Topic: Indian Economy/Financial Market

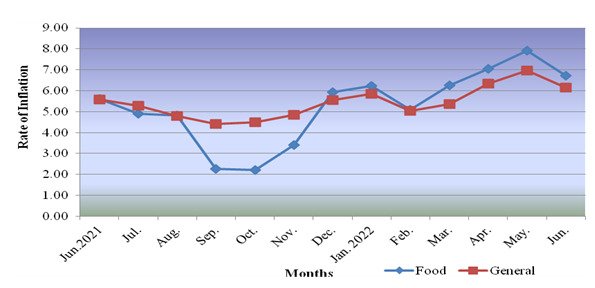

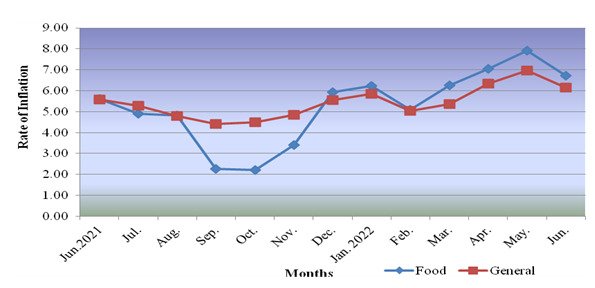

1. Retail inflation for industrial workers declined from 6.97% in May 2022 to 6.16% in June 2022.

- Inflation based on Consumer Price Index for Industrial Workers (CPI-IW) stood at 5.57% during the corresponding month a year ago (June 2021).

- Food inflation was at 6.73% in June 2022 against 7.92% in May 2022 and 5.61% in June 2021.

Y-o-Y Inflation based on CPI-IW (Food and General)

(Source: PIB)

- For June 2022, All-India CPI-IW increased by 0.2 points. It stood at 129.2 points. It stood at 129 points in May 2022.

- The maximum upward pressure in CPI-IW for June 2022 came from Food & Beverages group. It contributed 0.20 percentage points to the total change.

- Puducherry recorded a maximum increase (2.6 points) followed by Amritsar (2.2 points) and Tripura (2.0 points).

- Sangrur recorded a maximum decrease of 2.4 points. 6 centres’ indices remained stationary.

- Consumer Price Index for Industrial Workers (CPI-IW):

- It is compiled by the Labour Bureau every month. The base year for CPI-IW is 2016.

- It is compiled on the basis of retail prices collected from 317 markets spread over 88 industrially important centres in the country.

- The index is released on the last working day of succeeding month.

Topic: Banking System

2. Deutsche Bank’s IFSC Banking Unit (IBU) at GIFT-IFSC in Ahmedabad inaugurated by PM Modi.

- The Deutsche Bank’s IBU at Gujarat International Finance-Tec City (GIFT City) will offer financial products across trade finance, fixed income and currencies in the starting phase.

- It will facilitate cash pooling for Indian and international clients. It will also facilitate external commercial borrowing (ECB) financing for its prime customers.

- Deutsche Bank is a German multinational investment bank.

Topic: Indian Economy/Financial Market

3. The share of exports of goods and services in GDP has increased by 2.7% between 2020-21 and 2021-22.

- The share of exports of goods and services in GDP has grown from 18.7% in 2020-21 (FY21) to 21.4% in 2021-22 (FY22).

- The overall share of goods export in GDP has increased by 2.4% from 10.9% in 2020-21 (FY21) to 13.3% in 2021-22 (FY22).

- Engineering goods contributed maximum (3.53%) to the share of the goods exports in the annual GDP in 2021-22.

- Engineering goods were followed by petroleum products (2.13%), gems and jewellery (1.23%), organic and inorganic chemicals (0.93%) and drugs and pharmaceuticals (0.78%).

- The share of exports of goods and services was 18.8% of GDP in financial year 2017-18. It was 19.9% in FY 2018-19. It declined to 18.7% in FY 2019-20.

Topic: Appointments

4. Auguste Tano Koume has replaced Junaid Kamal Ahmad as World Bank’s Country Director for India.

- His appointment as World Bank’s Country Director for India has become effective from 01 August 2022.

- He recently served as the World Bank’s Country Director for the Republic of Türkiye.

- Auguste is a national of Côte d’Ivoire (a country on the southern coast of West Africa).

- India is the World Bank Group’s largest client.

- In 2021-22 FY, India has taken a loan of $3.98 billion from the International Bank for Reconstruction and Development (IBRD) and $83 million from International Development Association (IDA).

- World Bank:

- It is an international financial institution founded in 1944.

- It provides loans and grants to governments of poor countries for capital projects.

- It is headquartered in Washington DC, the United States and David Malpass is its President.

Topic: Taxation

5. E-invoicing will be compulsory for businesses with aggregate turnover of over ₹10 crore from October 1, 2022.

- As of now, e-invoice is mandatory for businesses having an annual turnover of more than ₹20 crore.

- Finance Ministry has issued a notification for lowering the threshold after the recommendation by the GST Council.

- E-invoicing provides a standardised format of an invoice that a machine can understand.

- The Goods & Services Tax Network (GSTN) uses this system to electronically authenticate B2B invoices before they can be used on the common GST portal.

- Every invoice submitted through the electronic invoicing system will receive an identification number from the GSTN-managed invoice registration portal (IRP).

- If businesses that are mandated to use electronic invoicing do not do so, their invoice will not be valid.

- The recipient is not allowed to claim Input Tax Credit (ITC) on such invoice, and additional penalties may apply.

- GSTN has empanelled various accounting and billing software products.

- They provide basic accounting and billing systems free of cost to small taxpayers (businesses having a turnover of less than ₹1.5 crore).

- Goods and Services Tax Network (GSTN) provides GST related IT infrastructure and services.

Topic: Reports and Indices

6. Manufacturing PMI increases from 53.9 in June 2022 to 8-month high level of 56.4 in July 2022.

- Services PMI has declined from 59.2 in June 2022 to four-month low level of 55.5 in July 2022.

- Presently, share of manufacturing in Gross Value Added (GVA) is more than 14% (14.4%). Share of services is around 55%.

- Purchasing Managers’ Index (PMI) is prepared by S&P Global and based on survey among 400 managers. Index above 50 means expansion, while below 50 shows contraction.

- Like manufacturing, services PMI is prepared by S&P Global on the basis of responses from 400 service sector companies.

- The sectors include consumer (excluding retail), transport, information communication, finance, insurance, real estate and business services.

Topic: Taxation

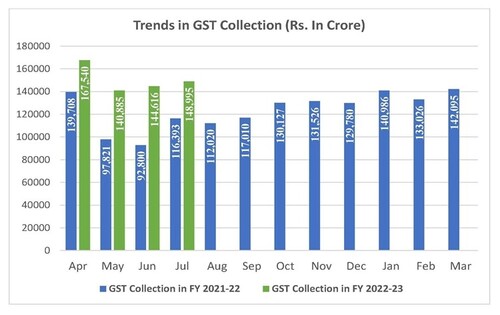

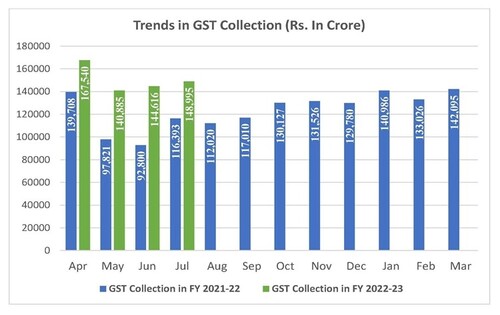

7. GST revenue collection in July 2022 is second highest revenue since introduction of GST.

- Over 1,48,995 crore rupees gross GST revenue has been collected in July 2022.

- Finance Ministry said GST revenue collection for July 2022 is 28% higher than the revenues in July 2021.

- Finance Ministry said the monthly GST revenues have been more than 1.4 lakh crore rupees for five months in a row. It has shown steady increase every month.

(Source: Ministry of Finance)

Topic: Reports and Indices

8. RBI has published Financial Inclusion Index (FI Index) for March 2022.

- The value of FI Index improved from 53.9 in March 2021 to 56.4 in March 2022.

- Growth has been witnessed across all the sub-indices of FI Index.

- RBI had constructed a composite Financial Inclusion Index (FI-Index) to capture the extent of financial inclusion across the country.

- RBI had published it in August 2021 for the FY ending March 2021.

- The annual FI-Index for the period ending March 2017 was at 43.4.

- The Index has been constructed without any ‘base year’. It captures information on various aspects of financial inclusion in a single value.

- The value may range between 0 and 100. 0 shows complete financial exclusion. 100 shows full financial inclusion.

- It comprises of three broad parameters. The parameters are access (35% weight), usage (45% weight), and quality (20% weight).

- The index is responsive to access, usage of services, and quality of services, in all 97 indicators.

Topic: Banking System

9. HDFC Bank Parivartan has signed ₹107.76 crore MoU with Indian Institute of Science, Bengaluru.

- As part of MoU, HDFC Bank has pledged ₹107.76 crore for the construction of Bagchi-Parthasarathy Hospital at IISc Bengaluru.

- The bank will support three wings of the multi-speciality, not-for-profit hospital, which is being developed by IISc.

- HDFC Bank:

- HDFC Bank is India's largest private sector bank. It is India’s second largest lender after State Bank of India.

- It is headquartered in Mumbai. It was founded in 1994. The CEO of HDFC Bank is Sashidhar Jagdishan.

Topic: Reports and Indices

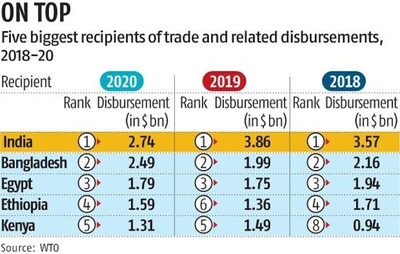

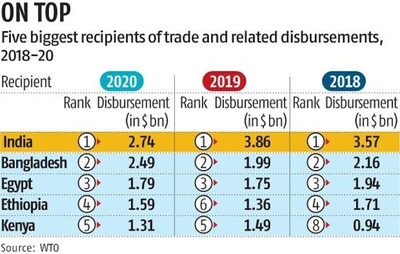

10. India has received the highest aid for trade from developed countries in 2020.

- In 2020, India received $2.7 billion as aid from developed countries for trade. India received $3.9 billion in 2019.

- Bangladesh is the second largest recipient of aid from developed countries, followed by Egypt, Ethiopia, Kenya, Vietnam, and Pakistan.

- The Joint Aid for Trade at a Glance 2022 report has been released by the WTO and the Organisation for Economic Cooperation and Development (OECD).

- World Bank, European Union Institutions, and Asian Development Bank are the top institution donors.

- Japan, the United States, Germany, and France are among the top donor countries.

- In 2020, the total disbursement was $48.7 billion. Around $4.7 billion has been given for the Covid-19-related activities.

- Aid for trade is mainly for the least developed economies. It consists of aid for building supply-side capacity and trade-related infrastructure for international trade.

Previous

Previous

Latest

Latest

Comments