Topic: RBI

1. On 6 July, 33rd Conference of State Finance Secretaries conducted in Mumbai.

- RBI governor inaugurated the conference which was attended by the Finance secretaries from 23 states and 1 UT.

- RBI governor Shaktikanta Das emphasized on the importance of debt sustainability of state governments and reviewed their market borrowings.

- As per RBI release, the states need to focus on

- Fiscal consolidation

- Improving quality of expenditure

- Other issues related to the fiscal health of states such as contingent liabilities/guarantees, etc.

- The meeting also reviewed administration of the consolidated sinking fund and guarantee redemption fund, matters related to state government guarantees and short-term financial accommodation to states from the RBI.

- State government borrowing has grown exponentially, with state bond issuance so far in this financial year surpassing the previous year's volume by more than ₹60,000 crore.

- The conference also focused on the importance of allocating increased funds for sectors like education, health, infrastructure, green energy projects.

Topic: RBI

2. RBI has released draft circular on Credit Card Network Portability.

- RBI has proposed rules that could possibly restrict card issuers from engaging in exclusive arrangements with card networks like Mastercard, Visa or RuPay.

- The central bank also proposed that rules would apply to both banks and non-banking finance companies that issue credit, debit or prepaid cards.

- As per RBI draft circular, the current arrangements between card networks and card issuers do not provide customers with sufficient choices. A customer is bound to use the network provided by the card issuers.

- The circular has mandated card issuers to offer cards on more than one card network and provide customers with an option to choose between card networks at the time of issuance and also later.

- The proposed rules by RBI will increase customer choice and promote competition among card network companies.

- Starting from 1 October 2023, RBI wants the bank to offer card on multiple networks and give customers the option to choose their preferred network.

- There are five card networks in India:

- Mastercard

- Visa

- NPCI- Rupay

- American Express

- Diners Club

Topic: RBI

3. RBI has launched “Centralised Information Management System” (CIMS).

- During the 17th Statistics Day Conference in Mumbai, RBI governor Shaktikanta Das announced the launch of Centralised Information Management System (CIMS) to revolutionize its data handling, analysis and governance.

- This system uses state-of-the-art technology to manage big data and will serve as a platform for power users to carry out data mining, text mining, visual analytics and advanced statistical analysis connecting data from multiple domains, such as, financial, external, fiscal, corporate and real sectors as well as prices.

- As per RBI governor Shaktikanta Das, it would lead to a paradigm shift in the Reserve Bank’s economic analysis as well as supervision, monitoring and enforcement across multiple domains.

- The new system will start with reporting by scheduled commercial banks and will be slowly extended to urban cooperative banks (UCBs) and non-banking financial companies (NBFCs).

Topic: Appointments

4. SBI Card has appointed Abhijit Chakravorty as MD and CEO for 2 years.

- India’s largest pure-play credit card issuer, SBI Cards and Payment Services (SBI Card), has appointed Abhijit Chakravorty as MD and CEO.

- He is currently a Deputy MD at SBI.

- He will assume charge as MD and CEO of SBI Card on 12 August. He will replace Rama Mohan Rao Amara.

- Chakravorty will assume his new role at a time when the Indian credit card industry is showing robust growth in terms of volumes and card spends.

Topic: Reports and Indices

5. As per BMI report, India’s ethanol program will cap future sugar exports.

- In the recent years, India has emerged as the world’s second largest producer and a major exporter.

- But, India going forward with expansion of government led ethanol programme will have a smaller role in the sugar export market.

- As per Asia Biofuel Outlook report prepared by BMI, India’s aim of increased ethanol blending in gasoline to cut the oil products’ import bill and reduce carbon emissions will support global sugar prices.

- In India, biofuel is made mainly from sugarcane. As more ethanol plants will start production, more of India’s sugarcane crop will be used to make the fuel, that will limit the amount of sugar produced.

- India’s ethanol blending reached 11.5%, while the government’s target is to reach 20% by 2025.

- As per the report, it is doubtful that India will be able to achieve its target by 2025 as the programme will cap exports of feedstocks used in ethanol production.

- India need to sharply increase sugarcane planting to reach the target.

Topic: Taxation

6. Government included GSTN on the list of entities mandated to share information with ED and FIU under the PMLA.

- The Government has decided to bring the Goods and Services Tax Network (GSTN) under the Prevention of Money-laundering Act (PMLA).

- It will facilitate sharing of information between the GSTN, Enforcement Directorate and other investigative agencies.

- The GSTN is now one of the organisations mandated by the PMLA Act to exchange information with the Enforcement Directorate (ED) and the Financial Intelligence Unit (FIU).

- Goods and Services Tax Network has been brought under PMLA after the rise in cases of GST fraud and fake registrations.

- Under the money laundering provisions, tax authorities will get more power to trace the original beneficiary in case of fraud.

- Now, Crimes under GST like fake input tax credits, fake invoices etc. will be included in the PMLA Act.

- The government has made changes in section 66 of the PMLA.

- Goods and Services Tax Network (GSTN) is an information technology system which manages the GST portal.

- It provides common IT infrastructure and services to Central and State governments, taxpayers and other stakeholders for the implementation of GST.

- PMLA’s main aim is to tackle terror funding and drug trafficking.

Topic: Summits/Conferences/Meetings

7. Union Home Minister Amit Shah will inaugurate a day-long mega conclave “Strengthening PACS through FPOs” in New Delhi on 14th July.

- The main aim of the conclave is to discuss ways to strengthen Primary Agricultural Credit Societies (PACS) through Farmer Producer Organisations (FPOs).

- The mega conclave is being organized by the National Cooperative Development Corporation (NCDC) in collaboration with the Union Ministry of Cooperation.

- The government has decided to form 1100 New FPOs in Cooperative Sector.

- The government is providing financial assistance of Rs 33 lakh to each FPO under the FPOs scheme.

- FPOs are playing a key role in making farming sustainable and in improving the overall quality of life of people dependent on agriculture.

Topic: Awards and Prizes

8. PM Modi to be honored with Lokmanya Tilak Award 2023.

- PM Modi has been selected as the 41st recipient of this award in recognition of his exceptional leadership and his efforts to promote the spirit of patriotism among the citizens.

- On the occasion of 103rd death anniversary of Lokmanya Tilak (1 August), the Tilak Smarak Mandir Trust (Hind Swaraj Sangh), will honor the Prime Minister with the award.

- Lokmanya Tilak National Award:

- Lokmanya Tilak was a prominent figure in India's freedom struggle in the early 20th century.

- It was started in 1983.

- The award comprises a cash prize of ₹1 lakh as well as a memento.

- Indira Gandhi, Atal Bihari Vajpayee, Dr. Manmohan Singh, Pranab Mukherjee, NR Narayana Murthy and Cyrus Poonawalla are some of the recipients of this award.

Topic: Appointments

9. K Rajraman has been appointed as new Chairperson of IFSCA.

- The senior bureaucrat and telecom secretary K Rajaraman has been appointed as the next Chairperson of the International Financial Services Centres Authority (IFSCA).

- He has replaced the first IFSCA Chairperson Injeti Srinivas who led the authority since 2020.

- Rajaraman will have a tenure of three years from the date of assumption of charge of his post or till he attains the age of 65 years or until further orders, whichever is earlier.

- International Financial Services Centres Authority (IFSCA):

- It was set up in April 2020 under the International Financial Services Centres Authority Act, 2019, at GIFT City, Gandhinagar in Gujarat.

- It was established to regulate all financial services in International Financial Services Centres (IFSCs).

- Presently, GIFT IFSC is the first International Financial Services Center in India.

- Prior to the establishment of IFSCA, RBI, SEBI, PFRDA, and IRDAI regulate the business in IFSC.

Topic: Indian Economy/Financial Market

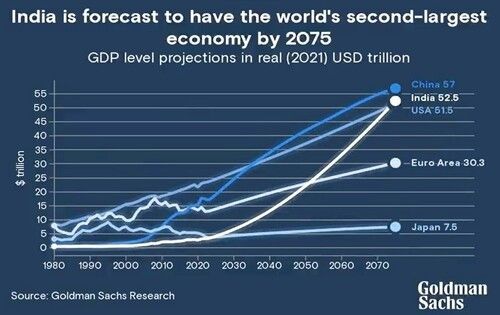

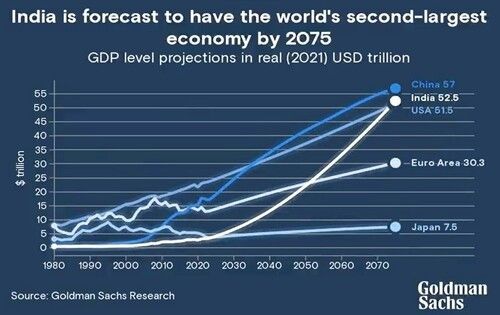

10. India is set to become the world’s second largest economy by 2075.

- As per Investment Bank Goldman Sachs, India will become world’s second-largest economy by 2075 crossing Germany, Japan and USA.

- With a population of 140 crores, India's GDP is estimated to grow to $52.5 trillion, which is higher than the US GDP estimate.

- In report, India's progress is forecasted due to a growing population, innovation and technology, high capital investment and increasing productivity of workers.

- This is the right time for the private sector to increase the capacity of services and manufacturing by bringing in a large labor force and creating more jobs.

- Increasing labor force participation, a huge talent pool, and a working-age population are some of the factors that will make India the second-largest economy in the world by 2075.

- India is now the top emerging market for investment, according to 85 sovereign wealth funds and 57 central banks.

- India has now overtaken China as the most attractive emerging market for investment in emerging market debt.

(Source: News on AIR)

Previous

Previous

Latest

Latest

Comments