Topic: Indian Economy/Financial Market

1. The GST Council has proposed a clarification on post-sales discounts.

Topic: Regulatory Bodies/Financial Institutions

2. SEBI has introduced a new framework to monitor intraday positions in equity index derivatives to manage market risk.

- The new rules will take effect from October 1.

- Net intraday positions in index options are capped at ₹5,000 crore per entity.

- This cap is in contrast to the existing end-of-day limit of ₹1,500 crore.

- The gross intraday limit remains unchanged at ₹10,000 crore.

- Stock exchanges must now track positions using at least four random snapshots daily.

- One of the snapshots must be taken during peak market hours between 2:45 pm and 3:30 pm.

- Breaches of limits will trigger regulatory scrutiny. Penalties or additional surveillance deposits may be imposed on violations.

- SEBI's objective is to curb excessive risk-taking and ensure orderly market functioning through tighter oversight.

Topic: Banking System

3. State Bank of India’s Start-up branch organized its first-ever pitch event called “Dream2Demo.”

Topic: Taxation

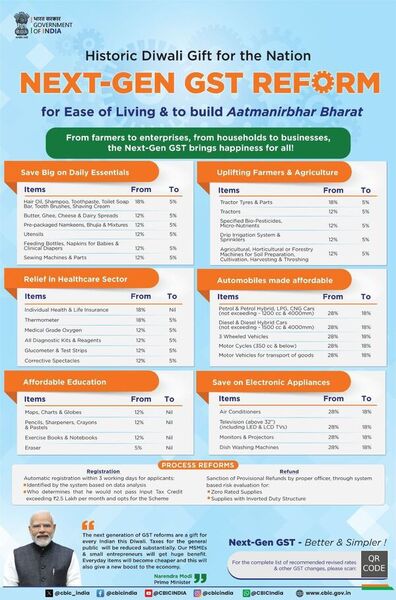

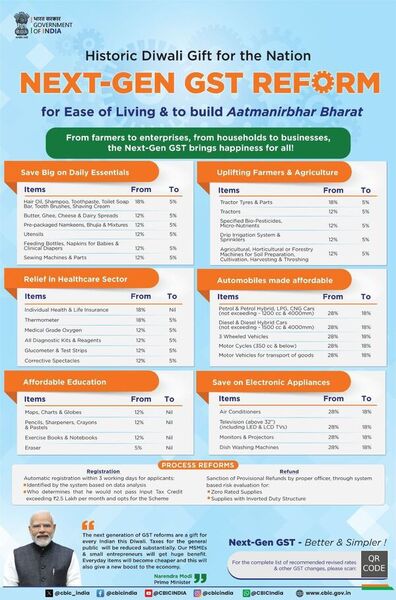

4. The GST Council has introduced a major revision of tax rates.

- This move is aimed at supporting common citizens, key industries, farmers, and the overall economy.

- Taxes on many middle-class and household items have been reduced.

- The previous rates of 12% or 18% are now brought down to 5%.

- All personal life and health insurance policies are now exempt from GST. This includes senior citizen and family floater plans.

- Thirty-three essential life-saving drugs will now attract zero GST. These were earlier taxed at 12%.

- Three critical medicines for cancer, rare diseases, and chronic conditions are also now tax-free. They were earlier under the 5% slab.

- General medicines will now be taxed at 5% instead of the earlier 12%.

- Medical equipment used in healthcare and diagnostics will now attract only 5% GST. Earlier, these were taxed at 18%.

- Daily-use items like shampoo, soap, toothpaste, toothbrushes, bicycles, and kitchen utensils will now fall under the 5% GST rate.

- GST on ultra-high temperature (UHT) milk, paneer, chena, and Indian breads has been removed. These items now have zero GST.

- Food products such as snacks, noodles, chocolates, sauces, cornflakes, butter, ghee, and preserved meat will now be taxed at 5%. Earlier, they were taxed at 12% or 18%.

- Appliances like air conditioners, large TVs, and dishwashers will now attract 18% GST. This is a reduction from the previous 28%.

- GST on small cars and motorcycles has also been reduced from 28% to 18%.

- All types of agricultural equipment will now be taxed at 5% instead of 12%.

- The GST Council has simplified the tax system. It has reduced the number of tax slabs from four to two.

- The 12% and 28% slabs have been removed. Only the 5% and 18% slabs will remain.

- The expected financial impact of these changes is ₹48,000 crore per year.

- However, the government considers this cost sustainable.

- The 56th meeting of the GST Council took place in New Delhi.

- It was chaired by Finance Minister Nirmala Sitharaman.

- The meeting included Chief Ministers, Deputy Chief Ministers, and Finance Ministers from various states and union territories.

- All new GST rates will take effect on September 22nd. This date marks the beginning of Navratri.

(Source: News on AIR)

Topic: Appointments

5. Rajit Punhani took charge as CEO of FSSAI.

- Rajit Punhani assumed charge as the Chief Executive Officer of the Food Safety and Standards Authority of India (FSSAI).

- He is a 1991-batch IAS officer belonging to the Bihar cadre.

- Punhani brings with him over three decades of administrative experience across various levels.

- He earlier served as Secretary in the Ministry of Skill Development and Entrepreneurship.

- He has also worked as Secretary of the Rajya Sabha and Chief Executive Officer of Sansad TV.

- Food Safety and Standards Authority of India (FSSAI) is a statutory body under the Ministry of Health and Family Welfare, Government of India.

- Its headquarters is in New Delhi. It was constituted on September 5, 2008, under the provisions of the Food Safety and Standards Act, 2006.

- This authority regulates the manufacture, storage, distribution, sale, and import of food items while setting standards to ensure food safety.

Topic: Summits/Conferences/Meetings

6. The 20th Global Sustainability Summit addressed by Union Minister Shri Bhupender Yadav in New Delhi on 2 September.

- The event was organized by the CII-ITC Centre of Excellence for Sustainable Development.

- Representatives from more than 10 countries and senior leaders from the industry were present at the gathering.

- Shri Yadav described India’s growth model as one that balances economic progress with ecological responsibility.

- He emphasized that sustainability should be treated not as a target but as a lifestyle rooted in resilience, regeneration, and responsibility.

- He informed that on August 29, 2025, the Government of India had notified the Environmental Audit Rules, 2025, which provide a formal framework for environmental audits across the country.

- The Minister informed that the revised methodology for the Green Credit Programme has been notified on 29th August 2025 to allow greater private participation and eco-restoration.

- On August 31, 2025, the ministry also amended the Forest (Conservation and Augmentation) Rules, 2023, to facilitate the objectives of achieving self-sufficiency in the critical minerals sector under the newly launched National Critical Minerals Mission, 2025.

- Under this mission, 24 minerals have been identified as critical and strategic, and 29 others have been identified as vital for strengthening the country's economy and national security.

Topic: Banking/Financial/Govt Schemes

7. BHARATI initiative has been launched by Agricultural and Processed Food Products Export Development Authority to boost agri-food exports.

Topic: MoUs/Agreements

8. An MoU signed by Indian Railways and SBI to enhance Insurance Benefits for Railway Employees.

-

On 1 September, Indian Railways (IR), one of the largest rail networks in the world, and the State Bank of India (SBI), the country’s largest public sector bank, signed a landmark MoU.

- The signing ceremony was attended by Shri Ashwini Vaishnaw, Hon’ble Minister for Railways, Information & Broadcasting, and Electronics & Information Technology.

- Under the MoU, insurance coverage for Railway employees maintaining salary accounts with SBI has been significantly enhanced.

- In case of accidental death, the insurance benefit has been increased to Rs 1 crore, while the current coverage for Group A, B, and C employees covered under CGEGIS is Rs 1.20 lakh, Rs 60,000, and Rs 30,000, respectively.

- Natural death insurance coverage of ₹10 lakh will also be provided to all employees holding only a salary account with SBI without any premium or medical examination requirement.

- Nearly 7 lakh Railway employees maintaining salary accounts with SBI are expected to benefit from this agreement.

- Key complimentary insurance covers under the MoU include an Air Accident (death) insurance of ₹1.60 crore, with an additional coverage of up to ₹1 crore on the RuPay Debit Card.

- Personal Accident insurance for Permanent Total Disablement has been set at ₹1 crore, while Permanent Partial Disability is covered up to ₹80 lakh.

- The MoU has been described as employee-centric and compassionate, particularly benefiting frontline Group C Railway personnel and other employees.

Previous

Previous

Latest

Latest

Comments