Topic: Infrastructure and Energy

1. Government adds provision to regulate freight charges in draft Merchant Shipping Bill, 2020

- Government has added a provision to regulate freight charges in the draft Merchant Shipping Bill, 2020.

- As per the added provision, the central government will regulate freight charges levied by shipping firms for export, import and domestic transportation.

- Ministry of Ports, Shipping and Waterways has prepared the draft of the bill. If the bill becomes an act, it will replace the Merchant Shipping Act, 1958 and Coasting Vessels Act, 1838.

- As per the bill, service providers or agents will be able to levy only those freight charges that are given in the bill of lading or other transport documents. Terms and conditions for their issuance will be prescribed by central government.

- Earlier, the government has tried to provide more autonomy to 12 state-owned major ports by bringing Major Port Authorities Bill, 2020. It is pending in Rajya Sabha.

Topic: Reports and Indices

2. SDG Investor Map for India launched by UNDP and Invest India

- SDG Investor Map for India has been launched by UNDP and Invest India.

- SDG Investor Map for India has 18 Investment Opportunities Areas (IOAs) spread over six critical areas.

- It has also identified eight White Spaces in which investors have shown interest.

- Six critical sectors included in SDG Investor Map are Education, Healthcare, Food & Beverages, Renewable Resources & Alternative Energy, Financials and Sustainable Environment.

- Out of the 18 areas, ten are mature investable areas and eight are emerging opportunities.

- United Nations Development Programme:

- It is the United Nations’ global development network that was formed in 1965.

- It works in more than 170 countries for the eradication of poverty and reduction of inequalities.

- Its headquarters is in New York City.

- HDI is released by the United Nations Development Programme (UNDP) annually.

Topics: Indian Economy

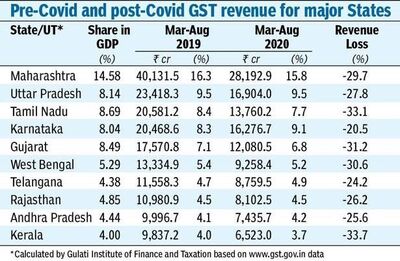

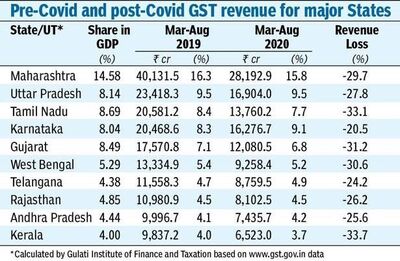

3. 27.6% GST revenue lost by states during March-August 2020

- A study of 30 states has shown that states have lost 27.6% GST revenue during March-August 2020 in comparison with March-August 2019.

- Odisha has seen a 14.1% decline in GST Collection during March-August 2020. Meghalaya has seen a decline of 39.3%.

- Among the southern states, Kerala has seen maximum decline of 33.7% and Karnataka has seen the lowest decline of 20.5%.

- Top five states account for 50% of aggregate state GST revenue. They are Maharashtra, Uttar Pradesh, Tamil Nadu, Karnataka, and Gujarat.

- The study shows that 1% population in these states contributes to 1.17% of tax revenue.

- The share of West Bengal, Telangana, Rajasthan, Andhra Pradesh and Kerala in aggregate state GST revenue is 22.6%.

- Kerala is at the lowest in these states even though its 1% population contributes 1.4% to GST revenue.

- GST collection across States: Whither Kerala study by faculties at Gulati Institute of Finance and Taxation (GIFT) says that Kerala is yet to achieve its potential.

(Source: The Hindu BusinessLine)

Topic: Banking/Financial Schemes

4. Emergency Credit Line Guarantee Scheme (ECLGS) 2.0 to cover 26 stressed sectors and the healthcare sector

- Emergency Credit Line Guarantee Scheme (ECLGS) 2.0 will cover 26 stressed sectors identified by the KV Kamath Committee and the healthcare sector.

- Entities, which have outstanding credit in the range of Rs 50 crore- Rs 500 crore as on February 21 will be eligible under ECLGS 2.0.

- Operational guidelines for ECLGS 2.0 have been released by National Credit Guarantee Trustee Company Limited (NCGTC). The scheme was announced by Finance minister as part of Atmanirbhar Bharat package 3.0.

- Earlier version of ECLGS will be continued. Under both schemes, 20% of credit dues will be available as working capital without any collateral.

- Banks will not charge more than 9.25% interest rate. Moratorium on loans will be one years under both schemes.

- While first version of ECLGS provides three years for repayment, ECLGS 2.0 provides four years for repayment.

- Overall size of credit will remain at Rs 3-lakh crore under the scheme. NCGTC will provide 100% guarantee for loans under the scheme.

- While the facility under ECLGS 1.0 was on opt-out basis, facility under ECLGS 2 shall be on opt-in basis.

- Borrowers account should be less than or equal to 60 days past due in the case of ECLGS 1.0. It should be less than or equal to 30 days past due as of February 29 in the case of ECLGC 2.0.

Topic: Banking System

5. Merger of Lakshmi Vilas Bank with DBS Bank India Limited approved

- Merger of Lakshmi Vilas Bank with DBS Bank India Limited has been approved by Union Cabinet.

- Lakshmi Vilas Bank was placed under a moratorium for one month from November 17, 2020 on RBI’s application under section 45 of the Banking Regulation Act, 1949.

- RBI superseded its Board of Directors and appointed an administrator.

- Cabinet has also approved an equity infusion of Rs 6,000 crore in NIIF Debt Platform, which comprises of Aseem Infrastructure Finance Ltd (AIFL) and NIIF Infrastructure Finance Ltd (NIIF-IFL).

- Out of the total equity, Rs 2,000 crore will be infused during the current fiscal year 2020-21.

- Rs. 2,480.92 crore FDI has been approved by the cabinet in ATC Telecom Infrastructure by ATC Asia Pacific.

Topic: Corporates/Companies

6. NPCI completes private placement of 4.63% of its equity shares

- National Payments Corporation of India (NPCI) has completed private placement of 4.63% of its equity shares.

- This has widened NPCI’s shareholding to 19 RBI regulated entities. The private placement offer was made to 131 RBI regulated entities and 19 were allotted shares in NPCI.

- The names of some new shareholders are IndiaPosts Payment Bank, Paytm Payment Bank, Mobikwik, Amazon Pay, Pine Labs and PhonePe.

- ICICI Securities was the advisor for private placement and Khaitan & Co, Mumbai was the legal advisor.

- Earlier, NPCI’s shareholding base was broadened from 10 to 56 banks in September 2016.

- National Payments Corporation of India (NPCI):

- It was formed in 2008 by the Reserve Bank of India (RBI) and Indian Banks’ Association (IBA).

- It is a “Not for Profit” Company headquartered in Mumbai. It has ten core promoter banks.

Topic: Agriculture

7. APEDA organizes virtual networking meet with German importers

- APEDA has organized virtual networking meet with German importers to promote the export of fresh fruits and vegetables.

- APEDA organized a meeting in partnership with Embassy of India, Berlin and German Agribusiness Alliance.

- During the meeting, presentations were made on the strength of Indian agricultural products in exports and on requirements of the German market.

- Agricultural and Processed Food Products Export Development Authority (APEDA) comes under the Ministry of Commerce and Industry. It was formed in 1986. It is headquartered in New Delhi.

Previous

Previous

Latest

Latest

Comments