Topic: Reports and Indices

1. Services PMI slowed to 54.3 in September in comparison to 57.2 in August.

- This is the lowest level in seven months. Services sector recorded an expansion in output for the fourteenth straight month.

- S&P Global India Composite PMI Output Index declined from 58.2 in August to 55.1 in September.

- S&P Global India Composite PMI Output Index measures combined services and manufacturing output.

- Service sector’s share in India’s Gross Value Added (GVA) is more than 54%.

- Services PMI is prepared by S&P based on responses to questionnaires sent to a panel of around 400 service sector companies.

- Sectors like consumer (excluding retail), transport, information, communication, finance, insurance, real estate and business services are covered in this.

- Score above 50 shows expansion. Score below 50 means contraction.

Topic: MoUs/Agreements

2. World Economic Forum (WEF) has signed an agreement with Madhya Pradesh on agricultural development.

- The agreement has been signed to promote agri innovations through private-public partnerships (PPPs).

- WEF is starting a network called Food Innovation Hubs.

- This is being done to strengthen local innovation ecosystems and achieve self-sufficiency in food production through PPPs.

- Food Innovation Hubs depend on one another for knowledge exchange with a Global Coordinating Secretariat in Holland.

- The Food Innovation Hubs will focus on digital agriculture and other things.

- At the State of States Conclave in 2021, Madhya Pradesh won the award for Most Improved Big State in Agriculture for the fourth consecutive year.

Topic: Reports and Indices

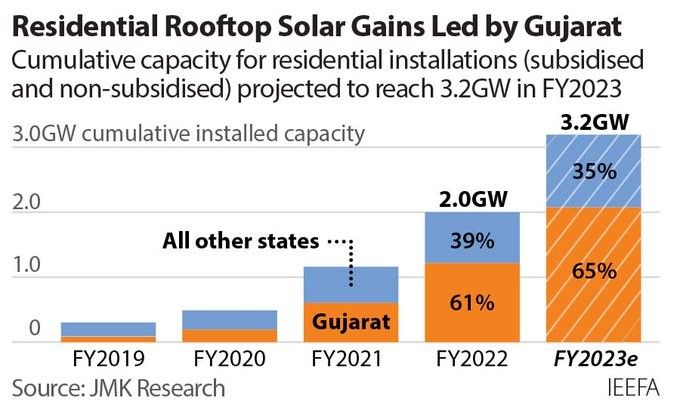

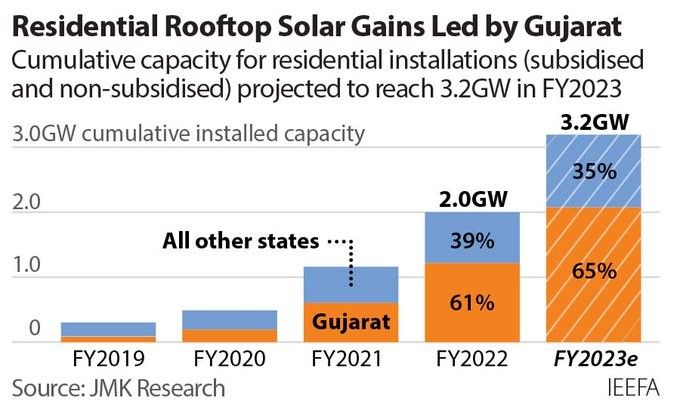

3. Residential rooftop solar market will reach 3.2GW by FY23 as per a report.

- The report has been jointly published by Institute for Energy Economics and Financial Analysis (IEEFA) and JMK Research.

- It is titled “Indian Residential Rooftops: A Vast Trove of Solar Energy Potential".

- Residential rooftop solar segment has 2GW cumulative installed capacity (as of FY22).

- Rooftop solar segment had added about 12 GW as of March 2022. This is against the target of adding 40 GW capacity by December 2022.

- Central government has introduced new subsidy scheme in July 2022.

- The central government will for the first time provide a subsidy for residential rooftop solar systems with a capacity of 10kW or more.

- Gujarat, Haryana, and Maharashtra are three most favourable states for residential rooftop solar installations.

- Gujarat’s SURYA scheme is an example for other regional markets to emulate.

- IEEFA examines issues related to energy markets, trends and policies.

Topic: Banking/Financial Schemes

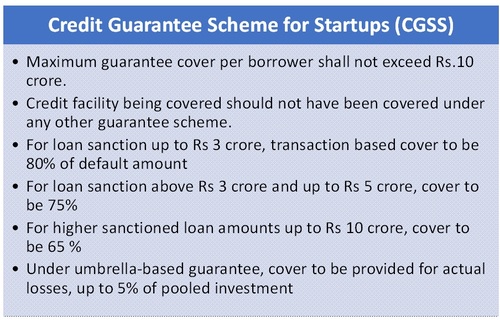

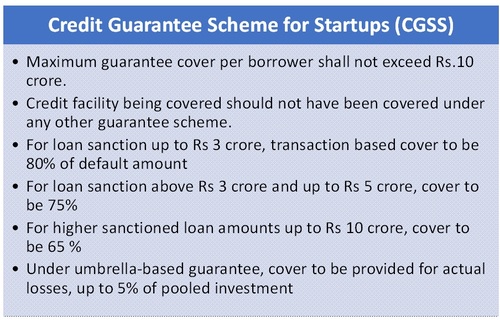

4. Centre has notified setting up of the Credit Guarantee Scheme for Startups (CGSS).

- This has been done for providing credit guarantees to loans extended up to a specified limit by scheduled commercial banks, NBFCs and SEBI-registered Alternative Investment Funds (AIFs).

- Under the scheme, credit guarantee cover would be transaction-based and umbrella-based.

- The exposure to individual cases would be capped at ₹10 crore per case or the actual outstanding credit amount, whichever is less.

- Credit facility being covered should not have been covered under any other guarantee scheme.

- Maximum guarantee cover per borrower shall not exceed Rs.10 crore.

- The extent of transaction-based cover will be 80% of the amount in default if the original loan sanction amount is up to ₹3 crore.

- The extent of transaction-based cover will be 75% of the amount in default if the original loan sanction amount is above ₹3 crore, and up to ₹5 crore.

- The extent of transaction-based cover will be 65% of the amount in default if the original loan sanction amount is above ₹5 crore (up to ₹10 crore per borrower).

- Under umbrella-based guarantee, cover will be provided for actual losses, up to 5% of pooled investment.

Topic: Banking System

5. Centre and LIC will divest their 60.72% stake in IDBI Bank.

- Centre will divest 30.48% stake. LIC will sell off 30.24% stake.

- As on March 31, 2022, LIC holds 49.24%, while the Centre holds 45.48% in IDBI Bank.

- A private sector bank, a foreign bank, a NBFC, an Alternative Investment Fund (AIF) or a fund/investment vehicle incorporated outside India can bid for the bank either solely or in consortium.

- Maximum number of participants in consortium can be four.

- The bidder should have a minimum networth of ₹22,500 crore or $2.85 billion.

- Expression of Interest (EoI) can be submitted till December 23.

- Large industrial/corporate houses and individuals (natural persons) are not permitted to take part in this bidding process.

- FDI norm for private bank will be applicable (74% through approval route, 49% under the automatic route and at all times, at least 26% of the paid-up capital of the bank is required to be held by residents).

|

IDBI Bank

|

(in %)

|

|

Promoters

|

94.72

|

|

Centre

|

45.48

|

|

LIC

|

49.24

|

|

Public shareholders

|

5.28

|

|

Institutions

|

0.25

|

|

Retail Investors

|

2.21

|

|

HNIs

|

1.94

|

|

Others

|

0.88

|

Topic: Appointments

6. The reappointment of Prashant Kumar as the MD and CEO of YES Bank has been approved by RBI.

- RBI has approved his reappointment for another 3 years. The appointment will be subject to the approval of shareholders of the private sector bank.

- Kumar became the head of the bank after YES Bank was bailed out and put under the YES Bank Reconstruction Scheme in March 2020.

- Kumar was Deputy MD and CFO of State Bank of India.

- YES Bank was founded in 2004. It is headquartered in Mumbai.

Topic: Banking System

7. SBI launched fourth phase of Gram Seva Program.

- SBI will adopt 30 remote villages across India under the 4th phase of Gram Seva program of SBI Foundation.

- The remote villages across Aspirational Districts in Haryana, Gujarat, Maharashtra, Punjab, Tamil Nadu, and West Bengal will be adopted by the banks.

- Under the program, 100 villages across 16 States in 3 phases have been adopted.

- The program emphasizes a comprehensive development of villages.

- SBI Foundation is the Corporate Social Responsibility (CSR) arm of the bank.

Topic: RBI

8. Directions for the appointment of an Internal Ombudsman (IO) for all Credit Information Companies (CICs) have been issued by RBI.

- CICs have been directed to complete the process of appointment of an IO at the apex of their internal grievance redress mechanism by April 1, 2023.

- As per RBI’s directions, every CIC must appoint the IO for a fixed term of not less than three years, but not exceeding five years.

- The IO shall be either a retired or a serving officer.

- The IO shall not be below the rank of Deputy General Manager or equivalent in any financial sector regulatory body with at least seven years of experience in certain fields.

- These fields are banking, non-banking finance, financial sector regulation or supervision, credit information or consumer protection.

- The IO shall not attain the age of 70 before the completion of the proposed term.

- There shall be no reappointment for an extension of term in the same CIC.

- The IO will not entertain any complaints directly from the members of the public.

- It will deal only with complaints that have already been examined by the CIC, but have been partly or wholly rejected by it (CIC).

- The following complaints will be outside the purview of IO.

- Complaints related to fraud, misappropriation, etc., except those resulting from a deficiency in service, if any, on the part of the CIC.

- Complaints/ references relating to internal administration, human resources, or pay and emoluments of staff.

- Presently, there are four CICs. They are given below.

- Credit Information Bureau (India) Ltd (CIBIL)

- Equifax Credit Information Services Pvt Ltd

- Experian Credit Information Company of India Pvt Ltd

- CRIF High Mark Credit Information Services Pvt Ltd

- These companies are governed by the Credit Information Companies (Regulation) Act (CICRA), 2005.

Topic: RBI

9. RBI governor Shaktikanta Das launched DAKSH.

- DAKSH is a new SupTech initiative. It will be the bank’s advanced monitoring system.

- It is expected to make the supervisory processes more robust. It is a web-based end-to-end workflow application.

- Through DAKSH, RBI will monitor compliance with the objective of further improving the compliance culture in Supervised Entities (SEs) like Banks, NBFCs, etc.

Topic: Indian Economy/Financial Market

10. World Bank in its South Asia Economic Focus report has cut India's GDP forecast to 6.5% from an earlier estimate of 7.5% for FY 2022-23.

- World Bank has revised its forecast of India’s growth for the third time.

- Earlier, World Bank slashed its forecast to 7.5% in June.

- World Bank has cut the forecast due to the global slowdown and rise in interest rates.

- The spillovers from the Russia-Ukraine war and higher prices of key commodities will affect the domestic demand in FY 2023-24.

- Private investment growth will reduce due to uncertainty and higher financing costs.

- World Bank has also cut growth estimates for Pakistan, Afghanistan, Bangladesh, Sri Lanka, Nepal, Bhutan and the Maldives.

- Recently, the Reserve Bank of India also cut its growth forecast to 7 per cent from an earlier estimate of 7.2 per cent.

Previous

Previous

Latest

Latest

Comments