Topic: Corporates/Companies

1. A new shopping app has been launched by PhonePe on ONDC.

- The app is named as Pincode. It is live now for customers in Bengaluru.

- Pincode is built on ONDC platform. It will focus on hyperlocal e-commerce.

- It will be launched in other cities soon. The aim of the app is to promote local shopkeepers and sellers.

- PhonePe is an Indian digital payments company. It is headquartered in Bengaluru, Karnataka. Sameer Nigam is its CEO.

- Open Network for Digital Commerce (ONDC) is an initiative of the Department for Promotion of Industry and Internal Trade (DPIIT), Ministry of Commerce.

- It was established to develop open e-commerce. It was incorporated on 31 December 2021.

Topic: Banking System

2. UPI processed 8.7 billion transactions in March 2023.

- This was highest number since the inception of UPI. 8.7 billion transactions amounted to Rs 14.05 trillion.

- As per NPCI data, UPI transactions in March 2023 were 60% higher in volume terms from the year-ago period.

- As per NPCI data, UPI transactions in March 2023 were 46% higher in value terms from the year-ago period.

- In March 2022, UPI had processed 5.4 billion transactions. They amounted to Rs 9.6 trillion.

- UPI had processed 8 billion transactions for the first time in January.

- It was launched in 2016. In three years, it reached the milestone of processing a billion transactions a month in October 2019.

- Unified Payments Interface (UPI) currently processes about 30 crore transactions a day.

- UPI is developed by National Payments Corporation of India (NPCI).

Topic: RBI

3. Data relating to India’s International Investment Position for end-December 2022 has been released by RBI.

- Non-resident net claims on India fell by US$ 12.0 billion between October and December 2022, reaching US$ 374.5 billion at the end of December 2022.

- The decrease in net claims was owing to a greater growth in Indian residents' abroad financial assets (US$ 28.7 billion) than an increase in Indians' overseas liabilities (US$ 16.7 billion).

- The gain in Indian residents' foreign assets during Q3:2022-23 was mostly due to a US$ 30.0 billion increase in reserve assets, which had previously decreased by US$ 56.5 billion in the previous quarter.

- As of the end of December 2022, reserve assets accounted for 64.3% of India's international financial assets.

- Trade credits and loans were the key contributors to India's increase in foreign liabilities.

- The proportion of debt liabilities in total external liabilities climbed to 50.2% at the end of December 2022, up from 49.8% the previous quarter and 48.4% the previous year.

- In December 2022, India's international assets covered 70.0% of its international liabilities, up from 72.5% the previous year.

Topic: Indian Economy/Financial Market

4. Corporate Social Responsibility (CSR) spending by corporate India increased to ₹25,715 crore in 2020-2021.

- As per data of Corporate Affairs Ministry (MCA), this was higher than CSR spend of ₹24,955 crore in 2019-20 and ₹20,197 crore in 2018-19.

- In the Companies Act 2013, government does not spend CSR fund.

- Allocation of CSR funds to the Government is not allowed.

- Companies shall file details of CSR expenditure annually in the MCA21 registry.

- The companies must file CSR details for financial year 2021-22 on or before March 31, 2023.

- As per Section 135 of the Act, every company have to do CSR if it is having net worth of ₹500 crore or more, or turnover of ₹1,000 crore or more, or net profit of ₹5 crore or more during the immediately preceding financial year.

- Such companies should spend at least 2% of the average net profits made over immediately preceding 3 financial years towards CSR.

Topic: Reports and Indices

5. Services Purchasing Managers’ Index (PMI) declined to 57.8 in March 2023.

- Services Purchasing Managers’ Index (PMI) stood at 59.4 in February 2023.

- Input cost inflation declined to its lowest level since September 2020.

- A reading of over 50 on the PMI shows expansion in activity.

- Expansion has been recorded for 12 successive months.

- No change in employment was seen either in services or in manufacturing.

- Nearly 98% of survey participants left payroll numbers unchanged.

Topic: Reports and Indices

6. The spending on essential items has increased in rural areas by 33% as per Consumer Sentiment Index (CSI).

- As per CSI, the spending on essential items has increased in urban areas by 31%.

- Spending on household items including personal care has grown for 33% of the respondent families.

- Despite an increase in essential items purchases in rural areas, discretionary spending has not increased.

- 19% of respondents between 18 to 25 years were planning to purchase white goods (large electrical goods of domestic use, AC, refrigerators etc).

- Axis My India conducted the CSI survey. It surveyed 10,034 people.

- Out of these, 66% were from rural India and 34% were from urban India.

Topic: RBI

7. Neeraj Nigam has been appointed as Executive Director (ED) of RBI.

- On April 3, the RBI appointed Niraj Nigam as ED, who will look after four departments including consumer education and protection.

- Before being promoted as ED, he was working as head of the Bhopal Regional Office of the RBI.

- As ED, he will look after the Department of Consumer Education and Protection, Department of Financial Inclusion and Development, Legal Department and Secretary Department.

- Reserve Bank of India (RBI):

- RBI was established on April 1, 1935, under the provisions of the Reserve Bank of India Act, 1934.

- It was set up on the recommendations of the Hilton Young Commission.

- It is the central bank of India and regulates the banking system in India. It also regulates the monetary policy of India.

- The Reserve Bank of India was nationalised on 1 January 1949.

- The RBI Central Board consists of 21 members, including the Governor and four deputy governors.

Topic: Regulatory Bodies/Financial Institutions

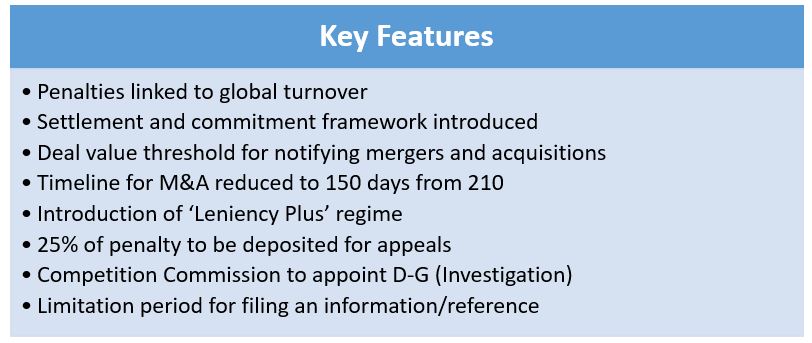

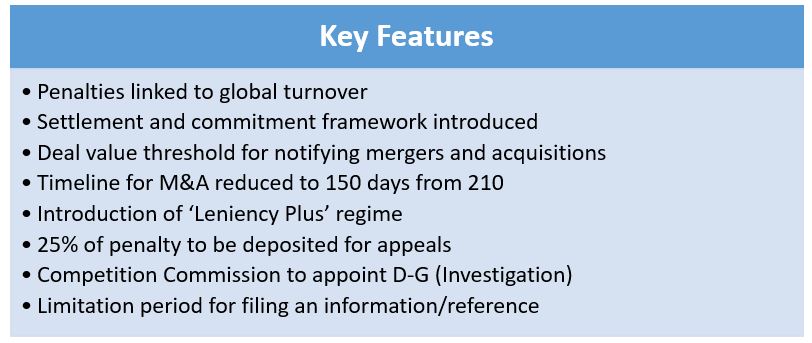

8. Parliament has passed the Competition (Amendment) Bill, 2023.

- Rajya Sabha approved the bill on 03 April 2023 without discussion. Lok Sabha already passed the bill on 29 March 2023.

- The Bill seeks to amend the Competition Act, 2002. It will regulate mergers and acquisitions based on the value of transactions.

- As per the bill, the deals with a transaction value of over 2,000 crore rupees will require the Competition Commission of India’s (CCI) approval.

- The bill proposes to cut down the timeline for the CCI to pass an order on such transactions from 210 days to 150 days.

- It also proposes a framework for settlement and commitment to faster resolution of investigations of anti-competitive agreements.

- It changes the nature of punishment from imposition of fines to civil penalties and decriminalises certain offences under the Act.

- These offences include failure to comply with orders of the CCI and directions of the Director General related to anti-competitive agreements and abuse of dominant position.

- The bill was introduced in the Lok Sabha in August 2022. It was referred to the Standing Committee in August 2022. The Standing Committee submitted its report in December 2022.

Topic: Taxation

9. In the financial year 2022-23, a growth of 25.90% has been registered in the gross collection of direct taxes.

- In the financial year 2022-23 till December 17, 2022, the figures of collection of direct taxes show that the net collection has been Rs 11,35,754 crore.

- In the same period of the last financial year i.e. FY 2021-22, the net collection was Rs 9,47,959 crore, showing an increase of 19.81%.

- Net direct tax collection of Rs. 11,35,754 crores (as on 17.12.2022) inclusive of Corporation Tax (CIT) of Rs. 6,06,679 crore (net of refund) and Personal Income Tax (PIT) which includes Securities Transaction Tax (STT) at Rs. 5,26,477 crores (net of refunds).

- The Gross collection of Direct Taxes (before adjusting for refunds) for the FY 2022-23 stands at Rs. 13,63,649 crores compared to Rs. 10,83,150 crores in the corresponding period of the preceding financial year, registering a growth of 25.90% over collections of F.Y. 2021-22.

- The gross collection of Rs 13,63,649 crore includes Corporation Tax (CIT) of Rs 7,25,036 crore and Personal Income Tax (PIT) including Securities Transaction Tax (STT) of Rs 6,35,920 crore.

- Advance tax of Rs 5,21,302 crore in 'small item' wise collections; TDS (tax deducted at source) of Rs 6,44,761 crore; self-assessment tax of Rs 1,40,105 crore; Regular Assessment Tax of Rs 46,244 crore; and tax of Rs 11,237 crore falling under other minor heads.

- The minor head wise collection includes advance tax of Rs. 5,21,302 crores; Tax deduction at source of Rs. 6,44,761 crores; Self-assessment tax of Rs. 1,40,105 crores; Regular assessed tax of Rs. 46,244 crores; and tax under other minor heads of Rs. 11,237 crores.

- The total advance tax collection in the first, second and third quarter of the financial year 2022-23 up to 17.12.2022 is Rs. 5,21,302 crores as against Rs. 4,62,038 crores in the same period of the immediately preceding financial year i.e. 2021-22 Advance tax collection was 12.83%.

- Advance tax collection of Rs.5,21,302 crore up to 17.12.2022 includes Corporation Tax (CIT) of Rs.3,97,364 crore and Personal Income Tax (PIT) of Rs.1,23,936 crore.

- There has been a significant increase in the speed of processing of Income Tax Returns filed during the current financial year, about 96.5% of duly verified ITRs have been processed till 17.12.2022.

- This has resulted in speedy issuance of refunds. The current financial year has registered an increase of about 109 per cent in the number of refunds issued.

- Refund amount of Rs. Rs.2,27,896 crore have been issued in FY 2022-23 up to 17.12.2022 as against refunds of Rs.1,35,191 crore issued during the same period in the previous FY 2021-22, an increase of over 68.57% showed.

Topic: Reports and Indices

10. World Bank cuts India’s FY24 growth forecast to 6.3%.

- World Bank predict that India’s growth will be 6.3% in FY 24, as against earlier estimate of 6.6%.

- World Bank in its report lowered the growth forecast due to moderation in consumption in FY 24.

- As per the World Bank, Current Account Deficit will remain at 2.1% in FY 24.

- World Bank report predict that Inflation will remain at 5.2% in FY 24 as against 6.6% in the current fiscal.

- Asian Development Bank lowered India’s economic growth projection for the current financial year to 6.4% from its earlier forecast of 7.2%.

- Asian Development Bank in its Asian Development Outlook report mentioned that India’s economic growth is likely to improve to 6.7% in the 2024-25 fiscal.

- ADB projected that Inflation will remain at 5% for fiscal 2023-24 and 4.5% for 2024-25.

- The current account deficit is projected to decline to 2.2% of GDP in FY2023 and 1.9% in FY2024.

Previous

Previous

Latest

Latest

Comments