Topic: Indian Economy/Financial Market

1. For FY 2024–2025, the Centre has disbursed ₹71,889 crore to States under a number of heads.

- This release of funds is based on the recommendations of the 15th Finance Commission.

- Allotted under the post-devolution revenue deficit grant is ₹18,362.25 crore.

- Under the urban local bodies grant, the rural local bodies grant, and the health sector grant, the Finance Ministry has allotted ₹6,845.04 crore, ₹20,847.25 crore, and ₹2,894.01 crore, respectively.

- The grants were ₹1,385.45 crore under the central share of the State Disaster Mitigation Fund and ₹15,823.20 crore under the central share of the State Disaster Response Fund.

- For severe natural disasters in the States, the Centre has set out ₹4,050.93 crore under the National Disaster Response Fund's central aid.

- ₹757.39 crore has been allocated for the modernization and growth of fire services in the states.

- The National Disaster Response Fund's (NDRF) assistance for preparedness and capacity-building funding window has contributed a total of ₹276.81 crore.

- For Chennai's urban flood protection project, the Center has additionally disbursed ₹646.55 crore from the National Disaster protection Fund.

Topic: Banking/Financial/Govt Schemes

2. The Pradhan Mantri Suraksha Bima Yojana (PMSBY) has registered nearly 48 crore people in ₹2 lakh accident insurance coverage.

- 47.59 crore people have been enrolled in the PMSBY overall.

- The total amount of claims received was 1,93,964. A total of 1,47,641 claims have been paid out.

- There were 53.13 crore PMJDY accounts in total as of August 14, 24.

- 55.6%, or 29.56 crore, Jan-Dhan account holders were women.

- 36.6%, or 35.37 crore, Jan Dhan accounts were in rural and semi-urban areas.

- The total amount of deposits in Pradhan Mantri Jan Dhan Yojana (PMDJY) accounts is ₹2,31,236 crore.

- According to the finance ministry, throughout the five years between FY 2019 and FY 2024, sanctions under Mudra loans increased at a compound annual rate of 9.8%.

- PMSBY is a one-year accidental insurance plan that provides coverage for accident-related death or disability and is renewable annually.

- Anyone between the ages of 18 and 70 who has a personal bank or post office account is eligible to sign up for the program.

- For a premium of ₹20 per year, accident-related death and disability coverage of ₹2 lakh (or Rs 1 lakh if you're partially disabled) is provided for death or disability brought on by an accident.

- Launched by Prime Minister Modi on August 28, 2014, PMJDY had completed a decade in August 2024.

Topic: Indian Economy/Financial Market

3. In FY2024–2025, the Department of Expenditure permitted states to borrow an additional ₹9.40 lakh crore.

-

According to the Finance Ministry, states are only allowed to borrow up to 3% of their gross state domestic product (GSDP).

- This amounts to ₹9,39,717 crore for the fiscal year 2024–2025 according to the Fifteenth Finance Commission's recommendations.

- As of September 30, 2024, the central government has authorized ₹6,83,203 crore for the purpose of raising Open Market Borrowing (OMB) for the fiscal year 2024–2025.

- As of September 30, 2024, it has authorized ₹62,721.57 crore for the use of negotiated loans for the fiscal year 2024–2025.

- According to the Ministry, Digital India is supported by the DBT via the Public Financial Management System (PFMS).

- According to the Ministry, practically all Central Sector Schemes (CS) and Centrally Sponsored Schemes (CSS) are on the PFMS.

- According to the Ministry, PFMS has interfaces with all of the major banks, including the Reserve Bank of India (RBI).

Topic: Miscellaneous

4. ASSOCHAM Secretary General, Deepak Sood has stepped down.

- Deepak Sood decided to step down to pursue other interests.

- Sood joined ASSOCHAM in 2019. He earlier served as the CEO of Invest Karnataka, Government of Karnataka, Executive Director at CII.

- Sanjay Nayar is the President of Associated Chambers of Commerce and Industry of India (ASSOCHAM).

- ASSOCHAM is India’s oldest apex chamber. It is a non-governmental trade association and advocacy group.

- It is based in New Delhi. It was established in 1920.

Topic: Banking System

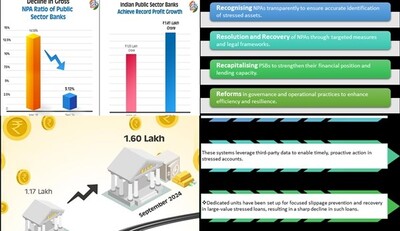

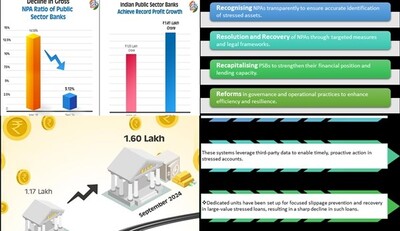

5. The Public Sector Banks (PSBs) in India earned their highest-ever total net profit of almost 1 lakh 41 thousand crore in FY24.

- In September 2024, the Gross Non-Performing Assets (GNPA) ratio dropped to 3.12%.

- Compared to the peak GNPA of 14.58 percent in March 2018, this is a sharp drop.

- The PSBs have also made a substantial contribution to shareholder returns, according to the Finance Ministry.

- Over the previous three years, they distributed dividends totalling about 62 thousand crore rupees.

(Source: News on AIR)

Topic: RBI

6. RBI increased limit for collateral-free agricultural loans from 1.6 lakh to 2 lakh rupees.

- The Reserve Bank of India has decided to increase the limit for collateral-free agricultural loans from 1.6 lakh to 2 lakh rupees.

- It will be effective from 1st January next year.

- It will enhance credit accessibility, particularly for small and marginal farmers.

- This new directive instructs banks to waive collateral and margin requirements for agricultural and allied activity loans up to Rs 2 lakh per borrower.

- It will facilitate easier access to Kisan Credit Card (KCC) loans and complement the government's Modified Interest Subvention Scheme.

- It will allow farmers to invest in agricultural operations and improve their livelihoods.

- This initiative will enhance financial inclusion in the agricultural sector.

Topic: Summits/Conferences/Meetings

7. World Hindu Economic Forum started in Mumbai.

- Maharashtra Chief Minister Devendra Fadnavis inaugurated the World Hindu Economic Forum in Mumbai for three days.

- Delegates from various fields across the globe are attending this summit.

- This is one of the biggest assemblies of industrialists, businessmen, startups, and entrepreneurs from the Hindu community under one roof.

- The theme of this year's forum is ‘Think in future, for the future’.

- The World Hindu Economic Forum was started in 2012 in Hong Kong. It was organized in Bangkok in 2023.

Topic: Miscellaneous

8. Elon Musk's net worth surpassed $400 billion, making him the first person to do so.

- The first individual to ever surpass that threshold is Musk. The stock of Tesla soared to an all-time high of $420.

- Following Musk's appointment as co-leader of the Department of Government Efficiency, or DOGE, the company's share price has risen 70% so far this year.

- Musk is the owner of X and the founder of SpaceX.

- A self-driving taxi was unveiled by Musk during Tesla's "We, Robot" event.

- Musk also demonstrated Optimus, the company's humanoid robot.

- Tesla, SpaceX, and xAI are among the seven businesses that Elon Musk co-founded.

- Musk also paid $44 billion for Twitter in 2022, rebranding it X.

Topic: Miscellaneous

9. Switzerland will suspend the most favored nation (MFN) clause in DTAA with India.

- It will suspend the MFN clause in its double taxation avoidance agreement (DTAA) with India from 1 January, 2025.

- As a result of this step, the withholding tax rate on dividends paid to Indian tax residents will double from 5% to 10%.

- The decision has come after a Supreme Court ruling of 2023.

- The Supreme Court ruling clarified that the MFN clause is not automatically applicable in case a country joins the Organisation for Economic Co-operation and Development (OECD), especially if a prior tax treaty is in place.

- In tax agreements, the MFN clause ensures equal treatment for all parties involved.

- Nestle, a Swiss company, requested a reimbursement of dividend withholding tax.

- It claimed the benefits of India-Switzerland tax treaty's MFN clause.

- At first, Switzerland thought that the MFN principle should automatically apply.

- But the 2023 Supreme Court decision proved otherwise.

- Supreme Court made it clear that the MFN clause could not be implemented automatically without official notification under Section 90 of the Indian Income Tax Act.

- Swiss authorities reconsidered the unilateral reduction of the withholding tax rate as a result of this clarification.

- Additionally, Switzerland's decision is not likely to affect European Free Trade Association (EFTA) investments into India.

Topic: Reports and Indices

10. India witnessed a significant rise in women's participation in the labour force.

- The study titled 'Female Labour Force Participation Rate: An Observational Analysis of the Periodic Labour Force Survey' has been released.

- It showed trends in women's involvement in the economy from 2017-18 to 2022-23.

- Rural female LFPR has increased nearly 70 per cent, from 24.6 per cent in 2017-18 to 41.5 per cent in 2022-23.

- States like Jharkhand and Bihar saw huge growth, with rural LFPR rising by 233 per cent in Jharkhand and six times in Bihar.

- Married women in rural areas, particularly in Rajasthan and Jharkhand, showed a significant increase in LFPR.

- Rural Bihar has shown considerable improvement despite the lowest LFPR in the past.

- Punjab and Haryana have persistently low female LFPR.

- Western and Southern India also witnessed growth in rural female LFPR, although urban areas have seen only a modest increase.

- The female LFPR has risen due to several government initiatives, particularly those targeting rural women.

Previous

Previous

Latest

Latest

Comments