Topic: Banking System

1. Banks warn their customers not to transact in cryptocurrencies.

- Certain banks have started to warn their customers about virtual currency transactions being done through their bank accounts.

- HDFC Bank has sent its customers cautionary mail that their account shows virtually currency transactions, which is not allowed by RBI on the basis of its 2018 circular.

- SBI Card said that credit card usage for transactions on virtual currency merchant platforms might lead to credit card suspension or cancellation.

- In March 2020, Supreme Court had lifted the ban on the trading of cryptocurrency. RBI has not issued any formal order on the issue.

- In 2018, a circular was issued by RBI. It said that RBI regulated entities should not deal in virtual currencies.

- In the circular, RBI further said that RBI regulated entities should not provide services for facilitating any person or entity in dealing with virtual currencies.

- Finance Ministry has proposed to bring a law to ban cryptocurrencies. But, it has been postponed.

- WazirX and CoinDCX are names of India’s cryptocurrency exchanges.

Topic: Corporates/Companies

2. Facebook-owned WhatsApp files a petition in Delhi High Court.

- On 25 May, Facebook-owned WhatsApp has filed a petition in Delhi High Court.

- The petition challenges the new IT rule that requires WhatsApp to trace the originator of message on its platform.

- WhatsApp said that tracing the originator of messages would severely undermine user privacy.

- May 25 was the deadline for IT intermediaries to comply with new IT rules, which came into effect on 26 May.

- New IT rules, Information Technology (Intermediary Guidelines and Digital Media Ethics Code) Rules 2021 were notified in February.

- Whatsapp was released in January 2009. It was acquired by Facebook in February 2014. It was originally programmed by Brian Acton and Jan Koum.

Topic: Banking System

3. Public Sector Banks (PSBs) develop templated approach for implementation of RBI’s Resolution Framework 2.0.

- PSBs have developed a templated approach for implementation of RBI’s Resolution Framework 2.0 for restructuring loans to individuals, small business and MSMEs up to Rs25 crore.

- The resolution process needs to be invoked within 30 days after receipt of the application. September 30 is the last date for invocation.

- In invocation, borrower and bank agree to proceed with the Resolution plan. The Resolution Plan should be implemented within 90 days from the date of invocation. It cannot be implemented later than December-end 2021.

- For the implementation of resolution framework, business loans have been categorized into 3 categories. The categories are up to ₹10 lakh, ₹10 lakh and up to ₹10 crore, and above ₹10 crore.

- Banks have sent bulk SMS to eligible customers under the templated standardised approach for restructuring Business and MSME loans up to ₹10 lakh.

- Banks will take a graded approach for restructuring of loans above ₹10 lakh and up to ₹10 crore, and above ₹10 crore.

- Resolution Framework 2.0 for Covid-Related Stressed Assets of Individuals, Small Businesses and MSMEs was announced by RBI on May 5.

- Borrowers – individuals, small businesses and MSMEs – having aggregate exposure of up to ₹25 crore are eligible to be considered under Resolution Framework 2.0.

Topic: Regulatory Bodies/Financial Institutions

4. Indian Broadcasting Foundation (IBF) to be renamed as Indian Broadcasting and Digital Foundation (IBDF).

- Indian Broadcasting Foundation (IBF) will be renamed as Indian Broadcasting and Digital Foundation (IBDF).

- IBF is the apex body of broadcasters. Digital streaming platforms will also come under its purview.

- IBDF is in the process of forming a news wholly-owned subsidiary to handle all matters of digital media.

- IBDF will also constitute a self-regulatory body for digital Over The Top (OTT) platforms. This self-regulatory body will be called Digital Media Content Regulatory Council (DMCRC).

- Indian Broadcasting Foundation (IBF) was established in 1999. It is a not-for-profit organization with members from News and Non-News Channels. K. Madhavan is its President.

Topic: Agriculture

5. Centre to tackle honey quality and adulteration issues in the long term through initiatives such as “hive to traceability” project.

- Centre will tackle honey quality and adulteration issues in the long term through initiatives such as the “hive to traceability” project.

- National Beekeeping and Honey Mission (NBHM) launched the “hive to traceability” project in April.

- National Beekeeping and Honey Mission (NBHM) was launched last year with an outlay of Rs 500 crore for two years.

- North-eastern region and Maharashtra are the key areas of natural honey production in India.

- US, UAE, Saudi Arabia and Canada are the primary buyers of Indian honey.

Topic: Corporates/Companies

6. CoC of Jaypee Infratech allows Suraksha Realty Ltd and NBCC to submit fresh bids by June 4.

- Committee of Creditors (CoC) of Jaypee Infratech has allowed Suraksha Realty Ltd and NBCC (India) Limited to submit fresh bids by June 4.

- Earlier, NBCC has challenged CoC’s decision to take up only the bid of Suraksha Group to acquire Jaypee’s stressed assets.

- After the request of NBCC, CoC had decided to put to vote the proposal to allow more time to both resolution applicants for submitting final resolution plan.

- NBCC (India) Limited, formerly known as National Buildings Construction Corporation Limited, is a Government of India Navratna Enterprise.

Topic: Agriculture

7. IFFCO to launch Nano Urea in the market.

- Indian Farmers Fertiliser Cooperative (IFFCO) will launch Nano Urea in the market.

- It will be equivalent to 45kg of normal urea, and it will cost 480 rupees per kg.

- It will help in increasing the productivity of the crop by 18-35% and reduce the burden of cost for cultivation.

- It is eco-friendly urea and reduces the consumption of normal Urea.

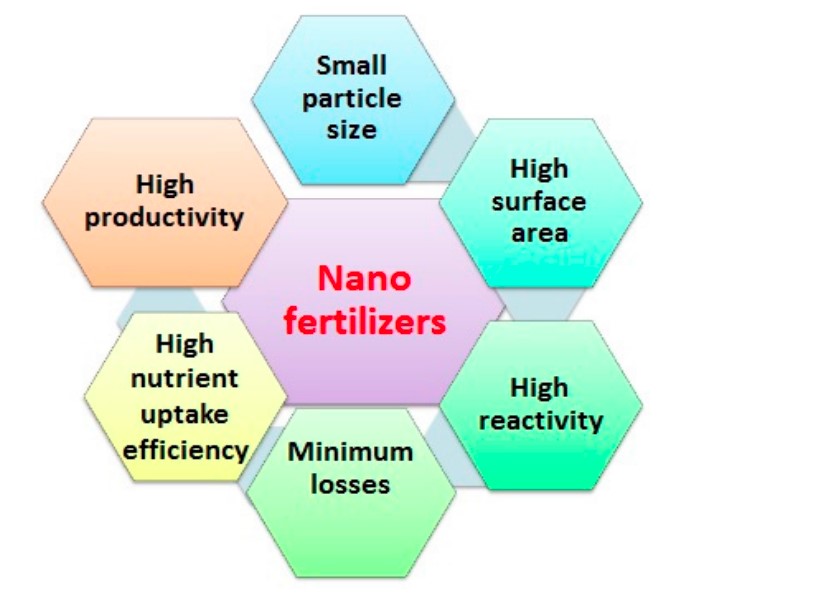

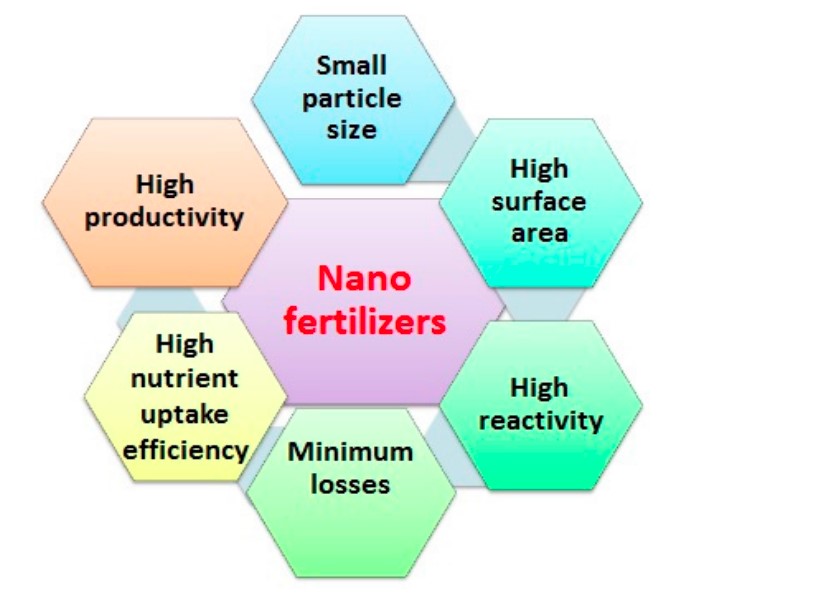

- Nano Urea:

- The Urea produced with the help of Nano-technology is known as Nano Urea.

- The commercial use of Nano Urea was approved by the government in 2020.

(Source: MPDI)

Previous

Previous

Latest

Latest

Comments