Topic: Indian Economy/Financial Market

1. The India’s manufacturing sector attracted FDI worth $21.34 billion in 2021-22, which is 76% more than the last year.

- As per Commerce Ministry, FDI equity inflows in the manufacturing sectors have increased by 76% in FY 2021-22 (USD 21.34 billion) compared to previous FY 2020-21 (USD 12.09 billion).

- Singapore (27.01%), USA (17.94%), Mauritius (15.98%), Netherlands (7.86%) and Switzerland (7.31%) were the top five sources of FDI in India in FY 2021-22.

- According to the UNCTAD World Investment Report (WIR) 2022, India is in the 7th spot among 20 countries.

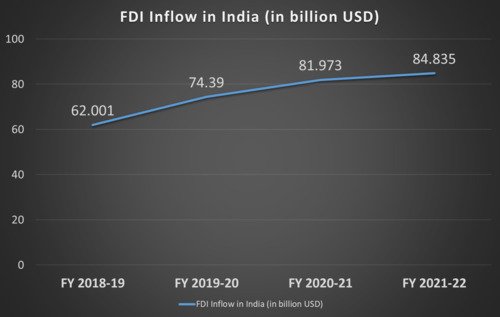

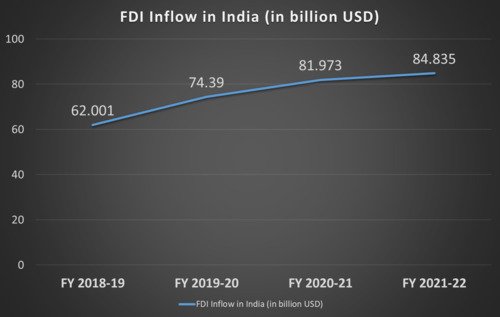

- India received the highest annual FDI inflows of USD 84,835 million in FY 21-22, USD 2.87 billion more than last year.

- During FY 2021-22, India received FDI from 101 countries. In India, FDI is permitted through the automatic route up to 100 percent in non-critical sectors.

|

Top five sectors receiving FDI Equity Inflow in FY 2021-22

|

Top five states receiving FDI in FY 2021-22

|

|

Computer Software & Hardware (24.60%)

|

Karnataka (37.55%)

|

|

Services Sector (12.13%)

|

Maharashtra (26.26%)

|

|

Automobile Industry (11.89%)

|

Delhi (13.93%)

|

|

Trading (7.72%)

|

Tamil Nadu (5.10%)

|

|

Construction (Infrastructure) Activities (5.52%)

|

Haryana (4.76%)

|

Topic: Agriculture

2. Union Minister of Agriculture Narendra Singh Tomar launched 11th Agriculture Census.

- Narendra Singh Tomar has also launched the Data Collection Portal/App.

- The use of mobile apps for data collection will accelerate the digitalization of the land record.

- The fieldwork for the agricultural census will begin in August 2022.

- It will be the first time data collection for agricultural computations will be done on smartphones and tablets.

- Agricultural computations will also contribute to the mapping of crops.

- The agriculture Census is conducted on every five years.

- Agricultural Census provides information on different agricultural parameters such as area of operational holdings, their size, class-wise distribution, land use, tenancy and cropping pattern, etc. at the minute level.

Topic: Regulatory Bodies/Financial Institutions

3. Union Cabinet has approved Competition (Amendment) Bill.

- It will introduce changes to the governing structure of the Competition Commission of India (CCI).

- It will amend the Competition Act, 2002. It will modify the substantive provisions in the law to address the needs of new age markets.

- It will make competition regulation more robust by addressing regulatory gaps. It will clarify provisions in the existing law.

- Competition Act, 2002:

- It was passed by the Parliament in the year 2002. President gave assent in January 2003.

- It replaced the Monopolies and Restrictive Trade Practices (MRTP) Act, 1969.

- It was amended by the Competition (Amendment) Act, 2007 and again by the Competition (Amendment) Act, 2009.

Topic: Indian Economy/Financial Market

4. The combined Index of Eight Core Industries (ICI) increased by 12.7% as compared to the Index of June 2021.

- Ministry of Commerce and Industry has revised final growth rate of ICI for March 2022 to 4.8% from its provisional level of 4.3%.

- Last month the output growth for February 2022 was also revised upwards to 5.9% from provisional level of 5.8%.

- The Ministry has said that the growth rate of ICI during April-June 2022-23 was 13.7% (provisional) as compared to the corresponding period of last FY.

- Eight core sectors’ output growth declined to 12.7% in June from 18.1% in May.

- All sectors except crude oil registered an increase in production. Crude oil output dropped 1.7% from a year ago period.

- The eight core industries have weightage of 40.27 percent in the index of industrial production (IIP).

- Eight core industries are Coal, Crude Oil, Natural Gas, Refinery Products, Fertilizers, Steel, Cement and Electricity.

Topic: RBI

5. RBI has temporarily permitted merchants and payment aggregators to save the Card-on-File (CoF) data.

- However, they can save data for a maximum period of “Transaction Date + 4 days” or till the settlement date, whichever is earlier.

- This is only for the settlement of transactions where cardholders decide to enter the card details manually.

- RBI said the data shall be used only for settlement of transactions. It must be purged (removed) after that.

- Acquiring bank can store CoF data until January 31, 2023, for handling other post-transaction activities.

- RBI said that there will be no change in the date of implementation of the requirements relating to “Restriction on Storage of Actual Card Data.

- All entities, except card issuers and card networks, shall purge the CoF data before October 1, 2022.

- In Card-on-File transactions, merchants are authorized by cardholders to store their payment information and to bill their accounts for future purchases.

Topic: Indian Economy/Financial Market

6. Centre’s fiscal deficit reached 21% during April-June quarter of current fiscal.

- Fiscal deficit stood at 18 percent during the corresponding period of last fiscal.

- However, fiscal deficit is not likely to breach the Budget Estimate of 6.4 percent.

- Revenue Secretary Tarun Bajaj said the government would stick to its projected target of Budget FY 2023.

- As per Ind-Ra, the fiscal deficit in FY23 will be in the range of 6.2-6.4 percent of GDP.

- According to Controller General of Accounts (CGA) data, centre received around ₹5.96-lakh crore and incurred expenditure of ₹9.47-lakh crore during three months.

- This resulted in fiscal deficit of over ₹3.51-lakh crore. Fiscal deficit is the difference between expenditure and income.

Topic: Banking System

7. Carlyle Group and Advent International will invest ₹8,900 crore in YES Bank.

- They will make an investment for a cumulative stake of up to 20 percent in the bank.

- Yes Bank will raise ₹8,900 crore, which will include ₹5,100 crore through shares and ₹3,800 crore through share warrants.

- The capital raise is subject to the approval of the bank’s shareholders.

- YES Bank is also looking to sell stressed loans worth ₹48,000 crore to an Asset Reconstruction Company (ARC).

- Yes Bank was founded in 2004. It is headquartered in Mumbai. Prashant Kumar is its MD and CEO. It is a private sector bank.

Topic: Banking System

8. Bank credit has shown growth of 13.7% in June 2022 as compared with 4.9% a year ago as per RBI.

- According to RBI’s sectoral deployment of bank credit statement, credit to agriculture and allied activities grew by 13% in June 2022 as compared with 10.6% a year ago.

- Credit to industry has shown 9.5% growth in June 2022 against a contraction of 0.6% in June 2021 according to RBI.

- According to RBI, credit to medium industries increased by 47.6% in June 2022 as compared with 59% last year.

- Credit growth to micro and small industries increased to 29.6% in June 2022 from 11.6% a year ago according to RBI.

- As per RBI, credit to large industries has shown a growth of 3.3% against a contraction of 4.8 % during the same period.

- Credit growth to services sector increased to 12.8% in June 2022 as compared with 4.0% a year ago as per RBI.

- As per RBI data, personal loans segment grew by 18.1% in June 2022, mainly driven by housing and vehicle loan segments.

- SBI’s Economic Research Department, in its report “Ecowrap”, has said that sector-wise credit data for June 2022 shows substantial improvement in incremental credit to each and every sector.

Topic: Banking System

9. Bandhan Bank has opened its first ever currency chest.

- The currency chest is located in Deedargunj, Patna. It will help in cash management in the city and enhance customers’ convenience.

- Union Bank of India (UBI) has set “RACE” - grow RAM (retail, agriculture and MSME) loans, improve Asset quality, increase CASA (current account, savings account deposits) and increase Earnings - as its goal for the year.

- UBI is currently the fifth largest public sector bank (PSB) in the country.

- A Manimekhalai, who took charge of UBI as MD & CEO on June 3 as its first woman chief, wants the bank to become the third largest PSB in the next couple of years.

- Bandhan Bank is a private sector bank. It is headquartered in Kolkata. Dr. Anup Kumar Sinha is its current chairman. Chandra Shekhar Ghosh is its MD and CEO.

Topic: Miscellaneous

10. Roshni Nadar continues to be the richest woman in India.

- Beauty product focused brand Nykaa owner, Falguni Nayar, is the richest self-made woman with a net worth of Rs 57,520 crore, as per the Kotak Private Banking-Hurun list 2021.

- Nayar saw a 963% increase in her wealth in 2021. Nayar is the second richest woman overall.

- HCL Technologies’ chairperson Roshni Nadar’s net worth increased 54% to Rs 84,330 crore in 2021.

- Net worth of Biocon’s Kiran Mazumdar-Shaw declined 21%. She is third richest woman in the country with a wealth of Rs 29,030 crore.

- The list of 100 women includes only Indian women, who are born or brought up in India and who are actively managing their businesses or are self-made.

- These 100 women now contribute 2 percent of India’s nominal GDP.

- Kanika Tekriwal (33 years old) of Bhopal-based Jetsetgo is the youngest self-made woman on the list.

- The list also includes three professional managers - Indra Nooyi, Renu Sud Karnad of HDFC and Shanti Ekambaram of Kotak Mahindra Bank.

Topic: Indian Economy/Financial Market

11. PM Modi launched India’s first international bullion exchange, India International Bullion Exchange (IIBX), in Gujarat.

- He launched IIBX at the Gujarat International Finance Tec-City (GIFT City) near Gandhinagar.

- He laid the foundation stone for the headquarters building of the International Financial Services Centres Authority (IFSCA).

- He launched NSE IFSC-SGX Connect platform, which will deepen liquidity in derivative markets at GIFT-IFSC.

- IIBX was announced in the 2020 Union Budget. Ashok Gautam took charge as the first MD and CEO of IIBX in February 2022.

- IIBX will allow qualified jewellers to directly import gold. Currently, there are 56 jewellers registered on the IIBX.

- Entities must have a minimum net worth of Rs 25 crore and 90% of their average annual turnover in the previous three fiscal years must come from sales of goods classified as precious metals to become qualified jewellers.

- Non-resident Indians and institutions can also participate on the exchange after registering with the IFSCA.

- The IIBX will submit a report to IFSCA on a monthly basis providing details of transactions in bullion by qualified jewelers.

- Gold 1 kg 995 purity and gold 100 gm 999 purity with a T+0 settlement (100% upfront margin) are expected to trade at IIBX initially.

- A cumulative storage capacity for about 125 tonnes of gold and 1,000 tonnes of silver is planned at the GIFT City.

- International Financial Sevices Centres Authority (IFSCA):

- It has been established on April 27, 2020 under the International Financial Services Centres Authority Act, 2019.

- It is an authority for the development and regulation of financial products, financial services and financial institutions in the International Financial Services Centre (IFSC) in India.

Previous

Previous

Latest

Latest

Comments