Topic: Indian Economy/Financial Market

1. The Index of Industrial Production (IIP) increased by 4.3% in December 2022.

- According to the Ministry of Statistics and Programme Implementation data, IIP increased by 5.4% from April to December of the current fiscal.

- The growth in IIP was at 15.3% in the year-ago period. In November 2022, India’s industrial production growth stood at 7.3%.

- The output of the manufacturing sector increased by 2.6% in December 2022.

- The growth of the manufacturing sector’s output stood at 6.4% in November 2022.

- The mining output increased by 9.8% from 2.6% in December 2021.

- Electricity production grew by 10.4% in December 2022.

- For December 2022, the Quick Estimates of IIP with base 2011-12 stands at 144.7.

- In December 2022, a growth of 7.6% was recorded in the capital goods segment.

- Infrastructure/construction goods recorded a growth of 8.2% in December 2022.

- The output of consumer durables declined by 10.4%. The output of consumer non-durable goods expanded by 7.2%.

- The output of primary goods recorded 8.3% growth in December 2022. The intermediate goods output growth declined to 0.3%.

- Factory output growth stood at 1% in December 2021. It is measured in terms of the Index of Industrial Production (IIP).

Topic: Banking System

2. State Bank of India has opened its specialised branch for start-ups in the country at Gurugram.

- This is the SBI’s third specialised branch for start-ups. It has been started to provide all banking services required by Start-ups under one roof.

- The aim of the branch is to provide end-to-end support to start-ups from their formation till their IPOs and FPOs.

- In addition to start-ups, the bank also aims to meet the needs of private equity (PE), venture capital (VC) and Alternative Investment Funds (AIFs).

- Gurugram branch has also entered into MoUs with Foundation for Innovation and Technology Transfer (FITT) at IIT-Delhi and other entities.

- Gurugram has third highest number of unicorns in the country after Bengaluru and Mumbai.

Topic: Banking System

3. Bank of Maharashtra has launched its own private cloud infrastructure, Mahabank Nakshatra.

- It has been launched to facilitate high-performance cloud capabilities for hosting applications of the bank.

- Bank of Maharashtra has also launched Arjun (Automated Remote Junction for Monitoring of Assets Under Stress) mobile app.

- Arjun has been launched to give a snapshot of stressed assets portfolio to bank staff.

- Bank of Maharashtra has also launched Mykase, a legal case tracking software.

- Bank of Maharashtra also launched Video-KYC. The bank has developed ‘Pension slip facility’ using Digi locker.

- Bank of Maharashtra is headquartered in Pune. Its CEO is A. S. Rajeev. It is a nationalized bank.

Topic: Indian Economy/Financial Market

4. RBI said the scope of Trade Receivables Discounting System (TReDS) platform will be expanded.

- The scope of TReDS platform will be expanded to provide insurance facility, enable secondary market operations and allow entities undertaking factoring business as financiers.

- As per RBI, these measures will support further improvement in the cash flows of MSMEs.

- Insurance companies will be allowed to take part as a “fourth participant” on TReDS, in addition to the MSME sellers, buyers and financiers.

- All entities / institutions that are eligible to carry out factoring business under the Factoring Regulation Act will be allowed to take part as financiers in TReDS.

- Secondary market operations will now be made possible on TReDS platforms.

- With this, financiers can transfer their current portfolio to other financiers within the same TReDS platform.

- Trade Receivables and Discounting System (TReDS):

- It is an electronic bill discounting platform regulated by RBI. It is endorsed by the central government.

- It is an electronic platform to help in financing/discounting of trade receivables of MSMEs through multiple financiers.

Topic: Miscellaneous

5. According to the Ministry of Communications, 7% of Indian villages do not have a 4G mobile network.

- Out of 6.44 lakh Indian villages, 45,180 villages lack 4G connectivity nearly 7 years after launch of 4G services in India.

- Central government has kept around ₹48,000 crore to bring 4G mobile coverage to the unconnected villages.

- States and UTs like Andaman and Nicobar, Arunachal Pradesh, Ladakh, and Sikkim do not have 4G connectivity in over 50% of villages.

- Odisha is the state, which has the highest number of unconnected villages.

- One in six Indian villages that are unconnected with the 4G network are in Odisha. India still has over 350 million 2G users.

|

State

|

Number of unconnected villages to 4G mobile network

|

|

Odisha

|

7,592

|

|

Maharashtra

|

3,793

|

|

Rajasthan

|

3,734

|

|

Arunachal Pradesh

|

3,731

|

|

Madhya Pradesh

|

3,240

|

Topic: Regulatory Bodies/Financial Institutions

6. Centre has plans to reverse the Supreme Court ruling in Excel Crop case of 2017.

- Supreme Court had ruled that Competition Commission of India (CCI) can impose penalty only on the basis of relevant turnover of specific product or service.

- It ruled that CCI cannot impose penalty on ‘total average turnover’ of the entire company.

- Under the amendments to the Competition (amendment) Bill 2022, the centre proposes to introduce global turnover from ‘all products and services’ as a base for imposition of monetary penalties by CCI.

- Presently, Competition Commission of India (CCI) can impose penalties as much as 10% of a firm’s turnover.

- This is restricted to the firm’s turnover recorded within India.

- This is also restricted to the specific good or service where anti-competitive conduct has been proven.

- According to the proposed amendment to the Competition (amendment) Bill, an explanation will be added to Section 27 of the Competition Act, 2002.

- Section 27 of the Competition Act, 2002 enables CCI to impose monetary penalties.

- For the purpose of imposing penalties, turnover would mean global turnover derived from all the services and products by an enterprise or person, both outside and within India.

- In Excel Crop Care Ltd. Vs Competition Commission of India (2017), Supreme Court upheld a decision of the Competition Appellate Tribunal.

- It ruled that the turnover for penalty in Section 27(b) of the Act means ‘relevant turnover’.

Topic: Banking System

7. Airtel Payments Bank has announced the launch of BizKhata.

- BizKhata is current account of Airtel Payments Bank. This account can be opened within 5 minutes with biometric authentication and minimal paperwork.

- It has features like unlimited transactions and instant activation for small merchants and business partners across the country.

- Customers can use the account within 5 minutes of opening it. They can do unlimited credit and debit transactions.

- Other features of BizKhata are zero minimum balance, safe and seamless payment digitization, auto sweep-out and one-click transaction history.

- Day-end balance of more than Rs 2,00,000 will be auto sweep-out to a current account with the partner bank.

- Sweep amount can be transferred back to the business account by user with a single click.

- It has been designed for small merchants and business owners who cannot fulfill the minimum balance requirement of business accounts and hence continue to use saving accounts for business purposes.

- Airtel Payments Bank’s BizKhata brings all business transactions to one platform.

- It allows small businesses to maintain clear records while taking many banking benefits.

Topic: Reports and Indices

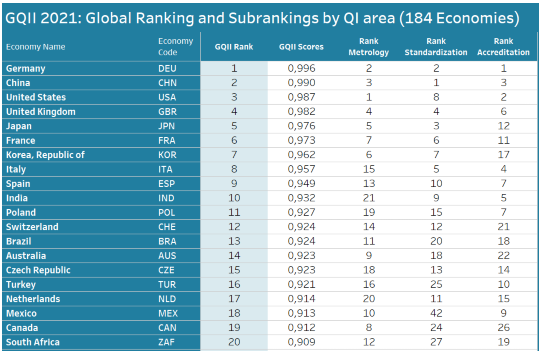

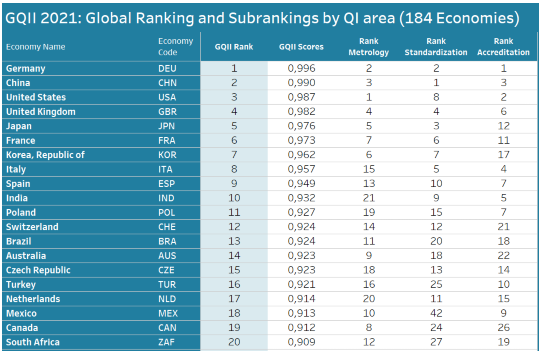

8. India’s accreditation system is in the fifth spot in the world.

- India’s national accreditation system under the Quality Council of India (QCI) is in the fifth spot in the recent Global Quality Infrastructure Index (GQII) 2021.

- Global Quality Infrastructure Index (GQII) gives a ranking to 184 economies based on the quality infrastructure (QI).

- In 2020, India was ranked ninth in the world in accreditation.

- India's overall QI system continues to be ranked 10th in the world. India is in 9th position in the standardization system and 21st in the world in the metrology system (under NPL-CSIR).

- The ranking of 2021 is based on the data till the end of December 2021.

- GQII rankings are published each year based on the data collected till the end of that year.

- The GQII measures growth by comparing the QIs of countries. A formula calculates scores for each country based on its position in the sub-rankings for metrology, standards and accreditation.

- The Top 25 QI systems are mainly located in Europe, North America and Asia-Pacific.

- Germany is in the top spot in the GQII rank while China and the United States are in the second and third spots.

- The National Accreditation System as per international standards in India is established by the Quality Council of India (QCI).

(Source: News on AIR)

Previous

Previous

Latest

Latest

Comments