Topic: RBI

1. RBI has released norms for regulating fintechs in cross-border payments space.

- Fintech companies will now be required to apply for Payment Aggregator-Cross Border (PA-CB) licences.

- All entities facilitating cross-border payment transactions for the import and export of goods and services will be directly regulated by RBI.

- Companies like PayU, Cashfree Payments, and Paypal will require to apply for this licence.

- Early-stage start-ups like Skydo will also require to apply for this licence.

- RBI’s guidelines will increase compliance costs for fintechs operating in cross-border payments space.

- As of now, the sponsor bank or authorised dealer (AD) used to manage the payment accounts for these companies.

- As per the new guidelines, non-banks that provide Payment Aggregator-Cross Border (PA-CB) services shall apply to RBI for authorization by 30 April 2024.

- The approval for PA-CB operations has been divided into three categories given below.

- Export-only PA-CB

- Import-only PA-CB

- Import and export PA-CB

- The minimum net worth of non-banks already providing PA-CB services as on date of the issue of the circular shall be ₹15 crore at the time of submitting an application to the RBI for authorisation.

- They will be required to further raise their net worth to a minimum of ₹25 crore by March 31, 2026.

- The rule of minimum net worth of ₹15 crore at the time of submitting an application to the RBI for authorization is also applicable to new entities (new non-bank PA-CBs) that have not begun their operations before the date of issue of the circular.

- These new non-bank PA-CBs will be required to achieve net worth of ₹25 crore by the end of 3rd financial year from the grant of authorisation.

Topic: Miscellaneous

2. Ministry of Information and Broadcasting (MIB) has appointed nodal officers to receive complaints against piracy.

- These nodal officers have also been appointed to direct the intermediaries to remove pirated content on digital platforms.

- MIB has taken this step after the Cinematograph (Amendment) Act, 2023 was passed by the Parliament in this year’s Monsoon session.

- The Act was last time amended in 1984. It has now been amended after 40 years and provisions against film piracy, including digital piracy have been incorporated.

- The amendment provide for punishment of at least 3 months imprisonment. It also provide for a fine of Rs 3 lakh.

- The fine can be extended up to 3 years imprisonment and upto 5% of the audited gross production cost.

- The nodal officers have been appointed in the Ministry and Central Board of Film Certification (CBFC) Mumbai office and regional offices.

- The need to renew film licenses every ten years has been done away.

- An original copyright holder or anybody authorised by original copyright holder can apply to the Nodal Officer for removal of pirated content.

- The digital platform shall remove internet links with pirated content within 48 hours of receiving instructions from the Nodal Officer.

- Section 79 of the Information Technology (IT) Act permits the “appropriate Government or its agency” to notify the intermediary about the use of its services for committing an unlawful act.

Topic: Indian Economy/Financial Market

3. India’s first 50-year Government Security (G-Sec) fully sold.

- RBI accepted 54 bids worth ₹9,988 cr at the cut-off yield of 7.46%.

- The maiden auction of the 50-year G-Sec was held on 03 November 2023.

- Investors, especially insurance companies and pension funds have shown enthusiastic bidding.

- Before this auction, the longest available government bond was of 40-year duration.

- The notified amount for the 50-year G-Sec (maturing in 2073) was ₹10,000 crore.

- The investors placed 216 competitive bids aggregating Rs 40,200 crore at the auction.

- France was first G7 country to issue 50-year bonds in 2005. China issued 50-year bonds in 2009.

- Government plans to issue 50-year bonds worth ₹30,000 crore between October 2023 and February 2024.

- RBI is the banker and debt manager to the government.

- The central government has planned to borrow Rs 6.6 trillion in the second half (H2) of the current financial year.

- This forms 42% of a total Rs 15.43 trillion planned for the current financial year.

Topic: Summits/Conferences/Meetings

4. PM Modi inaugurated World Food India 2023 on 03 November 2023.

- The inauguration of 2nd edition of the World Food India took place at Pragati Maidan in New Delhi.

- On the first day of event, 16 Memoranda of Understanding (MoUs) signed between Ministry of Food Processing Industries (MoFPI) and various industry entities. These agreements were worth around Rs 17,990 crore.

- At the time of inauguration, PM provided Seed Capital Assistance to over one lakh Self Help Group (SHG) members.

- He said that the India's food processing sector has attracted foreign direct investments exceeding Rs 50,000 crores in the past nine years.

- He said that food processing industry has emerged as the “sunrise sector” in India.

- He said the contribution of the processed food segment to agri exports has increased from 13% to 23% in the past nine years.

- He further said that the exports of processed food have increased by 150%. India today ranks seventh globally in terms of agro exports.

- The second edition ‘World Food India 2023’ is being organised by Ministry of Food Processing Industries from 3rd-5th November, 2023 at New Delhi.

- The first edition of World Food India was launched by the Ministry of Food Processing Industries in 2017.

Topic: Reports and Indices

5. Services sector growth fell to a 7-month low in October.

- The S&P Global India Services Purchasing Managers' Index (PMI) has declined to 58.4 in October from 61 in September.

- Services PMI reached to 13-year high of 62.3 in July and it remained above the 60 level in the July-September quarter.

- India’s service sector witnessed a slower expansion in October. It is the slowest rate in the last seven months.

- Growth of the services sector accounted for nearly 58% of India’s economy.

- The rate of job creation has declined due to a decrease in demand.

- The Job creation in the service sector in October was the lowest in the last three months.

Topic: Banking System

6. State Bank of India (SBI) and M&M Financial Services have signed co-lending agreement.

- The agreement aims to offer affordable solutions to the customers of NBFC and it is Mahindra Finance’s first co-lending tie-up with a bank.

- Through the agreement, SBI's cost-effective capital and Mahindra Finance's distribution power will be combined.

- This will ensure wider outreach and better interest rates for customers.

- The partnership will help unlock the potential of priority sector lending. It reflects both entities commitment to empowering the MSME sector.

- Mahindra & Mahindra Financial Services Limited (MMFSL) is an Indian rural non-banking financial company headquartered in Mumbai.

Topic: RBI

7. RBI has prescribed norms for the closure of DCCB branches.

- On October 30, the RBI said that district central cooperative banks are allowed to close their unprofitable branches without prior permission of the central bank.

- However, approval from the Registrar of Cooperative Societies of the concerned state will be required.

- In a circular, the RBI said the decision to close branches should be taken by the board after taking into account all relevant factors.

- The Bank should give two months’ notice to all existing depositors/customers of the branch through a press release in local leading newspapers and also inform each constituent of the branch well in advance of the closure of the branch.

- In addition, the District Central Cooperative Bank (DCCB) should return the original license issued for the closed branch to the concerned regional office of the Reserve Bank.

- However, if restrictions have been imposed on the bank by the RBI, DCCB will not be allowed to close branches.

Topic: Reports and Indices

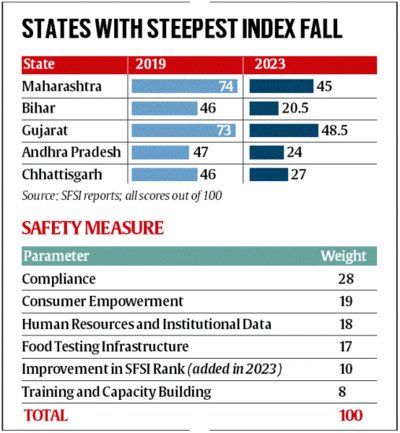

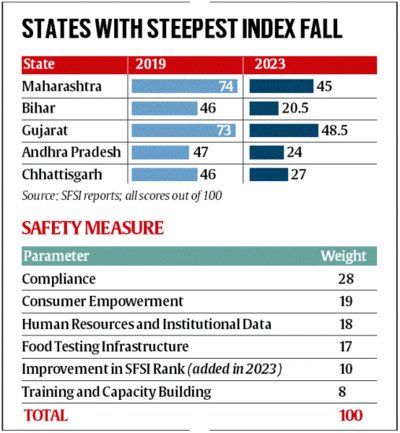

8. Food Safety and Standards Authority of India (FSSAI) released the State Food Safety Index (SFSI) for 2023.

- According to SFSI, 19 out of 20 big states' scores registered a decline in 2023 as compared to 2019.

- Maharashtra, Bihar, Gujarat and Andhra Pradesh recorded a drop in their 2023 scores from 2019.

- In the last five years, the steepest fall was seen in Maharashtra, with its score declining to 45 in 2023 as compared to 74 in 2019.

- Bihar score has decreased to 20.5 in 2023 as compared to 46 in 2019.

- The average scores of all large states improved marginally to 56 points in 2020 from 52 points in 2019.

- The average score dropped to 51 points in 2021 and 2022.

- SFSI score is being given to states from 2019. It is given out of a total of 100 points that are calculated on the basis of five parameters with different weightage.

- The most decrease has been seen in the ‘Food Testing Infrastructure’ parameter.

- The ‘Compliance’ parameter has the highest weightage (28%) in the Index.

- The ‘Consumer Empowerment’ parameter has the second highest weightage (19 per cent) in 2023.

- The 2023 average compliance score for all large states was 11 points out of 28 in 2023.

|

Five parameters of the State Food Safety Index (SFSI)

|

|

Human Resources and Institutional Data

|

Compliance

|

|

Food Testing Infrastructure

|

Training and Capacity Building

|

|

Consumer Empowerment

|

|

(Source: SFSI Report)

Topic: Reports and Indices

9. Prime Global Cities Index Q3 2023 has been released by real estate consultant Knight Frank India on 01 November 2023.

- Mumbai has got fourth place among 46 cities globally in terms of price rise of luxury homes.

- Mumbai was ranked at 22nd place in Q3 2022. So, its rank improved by 18 places.

- A rise has been recorded in average annual prices of prime residential or luxury homes in the July-September period in Mumbai, Bengaluru and New Delhi.

- The rank of Bengaluru has improved to 17th in Q3 2023 from 27th rank in the third quarter of 2022.

- National Capital Region (NCR) moved to 10th rank in July-September of 2023 from 36th rank in the year-ago period.

- Manila is in the top spot of ranking with a 21.2% annual rise in prices.

- Dubai with an annual growth of 15.9% is in the second place on the ranking. It has been displaced from the top position for the first time in eight quarters.

- Shanghai is in the third place with an annual growth of 10.4%. The index tracks nominal prices in local currency. San Francisco was ranked at last (46th) place.

Topic: Awards and Prizes

10. Nandini Das has won the 2023 British Academy Book Prize for Global Cultural Understanding.

- India-born author Nandini Das has won this prize for her book ‘Courting India: England, Mughal India and the Origins of Empire'.

- The winning book is her debut. Critics have described it as the “true origin story of Britain and India told through England's first diplomatic mission to the Mughal courts”.

- In the book, Das presents a new perspective on the origins of the empire through the story of the arrival of Sir Thomas Roe in the early 17th century.

- Sir Thomas Roe was the first English ambassador in India.

- Vihaan Talya Vikas won the prestigious ‘Wildlife Photographer of the Year’ award.

- A 10 year-old-Bangalore kid, Vihaan Talya Vikas, won the Wildlife Photographer of the Year (WPY) competition in the under-10 category.

- Vihaan's photograph captured a spider in an intriguing position with a sculpture of Lord Krishna, nestled on the outskirts of Banglore.

- Karine Aigner from the USA had won the Wildlife Photographer of the Year 2022.

Topic: Summits/Conferences/Meetings

11. India Manufacturing Show has been inaugurated by Raksha Mantri Shri Rajnath Singh in Bengaluru.

- Raksha Mantri inaugurated the three-day show on 02 November 2023.

- Laghu Udhyog Bharti & IMS Foundation are jointly organising the show.

- The show is supported by the Department of Defence Production, Ministry of Defence.

- Its central theme is ‘Make in India, Make for the World’.

- 6th edition of the ‘India Manufacturing Show’ will serve as a platform for the exhibitors to showcase their technologies, equipment and R&D in different sectors.

- Some of these sectors are aerospace & defence engineering, automation, robotics & drones.

- Laghu Udyog Bharati is an all-India organization of Micro and Small Industries in India since 1994.

Topic: Banking System

12. FM Nirmala Sitharaman inaugurated SBI’s branch in Trincomalee, Sri Lanka.

- The occasion was graced by the Governor of the Eastern Province of Sri Lanka Senthil Thondaman, High Commissioner of India to Sri Lanka Gopal Baglay, and SBI Chairman Dinesh Khara.

- State Bank of India's dedication to growth both domestically and internationally, particularly amid Sri Lanka's economic crisis, was commended by Mrs. Sitharaman.

- The Government of India was able to smoothly extend a $1 billion Line of Credit to Sri Lanka thanks to the efforts of SBI.

Previous

Previous

Latest

Latest

Comments