Topic: RBI

1. RBI has tightened norms for Housing Finance Companies (HFCs).

- This is a part of part of RBI’s “review of regulatory framework for HFCs and harmonisation of regulations applicable to HFCs and NBFCs”.

- The maximum amount of public deposits that deposit-taking HFCs may hold has been lowered from three times to one and a half times of net owned funds.

- This is applicable to HFCs that accept deposits and have a minimum investment grade credit rating in accordance with all regulatory standards.

- Deposit-taking HFCs that have deposits over the revised limit are unable to take in new deposits from the general public or renew those that already exist until they reach the revised limit.

- However, excess deposits will be permitted to run off until maturity.

- Any public deposits that HFCs accept or renew will be repaid after twelve months or longer, but no later than sixty months (now 120 months).

- Current deposits that have maturities longer than 60 months may be reimbursed in accordance with their current repayment schedule.

- Every HFC that accepts deposits must continuously retain liquid assets equal to 15% (as opposed to the present 13%) of the public deposits they hold.

- A phased approach is required, with 14% to be completed by January 1, 2025, and 15% to be completed by July 1, 2025.

- The HFCs that accept public deposits must consistently earn a minimum investment grade credit rating at least once a year in order to be qualified to accept public deposits.

- The HFC cannot renew current deposits or take in new ones unless it receives an investment grade credit rating if its credit rating is below the minimal investment grade.

Topic: Taxation

2. E-way bill generation reached an all-time high level of 10.48 crore in July 2024.

- According to data from the GST Network (GSTN), the generation of e-way bills in July exceeded the previous high of 10.35 crore in March of this year.

- This is the fifth time that generation has exceeded 10 crores in a single month since the e-way bill was introduced in 2018.

- This is the third time in the current fiscal year that the amount generated in a single month has surpassed 10 crores.

- An electronic document created on a portal that certifies the movement of goods is called an e-way bill.

- It also shows whether tax has been paid for the moving goods.

- In accordance with Rule 138 of the CGST Rules, 2017, each registered individual engaged in the transportation of goods with a consignment value over 50,000 must produce an e-way bill.

- When compared to the same period last year, gross direct tax receipts from April 1 to August 11 increased by 23.99%.

- Between April 1 and August 11, gross direct tax receipts totalled 8.13 lakh crore rupees.

- According to the Income Tax Department, at the same time previous year, collections totalled 6.55 lakh crore rupees.

- With 6.93 lakh crore rupees in net collections, a 22.48 percent rise was seen.

Topic: RBI

3. In the case of an emergency, RBI has directed NBFCs to return the entire cash deposit within the first three months.

- If an NBFC receives a withdrawal request from a depositor alleging an emergency like as medical costs or a natural disaster, they are required to refund 100% of the deposit amount within the first three months.

- According to the RBI, no interest would be paid for these early withdrawals.

- NBFCs may pay 50% of the deposit without charging interest to depositors who want to withdraw for any other reason.

- According to the RBI, early payment is permitted up to 50% of the principal amount or 5 lakh rupees, whichever is less.

- Additionally, RBI has mandated that NBFCs notify depositors of maturity a 14-day ahead of time, as opposed to the current norms that only specify a two-months.

- These changes will become effective from 1st January, 2025.

- RBI has said that limitations on investments in unquoted shares applicable for non-banking financial companies (NBFCs) will also be applicable to housing finance companies (HFCs).

Topic: Indian Economy/Financial Market

4. India’s steel exports continued to decline in July while steel imports continued to increase in July.

- The steel exports declined 14% sequentially to 0.30 million tonnes (mt) and steel imports increased 18% to 0.75 mt.

- India was net importer for the month due to imports exceeding exports.

- Finished steel exports in June were 0.35 mt, while imports in June were 0.64 mt.

- Steel imports were 2.7 mt during the April–July FY25 period, up 35% year over year.

- Additionally, during April–July FY25, imports of steel outpaced exports. India was net exporter in the year-ago-period.

- Finished steel includes non-alloyed offerings (hot rolled coils and cold rolled coils), alloyed offerings and stainless steel.

- India produced about 47 mt of finished steel in April–July, an increase of 5% year over year.

- In contrast, demand or consumption increased by over 15% to reach 47.8 mt.

Topic: Corporates/Companies

5. The National Payments Corporation of India (NPCI) incorporated Bharat Interface for Money (BHIM) as a wholly-owned subsidiary.

- The resulting new entity is known as NPCI-BHIM Services Ltd (NBSL).

- Lalitha Nataraj will be the chief executive officer (CEO) of the new subsidiary.

- Lalitha Nataraj has earlier worked with IDFC FIRST Bank and ICICI Bank.

- Rahul Handa will be chief business officer (CBO) of NPCI-BHIM Services Ltd (NBSL).

- He had worked as the executive vice president at the Open Network for Digital Commerce (ONDC).

- At present, PhonePe and Google Pay jointly process about 85% of UPI volumes in India.

Topic: Committees/ Commissions/Taskforces

6. RBI has formed an expert committee to benchmark its statistics.

- The committee has been constituted by RBI under the chairmanship of deputy governor Michael Debabrata Patra.

- It has been constituted for benchmarking the statistics regularly disseminated by RBI against global standards.

- The Expert Committee has been constituted for following purposes.

- Benchmark the statistics regularly disseminated by it against global standards / best practices

- Study the quality of other regular data, where such benchmarks do not exist (e.g., sectors of national priority)

- Provide guidance on the scope for any further data refinement

- The Committee is expected to submit its report by the end of November 2024.

- The Committee has 10 members. The members of the committee include R. B. Barman, Sonalde Desai, Partha Ray, Bimal Roy, Paul Schreyer, Sudarshan Sen, Bruno Tissot, Muneesh Kapur and O.P. Mall.

Topic: Indian Economy/Financial Market

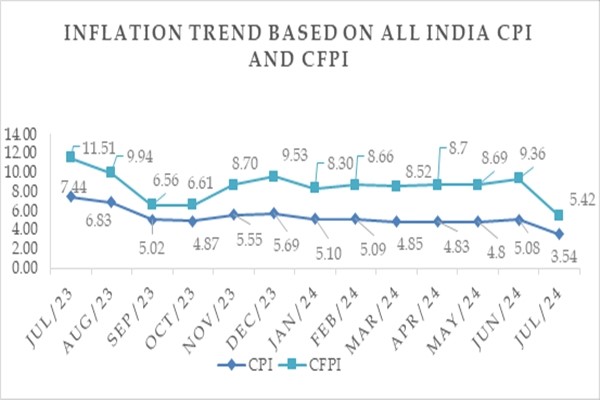

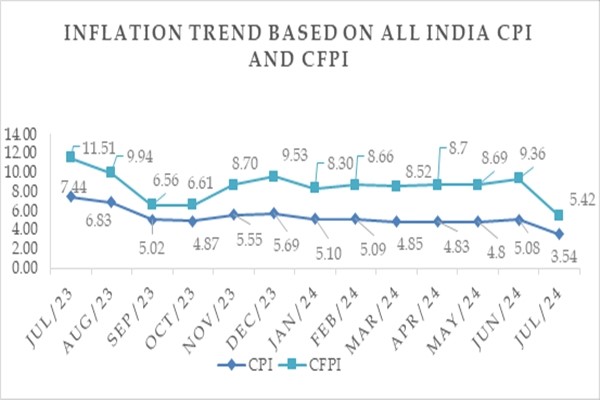

7. Retail inflation for July 2024 declined to 59 months low level of 3.54 % on a year-on-year basis.

- Consumer Price Index for July 2024 declined mainly because of decrease in prices of vegetables, fruits and spices.

- Food inflation for July 2024 was at its lowest level since June 2023.

- Food inflation was 5.42 % for July 2024 according to the data.

- Inflation for rural areas stood at 4.10% for July 2024. Urban inflation was 2.98% for July 2024.

- In June 2024, retail inflation had increased to 5.08%. Food inflation stood at 8.36% in June 2024.

- The inflation rate in July 2024 was below the Reserve Bank of India’s target of 4%.

(Source: News on AIR)

Topic: Indian Economy/Financial Market

8. A growth of 4.2% has been recorded in India’s Index of Industrial Production (IIP) in June 2024.

- In June, India's industrial production decreased from 6.2% in May to 4.2%, as reported by the Ministry of Statistics and Programme Implementation.

- The Index of Industrial Production (IIP) growth rate in June 2023 was 4.0 percent.

- In October 2023, the IIP reached its previous high of 11.9%.

- In June 2024, the mining, manufacturing and electricity sectors have grown by 10.3, 2.6, and 8.6% respectively.

- As per Use-based classification, growth rates of IIP in June 2024 over June 2023 was 2.4 percent in Capital goods.

- Growth rates of IIP in June 2024 over June 2023 was 8.6 percent in consumer durables and -1.4 percent in consumer non-durables.

- In June 2024, the building and infrastructure goods saw a slight increase of 4.4%.

- In June 2024, the primary goods output grew by 6.3%.

Topic: Miscellaneous

9. IIT Madras ranked top spot in the NIRF Ranking 2024.

- The Indian Institute of Technology (IIT) Madras has once again topped the National Institutional Ranking Framework (NIRF) 2024.

- This marks its sixth consecutive year as the country’s leading higher educational institution.

- IGNOU ranked first in the category of open universities.

- On 12 August, the rankings were officially announced by the Ministry of Education.

- Indian Institute of Science (IISc), Bengaluru was ranked the best university in the country.

- Now, the NIRF, in its 9th edition, assesses institutions according to five major parameters: teaching, learning, and resources; research and professional practice; graduation outcomes; outreach and inclusivity; and perception.

- This year, three new categories were added to the framework, increasing the total categories to 16.

- Higher educational institutions are now ranked in 16 categories: overall, universities, medicine, engineering, management, law, architecture, research institutes, pharmacy, dentistry, agriculture and allied sectors, innovation, state universities, open universities and skills universities.

Topic: Agriculture

10. 109 climate-resilient seed varieties released by PM Modi to increase agricultural production and nutrition.

- On August 11, 2024, 109 high-yielding, climate-resilient and bio-fortified seed varieties of agricultural and horticultural crops were released by PM Narendra Modi, aimed at increasing agricultural productivity and farmers' income.

- These varieties, developed by the Indian Council of Agricultural Research (ICAR), are suitable for 61 crops, including 34 regional crops and 27 horticultural crops.

- The seeds were unveiled by Mr Modi at three experimental farming sites at the Pusa campus in Delhi, where he also interacted with farmers and scientists.

- The varieties of field crops include cereals, millets, forage crops, oilseeds, pulses, sugarcane, cotton and fibre crops.

- For horticulture, the Prime Minister released new varieties of fruits, vegetables, plantation crops, tubers, spices, flowers and medicinal plants.

Previous

Previous

Latest

Latest

Comments