Topic: Appointments

1. BVR Subrahmanyam has been appointed as the new CEO of NITI Aayog.

- His appointment has been approved by the Appointment Committee of the Cabinet for a period of two years from the date of assumption of the charge of the post.

- BVR Subrahmanyam will replace Parameswaran Iyer.

- Parameswaran Iyer has been appointed as Executive Director, World Bank headquarters, Washington DC, USA. Mr. Iyer will replace Rajesh Khullar.

- Parameswaran Iyer was 3rd CEO of NITI Aayog. He became CEO of NITI Aayog in July 2022.

- BVR Subrahmanyam is a Chhattisgarh cadre Indian Administrative Service officer.

- Chief Executive Officer (CEO) of NITI Aayog is appointed by Prime Minister for a fixed tenure.

Topic: MoUs/Agreements

2. HDFC Bank and LuLu Exchange have entered into partnership to strengthen cross-border payments between India and Gulf Cooperation Council (GCC) region.

- Under the partnership, a digital inward remittance service titled ‘RemitNow2India’ will be launched.

- This will allow UAE residents to send money to any Indian bank account via IMPS and NEFT through HDFC Bank.

- The MoU will also try to strengthen the existing relationship between the two entities in India.

- LuLu Exchange is a UAE-based financial services company.

- HDFC Bank is India's largest private sector bank by assets.

Topic: Appointments

3. Vardhini Kalyanaraman has been appointed as Additional Director (Independent Category) on the Board of Dhanlaxmi Bank.

- Vardhini Kalyanaraman has been appointed with effect from February 23, 2023.

- Ex-SBI executive Aparna Kuppuswamy has been appointed by BharatPe Group as its Chief Risk Officer.

- She was the Chief Risk Officer at SBI Cards. Amit Jain is currently the Chief Risk Officer of BharatPe.

- He will be working closely with Aparna and will be investing more of his time on collections.

- Dhanlaxmi Bank is an Indian private sector bank based in Thrissur, Kerala. Shivan J K is Managing Director and CEO of Dhanlaxmi Bank.

- BharatPe was co-founded by Ashneer Grover and Shashvat Nakrani in 2018. In 2018, it launched UPI interoperable QR code, the first zero Merchant Discount Rate (MDR) payment acceptance service.

Topic: Banking System

4. Central Bank of India and Moneywise Financial Services Pvt Ltd have entered into a co-lending partnership.

- They have entered into co-lending partnership for lending to micro, small and medium-sized enterprises (MSMEs).

- The partnership will expand portfolio of Central Bank and Moneywise Financial Services.

- As part of the partnership, Moneywise Financial Services will process MSME loan proposals as per jointly decided credit parameters and eligibility criteria.

- Central Bank of India will take into its books 80% of the MSME loans under mutually agreed terms.

- Moneywise Financial Services is a non-banking financial company focused on MSME lending.

- Central Bank of India is an Indian public sector bank. It is based in Mumbai. Matam Venkata Rao is its MD & CEO.

Topic: Indian Economy/Financial Market

5. According to Ind-Ra, India requires annual GDP growth of 7.6% till 2036-37 to achieve pre-pandemic GDP trend.

- Ind-Ra expects that Indian economy will grow at 5.9% in 2023-24.

- This is lower than IMF’s projection of 6.1% and the RBI’s projection of 6.4%.

- The pre-pandemic trend indicates that from 2011–12 and 2019–20, the average GDP grew by 6.6%.

- The first year of the pandemic saw a 6.6% decline in growth. Growth in FY22 was 8.7%, primarily as a result of base effect. There is a 7% projection for the current year.

- According to the agency, India has to increase 7.6% annually for the following 13 fiscal years, from 2024–2025 to 2036–2037, in order to catch up with the GDP trend before the pandemic.

- Ind-Ra expects that agriculture sector will grow 3.1% in FY24 against 3.5% in FY23.

- It expects that industrial sector will grow 3.9% as against 4.1% and services at 7.1% as against 9.1%.

- India Ratings & Research (Ind-Ra):

- It is headquartered in Mumbai. It is a 100% owned subsidiary of the Fitch Group.

- It is recognised by the Securities and Exchange Board of India and Reserve Bank of India.

Topic: Indian Economy/Financial Market

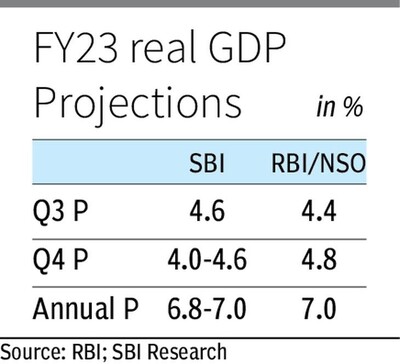

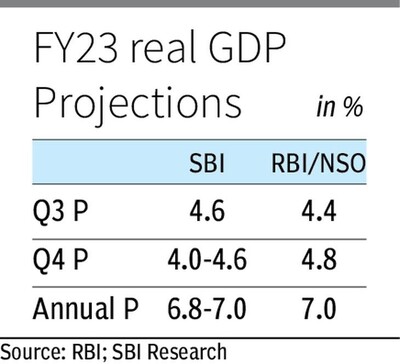

6. In SBI research report titled Ecowrap, India’s GDP growth for Q3 FY23 is estimated at 4.6%.

- This estimate is higher than NSO and RBI’s growth projection of 4.4%, but lower than Ind-Ra’s estimate of around 5%.

- This estimate is based on an in-house SBI Artificial Neural Network (ANN) model.

- National Statistical office (NSO) will release the actual number on February 28.

- India’s Gross Domestic Product (GDP) grew 0.7% and 5.4% in Q3 FY21 and Q3 FY22, respectively.

- GDP Growth for Q1 and Q2 of the current fiscal has been kept at 13.5% and 6.3%, respectively.

- ANN is a computational network model. SBI ANN model has been developed with 30 high-frequency indicators.

Topic: Reports and Indices

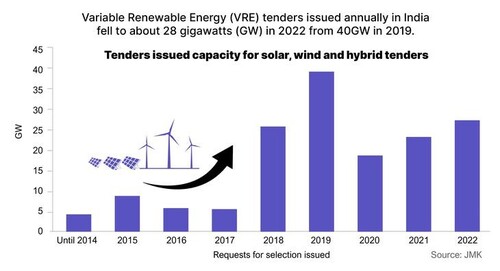

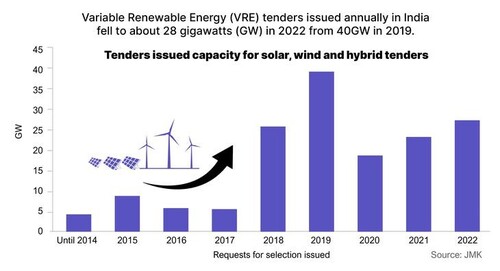

7. According to a joint report by the IEEFA and JMK Research & Analytics, annual renewable tender issuance should increase to 35GW to achieve India’s 2030 targets.

- Annual tender issuance have declined by 30%, from 40 GW in 2019 to about 28 GW in 2022.

- Annual tender issuance of 28 GW per year is not sufficient to achieve the target of 450 GW of renewable capacity by 2030.

- The report has been jointly released by IEEFA (Institute for Energy Economics and Financial Analysis) and JMK Research & Analytics.

- Discoms' financial problems are the main cause of the sluggish adoption of renewable energy tenders, which resulted in under-subscription and pricing renegotiation.

- Particularly in the wind industry, supply chain problems and rising project costs are causing developers to be cautious and submit fewer bids.

(Source: JMK)

Topic: Miscellaneous

8. Telangana government is aiming to increase the size of pharma-life sciences ecosystem in the State from $50 billion to $100 billion by 2028.

- State Industries Minister KT Rama Rao said this while interacting with reporters on the eve of the 20th edition of BioAsia 2023.

- Rao also said that upcoming Hyderabad Pharma City with a life sciences university and B-Hub to encourage start-ups will further boost the pharma-life sciences industry in the State.

- BioAsia 2023 is scheduled to be held during February 24-26 in Hyderabad.

- United Kingdom is the country partner for BioAsia 2023.

Topic: Indian Economy/Financial Market

9. India’s steel imports from Russia reached eight-year high level in April-January of FY23.

- India imported 281,000 tonnes of steel from Russia between April and January.

- This was nearly five times higher than the same period a year ago.

- Russia was the 4th biggest steel supplier to India during the April to January period.

- It emerged as one of the top five steel exporters to the India for the first time since the 2016-17 fiscal year.

- Russia displaced Japan as the second-largest supplier of hot-rolled coil (HRC) to India for the first time in eight years.

- India is the world's second-largest crude steel producer.

Topic: Miscellaneous

10. Cross-border connectivity between the Unified Payments Interface (UPI) of India and PayNow of Singapore launched on 21 February.

- PM Modi and his Singapore counterpart, Lee Hsien Loong witnessed the launch of cross-border connectivity between UPI of India and PayNow of Singapore through video conferencing.

- The launch was done by RBI Governor Shaktikanta Das and Ravi Menon, Managing Director, Monetary Authority of Singapore.

- The linkage of UPI and PayNow will make it possible for citizens of both nations to send remittances across borders more quickly and affordably.

- A quick and inexpensive money transfer from Singapore to India will benefit the Indian community in Singapore, particularly migrant workers and students.

- PhonePe has earlier launched support for cross-border UPI payments, under UPI International.

- This allows apps’ users to use their Indian bank accounts to pay at merchant outlets in the UAE, Singapore, Mauritius, Nepal and Bhutan.

- RBI has proposed to allow all inbound travelers to India to use UPI for their merchant payments while they are in the country.

- Non-resident Indians (NRIs) who have bank accounts in India and reside abroad will soon be able to use UPI platforms with the help of their international mobile numbers.

- NPCI has permitted UPI platforms to onboard non-resident accountholders from ten countries with international mobile numbers with certain restrictions.

Previous

Previous

Latest

Latest

Comments