Topic: Indian Economy/Financial Market

1. Fitch Ratings has reaffirmed India’s sovereign credit rating at ‘BBB-’.

- The outlook remains stable. This decision reflects India’s strong economic performance and resilient external finances.

- India’s economic growth is expected to remain at 6.5% in the current fiscal year.

- This shows resilience despite global trade uncertainties, including possible US tariffs.

- While Fitch held its rating steady, other agencies have been more optimistic.

- S&P Global and DBRS both upgraded India to a higher ‘BBB’ rating.

- Fitch highlighted strong domestic demand. This is supported by government-led infrastructure spending and steady consumer activity.

- However, Fitch also pointed out structural concerns.

- These include high fiscal deficits, rising public debt, and weaker fundamentals compared to other ‘BBB’ countries.

- India’s per capita income remains low. Governance indicators also lag behind peers.

- These factors continue to limit the potential for a rating upgrade.

- Private investment is likely to remain cautious. This is partly due to uncertainty over proposed US tariff hikes.

- Nominal GDP growth is projected to slow. Fitch expects it to be 9% in FY26, down from 9.8% in FY25 and 12% in FY24.

- The US plans to impose a 50% tariff on Indian goods by August 27. Fitch sees this as a moderate risk.

- Exports to the US account for only 2% of India’s GDP. So the direct economic impact will be limited.

- Still, ongoing tariff uncertainty could hurt business sentiment and reduce investment.

Topic: Banking System

2. SEBI has approved LIC’s reclassification as a public shareholder in IDBI Bank.

- LIC held a 49% stake in IDBI Bank at the end of June.

- This decision is part of the government’s strategy to privatise the bank.

- The government had approved IDBI Bank’s privatisation in May 2021.

- LIC’s voting rights in the bank will be limited to 10%.

- The insurer cannot exercise direct or indirect control over the bank’s operations.

- It will also not enjoy any special privileges or rights in the bank.

- This applies to both formal agreements and informal arrangements.

- LIC will not have any representation on IDBI Bank’s board. It cannot appoint a nominee director.

- LIC is also barred from acting as a key managerial person in the bank.

- The plan to classify LIC’s remaining shares as public will be disclosed.

- This will be stated in the open offer letter sent to IDBI Bank’s shareholders.

- Once the disinvestment is completed, LIC must reduce its shareholding.

- LIC is required to bring its stake down to 15% or lower.

- This must be done within two years from the closing date of the deal, as directed by the RBI.

Topic: RBI

3. The Reserve Bank of India has approved SMBC’s proposal to acquire up to 24.99% of Yes Bank’s shares.

Topic: Appointments

4. Rajiv Anand has officially taken over as the new Managing Director and Chief Executive Officer of IndusInd Bank for a three-year term.

- This leadership change received formal approval from the bank’s Board of Directors.

- Anand brings prior experience as the former Deputy MD at Axis Bank.

- His tenure as MD and CEO began on August 25, 2025.

- His appointment comes in the wake of operational and leadership challenges the bank encountered earlier in the year.

- With his assumption of the role, the temporary executive committee managing daily functions has been disbanded.

Topic: Appointments

5. Rajiv Ranjan has been appointed as Vice President of the New Development Bank (NDB).

Topic: Banking/Financial/Govt Schemes

6. A one-time switch facility from UPS to NPS introduced by the Union Finance Ministry.

- A one-time facility allowing a shift from the Unified Pension Scheme (UPS) to the National Pension System (NPS) has been announced by the Union Finance Ministry.

- According to the notification, the option can be availed up to one year before superannuation or three months before voluntary retirement.

- It has been stated that employees facing dismissal, removal, or disciplinary action will not be eligible for this switch.

- Once exercised, the option to switch will make employees ineligible for UPS benefits, including assured payouts.

- The government’s 4% differential contribution will be credited to the NPS corpus of the individual at the time of exit.

- The initiative has been aimed at providing flexibility and reinforcing NPS as a long-term retirement solution.

- The government has introduced UPS as an option under the National Pension System for central government employees from April 1, 2025.

- Assured payouts have been promised under the UPS for employees opting for the scheme.

- Till July 20, around 31,555 central government employees had opted for UPS.

- The last date for enrolling under the Unified Pension Scheme has been set as September 30.

Topic: Summits/Conferences/Meetings

7. The FIBAC banking conference titled ‘Charting New Frontiers’ held in Mumbai from August 25.

- It was a two-day event. The conference is jointly organised by the Federation of Indian Chambers of Commerce and Industry (FICCI) and the Indian Banks’ Association (IBA).

- RBI Governor Sanjay Malhotra addressed the gathering. He said India is on track to become the world’s third-largest economy.

- He spoke about current global economic challenges.

- These include ongoing trade disputes, financial instability, and rising geopolitical tensions.

- Malhotra stressed the importance of monetary policy.

- He said it plays a key role in maintaining stability while promoting growth.

- Malhotra announced plans for a Regulatory Review Cell.

- This cell will reassess financial regulations every 5 to 7 years.

- Malhotra spoke about building a prosperous India—‘Samriddh Bharat’.

- The conference brings together top banking leaders and global experts.

- They will discuss major issues facing the sector and share effective strategies.

- A roadmap for the future of India’s banking industry will be developed during the event.

Topic: Indian Economy/Financial Market

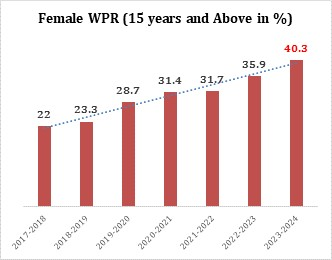

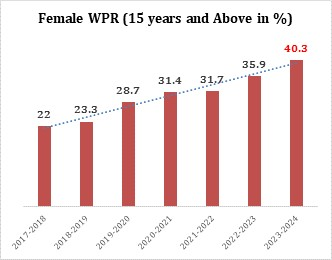

8. The Ministry of Labour and Employment has reported a major increase in women’s employment.

(Source: News on AIR)

Previous

Previous

Latest

Latest

Comments