Topic: Reports and Indices

1. Per capita women deposits in India grew by ₹4,618 to ₹42,503 in last five years.

- Per capita women deposits increased from ₹37,885 in FY19 to ₹42,503 in FY23, as per SBI’s Economic Research Department (ERD).

- The maximum increase of ₹9,758 has been reported in urban areas.

- In urban areas, per capita women deposits increased from ₹51,980 to ₹61,738, as per ERD’s Ecowrap report. This report is based on RBI data.

- Per capita women deposits are highest in metropolitan areas at ₹83,434 in FY23.

- Per capita women deposits in semi-urban areas stood at ₹29,563 in FY23.

- Per capita women deposits in rural areas stood at ₹18,563 in FY23.

- As per RBI’s latest report ‘Deposits with Scheduled Commercial Banks – March 2023 (BSR 2)’, the overall deposits of Scheduled Commercial Banks grew by 10.2%.

- The share of individuals in total deposits declined during the year ending March 2023.

- The share of women customers in total deposits increased to 20.5% in the year ending March 2023 (from 18% in the year ending March 2019).

- Women borrowers’ share in household credit to individuals increased from 18.3% in FY15 to 22.9% of outstanding credit in FY23.

- Women borrowers’ share in household credit to individuals increased from 8.9% in FY15 to 24.9% of incremental credit in FY23.

- Share of women in personal loans segment has continued to be the same (20.5% in FY23 and 20.6% in FY19).

- Regional Rural Banks (RRBs) are the major contributors in increased women deposits share.

- The per capita increase in women deposits from FY19 to FY23 has been driven by private sector banks.

- Nine states recorded over ₹10,000 increase in per capita women deposits from FY19 to FY23.

Topic: Indian Economy/Financial Market

2. Core industries output in June 2023 reached a 5-month high level at 8.2%.

- This was higher than the 5% growth recorded in core industries output in May 2023.

- However, this was lower than the 13.1% growth recorded in core industries output in June 2022.

- Seven out of eight core industries recorded positive growth.

- These seven core industries are coal, natural gas, refinery products, fertilisers, steel, cement and electricity.

- Only the crude oil sector recorded negative growth. It contracted marginally at 0.6%.

- Core sector output growth was 5.8% for April-June 2023. It was 13.9% in April-June 2022.

- Core industries output grew 7.6% in fiscal 2022-23. This was less than the 10.4% growth in the previous fiscal.

- The final growth rate of core industries for March 2023 has been revised upwards to 4.2%.

- Both Steel and Cement sectors performed well in June 2023.

- Steel and Cement sectors recorded double-digit growth rates of 12.2% and 15.9%, respectively in April-June 2023.

- The IIP growth was 13.1% in June 2022. Provisional y-o-y growth rate for overall index for June 2023 is 8.2%.

Topic: Indian Economy/Financial Market

3. Central government’s fiscal deficit reached 25.3% of the annual target.

- In the first (April-June) quarter of the current financial year 2023-24, the central government’s fiscal deficit has reached 25.3% or Rs 4.5 lakh crore.

- The fiscal deficit in the corresponding period of the last year was 21.2% of the budget estimates.

- The Fiscal deficit for April-June 2023 has increased due to a rise in capital expenditure and accelerated tax devolution to states.

- According to the controller general of accounts (CGA) data, the total non-tax revenue for the first three months of 2023 was Rs 1,54,968 crore or 51.4% of the budget estimates.

- Dividends and profits made up 105% of the non-tax revenue.

- The tax revenue for the April-June 2023 period was Rs 4,33,620 or 18.6% of the budget estimates. Last year, it was 26.1% of the budget estimates.

- The government has released Rs 3.09 lakh crore in tax devolution to states till July.

- Of the total expenditure, Rs 7.72 lakh crore was done on the revenue account and Rs 2.78 lakh crore on the capital account.

- The government is aiming to bring down the fiscal deficit to 5.9% of the gross domestic product (GDP) in 2023-24.

- A fiscal deficit is the difference between the government's expenditure and revenue. It was 6.4% of the GDP in 2022-23.

- Capex (Capital Expenditure) at Rs 2.78 lakh crore reached 28% of Budget Estimate (BE) in April-June.

|

Key Ministries/Departments

|

Capital Expenditure (% of Budget allocation)

|

|

April-June 2022-23

|

April-June 2023-24

|

|

Road Transport & Highways

|

43

|

39

|

|

Railways

|

34

|

33

|

|

Telecommunications

|

1

|

44

|

|

Capital Outlay on Defence Services

|

16

|

11

|

|

Transfer to States

|

2

|

22

|

|

Housing & Urban Affairs

|

11

|

20

|

|

Total Amount Spent

|

23 (Rs 1,75,064 crore)

|

28 (Rs 2,78,480 crore)

|

Topic: Reports and Indices

4. Manufacturing PMI declined slightly from 57.8 in June 2023 to 57.7 in July 2023.

- Services PMI increased to 13-year high level of 62.3 in July 2023.

- As per S&P Global, demand for Indian services improved to greatest extent in more than 13 years in July.

- About 29% of survey participants reported higher intakes of new business.

- While manufacturing has a share of around 18% in GVA, services has a share of over 53% in Gross Value Added (GVA).

Topic: Taxation

5. The norms for restricting IGST refund in respect of pan masala, tobacco and mentha oil have been notified by CBIC.

- The restriction will be applicable from October 01, 2023. It is based on the GST Council’s recommendation of July 11.

- According to the notification of Central Board of Indirect Taxes & Custom (CBIC), the restriction will be applicable on 25 types of products.

- The GST Council’s recommendation is based on the recommendations of the Group of Ministers (GoM) headed by Odisha’s Finance Minister, Niranjan Pujari.

- The GoM recommended that the IGST (Integrated Goods & Services Tax) refund route on exports should be closed for commodities like pan masala, gutkha, chewing tobacco, and similar other goods.

- GST at a uniform rate of 28% on full face value for online money gaming, casinos, and horse racing is likely to be implemented from October 1.

- There would be a review of the levy after six months of its implementation.

- GST collection increased 11% to more than ₹1.65-lakh crore in July 2023.

- Gross GST collection has reached beyond ₹1.60 lakh-crore mark for the fifth time.

|

GST Collection Trends (₹ crore)

|

|

Month

|

FY 2022-23

|

FY 2023-24

|

|

April

|

1,67,540

|

1,87,035

|

|

May

|

1,40,875

|

1,57,090

|

|

June

|

1,44,616

|

1,61,497

|

|

July

|

1,48,995

|

1,65,105

|

Topic: Corporates/Companies

6. Tesla to open its first office in India in Pune.

- Tesla India Motor & Energy Pvt Ltd has taken office space on lease for 5 years at Panchshil Business Park in Pune.

- This will be Tesla’s first real office setup in India.

- Tesla founder Elon Musk had met Prime Minister Narendra Modi last month.

- Tesla’s India arm was registered in Bengaluru in early 2021.

- Tesla, Inc. is an American multinational automotive and clean energy company. It is headquartered in Austin, Texas, US.

Topic: Miscellaneous

7. India has made Schedule M mandatory for MSME pharma firms.

- It has asked pharma companies to obtain a certificate for good manufacturing practices (GMP) during the next 6 to 12 months.

- The number of manufacturers, including MSMEs, in India is 10,500.

- Out of these, only 2,000 companies have a good manufacturing practice certificate. They are mainly exporters.

- The remaining 8,500 units are required to complete the certification process within 6 months or 12 months from August 1.

- Companies, particularly MSMEs, with an annual turnover of less than ₹250 crore will be required to complete the certification process within 12 months.

- Companies with an annual turnover of over ₹250 crore, will be required to complete the certification in 6 months.

- Schedule M of the Drugs and Cosmetics Act has been amended.

- Pharma companies, including MSMEs, will be required to transition to the new regime.

- The Schedule M of prescribes requirements for manufacture, control and safety testing, storage, transport of material, written procedures etc.

- Government first incorporated the good manufacturing practices in Schedule M of the Drugs and Cosmetics Rules, 1945 in the year 1988.

Topic: Indian Economy/Financial Market

8. The debt of central government declined from 61.5% of GDP in FY21 to 57.1% of GDP in FY23.

- The debt of central government stood at ₹155.6 lakh crore as on March 31, 2023.

- The state governments’ debt at FY23 end is estimated to be about 28% of GDP.

- Gross Fixed Capital Formation (GFCF) has grown from ₹45.41 lakh crore (constant FY12 prices) in FY19 to ₹54.35 lakh crore in FY23 (Provisional Estimates).

- Scheme for Special Assistance to States for Capital Expenditure' (FY21 & FY22) is being implemented by the government.

- Government is also implementing 'Scheme for Special Assistance to States for Capital Investment' (FY23 & FY24).

- It released loan in the form of a 50-year interest free loan for capital expenditure on capital projects.

- During FY24, ₹84,883.90 crore have been sanctioned under Scheme for Special Assistance to States for Capital Expenditure/Investment.

- The capital expenditure of central government has increased from 2.15% of GDP in FY21 to 2.7% of GDP in FY23.

- Capital investment outlay has increased by 33% to ₹10 lakh crore (3.3 per cent of GDP).

Topic: Reports and Indices

9. India's per capita income will increase by about 70% to US$4,000 by FY2030.

- India's per capita income is expected to grow by nearly 70% to US$4,000 by FY2030 from US$2,450 in FY2023.

- This income growth will help India to become a middle-income economy with a GDP of US$6 trillion.

- As per the report, the key growth factor will be external trade which could almost double from US$ 1.2 trillion in FY2023 to US$ 2.1 trillion by 2030.

- The second biggest growth factor will be household consumption which is seen jumping to USD 3.4 trillion by fiscal 2030 from USD 2.1 trillion in fiscal 2023.

- Household consumption now accounts for 57% of GDP.

- The report noted that nine states with a per capita income of US$4,000 are rising to upper middle-income country status.

- Currently, Telangana leads the league table with a per capita income of Rs 2,75,443 or US$3,360 in FY 2023, followed by Karnataka (Rs 2,65,623), and Tamil Nadu (Rs 2,41,131).

- But the Standard Chartered Bank report sees Gujarat as the leader by FY2030, followed by Maharashtra, Tamil Nadu, Karnataka, Haryana, Telangana, and Andhra Pradesh.

- Of these, Telangana, Delhi, Karnataka, Haryana, Gujarat, and Andhra Pradesh together account for 20% of the national GDP today and will have a per capita GDP of US$6,000 by fiscal year 2030.

- On the other hand, the large states of UP and Bihar, which account for 25% of the total population, will have per capita incomes of less than US$2,000 even in FY2030, which will be still twice their FY2020 levels.

Topic: Awards and Prizes

10. Tata Group Chairman Ratan Tata will receive the first Udyog Ratna Award of Maharashtra.

- Maharashtra Government will award its Udyog Ratna Award to Ratan Tata.

- The Maharashtra government has decided to begin the Udyog Ratna Award from this year onward.

- The first Udyog Ratna Award of Maharashtra will be presented to Ratan Tata.

- Ratan Tata received the Padma Vibhushan in 2008 and Padma Bhushan in 2000.

- In 2023, he also received the Honorary Officer of the Order of Australia.

Topic: Banking/Financial/Govt Schemes

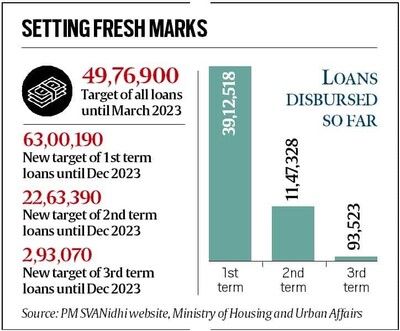

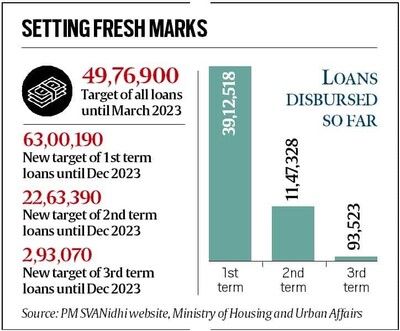

11. Government has set a fresh target of 63 lakh loans for street vendors.

- The Union Housing and Urban Affairs Ministry has set a target of disbursing 63 lakh new loans to street vendors in less than six months till December 2023.

- Since the launch of the scheme, 50 lakh loans to 39 lakh beneficiaries have been disbursed.

- The Pradhan Mantri Street Vendors Atmanirbhar Nidhi (PM SVANidhi) was launched in 2020. Under this scheme, a small capital of Rs 10000 is provided to street vendors.

- It was launched during the Covid Pandemic to provide support to street vendors with small working capital loans of Rs 10,000 each.

- At the time of the launch of the scheme, the target was set to cover 50 lakh people.

- As per the new target, 60,99,000 first-term loans will be granted in big states, 34,990 loans will be granted in small states and UTs and 166200 loans will be disbursed in Himachal Pradesh and Uttarakhand and the Northeast.

- Union Minister Manoj Joshi said that the target for second-term loans is 22.63 lakh beneficiaries, which is up to Rs 20,000 loan per person. It will be given to those who have paid off the first loans.

- 2.93 lakh is the target for the third-term loans. Under this, Rs 50,000 will be given to those who have paid the second-term loans.

- In April 2022, the Cabinet extended the scheme’s lending period until December 2024.

(Source: PM SVANidhi Website)

Previous

Previous

Latest

Latest

Comments