Topic: Appointments

1. World Bank has appointed India’s Mr. Indermit Gill as its Chief Economist and Senior Vice President for Development Economics.

- He will replace American economist Carmen Reinhart.

- His appointment will be effective from September 1, 2022.

- He will be the second Indian to serve as chief economist at the World Bank after Kaushik Basu, who served as the Chief Economist of the World Bank from 2012 to 2016.

- World Bank:

- The World Bank is an international financial institution. It provides loans and grants to governments in poor countries for the purpose of pursuing capital projects.

- It is headquartered in Washington DC, United States. It was founded in 1944. David Malpass is its President.

Topic: Indian Economy/Financial Market

2. IMF has lowered India’s FY23 GDP growth forecast to 7.4% and expects India’s economy to grow 6.1% in FY24.

- In its latest World Economic Outlook report, it cut the global growth forecast to 3.2% for 2022 from 6.1% in 2021.

- IMF raised global inflation to 6.6% in advanced economies and 9.5% in emerging market and developing economies.

- IMF said the revision in India’s FY23 GDP growth forecast reflects mainly less favorable external conditions and more rapid policy tightening.

- The IMF reported that the growth forecast of China was reduced by 1.1 percentage points to 3.3% for 2022 as a result of additional lockdowns and the worsening real estate crisis.

- IMF said global trade growth would likely slow to 4.1% in 2022 from 10.1% in 2021.

Topic: Banking/Financial Schemes

3. ECGC launched a new scheme to provide credit risk insurance cover up to 90% to small exporters.

- Export Credit Risk Insurance cover of up to 90% will be provided to small exporters under ‘Export Credit Insurance for Banks’ (Entire Turnover Packaging Credit and Post Shipment) (ECIB-WTPC, PS).

- This is expected to benefit many small-scale exporters availing export credit from banks having ECGC WT-ECIB cover.

- The manufacturer- exporters availing of the fund-based export credit working capital limit of up to ₹ 20 crores will get the benefit of the enhanced cover.

- It excludes Gems, Jewellery & Diamond sector and merchant exporters/traders.

- This will increase the percentage of accounts up to Rs 20 crore, which will provide further stability to the ECGC portfolio.

- ECGC Limited:

- It is a government-owned export credit provider and was set up in 1957.

- Its main objective is to promote exports by providing credit risk insurance and related services for exports.

- It was formerly known as Export Credit Guarantee Corporation of India Ltd.

Topic: Banking System

4. India’s first all-women-run cooperative bank will be established in Rajasthan on the lines of the Stree Nidhi model of Telangana.

- Rajasthan government has also signed an MoU with the Telangana government’s Stree Nidhi Credit Cooperative Federation.

- The Rajasthan Mahila Nidhi will be established along the same lines as the Telangana Stree Nidhi.

- This cooperative bank will be operated entirely by women and will act as a complementary body to the formal banking system.

- During the first two years of its operations, it will get a grant of ₹50 crores from the State government.

Topic: Reports and Indices

5. RBI has announced Digital Payments Index for March 2022.

- Digital Payments Index (DPI) for March 2022 stands at 349.30. DPI for September 2021 was 304.06.

- DPI for March 2021 was 270.59. DPI for March 2020 was 207.84.

- RBI-DPI from March 2019 to March 2022 shows rapid adoption and deepening of digital payments across the country.

- About RBI-Digital Payments Index (DPI):

- The RBI-DPI captures the extent of digitisation of payments across the country.

- It has been constructed with March 2018 as the base period. DPI score for March 2018 is 100.

- It comprises of 5 broad parameters. Each of these parameters has sub-parameters. Sub-parameters consist of various measurable indicators.

|

Period

|

RBI - DPI Index

|

|

March 2018 (Base)

|

100

|

|

March 2019

|

153.47

|

|

September 2019

|

173.49

|

|

March 2020

|

207.84

|

|

September 2020

|

217.74

|

|

March 2021

|

270.59

|

|

September 2021

|

304.06

|

|

March 2022

|

349.30

|

|

Five Broad Parameters of DPI

|

Sub-parameters

|

|

Payment Enablers (weight 25%)

|

Internet, mobile, Aadhaar, bank accounts, participants and merchants

|

|

Payment Infrastructure – Demand-side factors (10%)

|

Debit cards, credit cards, prepaid payment instruments, customers registered–mobile and internet banking and FASTags

|

|

Payment Infrastructure – Supply-side factors (15%)

|

Bank branches, business correspondents, ATMs, PoS (point of sale) terminals, QR (quick response) codes and intermediaries

|

|

Payment Performance (45%)

|

Digital payment systems (volume), digital payment systems (value), unique users, paper clearing, currency in circulation and cash withdrawals

|

|

Consumer Centricity (5%)

|

Awareness and education, declines, complaints, frauds, and system downtime

|

Topic: Corporates/Companies

6. The Union Cabinet has approved the revival package of BSNL worth ₹1.64 lakh crore.

- The package contains a cash component of ₹43,964 crore and ₹1.2 lakh crore non-cash part spread over four years.

- The revival measures focus on fresh capital for upgrading services, allocating spectrum, de-stressing its balance sheet and augmenting its fiber network by merging BBNL with BSNL.

- To provide 4G services, BSNL will be allotted spectrum in 900/1800 MHz band administratively at the cost of Rs 44,993 Cr through equity infusion.

- BSNL is in process of deploying Atmanirbhar 4G technology stack. To meet the projected capital expenditure for the next 4 years, government will fund capex of Rs 22,471 Cr.

- Rs 13,789 Cr will be provided to BSNL as viability gap funding for commercially unviable rural wire-line operations done during 2014-15 to 2019-20.

- The authorized capital of BSNL will be increased from Rs 40,000 Cr to Rs 1,50,000 Cr.

- To improve the balance sheet, AGR dues of BSNL amounting to Rs 33,404 Cr will be settled by conversion into equity.

- BSNL will re-issue preference share of Rs 7,500 Cr to the Government.

- To facilitate wider utilization of infrastructure laid under BharatNet, Bharat Broadband Network Ltd (BBNL) will be merged with BSNL.

- The infrastructure created under BharatNet will continue to be a national asset.

- It will be accessible on a non-discriminatory basis to all the Telecom Service Providers.

- Government is expecting BSNL to earn profit in FY 2026-27 with the implementation of the above revival plan.

- Bharat Broadband Network Ltd (BBNL):

- It is a government-owned broadband infrastructure provider.

- It was set up by the Department of Telecommunications, Ministry of Communications.

- It was formed in February 2012 to lay an optical fibre network across 2.5 lakh village panchayats across the country.

Topic: Reports and Indices

7. NITI Aayog suggested introducing a restricted Digital Business bank licence and a restricted Digital Consumer Bank licence.

- NITI Aayog has suggested this as part of a phased licensing approach in its newly released report on digital banks.

- The report is titled “Digital Banks: A Proposal for Licensing & Regulatory Regime for India”.

- In the report, NITI Aayog suggested that in the second phase, the applicant acquiring a restricted licence should enlist in the regulatory sandbox.

- Then, they should start operations as a Digital Business Bank/ Digital Consumer Bank as the case may be, in the sandbox.

- The report suggests that depending on the satisfactory performance of the licensee in the Sandbox, the restrictions can be relaxed in the final phase when the entity becomes a full-scale digital bank.

- The report says that Digital Business Bank could need to bring a minimum paid-up capital of ₹20 crore in the restricted phase.

- According to the report, a full-scale Digital Business Bank will need to raise 200 crores in the capital once it leaves the sandbox.

- The methodology for the licensing offered by the report is based on an equal weighted digital bank regulatory index.

- It has four factors. They are entry barriers, competition, business restrictions, and technological neutrality.

Topic: Corporates/Companies

8. Spending of CSR money towards the ‘Har Ghar Tiranga’ campaign is an eligible CSR activity under the Company law.

- Corporate Affairs Ministry (MCA) has clarified that spending of CSR funds for the activities related to ‘Har Ghar Tiranga’ campaign is eligible CSR activities under item no (ii) of Schedule VII of the Companies Act 2013.

- The activities are eligible CSR activities under item no (ii) of Schedule VII of the Companies Act 2013 pertaining to the promotion of education relating to culture.

- The eligible activities include mass scale production and supply of the National Flag, outreach and amplification efforts and other related activities.

- As part of the ‘Azadi Ka Amrit Mahotsav’, ‘Har Ghar Tiranga’ campaign will be celebrated from 13 to 15 August.

- It is a campaign to encourage people to bring the Tiranga home and to hoist it to mark the 75th year of India’s Independence.

- Under the Companies Act 2013, companies with a net worth of ₹500 crore or more, or turnover of ₹1,000 crore or more, or a net profit of ₹5 crore or more during the immediately preceding financial year, are required to spend 2% of the average net profits of the immediately preceding three years on CSR activities.

- Schedule VII of the Companies Act 2013 provides activities that may be included by companies in their corporate social responsibility policies.

Topic: Corporates/Companies

9. Cabinet has approved additional investment of $1.6 billion by BPRL for development of BM-SEAL-11 Concession Project in Brazil.

- Bharat PetroResources (BPRL) is a subsidiary of state-run Bharat Petroleum Corporation (BPCL).

- It has 40% participating interest (PI) in this concession along with Petrobras.

- Petrobras is the National Oil Company of Brazil. It has 60 percent Participating Interest as the operator.

- Bharat Petroleum Corporation Limited’s Kochi refinery has despatched the first indigenous superabsorbent polymer from its Propylene Derivatives Petrochemical Complex.

- Executive Director (Kochi Refinery) flagged off the lorry carrying the first consignment to Bapuji Surgical, Bangalore.

- Superabsorbent polymer (SAP) is the main component of sanitary napkins, and other incontinence products. It is being produced for the first time in India.

- SAP is made using the in-house acrylic acid produced at Kochi Refinery.

- Bharat Petroleum Corporation Ltd is a Maharatna oil refining and marketing company. Its headquarters is located in Mumbai.

Topic: Indian Economy/Financial Market

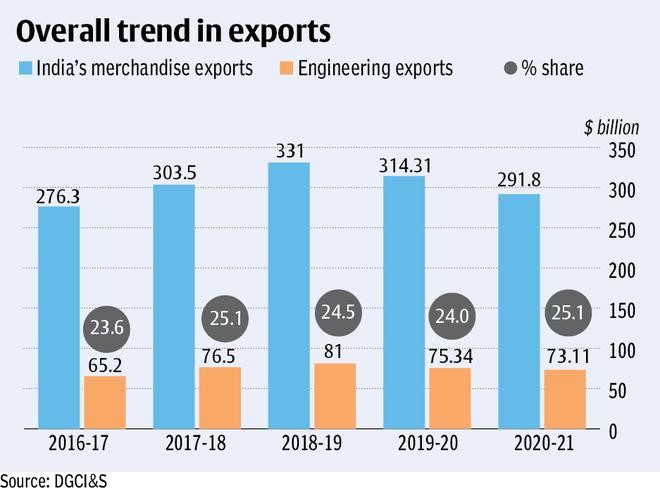

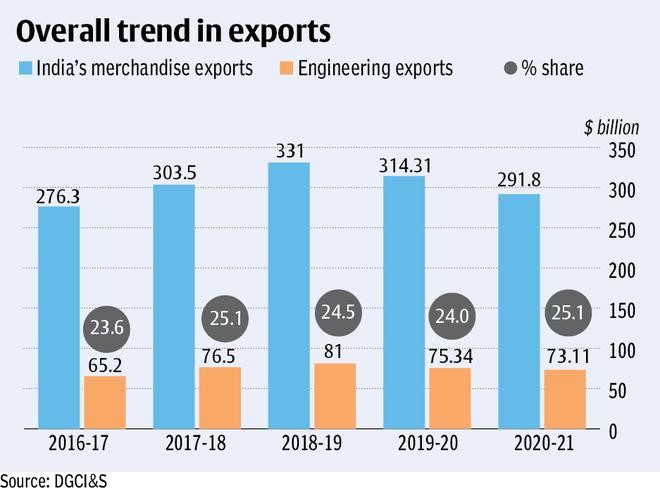

10. Engineering goods exports from India in April-June of 2022-23 on year-on-year basis increased 11.8% to $28.96 billion.

- The increase is despite a sharp decline in exports to China.

- Growth in engineering products exports slowed down in June to 4.2% at $9.69 billion.

- In June, share of engineering good exports in total goods exports from India was recorded at 23.86%.

- The share was slightly higher at 24.35% during April-June 2022-23.

- US remained the top importer of India’s engineering goods in June 2022 and during April-June 2022-23.

- Engineering exports to the US increased 28.59% in June 2022 to $1.67 billion.

- US, Germany, Mexico, UK and Bangladesh were the top five export destinations for engineering goods during June 2022.

- Major decline was seen in iron and steel, copper and its products, lead and products and industrial machinery for boilers.

- Engineering exports recorded a 46% growth in 2021-22 to $112 billion.

- The industry is trying to achieve an export target of $127 billion for 2022-23.

Topic: Appointments

11. Akshaya Moondra has been appointed as CEO of Vodafone Idea.

- He has been appointed with effect from August 19 for three years.

- Current CEO Ravinder Takkar’s three-year term will end on August 18.

- Takkar will remain non-executive and on-independent director of the company after completing the term of MD and CEO.

- Vodafone Idea Limited is an Aditya Birla Group and Vodafone Group partnership. Himanshu Kapania is its Chairman.

Topic: RBI

12. RBI asked all UCBs to make sure that their loan policy is reviewed by the Board at least once in a financial year.

- RBI’s directive is aimed at ensuring that urban co-operative banks’ loan policy reflects the approved internal risk appetite.

- As per RBI’s Master Directions (April 8) on management of advances, UCBs are required to lay down, with the approval of their boards, transparent policies and guidelines for credit dispensation.

- RBI’s Sustainable Finance Group (SFG) has recommended that banks should place a mechanism for overseeing and scaling up initiatives relating to climate risk and sustainability.

- The mechanism should be at either the Board or top management level.

- RBI Survey on Climate Risk and Sustainable Finance has found that Board-level engagement on climate risk and sustainable finance is inadequate.

- The survey was carried out in January 2022 among 12 public sector banks, 16 private sector banks and six foreign banks in India.

- As per the survey, the responsibility for overseeing climate risk and sustainability related initiatives was yet to be assigned to about a third of the banks.

- Only a few banks have included climate risk, sustainability, environmental, social and governance (ESG) related Key Performance Indicators (KPIs) in the performance evaluation of their top management.

Topic: Regulatory Bodies/Financial Institutions

13. The notices have been issued by CCPA to several electric vehicle makers on EV-related fire incidents.

- CCPA has taken suo-motu cognisance of recent fire-related and battery explosion incidents in the country.

- It is also working on guidelines to prevent fake reviews on web portals to protect consumer interests.

- Central Consumer Protection Authority (CCPA):

- It is a regulatory authority set up under Section 10(1) of the Consumer Protection Act, 2019.

- It was set up with effect from 24th July 2020. Nidhi Khare is the current Chief Commissioner of CCPA.

Topic: Taxation

14. Madhya Pradesh Authority for Advance Ruling (MPAAR) ruled that malai sweets be treated as sweetmeat for applicability of GST.

- MPAAR has said that traditional Indian sweets cannot be categorised as ‘confectionary’ in the traditional sense.

- Confectionary (sugar boiled confectionery, lozenges, chewing gum and bubble gum, chocolate and ice lollies or edible ices, cakes, pastries) attract GST at the rate of 12 or 18%.

- Sweetmeats (Indian traditional sweets such as laddoo, khoya barfi, peda, gulab jamun, milk-based sweets) attract GST at the rate of 5%.

- Therefore, malai sweets will attract GST at the rate of 5%.

Topic: RBI

15. RBI has permitted Piramal Enterprises to begin NBFC business without accepting public deposits.

- The company received the licence on 26 July 2022.

- It had earlier received clearance from the shareholders to demerge its pharmaceuticals business and simplify its corporate structure.

- The company said that under Section 45 IA of the Reserve Bank of India Act 1934, RBI has granted it a Certificate of Registration to commence the business of nonbanking financial institution without accepting public deposits.

- Earlier, the company had acquired Dewan Housing Finance (DHFL) for Rs 34,250 crore.

- Piramal Enterprises is the largest company of Piramal Group, an Indian multinational diversified global business conglomerate.

Previous

Previous

Latest

Latest

Comments