Topic: Awards and Prizes

1. Stellapps Technologies wins National Startup Award 2021 in the Animal Husbandry sector.

- Stellapps Technologies has won National Startup Award 2021 in the Animal Husbandry sector.

- The startup has won the National Startup Award for its efforts towards digitization of the dairy supply chain in India.

- Stellapps is one of the 46 startups declared winners of the National Startup Awards 2021.

- As part of the award, the founders of startup were awarded a cash prize of ₹5 Lakh.

Topic: RBI

2. Regulations under amended Factoring Regulation Act, 2011 issued by RBI.

- Regulations under the amended Factoring Regulation Act, 2011 have been issued by RBI.

- Under the regulations, all existing non-deposit taking NBFC-Investment and Credit Companies (NBFC-ICCs) having asset size of ₹1,000 crore & above will be allowed to carry out factoring business.

- Due to this provision, the number of NBFCs eligible to undertake factoring business will increase significantly from 7 to 182.

- Other NBFC-ICCs can also carry out factoring business by registering as NBFC-Factor.

- In case of trade receivables financed through a Trade Receivables Discounting System (TReDS), concerned TReDS shall file particulars of assignment of receivables with the Central Registry on behalf of the Factors within 10 days.

- In factoring business, account receivables of a business are sold to a third party at a discount.

Topic: Agriculture

3. India’s exports of agricultural products expected to cross $50 billion for first time this financial year.

- According to Ministry of Commerce, India’s export of agricultural products (including marine and plantation goods) is expected to cross $50 billion for the first time this financial year (FY22).

- Ministry of Commerce said that in April-November 2021, India’s exports of agricultural products (including marine and plantation goods) increased 23.21% to $31.05 billion.

- The Ministry further said that exports of marine products are expected to cross $8 billion in the current fiscal for the first time.

- Spice exports are expected to reach a record high of around $4.8 billion.

- The Ministry has also informed that rice exports are expected to reach 21-22 million tonnes this year.

- In FY21, India’s export of agricultural products stood at $41.25 billion. This increased by 17% from $35.16 billion in 2019-20 (FY20).

Topic: Indian Economy/Financial Market

4. Ind-Ra estimates GDP to grow at 7.6% in FY23.

- India Ratings & Research (Ind-Ra) has estimated GDP to grow at 7.6% in FY23.

- Economic Survey is scheduled to be tabled in the Parliament on January 31. It will provide the government’s estimate for FY23.

- According to Ind-Ra, real GDP in FY23 will be 9.1% higher than the FY20 GDP level.

- However, the Indian economy’s size in FY23 will be 10.2% lower than the FY23 GDP trend value.

- It is estimated that continued weakness in private consumption and investment demand will contribute 43.4% and 21% respectively to this shortfall.

- The rating agency has also talked about risks to ongoing recovery. It pointed to NSO's advanced estimate of FY22.

- NSO advanced estimate of FY22 show that private final consumption expenditure (PFCE) grew only 6.9% year on year (yoy) in FY22.

- PFCE grew only 6.9% despite the low base and robust growth shown by many consumer durables.

- PFCE is the largest component of GDP (58.6%) from the demand side and is a proxy for consumption demand.

- The agency said that this shows weak consumption demand and robust PFCE growth is required for sustained growth recovery.

- Investments, as measured by gross fixed capital formation (GFCF), are expected to grow 8.7% yoy in FY23, according to India Ratings.

- India Ratings & Research (Ind-Ra) is a 100% owned subsidiary of the Fitch Group. It is India's most respected credit rating agency. It is headquartered in Mumbai.

Topic: RBI

5. RBI releases Digital Payments Index (DPI) for September 2021.

- DPI for September 2021 stands at 304.06. It stood at 270.59 for March 2021.

- The DPI has increased by 39.64% to 304.06 in September 2021 against 217.74 in the year-ago month.

- RBI releases DPI for March and September in July and January respectively.

- RBI-DPI:

- It aims to capture the extent of digitisation of payments across the country. It has March 2018 as a base. DPI score for March 2018 is taken as 100.

- It comprises of five broad parameters given below.

- Payment enablers (25% weight)

- Payment infrastructure – demand side factors (10% weight)

- Payment infrastructure – supply-side factors (15% weight)

- Payment performance (45% weight)

- Consumer centricity (5% weight)

Topic: Indian Economy/Financial Market

6. Foreign investment flow into India declined by 26% in 2021 according to UNCTAD’s Investment Trends Monitor.

- Foreign Direct Investment (FDI) flows to India have declined by 26 percent in 2021 as compared to the previous year.

- According to UNCTAD’s Investment Trends Monitor, the FDI inflows in India come down due to fewer mergers and acquisitions (M&A) recorded in 2021.

- In 2021, Global Foreign Direct Investment (FDI) flows showed a strong rebound. It has grown by 77% from $929 billion in 2020.

- FDI flows in developing economies increased by 30%. Latin America reached near the pre-pandemic level.

- FDI flows to South Asia have decreased by 24% to $54 billion in 2021 from $71 billion.

- FDI flows in the United States have doubled due to an increase in cross-border mergers and acquisitions.

- FDI flow to East and South-East Asia has also increased by 20%. China recorded an increase of 20% in FDI inflows.

- According to World Investment Report by UNCTAD, India received USD 64 billion in foreign direct investment in 2020. The report was released in June last year.

- Foreign Direct Investment (FDI) is an investment made by a firm or individual in one country into business interests located in another country.

Topic: Appointments

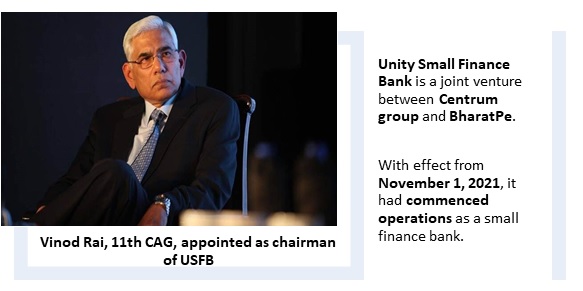

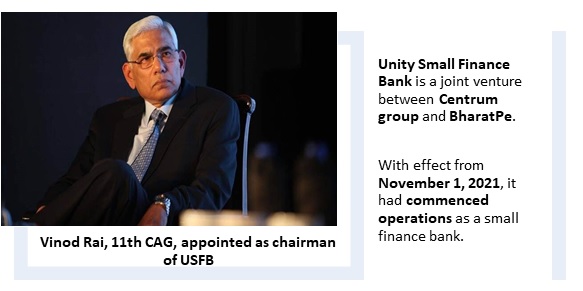

7. Vinod Rai appointed independent chairman of USFB.

- Vinod Rai has been appointed as the independent chairman of the Unity Small Finance Bank (USFB) by RBI.

- Rai is the former (11th) Comptroller and Auditor General (CAG) of India.

- In addition to Rai, Sandip Ghose, Basant Seth, and Subhash Kutte are also members of USFB board.

- Unity Small Finance Bank:

- Unity Small Finance Bank is a joint venture between Centrum group and BharatPe.

- With effect from November 1, 2021, it had commenced operations as a small finance bank.

- It was established with capital of about ₹1,100 crore as against regulatory requirement of ₹200 crore for establishment of a small finance bank.

Topic: Reports and Indices

8. Start-ups raised a record $24.1 billion in 2021.

- As per the study by NASSCOM and Zinnov, start-ups raised a record $24.1 billion in 2021.

- As per the study, ‘Indian Tech Start-up Ecosystem: Year of The Titans’, over 2,250 start-ups were added in 2021. This was more than that added in the previous year.

- The study said that over $6 billion has been raised via public markets with 11 start-up IPOs in 2021.

- As per the study, Start-up ecosystem provided 6.6 lakh direct jobs and over 34.1 lakh indirect jobs.

- National Association of Software and Service Companies (NASSCOM) is an association of the software industry. It was established in 1988. Debjani Ghosh is its President. Zinnov is a management & strategy consulting firm.

Previous

Previous

Latest

Latest

Comments