1. MoHUA and Swiggy signed MoU to take street food vendors online

- The Ministry of Housing and Urban Affairs has signed an MoU with Swiggy to onboard street food vendors on its e-commerce platform.

- It will provide thousands of consumers to street vendors that will help them to grow their businesses.

- This MoU is facilitated under the Prime Minister Street Vendor’s AtmaNibhar Nidhi (PM SVANIDHI) Scheme.

- It will be run on a pilot basis in Ahmedabad, Chennai, Delhi, Indore, and Varanasi.

- Street vendors will be helped with PAN and FSSAI registration, training on technology, menu digitization and pricing along with hygiene and packaging best practices.

- PM Street Vendor’s AtmaNirbhar Nidhi (PM SVANIDHI):

- It was launched by the Ministry of Housing and Urban Affairs on 1 June 2020.

- It will provide affordable Working Capital loan to street vendors to resume their livelihoods during the COVID-19 lockdown.

- It will provide a capital loan of up to ₹10,000, which must be repaid in monthly installments in one year.

2. SC bench asks about action taken to implement KV Kamath Committee report

- SC bench has asked the government and RBI about action taken to implement the report of KV Kamath Committee, a five-membered expert committee formed by RBI on August 7, 2020.

- SC bench has said that the government has not made any official statement about action taken to implement KV Kamath Committee report.

- The bench adjourned hearing on petitions till 13 October and asked the government and RBI to file affidavit and explain steps taken to implement recommendations made by Kamath committee on waiver on compound interest of small borrowers.

- The bench was hearing petitions about interest waiver on loans during the moratorium till 31 August.

- During the hearing, the Finance Ministry has said that the government has decided to provide waiver on loans up to ₹2 crore only.

3. Two NABARD-supported Organic Spices Seed Parks to be established in Gujarat

- Banaskantha and Patan in Gujarat, each will have one NABARD-supported Organic Spices Seed Parks for saunf (fennel) and jeera (cumin) seeds.

- Organic Spices Seed Park at Banaskantha in Gujarat will be for saunf (fennel) seeds.

- Organic Spices Seed Park at Patan in Gujarat will be for jeera (cumin) seeds.

- The parks will be for promoting organic seed value chain, capacity building and best practices in the production of saunf (fennel) and jeera (cumin).

- The sanction letters for two parks have been given to two farmer producer organisations (FPOs) and released by Gujarat Chief Minister. The FPOs will be responsible for the functioning of parks.

- Both parks have been given grant assistance of ₹23 lakh and they will have 50 farmers each.

- NABARD is also working on the concept of value-chain finance or financing of every level of FPO chain.

4. Indian Bank’s first Customer Acquisition & Processing Centre launched

- The first Customer Acquisition & Processing Centre (CAPC) has been launched by Indian Bank in Chennai.

- The bank will bring its branches in Tamil Nadu and Puducherry under CAPC before December 2020.

- Executive Director of Indian Bank MK Bhattacharya has inaugurated by CAPC.

- Indian Bank was founded in 1907. Its headquarters are in Chennai Ms. Padmaja Chunduru is its MD & CEO. From 1 April 2020, Allahabad bank has been merged with Indian Bank.

5. Swaminathan Janakiraman and Ashwini Kumar Tewari recommended for posts of MD at SBI

- Swaminathan Janakiraman and Ashwini Kumar Tewari have been recommended for posts of MD at SBI.

- The recommendation has been made by Bank Board Bureau (BBB). Janakiraman is currently serving as Deputy Managing Directors (DMDs) at SBI.

- Ashwini Kumar Tewari is serving as MD and CEO at SBI Cards and Payment Services Ltd.

- Two posts of MD will become vacant in October. They are currently held by Dinesh Kumar Khara and Arijit Basu.

- Dinesh Kumar Khara, Managing Director (Global Banking and Subsidiaries) will become Chairman of SBI on October 8.

- Arijit Basu, Managing Director (Commercial Client Group) will retire on October 31.

- Prakash Chandra Kandpal and Lok Kumar Choudhary have been kept in the reserve list for two posts.

- Currently, there are four MDs in SBI. They are Dinesh Kumar Khara, Arijit Basu, CS Setty and Ashwani Bhatia.

- Banks Board Bureau is an autonomous recommendatory body. It received approval from the government in February 2016 and became operational in April 2016. Bhanu Pratap Sharma is its current Chairperson.

- Banks Board Bureau recommends the selection of whole-time directors as well as non-executive chairpersons of public sector banks and state-owned financial institutions.

- State Bank of India (SBI) was formed in 1955 from the Imperial Bank of India. It is headquartered in Mumbai. Its tagline is The Banker to Every Indian.

6. BFSL and ICSI launch BoB-ICSI Diamond credit card

- BOB Financial Solutions Ltd (BFSL) and Institute of Company Secretaries of India (ICSI) have launched BoB-ICSI Diamond credit card for Company Secretaries.

- BoB-ICSI Diamond credit card will provide the following benefits to Company Secretaries.

- 12 free domestic lounge visits

- 5X rewards on online spends and utility payments

- Activation, frequency and milestone-based rewards

- Exclusive insurance benefits

- BOB Financial Solutions Ltd (BFSL) is an NBFC earlier known as Bobcards Limited.

- Institute of Company Secretaries of India (ICSI) is a statutory body under Company Secretaries Act, 1980. Its headquarters are in New Delhi. Ashish Garg is the President of ICSI.

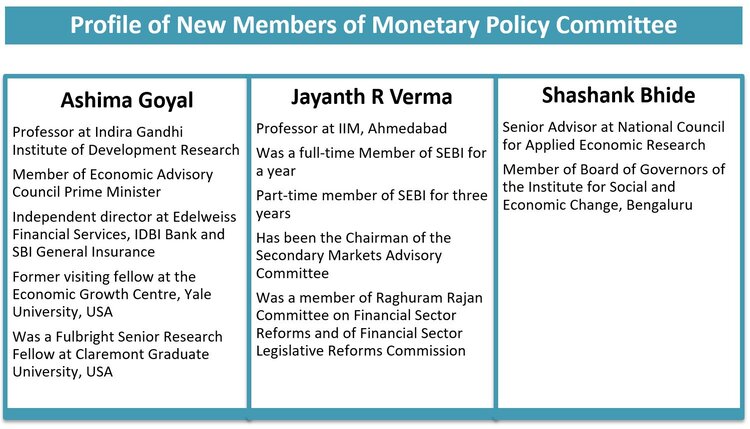

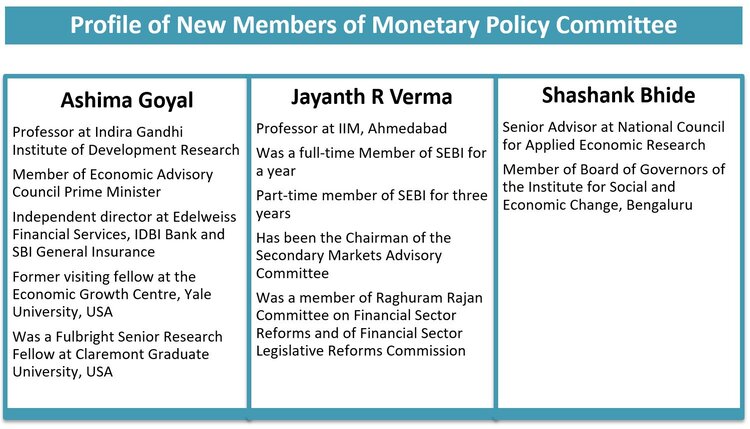

7. Government notifies names of three new members of MPC

- The government has notified Ashima Goyal, Jayanth R Verma and Shashank Bhide as three new members of the Monetary Policy Committee (MPC).

- The first meeting of MPC was held in October 2016. The term of Ravindra Dholakia, Chetan Ghate and Pami Dua as members of MPC has ended.

- MPC postponed its meeting scheduled for 30 September-2 October as three members were not nominated by the government.

- The term of new MPC members will be four years or until further orders, whichever is earlier.

- MPC has six members. RBI Governor is Chairman of MPC. Along with RBI governor, MPC consists of Deputy Governor, RBI and one officer of RBI as its members. Three members are nominated by the government.

Previous

Previous

Latest

Latest

Comments