from 5.0% in 2023 to 4.9% in 2024.

- The report shows that the unemployment rate in rural areas declined marginally from 4.3% to 4.2%.

- The Labour Force Participation Rate (LFPR) held steady at 56.2% overall, reflecting a consistent engagement of the working-age population in the labour market.

- The report shows that the labour force participation rate in urban areas has increased from 50.3% to over 51%.

- However, under the Principal and Subsidiary Status (PS+SS) methodology, there was a marginal decline in the LFPR, falling from 59.8% to 59.6%.

- The Worker Population Ratio (WPR) at the national level was virtually unchanged, rising slightly from 53.4% to 53.5% and in urban areas from 47.0% to 47.6%.

- A significant contributor to the decline in rural female participation was the decline in unpaid helpers in household enterprises, falling from 19.9% in 2023 to 18.1% in 2024.

Topic: RBI

5. RBI’s Monetary Policy Committee has reduced the policy repo rate by 25 basis points.

- This brings the repo rate to 6 percent. It marks the second consecutive rate cut by the MPC.

- The standing deposit facility (SDF) rate is now 5.75 percent.

- The marginal standing facility (MSF) rate and the Bank Rate are now set at 6.25 percent.

- In February 2025, the MPC also lowered the repo rate by 25 basis points.

- This was the first rate cut since May 2020.

- Food inflation dropped to 3.8 percent in February 2025.

- This decrease was driven by a seasonal reduction in vegetable prices.

- Core inflation rose to 4.1 percent in February due to higher gold prices.

- RBI forecasts CPI inflation at 4 percent for 2025-26.

- The MPC has changed its stance from neutral to accommodative.

- This shift reflects the need for continuous monitoring of economic conditions.

- The RBI Governor noted that global central banks are being cautious.

- This caution is due to the weakening US dollar, lower bond yields, stock market corrections and falling oil prices.

- The next MPC meeting is scheduled from June 4 to June 6, 2025.

Topic: Miscellaneous

6. ‘AI Rising Grand Challenge’ launched by the Telangana government to resolve public sector issues.

- The initiative was inaugurated by State Chief Minister A. Revanth Reddy to serve as a unified data exchange, bringing together high-quality datasets from various government departments and partner organizations.

- This platform will support the development, testing, and scaling of AI solutions in real-world scenarios by providing secure and structured access to these datasets as well as many other functionalities.

- By fostering collaboration across government, startups, industry, and academia, it will help accelerate innovation and promote widespread AI implementation in the state.

- The Grand Challenge is being led by the State IT Electronics and Communication Department and Japan International Cooperation Agency (JICA), along with support from other important ecosystem enablers.

- The Telangana AI Rising Grand Challenge focuses on high-impact use cases in key sectors such as education, healthcare, public transport, etc.

- The challenge aims to harness AI's power to improve governance, boost citizen services, and drive public sector innovation through tools like interactive learning and predictive healthcare models.

- The winner of the challenge for each use case will receive a cash prize of Rs 15 lakh to implement pilot projects within the state of Telangana.

Topic: Summits/Conferences/Meetings

7. On 10 April, the 9th edition of the Global Technology Summit (GTS) 2025 kicked off in New Delhi.

Topic: Reports and Indices

8. NITI Aayog has released a report titled "Automotive Industry: Powering India’s Participation in Global Value Chains."

- The report provides a comprehensive analysis of India’s automotive sector.

- It highlights the sector’s opportunities and challenges.

- The report also suggests a strategic plan to make India a major player in global automotive markets.

- The launch event was attended by NITI Aayog Vice Chairman Suman Bery and CEO BVR Subrahmanyam.

- The report outlines several fiscal and non-fiscal measures to enhance India’s competitiveness in the automotive industry.

- These measures are categorized into four groups based on the complexity and development of automotive components.

- The categories include Emerging and Complex, Conventional and Complex, Conventional and Simple, and Emerging and Simple.

- According to the report, global automobile production reached approximately 94 million units in 2023.

- The global automotive components market was valued at two trillion US dollars, with exports accounting for nearly 700 billion dollars.

- India is now the fourth-largest automobile producer, following China, the USA, and Japan.

- India’s annual vehicle production is close to six million units.

- The report notes that India’s automotive sector has a strong presence in both domestic and export markets.

- India is particularly dominant in the small car and utility vehicle segments.

- With the Make in India initiative and its cost-effective workforce, India is becoming a hub for automotive manufacturing and exports.

- CEO BVR Subrahmanyam highlighted that the report was based on detailed research.

- He also mentioned that India’s share in the global auto components market is 70 billion dollars.

Previous

Previous

Latest

Latest

Comments