Topic: Infrastructure and Energy

1. Data centres with over 5 megawatt (MW) capacity of IT load have been given infrastructure status by the government.

- As per the government notification, Data Centre has been included in the Harmonized Master List of Infrastructure sub-sectors by insertion of a new item in the category of 'Communication'.

- The notification says Data Centre housed in a building for storage and processing of digital data applications with a minimum capacity of “5 MW of IT load" will be eligible for infrastructure status.

- In the budget speech for 2022-23, Finance Minister Nirmala Sitharaman has announced that data centres will be granted infrastructure status.

- As per ICRA report, data centres’ capacity expansion in India by both foreign and local firms will add investments of ₹1.05 lakh to ₹1.2 lakh crore over next 5 years.

Topic: Indian Economy/Financial Market

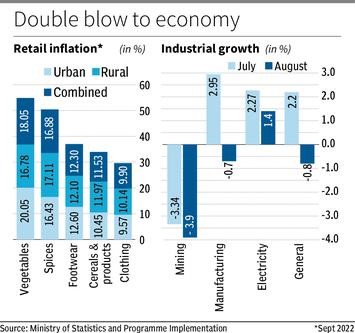

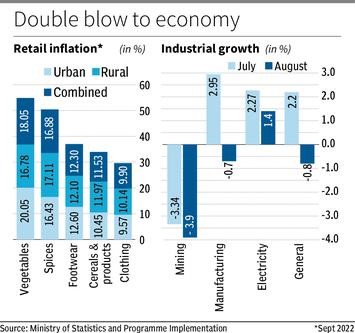

2. Consumer Price Index (CPI) - based retail inflation increased to 7.41% in September as against 7% in August.

- This is the ninth continuous month of retail inflation being more than RBI‘s tolerance level of 6%.

- IIP-based industrial production contracted to 0.8% in August 2022 as against an expansion of 2.2% in July.

- As per Index of Industrial Production (IIP) data released by the National Statistical Office (NSO), manufacturing sector output contracted 0.7% in August 2022.

- The mining output contracted 3.9%. Power generation increased 1.4% in August 2022.

- Prices of food items, particularly vegetables, cereals and spices increased the retail inflation. Manufacturing brought down the industrial production.

(Source: MoSPI)

Topic: Miscellaneous

3. Meghalaya government has scrapped Meghalaya Regulation of Gaming Act.

- Meghalaya Regulation of Gaming Act was introduced last year to promote setting up of casinos and gambling parlours in the state.

- Taxation Minister James PK Sangma announced Meghalaya Regulation of Gaming Act, 2021, will be repealed.

- Meghalaya CM Conrad Sangma currently heads a central government-appointed Group of Ministers (GoM) on casinos, race courses and online gaming.

Topic: Banking System

4. Paytm has partnered with Jana Small Finance Bank.

- One97 Communications Limited, which owns the Paytm brand, has partnered to deploy card machines to further drive digitisation among merchants all over India.

- The partnership will allow Jana Small Finance Bank to extend Paytm’s All-in-one EDC machines to its existing and potential customers.

- NPCI International Payments (NIPL) has partnered with Euronext-listed payments facilitator Worldline.

- NIPL is the international arm of National Payments Corporation of India (NPCI).

- This will enable Indians to pay through Unified Payments Interface (UPI) when they travel and shop in the European markets.

Topic: RBI

5. RBI has allowed standalone primary dealers to offer all forex market-making facilities to users.

- They are allowed to offer all facilities, as are Category-I authorised dealers currently permitted.

- RBI has also permitted standalone primary dealers to take up trading and self-clearing membership with SEBI-approved stock exchanges/ clearing corporations.

- They are permitted to do so for undertaking proprietary transactions in equity and equity derivatives market.

- Standalone primary dealers (SPDs) were earlier allowed to carry out foreign currency business for limited purposes.

- There are seven SPDs, including ICICI Securities Primary Dealership, PNB Gilts, SBI DFHI and STCI Primary Dealer.

- RBI has said the amounts received by banks from the National Credit Guarantee Trustee Company Ltd (NCGTC) need not be treated as outside liabilities for the purpose of computation of deposits for maintaining statutory reserve ratios (CRR and SLR).

- Primary dealers are RBI registered entities authorized to trade in government securities.

- SPDs are subsidiaries of scheduled commercial banks, subsidiaries/joint ventures entities incorporated abroad or the companies incorporated in India.

Topic: MoUs/Agreements

6. Indian Railway Finance Corporation (IRFC) and India Infrastructure Finance Company Ltd (IIFCL) have signed an MoU.

- The MoU has been signed to strengthen cooperation in financing railway infrastructure projects.

- The agreement will help both organisations leverage financing opportunities for viable infrastructure projects.

- NMDC and RailTel Corporation of India have signed MoU for ICT and Digital Solutions.

- RailTel will provide Consultancy, Project Management and Execution services.

- Indian Railway Finance Corporation (IRFC) is a wholly owned subsidiary of the Indian Railways.

- It is headquartered in New Delhi. Amitabh Banerjee is its Chairman & MD.

- India Infrastructure Finance Company Ltd (IIFCL) is a wholly-owned Government of India company.

- It was set up in 2006. Padmanabhan Raja Jaishankar is its MD.

- National Mineral Development Corporation (NMDC) is the country’s largest Iron Ore producer.

- It is a Central Public Sector Enterprise under the Ministry of Steel. It is headquartered in Hyderabad. Sumit Deb is its CMD.

- RailTel Corporation of India Limited is an Indian public sector enterprise that was founded in September 2000. It is a Mini Ratna (Category-I) PSU.

- It is a wholly-owned subsidiary of the Indian Railways. It is headquartered in New Delhi. Sanjai Kumar is its CMD.

Topic: Committees/ Commissions/Taskforces

7. An expert committee to investigate the WHO report on the deaths of 66 children in Gambia has been formed by Central government.

- The committee has four members. It will be chaired by Vice Chairperson of Standing National Committee on Medicines Dr Y K Gupta.

- Other members of the Committee are Dr Pragya Yadav, Dr Arti Bahl and A K Pradhan.

- The committee will investigate World Health Organisation report on the deaths of 66 children in Gambia by consumption of cough syrups from Maiden Pharmaceuticals Limited.

- Production of cough syrups by Maiden Pharmaceuticals Limited has been suspended.

- Maiden Pharmaceuticals Limited is a Sonipat-based Company. It exported ‘substandard’ pediatric cough syrups to the Gambia.

Topic: RBI

8. The minimum capital requirement for setting up an ARC has been increased by RBI from the existing Rs 100 crore to Rs 300 crore.

- The main aim of this step is to strengthen the securitization sector, which plays a critical role in the management of distressed financial assets.

- The current ARCs have to meet the minimum net owned fund (NOF) requirement till April 2026.

- RBI said that the settlement of dues with the borrower will be done only after the proposal is examined by an Independent Advisory Committee (IAC).

- RBI’s circular said that ARCs will have to constitute an audit committee of the board comprising non-executive directors only.

- The regulatory framework for ARCs has also been amended based on the feedback of stakeholders and the committee’s recommendations.

- An Asset Reconstruction Company (ARC) is a specialized financial institution that buys NPAs or bad assets from banks and financial institutions.

Topic: Indian Economy/Financial Market

9. International Monetary Fund (IMF) has cut India’s GDP growth forecast to 6.8% for Financial Year 2023.

- According to the IMF's World Economic Outlook 2022 report, India will be the world's fastest-growing large economy.

- It predicted that India will continue to remain on track to become one of the world’s fastest-growing economies.

- IMF predicted that inflation in India will come down to the 4% range next year.

- IMF has said that global growth projection will slow from 6% in 2021 to 3.2% in 2022 and 2.7% in 2023.

- IMF said that this will be the weakest growth since 2001, with the exception of the global financial crisis and the acute phase of the pandemic.

- According to the IMF, global inflation will likely peak at 9.5% this year before slowing to 4.1% by 2024.

Topic: Reports and Indices

10. “Education 4.0 India” Report has been released by World Economic Forum.

- This report has been prepared by World Economic Forum in collaboration with the United Nations Children's Education Fund and YuWaah (Generation Unlimited India).

- As per the report, India has more than 60 million secondary and higher secondary students.

- About 85% of the schools haven’t implemented vocational courses as part of their curriculum.

- As per the report, presently school pedagogy is being designed with no reference to industry needs. There are no formal channels for industry participation in curriculum design.

- The report explains how technology can reduce learning gaps and make education accessible for all.

- The report highlighted that School-to-work (S2W) transition process still faces many problems such as a lack of trainers, inadequate resources and infrastructure and poor linkages between localised skill gaps and vocational courses.

- The report mentioned that many students and parents consider vocational education the second-best option after mainstream education.

- The report recommended enhancing opportunities for career awareness through internships and apprenticeships.

- It also insisted upon providing education and training for holistic development through STEM-based courses, language learning, and life-skills coaching.

Previous

Previous

Latest

Latest

Comments