Topic: RBI

1. RBI has limited individual investors’ investment in primary issuances to 25% of the total issuance.

- RBI has taken this step to make sure that individual investors’ losses are minimised if issuers default on short-term financial instruments.

- Now, individual investors’ investment in short-term CPs, NCDs is limited to 25% of issue size. There was no limit earlier for individual investors’ investment.

- The new rule applies to the total subscription by all individuals, including Hindu Undivided Families, (HUF) in any primary issuance of CPs or NCDs.

- Moreover, issuers of non-convertible debentures (NCDs) and commercial papers (CPs) are required to provide information on any payment default via a variety of means.

- The RBI's amended master instruction on CPs and NCDs of original or initial maturity up to one year stipulates that the issuers' websites may be used as one of the means for publicly disseminating such information.

- CPs and NCDs are issued in multiples of ₹5 lakh initially, and in denominations of at least ₹5 lakh afterward.

- The category of CP and NCD issuers has been expanded by RBI to include Infrastructure Investment Trusts (InvITs) and Real Estate Investment Trusts (REITs).

- CPs can also be issued by co-operative societies and limited liability partnerships with a minimum net-worth of ₹100 crore.

- CP is an unsecured money market instrument issued in the form of a promissory note.

- In the RBI’s circular, NCD is defined as a secured money market instrument with an original or initial maturity up to one year.

- When an issuer fails to repay a coupon or redemption, either fully or partially, of a CP and/or NCD, they must notify the IPA (Issuing and Paying Agent) of the situation by 5 p.m. on the default date.

- The Debenture Trustee should also be informed of the details in the case of NCDs.

- According to the RBI, the issuer may choose to refund debts under a defaulted CP or NCD directly to the investor or through the IPA or Debenture Trustee.

- Additionally, investors should get any partial repayments of a CP/NCD in accordance with the amount they invested in these instruments.

Topic: MoUs/Agreements

2. Paytm signed Memorandum of Understanding (MoU) with Ayodhya Nagar Nigam.

- Ayodhya Nagar Nigam and One97 Communications Ltd (OCL), the company that owns the Paytm brand, have inked an agreement.

- This will make it possible to use the Paytm-pioneered QR code, Soundbox, and card machines for mobile payments in Ayodhya.

- The goal of this MoU is to offer flawless mobile payment services on January 22, when Ram Mandir in Ayodhya opens.

- The company will also install Paytm card readers at cash collection locations run by State Nagar Nigam departments thanks to this Memorandum of Understanding.

- This MoU was signed in presence of Girish Pati Tripathi, Mayor, Ayodhya Nagar Nigam.

Topic: Reports and Indices

3. Funding in Indian fintech sector has recorded a decrease of 63% in 2023 according to a Tracxn FinTech Report.

- The fintech sector got funding of $2 billion in 2023. This is a decline of 63% compared to $5.4 billion raised in 2022, according to a Tracxn FinTech Report.

- This is a decline of 76% compared to $8.4 billion in 2021, according to a Tracxn FinTech Report.

- Peak XV Partners, Y Combinator, and LetsVenture were the top investors.

- The year recorded five funding rounds surpassing the $100 million mark.

- Only two companies (Zaggle and Veefin) announced IPOs in 2023.

- Bengaluru emerged as the leader in total fintech funding raised in 2023. It was followed by Mumbai and Jaipur.

- As per the report, India ranked third globally in 2023 in fintech start-up funding.

Topic: Agriculture

4. India’s pulses imports may increase to six-year high level in the current financial year.

- India’s pulses imports may increase due to shortfall in domestic output after deficit rainfall in growing areas.

- As per trade estimates, the pulses imports may touch 3 million tonnes (mt) in this financial year.

- This is an increase of about 31% over 2.29 mt of imports of last year.

- The government has opened up imports of yellow peas till March 31, 2024 to increase the supplies and controlling rising prices.

- It has extended the window for duty-free imports of pulses like lentils (masur), tur (pigeon pea) and urad (black matpe) till March 2025 to increase the supplies and controlling rising prices.

- India had imported a record 6.5 million tonnes of pulses during 2017-18.

- Guaranteed price scheme for tur farmers has been launched by government. Maize, urad, and masur crops are planned to be included in the scheme.

- Cooperation minister Amit Shah launched a portal where farmers can register to get assured price.

- Initially, the portal will be only for tur crop. It would be extended to all pulses (except gram and green gram) and to maize.

- Under the scheme, National Agricultural Cooperative Marketing Federation of India Ltd (Nafed) and the National Cooperative Consumers’ Federation of India (NCCF) will undertake pulses procurement on behalf of the government.

- He said that by December 2027, India should become self-reliant in pulses.

Topic: Indian Economy/Financial Market

5. Toys exports from India increased 239% from $96 million in 2014-15 to $326 million in 2022-23.

- Toys imports declined 52% from $332 million to $159 million in the same period.

- Toys exports increased and imports declined because of measures like import tariff increase and quality control, as per a case study on the ‘success story of made in India toys’.

- The study was conducted by IIM Lucknow on behalf of the Department for Promotion of Industry and Internal Trade (DPIIT).

- About 12% compounded annual growth rate is expected in toy sector in the next eight years.

- It is likely that toy exports will increase to $3 billion by 2028.

- Tariff on imported toys were increased from 20% to 60%. Quality control orders were introduced to stop dumping of sub-standard products.

- As per the report, government efforts led to doubling of the number of manufacturing units from 2014 to 2020.

- Government efforts also led to reduction in dependence on imported inputs from 33% to 12% and increase in gross sales value by a CAGR of 10%.

Topic: Reports and Indices

6. PMI Manufacturing declined to 54.9 in December.

- This is the 18-month low level of HSBC India Purchasing Managers’ Index (PMI). In November, PMI stood at 56.

- However, the future output index has increased since November.

- Despite the decline in PMI, manufacturing sector is still in expansion mode.

- Input costs rose at the second-slowest rate in nearly three-and-a-half years. Charge inflation declined to a nine-month low.

- The index is compiled by S&P Global from responses to questionnaires, which are sent to purchasing managers in a panel of around 400 manufacturers.

Topic: Banking/Financial/Govt Schemes

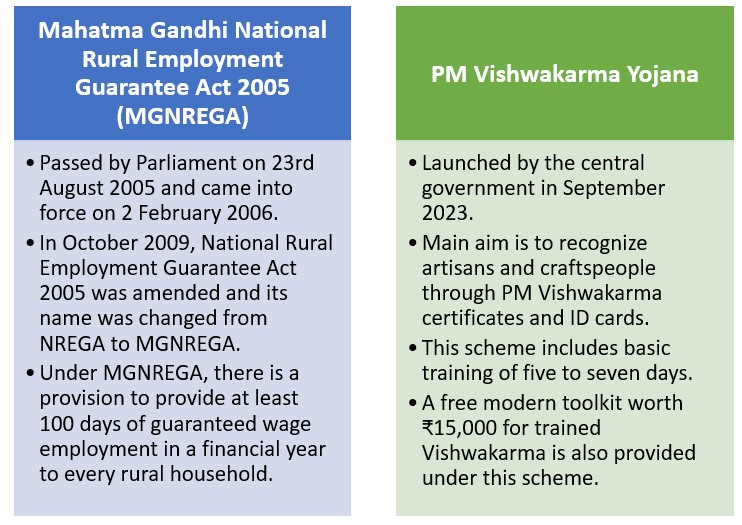

7. Government made the Aadhaar-based system mandatory for NREGS payments and Jammu and Kashmir became the first UT to implement PM Vishwakarma Yojana.

- The Aadhaar-based payment system (ABPS) has become mandatory for paying wages to NREGS workers from 1 January 2024.

- The government may consider exemptions on a “case-by-case basis” if any gram panchayat faces either a technical issue or an Aadhaar-related problem.

- Under the Aadhaar-based payment system (ABPS), workers' Aadhaar numbers will be linked to their Job cards and their bank account numbers.

- The ABPS will ensure wage payment of beneficiaries into their bank accounts, even in case of frequent change of bank account.

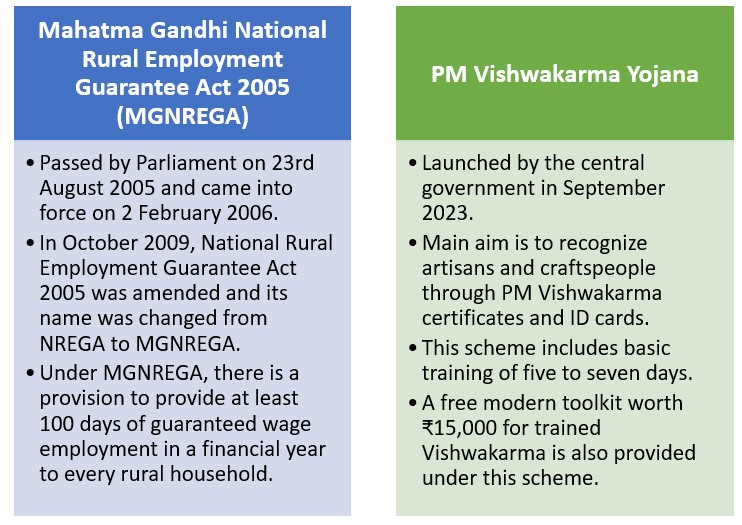

- Jammu and Kashmir has implemented the PM Vishwakarma Yojana (PMVY).

- PM Vishwakarma Yojana is an initiative to empower and enhance the skills of the craftsman community.

- The training programme for the first batch of 30 trainees (Viswakarmas) in 'darzi craft' has been inaugurated at the Industrial Training Institute in Shopian.

- The scheme is expected to be operationalized in all districts of J&K soon.

Topic: RBI

8. RBI has proposed new rules of dividend payout for banks.

- In a recently released draft circular, RBI has proposed new rules of dividend payout for domestic and overseas banks operating in India.

- The proposed rules will be effective from fiscal year 2024-25 onwards.

- RBI has invited public feedback on the proposed rules by 31 January, 2024.

- The draft circular will be implemented from April 2024 onwards.

- As per the proposal, banks with net non-performing asset ratio (NNPA) of more than 6% and capital adequacy ratio of less than 11.5% cannot declare dividends.

- Minimum capital adequacy ratio has been kept at 15% for a small finance bank and payment banks. It has been kept at 9% for local area banks and regional rural banks.

- According to the RBI’s circular, banks must compute dividends on the basis of the “dividend payout ratio”.

- Dividend payout ratio is the ratio between the amount of the dividend payable in a year and the net profit for the financial year for which the dividend is proposed.

- Only dividend on equity shares shall be included in the proposed dividend payable.

- Increasing the ceiling on dividend payout ratio to 50% if net NPA is zero has also been proposed by RBI. Earlier ceiling was 40%.

- Presently, banks require a NNPA ratio of up to 7% to become eligible for declaration of dividends.

Topic: Awards and Prizes

9. M S Swaminathan Award has been given to Prof B R Kamboj.

- Prof. B.R. Kamboj is the Vice Chancellor of the Chaudhary Charan Singh Haryana Agricultural University.

- He has been honoured with this prestigious award in recognition of his contributions as a scientist and extension specialist in the field of agronomy.

- Karnataka Governor Thawar Chand Gehlot presented him with the award.

- The award ceremony took place at the International Conference on 'One Health One World' organized at Rajmata Vijayaraje Scindia Agricultural University in Gwalior, Madhya Pradesh.

- M.S. Swaminathan Award:

- M.S. Swaminathan Award was instituted in 2004.

- The award aims to recognize the lifetime contribution of eminent individuals who have made a global impact in the field of agriculture, including food security and the sustainability of agriculture in India.

- The first award was presented to Nobel Peace Prize winner Dr. Norman E. Borlaug by the then President of India, Dr. APJ Abdul Kalam, on March 15, 2005.

- The previous M S Swaminathan Award was presented to Dr. Surinder (Suri) M. Sehgal, Founder of SM Sehgal Foundation (India) and Sehgal Foundation (USA), on 19 August 2023.

Topic: Awards and Prizes

10. One District One Product Awards 2023 presented in Aatmanirbhar Bharat Utsav 2024 in New Delhi.

- On January 3, 2024, Chief Guest Union External Affairs Minister Dr. S. Jaishankar inaugurated the 'Atmanirbhar Bharat Utsav 2024' in New Delhi.

- The Department for Promotion of Industry and Internal Trade (DPIIT), Ministry of Commerce and Industry hosted Aatmanirbhar Bharat Utsav 2024.

- The objective of the ODOP initiative is to promote the socio-economic development of all the districts of the country to realize the vision of Hon'ble Prime Minister Shri Narendra Modi of Self-reliant India.

- The ODOP Awards recognize significant efforts and successes in promoting ODOP initiatives.

- There are a total of 24 awards in 3 categories–for districts, states, union territories, and Indian missions abroad.

- In the States (Category A), Uttar Pradesh and Gujarat have won gold and silver award, respectively.

- In the States (Category B), J&K and Uttarakhand have won gold and silver award, respectively.

- List of other Awardees for ODOP Awards 2023:

|

Categories

|

Districts / States

|

Product

|

Award

|

|

Districts Awards (Agriculture)

|

Alluri Sitharama Raj (Andhra Pradesh)

|

Araku Coffee

|

Gold

|

|

Uttarkashi (Uttarakhand)

|

Red Rice

|

Silver

|

|

Shopian (J&K)

|

Apple

|

Bronze

|

|

Kandhamal (Odisha)

|

Turmeric

|

|

Bathinda (Punjab)

|

Honey

|

Special Mention

|

|

Burhanpur (Madhya Pradesh)

|

Banana

|

|

Districts Awards (Non-Agriculture)

|

Kakinada (Andhra Pradesh)

|

Uppada Jamdani Saree

|

Gold

|

|

Banda (Uttar Pradesh)

|

Shazar Stone Craft

|

Silver

|

|

Srikakulam (Andhra Pradesh)

|

Ponduru Cotton Sarees

|

Bronze

|

|

Kumool (Andhra Pradesh)

|

Handloom silk sarees

|

|

Annamayya (Andhra Pradesh)

|

Madanapalle Silk Sarees

|

Special Mention

|

|

Guntur (Andhra Pradesh)

|

Mangalagiri handloom

|

Previous

Previous

Latest

Latest

Comments