Topic: RBI

1. RBI’s first cohort for voice-based retail payments successfully completed by ToneTag.

- RBI’s first cohort for voice-based retail payments has been successfully completed by ToneTag.

- As per Kumar Abhishek, Founder and CEO of ToneTag, the success of the company’s technology will bring rural India into the digital payment ecosystem.

- The success of company’s technology will also bridge the gap between conventional and futuristic payment options for customers who currently don’t have access to digital payment services.

ToneTag is a company that uses encrypted sound waves to make offline, proximity-based contactless payments on any device. It is headquartered in Bengaluru.

Topic: Corporates/Companies

2. UST achieves Carbon Neutral company certification in accordance with The CarbonNeutral Protocol.

- UST has achieved Carbon Neutral company certification in accordance with The Carbon Neutral Protocol.

- The Carbon Neutral Protocol is a leading global framework for carbon neutrality. It provides clear guidelines for businesses to achieve carbon neutrality. It was set up by Natural Capital Partners in 2002.

Natural Capital Partners is a London based company that works on climate finance and carbon neutrality solutions.

UST is a leading digital transformation solutions company. It has joined Amazon-led The Climate Pledge.

Amazon-led The Climate Pledge is a cross-sector business community that is working together to solve the challenges of decarbonising the economy and crack the climate crisis.

Topic: Corporates/Companies

3. Ecozen, a Pune-based start-up, included in Cleantech Group’s 50 to Watch List.

- Ecozen, a Pune-based start-up, has been included in Cleantech Group’s 50 to Watch List.

- Cleantech Group is a San Francisco-based international body. It came out with its 50 to Watch List.

- The List praises entrepreneurs and their firms that have created new technologies and business models supporting clean hydrogen, increasing food availability etc.

- Ecozen provides solutions in the value chain processes for perishable commodities with its cutting edge technology.

- Ecozen was founded by three IIT graduates (Devendra Gupta, Prateek Singhal and Vivek Pandey). Devendra Gupta is its CEO.

Topic: Banking System

4. India’s first ever Euro-denominated green bonds issued by Power Finance Corporation (PFC).

- India’s first ever Euro-denominated green bonds have been issued by Power Finance Corporation (PFC).

- The company launched its maiden €300 million 7-year Euro Bond issuance on September 13. It is also the first Euro bond issuance by PFC.

- The issuance got oversubscribed 2.65 times by institutional investors across Asia and Europe.

Power Finance Corporation Ltd (PFC) was formed in 1986. It is a Navratna PSU. It is headquartered in New Delhi. Rural Electrification Corporation (REC) is its subsidiary.

PFC is India's largest NBFC. It is also the largest infrastructure finance company in India. It is the financial backbone of Indian Power Sector.

Topic: Banking System

5. Union Bank of India signs first $1.50 billion sustainability-linked overseas loan.

- Union Bank of India has signed the first $1.50 billion sustainability-linked overseas loan.

- The bank said that it has syndicated a “sustainability-linked loan” facility aggregating $1.50 billion for a Singapore-based global trading corporate.

- The tenor of syndicated loans is 3 years. The coupon rate is LIBOR (London Inter-Bank Offered Rate) plus 155 basis points.

- As per the bank, the loan facility includes three Key Performance Indicators (KPIs). They are related to reduction in greenhouse gas emissions, responsible sourcing of metals and growing renewable power portfolio.

Union Bank of India was founded in 1919. Its CEO is Rajkiran Rai G. It is headquartered in Mumbai. It is a government-owned bank.

Topic: Banking System

6. Union Cabinet approves proposal that requires government to guarantee the security receipts issued by NARCL.

- Union Cabinet has approved a proposal that requires the government to guarantee the security receipts issued by National Asset Reconstruction Company Ltd (NARCL) when buying NPAs from banks.

- NARCL got incorporated in Mumbai last month. Indian Banks Association (IBA) moved RBI for a licence to set up ₹6,000-crore bad bank.

- NARCL is likely to be sponsored primarily by Canara Bank. It will buy bad loans from banks and issue security receipts up to 85% and cash for the remaining.

- On Thursday, Finance Minister said that guarantee to security receipts will be valid for five years.

- She said that a government guarantee can be used to deal with the deficit between the amount realised from the underlying asset and the face-value of the Security Receipt issued for it.

- She said that ₹30,600-crore guarantee will be available for stressed assets of ₹2-lakh crore. Out of ₹2-lakh crore, ₹90,000 crore will get transferred from banks to NARCL in the first phase.

- For this transfer, NARCL will pay banks 15% cash and 85% in Security Receipts.

- Debashish Panda, Secretary, Department of Financial Services, said that 16 banks and NBFCs are coming together for NARCL. He said that public sector banks will have 51 % stake in it.

- Finance Minister said that India Debt Resolution Company Ltd has already been established. It will function as an asset management company.

- She said that 4 Rs (Recognition, Resolution, Recapitalisation and Reforms) strategy since 2015 had served the banking system well.

Topic: Taxation System

7. GST Network said that no e-way bills required if principal supply is service.

- GST Network has said that no e-way bills are required if principal supply is service and no goods are involved.

- E-way bills will be required to be generated by entering codes for both in case of mix of goods and services.

- E-way bill is needed to be produced for the moving of goods if their value is ₹50,000 or more.

- It is proof that tax has been paid on the goods being moved from one State to another or even from one city to another within a State.

GSTN is a non-profit, non-government organization. It manages the entire IT system of the GST portal. It forms the information technology backbone for the GST.

Topic: Regulatory Bodies/Financial Institutions

8. NFRA seeks consolidation of all penal provisions relating to financial reporting.

- National Financial Reporting Authority (NFRA) has sought consolidation of all penal provisions relating to financial reporting.

- NFRA Chairperson, Rangachari Sridharan said that this would allow integrated regulation of all the participants in the financial reporting system.

- Currently, NFRA has the power to penalize the auditors for misconduct. It has no authority to deal with the functionaries of the companies responsible for financial reporting.

- Section 132 of the Companies Act 2013 empowers NFRA to take action against auditors for professional misconduct.

National Financial Reporting Authority (NFRA):

The government formed NFRA on 1 October 2018.

It supervises the work of auditors, establishes and enforces standards of accounting and auditing.

Chairperson: Rangachari Sridharan

Topic: Miscellaneous

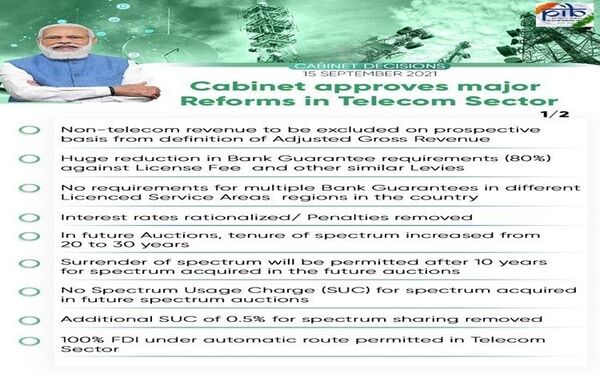

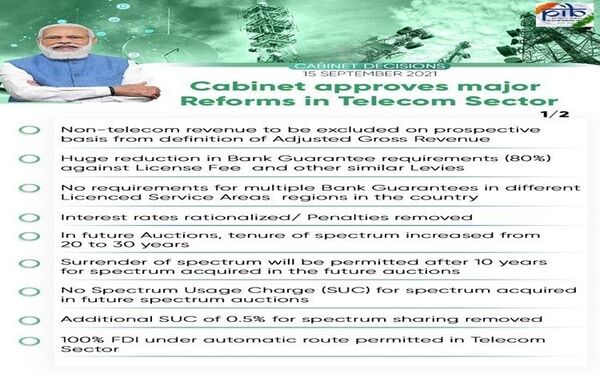

9. Union Cabinet approves structural and process reforms in Telecom Sector.

- Union Cabinet has approved structural and process reforms in Telecom Sector.

- Under structural reforms, non-telecom revenue has been excluded on prospective basis from the definition of Adjusted Gross Revenue (AGR).

- In future Auctions, the tenure of spectrum has been increased from 20 to 30 years. Surrender of spectrum will be permitted after 10 years for spectrum acquired in future auctions.

- There will be no Spectrum Usage Charge (SUC) for spectrum acquired in future spectrum auctions.

- To encourage investment, 100% Foreign Direct Investment (FDI) under automatic route has been permitted in Telecom Sector.

- Under procedural reforms, the cabinet has approved Self-KYC (App based). Further, E-KYC rate has been revised to only One Rupee. Shifting from Prepaid to Post-paid and vice-versa will not require fresh KYC.

- In order to address liquidity requirements of Telecom Service Providers (TSP), Union cabinet has approved moratorium/deferment of upto four years in annual payments of dues arising out of the AGR judgement.

- Further, Union Cabinet has approved moratorium/deferment on due payments of spectrum purchased in past auctions (excluding the auction of 2021) for upto four years.

(Source: News on AIR)

Topic: RBI

10. India’s UPI and Singapore’s PayNow will be linked by July 2022.

- India’s Unified Payments Interface (UPI) and Singapore’s PayNow will be linked by July 2022. This decision has been jointly taken by the Reserve Bank of India (RBI) and the Monetary Authority of Singapore (MAS).

- This UPI-PayNow linkage will enable users to make instant fund transfer on a reciprocal basis.

- It is a significant step towards the development of infrastructure for cross-border payments between India and Singapore.

- This UPI-PayNow linkage is the effort of NPCI International Private Limited (NIPL) and Network for Electronic Transfers (NETS) to increase cross-border interoperability of payments between India and Singapore.

- PayNow is a payment system in Singapore that enables users to send and receive money instantly.

Unified Payments Interface (UPI) was launched in 2016. It is an instant real-time payment system for transfer money in bank accounts.

Previous

Previous

Latest

Latest

Comments