Topic: Indian Economy/Financial Market

1. Finance Minister Nirmala Sitharaman presented the Economic Survey 2023-24 in the parliament.

- According to the Economic Survey 2023-24, the Indian economy will continue to expand amid geopolitical challenges.

- Key Highlights of the Economic Survey 2023-24 are:

- It projected GDP growth of 6.5–7 percent for FY25. The survey's predictions are lower than the Reserve Bank of India's 7.2 per cent but align with the forecast of the IMF.

- Retail inflation decreased to 5.4 percent in FY24, down from 6.7 percent in FY23.

- FDI flow has declined from USD 47.6 billion in FY23 to USD 45.8 billion in FY24.

- The services sector grew by 7.6 percent in FY24, while the agriculture sector expanded by 4.18 percent over the past five years.

- The survey highlighted that global financial markets have scaled new heights in the past year, with investors betting on global economic expansion.

- Overall employment in unincorporated non-agricultural enterprises (excluding construction) fell to 10.96 crore from 11.1 crore in 2015-16.

- Public investment has been pivotal in sustaining capital formation, with the private sector also beginning to invest significantly since FY22.

- The trade deficit in FY24 was lower compared to FY23, with the current account deficit around 0.7% of GDP.

- The Government’s thrust on capex and sustained momentum in private investment has boosted capital formation growth.

- Bank credit growth was broad-based and double-digit. Gross and net non-performing assets (NPAs) reached multi-year lows.

- Primary capital markets facilitated capital formation of ₹10.9 lakh crore in FY24.

- The Economic Survey highlighted the mental health issue and its significance and implications on policy recommendations for the first time.

- It mentioned that aggregate economic level and mental health disorders are related to productivity losses due to absenteeism, decreased productivity, disability, and increased healthcare costs.

- According to the National Mental Health Survey (NMHS) 2015-16, 10.6% of adults in India suffered from mental disorders.

- The treatment gap for mental disorders is between 70% and 92% for different disorders.

- The Survey highlighted the increased prevalence of poor mental health among adolescents, exacerbated by the COVID-19 pandemic.

- The Economic Survey is an annual document presented by the government ahead of the Union Budget.

- It is prepared by the Economic Division of the Department of Economic Affairs in the Ministry of Finance under the supervision of the chief economic adviser.

Topic: Indian Economy/Financial Market

2. Five schemes with an outlay of Rs 2 lakh crore are proposed in the budget to generate employment for the youth.

- Amid rising unemployment rate, job and salary losses, the first budget of the third Narendra Modi government has proposed a priority approach to employment and skills.

- In the Budget 2024, Rs 2 lakh crore allocated to provide employment to 4.1 crore youth in the next 5 years.

- Five schemes with an outlay of Rs 2 lakh crore have been proposed in the Union Budget to create employment for the youth.

- Government will implement 3 schemes for ‘Employment Linked Incentive’ to be implemented. These are as follows:

- First Scheme: First Timers

- One-month salary of up to Rs 15,000 will be provided in 3 installments to first-time employees.

- Second Scheme: Job Creation in Manufacturing

- Incentive will be provided directly to both employee and employer with respect to their EPFO contribution in the first 4 years of employment.

- Thirds Scheme: Support to Employers

- The government will reimburse up to Rs 3,000 per month for 2 years towards EPFO contribution of employers, for each additional employee.

- Other Two Schemes:

- Fourth Scheme:

- Its aims to skill 20 lakh youth over five years. 1,000 Industrial Training Institutes will be upgraded in a hub-and-spoke arrangement with an outcome orientation.

- Fifth scheme: Internship scheme

- It will provide one crore youth with 12-month internship opportunities in 500 top companies over the next five years, with the government offering a ₹5,000 monthly internship allowance and ₹6,000 one-time assistance. The companies will bear 10% of the training cost and internship cost from their CSR funds.

Topic: Indian Economy/Financial Market

3. The Ministry of Defence has been given Rs 6,21,940.85 crore in Union Budget for the Financial Year (FY) 2024–2025.

- Among the Ministries, this is the highest. The Ministry of Defence has received an allocation for FY 2024–25 that is approximately Rs one lakh crore (18.43%) greater than that of FY 2022–2023.

- The entire amount allotted equals around 12.90% of India's budgetary estimate.

- The Defence Forces would receive a budgetary allocation of Rs 1.72 lakh crore under the capital head for FY 2024–2025.

- 75% of the modernisation budget has been set aside by the Ministry of Defence for procurement through domestic industries in this fiscal year.

- For the Budget Estimates (BE) 2024–2025, Border Roads Organisations (BRO) have been allocated a capital budget of Rs 6,500 crore.

- The budget for defence pensions has been raised to Rs 1.41 lakh crore.

- In the budget, a venture capital fund of Rs 1,000 crore has been announced to expand the space economy by five times in the next 10 years.

- The government’s vision is to increase India’s share in the global commercial space economy to 10% by 2030 from only 2% at present.

- Government has committed of setting up a corpus of Rs 1 lakh crore to provide long-term, interest-free loan to encourage research and development by private sector.

Topic: Taxation

4. Presenting the Union Budget 2024–25, Finance Minister Nirmala Sitharaman proposed to abolish angel tax for all investor classes.

- In order to reduce uncertainty and disputes, she also suggested that the I-T regulations be completely streamlined for reopening and reevaluation.

- Reopening an assessment after three years is possible only if the evaded income is at least Rs 50 lakh, and this can happen for a maximum of five years from the assessment year's conclusion.

- It is proposed to shorten the current ten-year time limit in search cases to six years prior to the search year.

- Currently, 1,17,000 registered startups are recognised by the Department for Promotion of Industry and Internal Trade under the Startup India program.

- The angel tax was first implemented in 2012 by Pranab Mukherjee, the finance minister at the time.

- It was imposed at a tax rate of about 31% (30.9%) on money raised by companies from angel investors when that money exceeded the company's fair market value.

- The initial purpose of the angel tax was to prevent money laundering.

- The purpose of this measure was to combat the abuse of exaggerated valuations that are frequently linked to shell companies and fraudulent startups.

Topic: Indian Economy/Financial Market

5. Fiscal deficit target reduced to 4.9% in Budget 2024.

- The fiscal deficit target for the current financial year is 4.9% of GDP, as announced by Union Finance Minister Nirmala Sitharaman.

- This is lower than the 5.1% target set in the interim budget presented on February 1, and also the 5.9% target set for 2023-24.

- The fiscal deficit, which represents the difference between total revenue and total expenditure, reflects the extent of government borrowing required.

- Sitharaman emphasized the government's commitment to fiscal consolidation, aiming to bring down the deficit to below 4.5% of GDP by fiscal year 2025-26.

- A lower fiscal deficit will improve India's sovereign rating update prospects as it will bring the country closer to its target of reducing the deficit to below 4.5% of GDP by fiscal year 2025/26.

- A record surplus transfer of 2.11 trillion rupees ($25.3 billion) from the Reserve Bank of India, more than double the amount estimated in February, has helped the government reduce the fiscal deficit.

Topic: Taxation

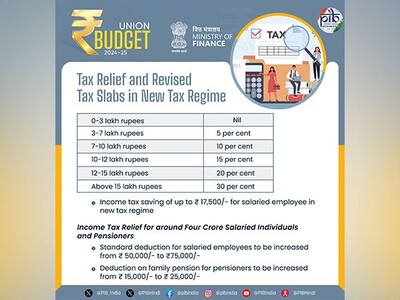

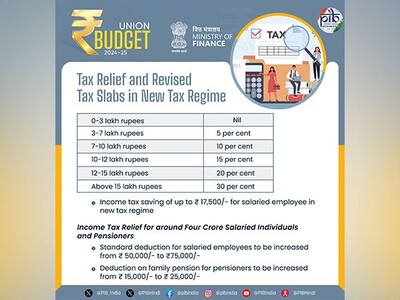

6. Government gave relief to the salaried class on tax slabs and standard deductions.

- A number of income tax reforms have been introduced by the government in the Union Budget 2024-25.

- Its main aim is to simplify income tax laws and promote compliance, and support economic growth.

- Earlier, a taxable income between Rs 3-6 lakh was taxed with an income tax rate of 5%.

- In this budget, this slab has been changed to Rs 3-7 lakh.

- The tax slab for the 10% tax rate has been changed from Rs 6-9 lakh to Rs 7-10 lakh.

- The tax slab for the 15% rate has also been changed from Rs 9-12 lakh to Rs 10-12 lakh.

- Tax rates for income between Rs 12-15 lakh will remain at 20%, and income above Rs 15 lakh will be taxed at 30%.

- The standard deduction has been increased from 50,000 to Rs 75,000.

- The deduction on family pensions has been raised from Rs 15,000 to Rs 25,000 under the new tax regime.

- The TDS rate for e-commerce operators has been reduced from 1% to 0.1%.

- In this budget, the deduction on employers' National Pension System (NPS) contribution to employees' basic salary has been raised from 10 percent to 14 percent.

- The NPS Vatsalya scheme has been announced in this budget. This scheme will allow parents and guardians to invest on behalf of children.

- This initiative will facilitate long-term savings for minors.

(Source: DD News)

Topic: Corporates/Companies

7. IRCTC has been upgraded from 'Schedule B' to 'Schedule A' category Central Public Sector Enterprises by the Government of India.

- The Ministry of Railways announced the upgrade of IRCTC from 'Schedule B' to 'Schedule A' Category CPSE.

- IRCTC has shown a CAGR of 50.63 per cent between Fiscal 2022 and Fiscal 2024 in total income.

- It declared dividend of Rs 280 crores, Rs 440 and Rs 520 crores for 2021-22, 2022-23 and 2023-24, respectively.

- Indian Railway Catering and Tourism Corporation (IRCTC) is in its 25th year of incorporation. It is a Mini-Ratna PSU under the Ministry of Railways.

- Indian Railway Catering and Tourism Corporation was established in 1999.

- It is headquartered in New Delhi. Sanjay Kumar Jain is its chairman and MD.

- It provides ticketing, catering, and tourism services for Indian Railways.

Topic: Appointments

8. KV Subramanian has been appointed MD & CEO of Federal Bank.

- Krishnan Venkat Subramanian will be MD & CEO of Federal Bank with effect from September 23.

- Shyam Srinivasan is the current and longest-serving MD and CEO of the bank.

- The term of the current managing director & CEO expires on September 22, 2024.

- According to RBI norms, a non-promoter CEO can serve in a bank for a maximum of 15 years.

- Subramanian was the joint managing director of Kotak Mahindra Bank till April 30, 2024.

Topic: Indian Economy/Financial Market

9. The government has provided ₹2.66 lakh crore for rural infrastructure in the Union Budget for 2024–25.

- With the announcement of ₹2.66 lakh crore set aside only for rural development, the flagship Pradhan Mantri Gram Sadak Yojana (PMGSY) has entered Phase IV.

- The PMGSY has been allotted ₹16,100 crore for the current year. This is more than the ₹14,800 crore revised estimate for 2023–2024.

- It has been announced that 25,000 rural habitations will have access to all-weather connectivity through Phase 4 of the PMGSY.

- 8,393 projects are still in progress while 1,80,319 projects totalling 7,65,472 km have been completed since the scheme’s launch in 2000.

- Additionally, the government has proposed Bhu-Aadhaar or a unique identifying number for land in rural areas.

- The finance minister announced that all lands would get a Unique Land Parcel Identification Number (ULPIN), also known as Bhu-Aadhaar, as part of the government's land-related rural initiatives.

- She added that three crore more houses will be built in both rural and urban regions as part of the PM Awas Yojana.

- From a revised estimate of ₹32,000 crore in FY24, the allocation under Pradhan Mantri Awas Yojna (PMAY) - Rural has been significantly increased to ₹54,500 crore.

Topic: Reports and Indices

10. India's business activity accelerated at its fastest pace in three months in July.

- HSBC's flash India composite purchasing managers' index increased to 61.4 in July from 60.9 in June.

- HSBC's flash India composite purchasing managers' index is compiled by S&P Global.

- PMI services increased to a four-month high of 61.1 in July from 60.5 in June.

- Factory PMI increased to 58.5 from 58.3 - its highest since April.

- Job creation increased at the fastest pace since April 2006.

Previous

Previous

Latest

Latest

Comments