Banking, Financial and Economic Awareness of 21 and 22 May 2020

(Source: The Hindu) 1. Local products having GI logo need to be supported

2. Safe Harbour Rules notified for the AY 2020-21

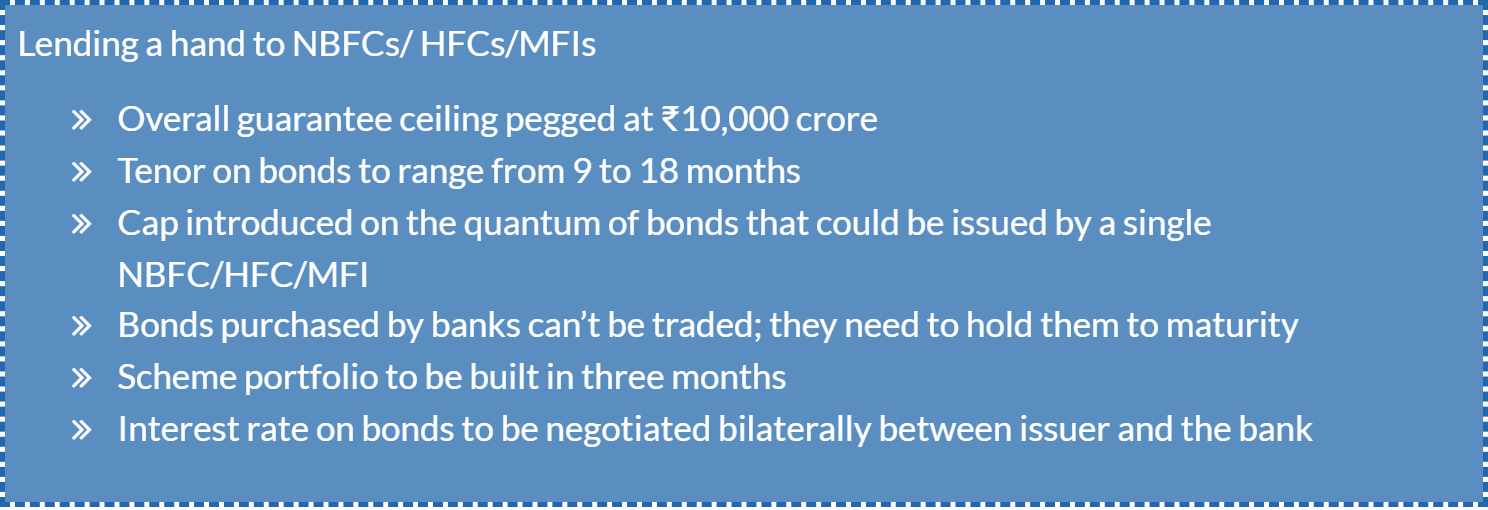

3. Partial Credit Guarantee Scheme (PCGS) 2.0 guidelines issued

4. Scheme for Formalization of Micro Food Processing Enterprises approved

5. Futures trading launched on Agridex

Daily Banking Awareness Quiz | 14 & 15 May 2020

Start QuizDaily Banking Awareness Quiz | 12 & 13 May 2020

Start QuizDaily Banking Awareness Quiz | 10 & 11 May 2020

Start QuizDaily Banking Awareness Quiz | 3, 4 & 5 May 2020

Start Quiz

Previous

Previous

Latest

Latest

Comments