Topic: Indian Economy/Financial Market

1. Wholesale Price Index (WPI) inflation increased from 13.11% in February to 14.55% in March.

- WPI inflation in March has reached four month high level. Main contributors to increase in WPI inflation are crude oil prices and prices of fuels and core items.

- Inflation in food articles decreased from 8.19% in February to 8.06% in March.

- Vegetable inflation decreased from 26.93% in February to 19.88% in March.

- Manufacturing inflation increased from 9.8% in February to 10.7% in March. On the same lines, edible oil inflation increased from 14.9% to 16.06%.

- As per data released last week by the Statistics Ministry, CPI-based retail inflation was at 17 month high level of 6.95%.

Topic: Corporates/Companies

2. Government amended FEMA rules to allow 20% FDI in LIC through the automatic route.

- These new rules will be called the Foreign Exchange Management (Non-debt Instruments) (Amendment) Rules, 2022.

- Recently, the Department for Promotion of Industry and Internal Trade (DPIIT) has amended the Foreign Direct Investment (FDI) policy to bring overseas investment in LIC.

- The government is planning to dilute its stake in LIC through the Initial Public Offering (IPO).

- As per the present Foreign FDI policy, foreign investment up to 20% in public sectors banks can be done through the automatic route.

- Foreign investment in LIC is in accordance with the provisions of the Life Insurance Corporation Act, 1956 (LIC Act).

- FEMA (Foreign Exchange Management Act):

- It was introduced in the year 1999.

- It has replaced the earlier act FERA (Foreign Exchange Regulation Act).

- Its main objective is to facilitate external trade and payments and to regulate the foreign exchange market in India.

Topic: Banking System

3. SBI has raised $500 million through a syndicated loan facility through its IFSC Gift City branch.

- This is SBI’s first offshore USD secured overnight financing rate-linked syndicated loan executed through its Gift City branch.

- The loan facility is for $400 million-plus-$100 million as a greenshoe option.

- MUFG, Bank of America, and JP Morgan were the joint lenders for this offering.

- First Abu Dhabi Bank acted as facility agent. SBI Gift City Branch has become the largest branch in IFSC.

Topic: Banking System

4. The board of Fino Payments Bank has approved investment of up to 12.19% in Paysprint.

- The investment is the first for Fino Payments Bank since its public listing.

- Fino Payments Bank is a wholly-owned subsidiary of Fino Paytech Limited (FPL).

- Fino Payments Bank was launched in 2017. MD and CEO is Rishi Gupta. Paysprint is a Delhi based fintech company.

Topic: Corporates/Companies

5. Grasim Industries has become most sustainable company in India.

- It is ranked first in the list of 2021 Capri Global Capital Hurun India Impact 50 companies.

- It has achieved a cumulative sustainability score of 47. Tech Mahindra (score 46), Tata Power Company (score 45) and Wipro (score 45) have come at 2nd, 3rd and 4th places.

- Climate action (SDG 13) and responsible consumption and production (SDG 12) are the most prioritized SDGs. Life below water (SDG 14) is the least prioritized SDG.

- Hindustan Unilever has the highest number of measurable SDGs with time-bound targets, followed by ITC, and Tech Mahindra.

- Only 29 companies have set a deadline for becoming carbon-neutral. ITC and Infosys, respectively, became carbon-neutral in 2006 and 2020.

- Cipla and Adani Ports and Special Economic Zone have set a goal of achieving it by the year 2025.

- The city with the most companies on the list is Mumbai, followed by New Delhi.

- Sustainability score of manufacturing companies is higher than service companies.

- 2021 Capri Global Capital Hurun India Impact 50 lists the top 50 companies based in India, ranked as per their alignment with 17 SDGs (Sustainable Development Goals).

Topic: Miscellaneous

6. Union Minister Dharmendra Pradhan launched India’s first SIIC at Skill Development Institute in Bhubaneswar.

- Skill India International Centre (SIIC) will provide high-quality training to youth.

- It will organize training sessions as per the demand of international employers.

- It will provide offer training of trainers, corporate training, upskilling and trade testing facilities.

- It will identify emerging trends in teaching and Skill delivery and it will create a pool of vocational education and training (TVET) teaching staff.

- He also launched WorldSkills Academy and National Academy for Skill Teachers.

Topic: Appointments

7. The reappointment of Renu Karnad as a non-executive director has been approved by the board of directors of HDFC Bank.

- Her reappointment is as a nominee director of HDFC Ltd, promoter of HDFC Bank.

- Her reappointment will become effective from 3 September 2022 for a period of 5 years. She is MD of HDFC Ltd since 2010.

- Her reappointment is subject to the approval of shareholders.

Topic: Indian Economy/Financial Market

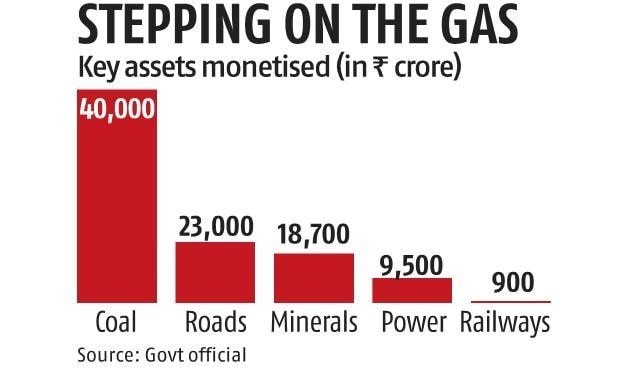

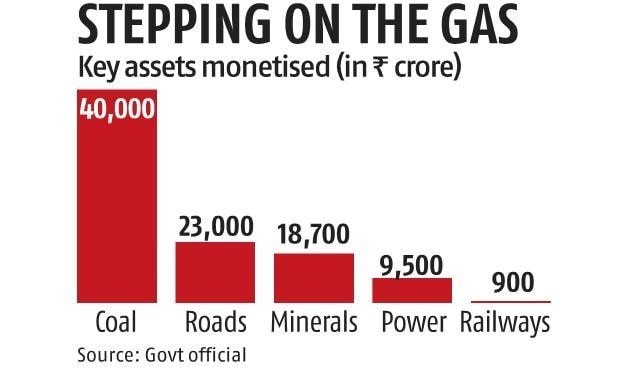

8. Government collected Rs 96,000 crore through asset monetization during FY22 and surpassed target of Rs 88,000 crore.

- The government has set a target of asset monetization worth Rs 1.62 trillion for FY 23.

- The list of assets to be monetized this year is being prepared by the NITI Aayog along with different ministries.

- In 2021-22, the Ministry of Road Transport and Highways monetized assets worth Rs 23,000 crore while the Ministry of Power monetized assets of Rs 9,500 crore.

- During FY 2022, around 31 mineral blocks were auctioned with a value of Rs 18,700 crore.

- The government has identified assets of about Rs 6 trillion to be monetized over the next four years period.

- The Ministry of Railways has monetized assets worth Rs 800-900 crore against its target of Rs 17, 810 crores.

- The government is planning to monetize assets worth Rs 1.79 trillion and Rs 1.67 trillion in FY 24 and FY 25 respectively.

Topic: Reports and Indices

9. World Bank Report says extreme poverty in India decreased by 12.3% from 22.5% in 2011 to 10.2% in 2019.

- As per World Bank’s policy research working paper, poverty reduction was higher in rural areas than in urban India.

- Income growth has been higher in the case of farmers with small landholding sizes.

- According to the UN, over 77 million people went into poverty in 2021 due to the coronavirus pandemic.

- As per the UN report released recently, rich countries were able to avoid the worst economic impacts of the pandemic.

- However, as per the report, poorer countries continue to deal with financial debt.

- The report has been released on 13 April 2022 and prepared by U.N.'s Inter-agency Task Force on Financing for Development.

Topic: Infrastructure and Energy

10. The Indian renewable energy sector added highest ever annual new capacity of 14,077 MW in FY22.

- The renewable power sector added new capacities of 7,356 MW and 8,711 MW in FY21 and FY20, respectively.

- The largest yearly capacity addition was recorded at 11,754 MW and 11,320 MW in FY18 and F17, respectively.

- The solar energy sector contributed 12,761 MW (91%) to total renewable energy addition in FY22.

|

Solar power capacity addition in FY22

|

12,761 MW

|

|

Ground-mounted power capacity addition (FY22)

|

10,148 MW

|

|

Rooftop power capacity addition (FY22)

|

2,206 MW

|

|

Off-grid power capacity addition (FY22)

|

407 MW

|

- The renewable energy sector has achieved a total grid-connected power capacity of 110 GW as of March 31, 2022.

- Center has fixed target of achieving 175 GW renewable power installed capacity by 2022-end.

- The target of 175 GW includes 100 GW from solar power, 60 GW from wind power, 10 GW from biomass power and 5 GW from hydropower.

Previous

Previous

Latest

Latest

Comments