1. Government asks companies involved in uploading or streaming of news and current affairs through digital media to comply with 26% FDI limit

- Ministry of Information and Broadcasting has asked companies involved in uploading or streaming of news and current affairs through digital media to comply with 26% FDI limit.

- Companies involved in uploading or streaming of news and current affairs through digital media and having less than 26% FDI will inform names and addresses of directors or shareholders and shareholding pattern to Ministry within one month.

- Companies involved in uploading or streaming of news and current affairs through digital media and having more than 26% FDI will take steps to reduce FDI to 26% by 15th October 2021.

- In August 2019, Cabinet has decided to limit FDI under government route in uploading or streaming of news and current affairs through digital media at 26%.

- Currently, there is no law or regulatory body for over-the-top (OTT) platforms. On 11 November 2020, a notification was issued to bring online films, digital news and current affairs content under I&B Ministry.

- The notification brought Over The Top (OTT) platforms, or video streaming service providers such as Netflix, Amazon Prime and others under I&B Ministry.

- In January 2019, a self-regulatory code was signed by eight video streaming services to prohibit 5 types of content on OTT. The government did not accept the code.

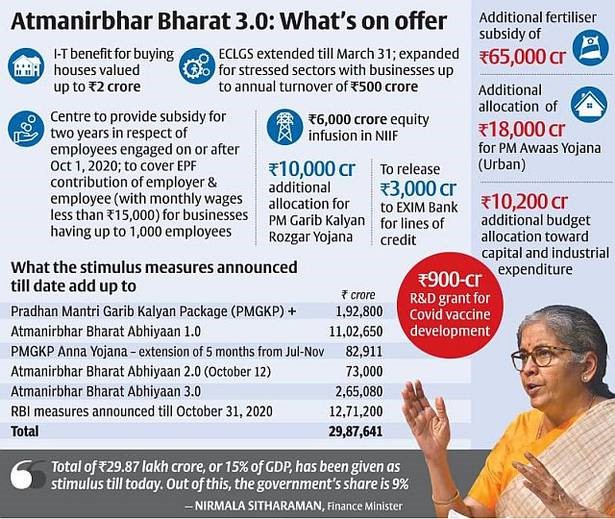

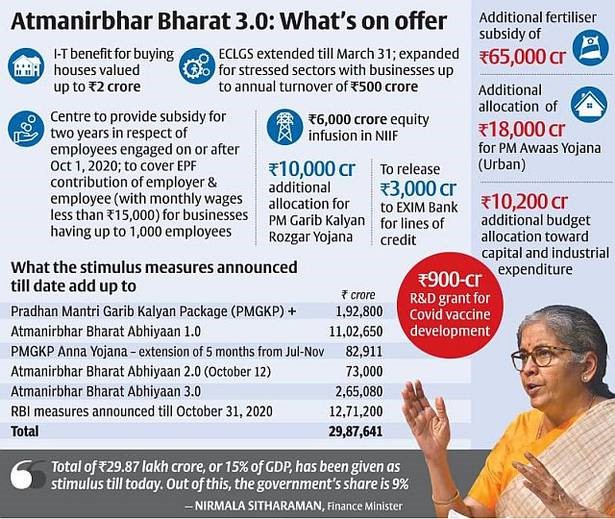

2. Union Finance Minister announces ₹2.65-lakh-crore worth economic stimulus under Atmanirbhar Bharat 3.0 package

- Union Finance Minister has announced total 12 measures amounting to ₹2.65-lakh-crore under Atmanirbhar Bharat 3.0 package on 12 November 2020.

- Government and RBI have till now announced a total stimulus of ₹ 29.87 lakh crore (15% of India’s GDP) to help stressed sectors during the Covid-19 pandemic. Out of the total stimulus, stimulus worth 9% of GDP came from the government.

- Government has so far announced stimulus measures five times and Atmanirbhar Bharat 3.0 is the fifth stimulus package.

- Government has announced an “Aatmanirbhar Bharat Rozgar Yojana”. Under it, the government will give Employees’ contribution and employers’ contribution to EPF registered organizations on recruiting new people.

- It will cover new employees whose monthly wages are less than Rs. 15000 in an EPFO-registered establishment and people who lost their jobs in the pandemic period from 1 March 2020 to 30 September 2020.

- The people losing job during the given period should be employed on or after 1 October 2020. The scheme will continue from 1 October 2020 to 30 June 2021.

- Other measures announced as part of Atmanirbhar Bharat 3.0:

- Extension of Emergency Credit Line Guarantee Scheme for MSMEs, businesses, MUDRA borrowers and individuals till March 31, 2021 and launch of ECLGS 2.0 for healthcare and 26 stressed sectors till 31.3.2021

- ₹1.46 Lakh Crore worth Production Linked Incentive to 10 sectors

- ₹18,000 Crore additional outlay for PM Awaas Yojana – Urban

- Cut in performance security on government contracts to 3% from 5% for the construction sector

- Increase in the difference between circle rate and agreement value in real estate income tax from 10% to 20%

- ₹6,000 Crore equity investment in debt platform of National Investment and Infrastructure Fund (NIIF)

- ₹65,000 Crore to ensure increased supply of subsidized fertilizers to farmers

- ₹10,000 Crore for PM Garib Kalyan Rozgar Yojana

- ₹3,000 Crore to EXIM Bank for promoting project exports under Indian Development and Economic Assistance Scheme (IDEAS Scheme)

- ₹10,200 Crore additional budget for capital and industrial expenditure on domestic defence equipment, industrial infrastructure and green energy

- ₹900 Crore to Department of Biotechnology as R&D grant for COVID Vaccine

- Indian Development and Economic Assistance Scheme (IDEAS Scheme):

- Government provides Line of Credit to countries under IDEAS Scheme since 2005-06.

- The scheme was extended by five years in 2009-10 and by another five years (2015-16 to 2019-20) in November 2015.

- In her budget speech 2019, Finance Minister has announced that government will revamp IDEAS scheme.

(Source: The Hindu BusinessLine)

3. Government’s CPI inflation target valid till 31 March 2021

- Government’s CPI inflation target of 4% is valid till March 31, 2021 and it has taken no call yet on continuing with the same target or fixing a new target.

- May 2016 amendment to Reserve Bank of India Act, 1934 provided for setting of an inflation target by Government in consultation with RBI, once in every five years.

- In August 2016, Government has notified Consumer Price Index (CPI) inflation target of 4% with an upper limit of 6% and a lower limit of 2%.

- The CPI inflation target was fixed for period from August 5, 2016 to March 31, 2021.

- If the consumer inflation crossed the target range for 3 successive quarters, it meant the failure of monetary policy and RBI was required to explain reasons as well as suggest corrective measures.

4. NTPC Limited in the process of procuring 5 million tonnes of biomass pallets made from farm stubble

- NTPC Limited is in the process of procuring 5 million tonnes of biomass pallets made from farm stubble to help governments in controlling air pollution in National Capital Region (NCR) due to stubble burning.

- NTPC tender calls for raw or torrefied (heated and dried, but not combusted) biomass pallets. But, proper technology to terrify paddy straw are not available.

- Commercial-scale firing of agro residue-based pellets was started by NTPC at its Dadri plant last year.

- National Thermal Power Corporation (NTPC):

- NTPC was formed in 1975. It is headquartered in New Delhi.

- NTPC deals in energy generation, sale, gas exploration and coal mining. Gurdeep Singh is its chairman and MD.

- NTPC comes under the Ministry of Power. It is a Public Sector Undertaking (PSU) with Maharatna status.

5. Team of scientists from ICAR-Sugarcane Breeding Institute, Coimbatore, wins National Water Awards-2019

- A team of scientists from ICAR-Sugarcane Breeding Institute, Coimbatore, has won National Water Awards-2019 for developing Soil Moisture Indicator (SMI).

- The team has developed SMI that is a small, user-friendly device to help farmers with efficient irrigation management.

- The team won award for its work on SMI and its application in irrigation water management. K Hari, D Puthira Prathap, P Murali, A Rameshsundar and B Singaravelu are part of the team.

- Inputs from farmers and sugar factory personnel through the Farmers’ Participatory Action Research Project (FPARP) helped the team in developing SMI.

- The National Water Awards consists of a cash prize of ₹2 lakh and a citation. It is awarded by the Department of Water Resources, River Development and Ganga Rejuvenation of Ministry of Jal Shakti.

6. Senapathy Gopalakrishnan appointed as first chairperson of Reserve Bank Innovation Hub (RBIH).

- Senapathy Gopalakrishnan, who is co-founder and former co-Chairman of Infosys and famous as Kris Gopalakrishnan, has been appointed as the first chairperson of Reserve Bank Innovation Hub (RBIH) by RBI.

- The chairperson Senapathy Gopalakrishnan will lead the Governing Council (GC) and Governing Council will guide and manage RBIH.

- GC will have nine other members, including a CEO, which is yet to be appointed. Ashok Jhunjhunwala, H. Krishnamurthy, Gopal Srinivasan and A.P. Hota, Former CEO, National Payments Corporation of India are other members.

- The announcement about setting up an Innovation Hub was made by RBI in its Statement on Developmental and Regulatory Policies on August 6, 2020.

- RBIH will promote innovation across the financial sector by collaborating with financial sector institutions, technology industry and academic institutions.

7. Public Sector Oil Marketing Companies (OMCs) to start procurement of ethanol made from maize soon

- Public Sector Oil Marketing Companies (OMCs) will soon start procurement of ethanol made from maize.

- The process for procuring ethanol from FCI surplus rice has already started for 2020-21.

- In December 2020 to November 2021 cycle, 450-460 crore litres of ethanol will be needed as annual motor spirit (petrol) consumption is likely to be 4,600 crore litres.

- The government is targeting to achieve 10% and 20% ethanol blending in Petrol by 2022 and 2030, respectively.

- Under National Policy on Biofuels 2018 Ethanol Blended Program (EBP), Public Sector OMCs should blend 10% ethanol in Petrol.

- In October 2020, the Cabinet Committee on Economic Affairs (CCEA) has approved the mechanism for procurement of ethanol by oil marketing PSUs and increased procurement price under the ethanol blending programme.

- Ethanol procurement can be done from indigenous supplies made from six feedstocks given below.

|

Six Feedstocks Permitted For Ethanol Procurement

|

- 100 % sugarcane juice/ sugar syrup/ sugar

|

- ‘C-Heavy’ molasses

|

- Surplus rice from FCI

|

- Damaged foodgrains

|

- ‘B-Heavy’ molasses

|

- Maize

|

8. Two entities start testing of offline e-payment facility for remote locations under test phase of RBI’s Regulatory Sandbox (RS)

- Natural Support Consultancy Services Pvt Ltd, Jaipur and Nucleus Software Exports Ltd, New Delhi has started testing of their products under test phase of RBI’s Regulatory Sandbox (RS).

- The entities started testing under Regulatory Sandbox (RS) - First cohort on Retail Payments - Test Phase from November 16. They are testing offline e-payment facility for remote locations in India.

- Natural Support Consultancy Services is testing its product ‘eRupaya’ and Nucleus Software Exports is testing its offline digital cash product, ‘PaySe’.

- eRupaya consists of Near-Field Communication (NFC) based Prepaid card and NFC-enabled Point of Sale (PoS) device.

- They will make offline Person-to-Merchant (P2M) transactions and offline digital payments in remote locations easier.

- RBI has selected six of the total 32 applications received for the Test Phase. Two have already started testing. Rest four will start testing soon.

- Regulatory Sandbox allows the testing of new products, services, and business models by market players on selected customers in a controlled environment on a real-time basis.

9. RBI places Lakshmi Vilas Bank (LVB) under moratorium and limits deposit withdrawal at Rs 25,000 per depositor

- RBI has placed Lakshmi Vilas Bank (LVB) under moratorium and limited deposit withdrawal at Rs 25,000 per depositor.

- RBI has also superseded the board of LVB for 30 days and announced a draft scheme for its amalgamation with DBS Bank India Ltd (DBIL).

- Withdrawal limit of Rs 25,000 per depositor will continue till 16 December. DBIL is Singapore based DBS Bank Ltd.’s wholly-owned subsidiary. DBS Bank Ltd. is a subsidiary of DBS Group Holdings Ltd.

- Lakshmi Vilas Bank (LVB) was facing losses. In September 2020, RBI has approved a Committee of Directors for LVB.

- The bank tried to take steps such as merging with Indiabulls Housing Finance and an investment deal with Clix Group in order to raise capital.

- Earlier, YES Bank was placed under moratorium due to financial trouble. In March 2020, State Bank of India led banks and financial institutions invested Rs 10,000 crore under reconstruction scheme for YES Bank.

Previous

Previous

Latest

Latest

Comments