Topic: Regulatory Bodies/Financial Institutions

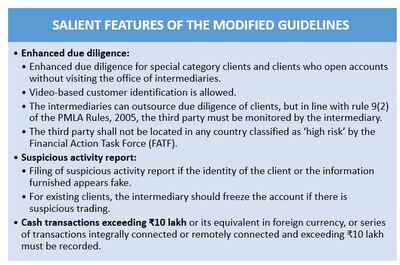

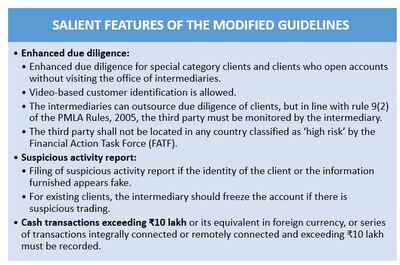

1. SEBI issued updated guidelines on anti-money laundering standards and combating financing of terrorism obligations for the securities of market intermediaries.

- In the updated guidelines, onus of knowing customers has been put on the intermediaries.

- The guidelines are applicable to all intermediaries registered with SEBI and recognized stock exchanges.

- The guidelines have introduced explanations and additions to the previous SEBI circular dated 15 October, 2019.

- The guidelines have added elements from notifications issued by the Ministry of Home Affairs that were related to the powers of central government under Section 51A of the Unlawful Activities (Prevention) Act, 1967.

- The guidelines are based on the Prevention of Money Laundering Act (PMLA), 2002.

- The measures to identify and discourage money laundering and terrorist financing must be implemented by the registered intermediaries.

- SEBI is empowered to specify the information that must be maintained by the intermediaries.

- SEBI is also empowered to mandate reporting entities to have an internal mechanism to detect specified transactions and furnish information.

- Violating the prohibitions on manipulative and deceptive devices will be treated as scheduled offences under PMLA.

- Insider trading, and substantial acquisition of securities or control will also be treated as scheduled offences under PMLA.

Topic: Miscellaneous

2. CAG GC Murmu said SAI of the G20 nations must carry out knowledge sharing to establish a coordinated audit response to audit the Blue Economy.

- He was speaking at a conference on ‘Blue economy’ organised by CAG.

- On 31 January, Supreme Audit Institution (SAI) India has formally assumed chairmanship of Supreme Audit Institutions (SAI) 20.

- Blue economy refers to exploitation, preservation and regeneration of the marine environment.

- Blue economy is linked to the Sustainable Development Goal (SDGs) 14 (Life below Water).

- The decade 2021-2030 has been declared by the UN as the decade of “Ocean Science for Sustainable Development”.

- According to Murmu, blue economy occupies important position in India’s economic growth.

- India has a 7,517-km-long coastline. It is home to nine coastal States and 1382 islands.

- India’s coastal economy sustains over 4 million fishermen and other communities.

- There are nearly 199 ports, including 12 major ports. In 2019, the Centre has released its vision for India 2030.

- Blue economy was listed as one of the ten most important dimensions to create modern India.

- The draft policy document on blue economy of India focused on seven thematic areas.

- As per Organization for Economic Cooperation and Development (OECD), over three billion people depend on the ocean for their livelihoods. Majority of these people live in developing countries.

- G-20 Nations have 45% of global coastline. They have jurisdictional responsibility of over 21% of World’s Exclusive Economic Zone.

Topic: Regulatory Bodies/Financial Institutions

3. PFRDA has mandated that four specified documents have to be mandatorily uploaded in the user interface of the central record keeping agency.

- Four specified documents, basically withdrawal and KYC documents, would have to be uploaded from April 1, 2023.

- NPS subscribers would upload documents themselves and authenticate them digitally through Aadhaar.

- The four documents are NPS exit/ withdrawal form, proof of identity and address as specified in the withdrawal form, bank account proof and copy of Permanent Retirement Account Number (PRAN) card.

- PFRDA in regulatory collaboration with IRDAI had simplified the process of buying annuity.

- In the simplified process, Annuity Service Providers (ASPs) shall use the NPS withdrawal form submitted at the time of exit by the subscribers for issuing annuity.

- Presently, the NPS gives returns annually. PFRDA is considering to have a separate scheme that can offer a guaranteed minimum rate of return to NPS subscribers, especially those who are risk averse.

Topic: Miscellaneous

4. Jan Vishwas Bill may be put before Parliament in the second part of the Budget session.

- Commerce & Industry Minister, Piyush Goyal introduced the bill in Parliament in December 2022.

- The bill was sent to the Parliamentary Joint Committee. The committee is likely to be ready with its report soon.

- Under the bill, as many as 183 sections across 42 Acts under 19 Ministries are proposed to be amended.

- These acts include the Indian Post Office Act, the Environment (Protection) Act, the Legal Metrology Act, the Motor Vehicles Act, the Public Liability Insurance Act and the Information Technology Act, 2000, among others.

- The Bill proposes to replace prison terms with only a monetary penalty under certain Acts.

- In some Acts, fines are imposed for minor offences. The Bill seeks to replace it with penalties.

Topic: RBI

5. RBI has placed restrictions on five co-operative banks.

- These banks cannot grant loans and make investments without prior approval of RBI.

- These banks cannot incur any liability and transfer or dispose of any of its properties.

- In separate statements, RBI said these restrictions shall remain in place for a period of six months.

- Customers of HCBL Co-operative Bank, Lucknow (Uttar Pradesh), Adarsh Mahila Nagari Sahakari Bank Maryadit, Aurangabad (Maharashtra), and Shimsha Sahakara Bank Niyamitha, Maddur, Mandya District in Karnataka cannot withdraw funds from accounts.

- Customers of Uravakonda Co-operative Town Bank, Uravakonda, (Anantapur District, Andhra Pradesh) and Shankarrao Mohite Patil Sahakari Bank, Akluj (Maharashtra) can withdraw up to Rs 5,000.

Topic: Miscellaneous

6. IMF has laid out a nine-point crypto assets action plan.

- The International Monetary Fund laid out a nine-point action plan for crypto assets.

- The action plan gives direction that how countries should handle crypto assets and urges to not give legal tender to cryptocurrencies such as bitcoin.

- The main recommendation of the action plan is to safeguard monetary sovereignty and stability by strengthening monetary policy frameworks.

- Central American country El Salvador is the first country to adopt bitcoin as legal tender in 2021.

- IMF said that Countries should also establish international arrangements to increase supervision and enforce regulations.

- Crypto is a digital currency designed to work as a medium of exchange through a computer network. It is an alternative form of payment created by using encryption algorithms.

- The government of India had announced a flat 30% tax on gains from cryptocurrency in the budget 2022.

- Cryptocurrencies in India is not regulated by any central authority.

- In the G20 FMCBG meeting, Finance Ministers and Central Bank Governors accepted Crypto Assets are major risks to financial stability.

- FMCBG meeting delegates took interest in the central bank digital currency (CBDC) pilot projects.

Topic: Corporates/Companies

7. Meta Platform to introduce 'LLaMA’ for artificial intelligence.

- Meta Platforms Inc. introduced its Large Language Model Meta AI (LLaMA) for artificial intelligence.

- This language model will help in generating text, having conversations, summarizing written material and performing complicated tasks.

- It will also help in solving math theorems or predicting protein structures.

- LLaMA is a research tool which will solve issues related to AI language models.

- LLaMA is a collection of language models that range from 7B to 65B parameters.

- According to Meta, LLaMA-13B outperformed OpenAI’s GPT-3 (175B) on most benchmarks.

- Currently, LLaMA is not used on any of Meta’s products. It will be also available for AI researchers.

- Earlier, Meta launched its LLM OPT-175B but LLaMA is more advanced system.

- Meta announced that LLaMA will be available in different sizes like 7B, 13B, 33B, and 65B parameters.

- Meta Platforms Inc. (Meta), formerly named Facebook, is an American multinational technology conglomerate.

Topic: Indian Economy/Financial Market

8. Nifty India Municipal Bond Index launched by NSE Indices.

- On 24 February, a branch of NSE, NSE Indices Ltd. said that it has introduced the country's first municipal bond index.

- The performance of municipal bonds issued by Indian municipal corporations across maturities and investment grade credit ratings will be tracked by the new Nifty India Municipal Bond Index.

- The index has been launched at the Securities and Exchange Board of India's (SEBI) workshop on Municipal Debt Securities in Bengaluru.

- Currently, the index consists of 28 municipal bonds issued by 10 issuers with a credit rating in the AA category.

- The index constituents are assigned weight in accordance with their outstanding amount.

- The index is calculated using the total return method, including price return and coupon return.

- The base date of the index is January 1, 2021, and the base value is 1,000. The index will be reviewed quarterly.

Previous

Previous

Latest

Latest

Comments