Topic: RBI

1. Financial Literacy Week (FLW) is being organized by the Reserve Bank of India (RBI) from February 13 to February 17, 2023.

- This year, the theme of FLW is “Good Financial Behaviour - Your Saviour.”

- The theme aligns with the overall strategic objectives of the National Strategy for Financial Education: 2020-2025.

- Its objective is to generate awareness among the general public, create financial resilience and sustain their interest.

- In this, the focus will be on creating awareness about savings, planning and budgeting and judicious use of digital financial services.

- During the month of February 2023, the RBI will undertake a centralized mass media campaign to disseminate financial awareness messages.

- Banks have also been advised to disseminate information and create awareness among their customers.

- Since 2016, the RBI has been organizing Financial Literacy Week (FLW) every year to disseminate financial education messages on a particular theme among public across the country.

Topic: Banking System

2. Profit of PSU Banks increased 65% to ₹29,175 crore during Q3 ended December 2022.

- Bank of Maharashtra (BoM) became top performer in terms of percentage growth in profit.

- Bank of Maharashtra recorded a 139% increase in profit to ₹775 crore at the end of December 2022.

- Kolkata-based UCO Bank followed Pune-headquartered Bank of Maharashtra.

- UCO Bank recorded a profit of ₹653 crore. Union Bank of India and Indian Bank are two other PSBs whose profit growth was higher than 100%.

- Union Bank of India recorded a 107% rise in net profit at ₹2,245 crore for the October-December period of 2022.

- Indian Bank reported a 102% increase at ₹1,396 crore for the Q3 of 2022.

- All 12 PSBs cumulatively made a profit of ₹29,175 crore in Q3 of current financial year.

- This is against the profit of ₹17,729 crore in the same period a year ago.

- PSBs have cumulatively made a profit of ₹70,166 crore for the 1st nine months of the current financial year.

- The profit stood at ₹48,983 crore in the year-ago period.

- The PSBs had made a cumulative profit of about ₹15,306 crore in the first quarter. This increased to ₹25,685 crore in the September quarter.

- The capital adequacy ratio of Bank of Maharashtra was also highest among PSBs. It stood at 17.53%.

- Bank of Maharashtra was followed by Canara Bank at 16.72% as on December 31, 2022.

- Bank of Maharashtra and State Bank of India were in the lowest quartile in terms of gross non-performing assets (NPAs) and net NPAs.

- The gross NPA and net NPA of Bank of Maharashtra were at 2.94% of its total advances and 0.47%, respectively, as on December 31, 2022.

- The gross NPA and net NPA of State Bank of India were at 3.14% of its total advances and 0.77%, respectively, as on December 31, 2022.

Topic: Banking System

3. Ujjivan Small Finance Bank has launched Hello Ujjivan.

- Hello Ujjivan is a mobile banking application with 3 Vs — voice, visual, and vernacular-enabled features.

- Hello Ujjivan has been launched to provide banking access to individuals with limited reading and writing skills.

- The app is accessible by voice in eight regional languages. It was co-created with Navana.AI.

- Users can perform banking transactions and access services by speaking to the app.

- These services include paying loan EMIs, opening FD and RD accounts and transferring funds.

- The app will be available to existing micro-banking customers in the starting phase.

- More languages and banking features will be added to the app in subsequent phase.

- These features include opening new customer accounts, mobile and DTH recharge, paying utility bills and availing repeat loans.

- Ujjivan Small Finance Bank:

- It was set up by Ujjivan Financial Services Limited (UFSL). It started banking operations from February 1, 2017.

- It is a Scheduled Small Finance Bank. It is headquartered in Bengaluru.

Topic: Miscellaneous

4. Paytm has launched a special G20-theme QR Code to celebrate India’s presidency of G20.

- Minister for Railways, Communications and Electronics & Information Technology, Ashwini Vaishnaw, launched the QR code at ‘Digital Payments Utsav’ at India Habitat Centre in Delhi.

- Special G20-theme QR Code features logos of MeitY’s DigiDhan Mission and those of the G20 2023 and the 75th year of India’s independence.

- Paytm’s associate Paytm Payments Bank has won top award of Ministry of Electronics and Information Technology (MeitY) for maintaining one of the lowest average Technical Decline in BHIM UPI transactions.

- Paytm Founder Vijay Shekhar Sharma is also the Chair of the Finance Task Force under 'Startup20'.

- Paytm:

- Parent organization: One97 Communications

- Headquarters: Noida

- Founder and CEO: Vijay Shekhar Sharma

Topic: Miscellaneous

5. India, Brazil and the US will work together to establish a global biofuel alliance along with other interested countries.

- The aim of global biofuel alliance will be to facilitate cooperation and intensify the use sustainable biofuels.

- The global biofuel alliance will emphasize on strengthening markets, facilitating global biofuels trade, and provision of technical support for national biofuels programs worldwide.

- The Ministry of Petroleum and Natural Gas (MoPNG) said that the alliance will complement the relevant regional and international agencies, and initiatives in the bioenergy, bio-economy, and energy transition fields.

- The global biofuel alliance was announced by Oil Minister H S Puri during the India Energy Week 2023 in Bengaluru.

- Global bioenergy partnership (GBEP) was founded in 2006. It was launched during the Ministerial Segment of the 14th session of the Commission on Sustainable Development (CSD14).

- Clean Energy Ministerial Biofuture Platform was launched at 11th Clean Energy Ministerial (CEM11). The Biofuture Platform is a 22-country effort to promote an advanced low-carbon bioeconomy.

Topic: Indian Economy/Financial Market

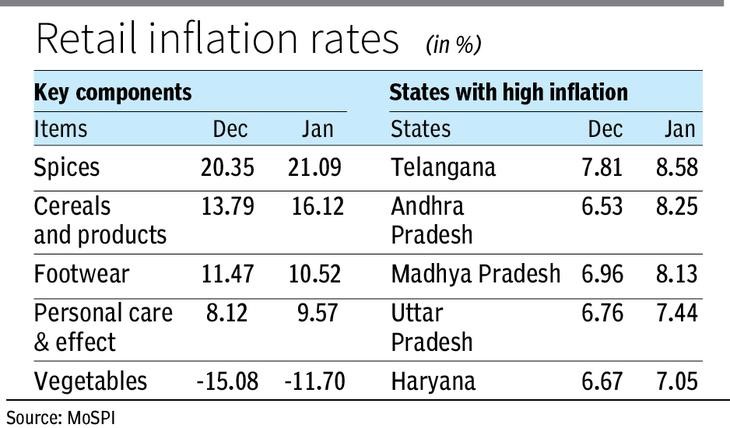

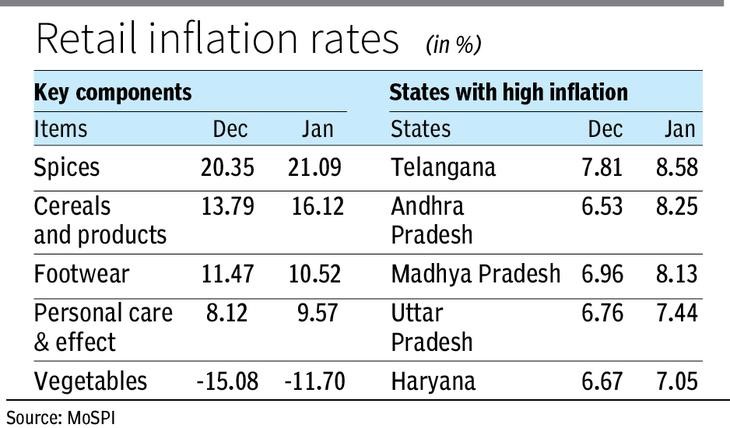

6. Retail inflation increased to three month high level of 6.52% in January 2023.

- Retail inflation has increased to 6.52% mainly due to higher prices in the food basket, including cereals and protein-rich items.

- Retail inflation was 6.77% in October 2022. It was 5.72% in December 2022 and 6.01% in January 2022.

- Since January 2022, retail inflation has been over the Reserve Bank of India's upper tolerance level of 6% with the exception of November and December 2022.

- In comparison to urban regions, where inflation was just 6%, rural areas had a higher rate of inflation at 6.85%.

- Headline CPI inflation declined by 105 basis points during November-December 2022.

Topic: Taxation

7. Gross direct tax collection increased to ₹15.67 lakh crore between April 1, 2022 and February 10, 2023.

- Gross direct tax collection stood at ₹12.63 lakh crore during corresponding period of last fiscal (FY22).

- Net collection (gross tax minus refund) increased to ₹12.98 lakh crore during the same period of FY23.

- Direct Taxes include Personal Income Tax and Corporate Income Tax mainly.

- Three reasons for higher collection are better performance of economy, improved performance of corporate and rise in salary.

- The Revised Estimates for the current fiscal kept direct tax revenues (net) at ₹16.50 lakh crore. This is higher than the budget estimates of ₹14.20 lakh crore.

Topic: Taxation

8. ₹25,000 crore is estimated to be collected from Special Additional Excise Duty (SAED) for FY23.

- Government expects to collect this amount from windfall tax, or SAED from the production of crude oil, export of Petrol, Diesel, and Aviation Turbine Fuel (ATF).

- Windfall tax came into effect from July 1, 2022. It is revised fortnightly.

- It is imposed on oil companies making windfall, or exceptionally high profits.

- The SAED does not apply to entities whose annual crude oil production is less than 2 million barrels in the previous financial year.

|

SAED for domestic crude production

|

|

Time period

|

Special Additional Excise Duty(SAED)

|

|

From November 17 to December 1, 2022

|

₹10,200 per tonne

|

|

From December 2 to December 15

|

₹4,900 a tonne

|

|

From December 16, 2022 to January 2, 2023

|

₹1,700 per tonne

|

|

From January 3 to January 16, 2023

|

₹2,100 a tonne

|

|

From January 17 to February 3, 2023

|

₹1,900 per tonne

|

|

From February 4, 2023 till date

|

₹5,050 a tonne

|

Topic: Taxation

9. The number of persons who pay personal income tax has increased by around 1 crore in the fiscal year immediately after demonetisation.

- The number of personal income tax payers has increased around 60% during the first seven years of Modi government.

- The number of corporate tax payers has increased over 32.5% during the first seven years of Modi government.

- The number of personal income tax payers was more than 5.10 crore in the Fiscal Year 2016-17 (Assessment Year 2017-18).

- In the same year, Prime Minister Narendra Modi announced the demonetisation of Rs 500 and Rs 1,000 notes.

- The personal income tax collection has increased from Rs 2.58 lakh crore to more than Rs 6.73 lakh crore in FY22. A growth of more than 160% has been recorded.

- During this period, corporate tax has increased to more than Rs 7.12 lakh crore from over Rs 4.28 lakh crore. A growth of more than 66% has been recorded.

Topic: Indian Economy/Financial Market

10. WPI inflation declined for eighth consecutive month to 4.73% in January 2023.

- The wholesale price-based inflation eased mainly due to easing in prices of manufactured items, fuel and power.

- However, inflation in food articles increased to 2.38% in January 2023.

- WPI based inflation rate was 4.95% in December 2022 and 13.68% in January 2022.

- According to Commerce and Industry Ministry, mineral oils, chemicals & chemical products, textiles, crude petroleum & natural gas, textiles, and food products primarily contributed to decline in the rate of inflation in January 2023.

- In January 2023, inflation in pulses was 2.41%. Inflation in vegetables was (-) 26.48% in January 2023.

- In January 2023, inflation in oil seeds stood at (-) 4.22%.

- Inflation in fuel and power basket declined from 18.09% in December 2022 to 15.15% in January 2023.

- Inflation in manufactured products was 2.99% in January 2023. It was 3.37% in December 2022.

Previous

Previous

Latest

Latest

Comments