Topic: RBI

1. RBI has said loan ratings without lenders’ details should be treated as unrated exposure.

- This may put pressure on the capital adequacy of banks as they are required to set aside capital using risk weightings applicable for unrated exposure to companies and non-banking finance companies.

- As per RBI, these instructions would become effective on March 31, 2023.

- RBI said that press releases issued by external credit assessment institutions (ECAI) on ratings do not have lenders’ details owing to absence of borrowers’ consent.

- Banks cannot reckon (calculate approximately) the bank loan rating given by ECAIs to corporates and NBFCs if the rating disclosure is devoid of lenders’ details.

- In such cases, banks shall apply risk weights of 100% or 150% as applicable as per extant instructions, said RBI.

- RBI noted that absence of lenders’ detail may lead to potentially lower provision of capital and underpricing of risks.

Topic: Banking System

2. Next-gen contact centre service has been unveiled by State Bank of India.

- It has been unveiled to deliver superior customer experience and drive business outcomes like sales and collections.

- It has been unveiled to support strategic focus areas like digital handholding for the bank’s products.

- It offers 30+ banking solutions in 12 languages. They are available 24x7.

- In the future, the bank aims to explore embedding advanced Artificial Intelligence/Machine Learning (AI/ML)-based technologies.

- State Bank of India (SBI):

- It is a nationalized public sector bank. Dinesh Kumar Khara is its chairperson.

- Its headquarters is in Mumbai, Maharashtra. Its tagline is The Banker to Every Indian.

Topic: Miscellaneous

3. South Indian Bank has set a world record for staging and swinging 101 ‘oonjals’ (swings) simultaneously.

- The event for staging and swinging 101 ‘oonjals’ simultaneously was held at a single venue at Marine Drive in Kochi.

- The World Book of Records team gave the certification to Murali Ramakarishnan, MD & CEO, South Indian Bank.

- The event ‘Onnichirikkam Oonjaladam’ (sit together and swing) saw a huge participation from people.

- The event also had cultural programmes like ‘Chenda Melam’. It also had musical performances by various bands including South Indian Bank’s own band.

- South Indian Bank is a private sector bank. It is headquartered in Thrissur, Kerala.

Topic: Indian Economy/Financial Market

4. Finance Ministry has designated one Debts Recovery Tribunal (DRT) each in Chennai, Delhi and Mumbai.

- This has been done for faster adjudication and recovery in high-value cases of ₹100 crore and above.

- As of February-end, 1,61,034 cases were pending at the DRTs.

- DRT 2 Chandigarh was having the most (10,578 cases), followed by DRT 3 Chandigarh (8,885) and DRT 3 Kolkata (7,171).

- As per the notification of Finance Ministry, DRT1 Chennai will deal with all cases involving a debt of ₹100 crore and above falling under the jurisdiction of DRT 2 and 3 in Chennai, DRT Madurai, DRT 1 and 2 Bengaluru, DRT 1 and 2 Ernakulum, and DRT Coimbatore.

- DRT 2 Delhi will deal with all cases involving a debt of ₹100 crore and above falling under the jurisdiction of DRT 1 and 2 Delhi, DRT Jaipur and DRT 1, 2 and 3 Chandigarh.

- DRT 1 Mumbai will handle all cases involving a debt of ₹100 crore and above falling under the jurisdiction of DRT 2 and 3 Mumbai, DRT Pune and DRT 1, 2 and 3 Ahmedabad, DRT Aurangabad and DRT Nagpur.

Topic: Taxation

5. Delhi High Court has directed cosmetic maker L’Oreal to deposit the profiteered amount with the tax department.

- It has upheld that the company did profiteering while not giving out the benefit of GST rationalisation.

- It observed that Section 171 of GST law is not a charging or a taxing provision but a consumer welfare provision. Section 171 of GST law deals with profiteering.

- It puts stay on the interest payment and penalty proceedings and further investigation by National Anti-Profiteering Authority.

- Section 171 prescribes any decrease in tax rate on any supply of goods or services or the benefit of input tax credit (ITC) shall be passed to the recipient through reduction in prices.

Topic: Appointments

6. Corporate Affairs Ministry has appointed Reetu Jain as an ex-officio member of the IBBI.

- Reetu Jain is Economic Advisor at the Department of Economic Affairs (DEA).

- She has been appointed in the place of Shashank Saksena. Shashank Saksena superannuated in June 2022.

- She will be the Finance Ministry’s nominee for IBBI Board.

- IBBI Governing Board currently has four ex-officio member. Other three ex-officio members are Anita Shah Akella, Rajiv Mani and Unnikrishnan A.

- Insolvency and Bankruptcy Board of India (IBBI):

- It was established on 1 October 2016 under the Insolvency and Bankruptcy Code, 2016.

- It is responsible for the implementation of the IBC code.

Topic: Companies/ Corporates

7. The membership of Maiden Pharmaceuticals has been suspended by Pharmaceutical Export Promotion Council (Pharmexcil).

- Maiden Pharmaceuticals is the exporter of ‘substandard’ pediatric cough syrups to the Gambia.

- With the suspension of Registration Cum Membership Certificate (RCMC) by Pharmexcil, Maiden Pharmaceuticals cannot access schemes and other benefits generally available to the exporters.

- Recently, World Health Organisation (WHO) identified four products as ‘substandard’ in the Gambia. These were exported by Delhi-based Maiden Pharma.

- The products contained unacceptable levels of diethylene glycol and ethylene glycol as contaminants.

- Pharmexcil:

- It was established by Ministry of Commerce and Industry in May 2004.

- It is government of India’s authorized agency for promotion of pharmaceutical exports from India. It is headquartered in Hyderabad.

Topic: Taxation

8. Gross direct tax revenue has increased by 24% in the current financial year so far (between April 1 and October 8, 2022).

- According to the tax department, the Gross direct tax revenue has reached Rs 8.98 lakh crore with an increase of 24% so far in the current financial year.

- It includes a 32.3 % growth in personal income tax and a 16.73 % increase in corporate tax revenues.

- Between 1 April and 8 October, direct tax collections were Rs 7.45 lakh crore after adjusting refunds. It is 52.46% of Budget Estimates (BE) for the full-year tax collection target.

- The Budget has estimated direct tax collection of Rs 14.20 lakh crore for this fiscal year.

- In the first six months of the fiscal year, the trade deficit has nearly doubled. The ‘Core sector’ hit a nine-month low of 3.3 % in August.

- The collection from GST is around Rs 1.45-1.46 lakh crore per month.

- Tax collection is a key indicator of the economic activity in any country.

Topic: Reports and Indices

9. A report titled “Poverty and Shared Prosperity 2022: Correcting Course” has been released by World Bank.

- As per the report, the world is unlikely to achieve the goal of ending extreme poverty by 2030.

- The report states that the global poverty reduction rate has slowed since 2015 and the Covid pandemic and the war in Ukraine have also further slowed down it.

- By 2015, the global extreme-poverty rate had been cut by more than half. In 2020, the number of people living below the extreme poverty line increased by 70 million.

- Around 719 million people are living on less than $2.15 a day by the end of 2020.

- The poorest people have bearded the steepest costs of the pandemic. Around 40 percent of poor people have lost their income by 4% while wealthy people have lost 20% of their income.

- In 2020, Global median income declined by 4%. For the first time, Global median income declined after measurements of median income began in 1990.

- As per the report, the Poverty level has declined in India. As per the latest estimate based on Sinha Roy and van der Weide (2022), poverty at the US$1.90 poverty line was 13.6% in 2017.

- The report uses data from the Centre for Monitoring Indian Economy (CMIE), because there are no official estimates of poverty available since 2011.

- National policy reforms can help in reducing poverty. Governments should act promptly on three fronts:

- Avoid Broad Subsidies, increase targeted cash transfers

- Focus on Long-Term Growth

- Mobilize Domestic Revenues without Hurting the Poor

Topic: Awards and Prizes

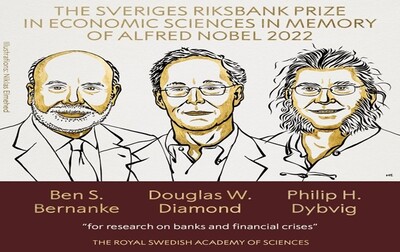

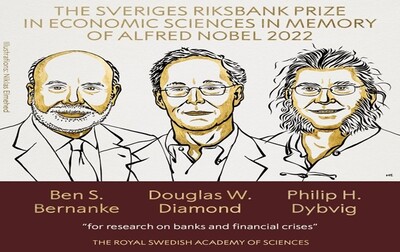

10. Three US-based economists won the 2022 Nobel Prize in Economics.

- US-based economists Ben Bernanke, Douglas Diamond and Philip Dybvig won the award for research on banks and financial crisis.

- Their research has improved our understanding of banks, bank regulation, banking crisis and how financial crisis should be managed.

- Their work had shown “why avoiding bank collapses is vital.”

- Nobel Economics Prize comprises a cash prize of 10 million Swedish krona ($914,447).

- Nobel Economics Prize is formally called the 'Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel.'

- The Nobel Economics prize is not one of the original five awards created in 1895. It was established by Sweden's central bank and was given for the first time in 1969.

- So far, only two women have won the Nobel Economics Prize, Elinor Ostrom in 2009 and Esther Duflo in 2019.

(Source: News on AIR)

- Brief overview of other Nobel Prize winners for the year 2022:

Previous

Previous

Latest

Latest

Comments