1. Remdesivir launched as Redyx in India

- Antiviral drug, Remdesivir has been launched under the brand name Redyx by Dr Reddy’s Laboratories Ltd in India.

- Gilead Sciences has developed Remdesivir. It is a potential drug for Covid-19 and sold under brand name Veklury.

- Gilead Sciences has granted Dr Reddy’s Laboratories Ltd right to register, manufacture and sell Remdesivir in 127 countries. India is one of them.

- Drug Controller General of India (DCGI) has already approved Remdesivir for restricted emergency use in India for treatment of Covid-19 patients with severe symptoms.

- Dr Reddy’s Laboratories has also launched over-the-counter Diclofenac Sodium Topical Gel. It is store brand version of Voltaren Arthritis Pain gel in the US markets. Voltaren is a trademark of Novartis Corporation.

- Drugs Controller General of India (DCGI) is a department of Central Drugs Standard Control Organization (CDSCO). It approves licenses of various categories of drugs in India. Its headquarters is located in New Delhi.

- Dr. Reddy’s Laboratories:

- Founder: Kallam Anji Reddy

- Headquarters: Hyderabad

- CEO: Erez Israeli

2. SBI’s loan product for organic cotton growers, SAFAL

- SBI is planning to launch Safe and Fast Agriculture Loan (SAFAL), a loan product for organic cotton growers without any credit history.

- SBI managing director C S Setty has told about SAFAL while he was at a Fintech conference by Federation of Indian Chambers of Commerce and Industry (FICCI).

- He has also spoken about the ways in which bank is using Artificial Intelligence (AI) and Machine Learning (ML) in its business.

- State Bank of India (SBI):

- It was formed in 1955 from the Imperial Bank of India.

- It is headquartered in Mumbai.

- Its tagline is The Banker to Every Indian.

- Rajnish Kumar is its chairman.

- In March 2020, SBI has acquired 48.2% shares of Yes Bank.

3. American Express has launched Shop Small campaign in India

- American Express has launched Shop Small campaign to help small merchants in Delhi, Mumbai and Bengaluru.

- American Express is providing Rs 300 cashback for enrolled card members in India to encourage customers to buy from small shops.

- To get cashback, enrolled card members in India should spend Rs 1,500 or more at any eligible small merchant up to five times from beginning till November 30.

- Card members can also locate small merchants open for in-store purchases in nearby areas through Shop Small Map.

- An online hub ‘All for Small’ has also been created by American Express to support small merchants with reopening.

- American Express is an American Financial Services Corporation headquartered in New York.

4. Nestle Professional to launch products for doorstep delivery

- Nestle Professional will launch products for doorstep delivery by restaurants and cloud kitchens.

- The products will enable restaurants and cloud kitchens in selling their products through food delivery channels.

- In July 2019, Nestle Professional has started offering contactless technology solutions for vending machines.

- Nestle Professional is a division of Nestle, a food and drink processing company headquartered in Switzerland. Nescafé, Kit Kat and Maggi are brands of Nestle.

5. India, US and Israel jointly working on 5G technology

- India, US and Israel has been jointly working on 5G communications network.

- Three countries will jointly do research and development work in next generation of emerging technologies.

- US-India-Israel forum was held last week. It discussed on strategic, tech and development/water cooperation.

- Silicon Valley in US, Bengaluru and Tel Aviv in Israel are recognized as innovative technology hubs. In 2019, Israel was fifth most innovative country in world.

- M R Rangaswami had presented tech-triangle (Silicon Valley-Tel Aviv and Bangalore) concept to Modi when Modi visited Israel in 2017.

6. CCEA approves monetization of assets of POWERGRID’s subsidiaries

- Monetization of assets of subsidiaries of Power Grid Corporation of India Limited (POWERGRID) has been approved by Cabinet Committee on Economic Affairs (CCEA).

- As per the approval granted, the assets will be monetized through Infrastructure Investment Trust (InvIT).

- The money earned from monetization of Tariff Based Competitive Bidding (TBCB) assets is likely to be used for investment in transmission network expansion and other capital schemes of company.

- Infrastructure Investment Trusts (InvITs) are mutual fund like instruments to facilitate investment in infrastructure sector. They are regulated SEBI.

- Power Grid Corporation of India Limited (POWERGRID) is a Maharatna company. It is owned by Government of India. It is headquartered in Gurgaon. Kandikuppa Sreekant is its chairman & MD.

7. Doorstep banking services launched along with the release of EASE 2.0 Index results

- Finance Minister has launched doorstep banking services by PSBs and released EASE 2.0 Index results.

- Under doorstep banking services, selected service providers will use Doorstep Banking Agents at 100 centres across India.

- Currently, only non-financial services such as delivery of cheque books, demand drafts are provided to customers. Financial services will be provided from October 2020.

- Between March-2019 and March-2020, overall EASE index score of PSBs increased by 37%. Average EASE index score improved from 49.2 to 67.4 out of 100.

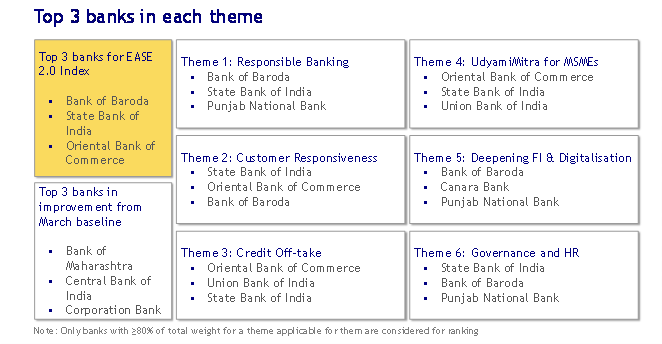

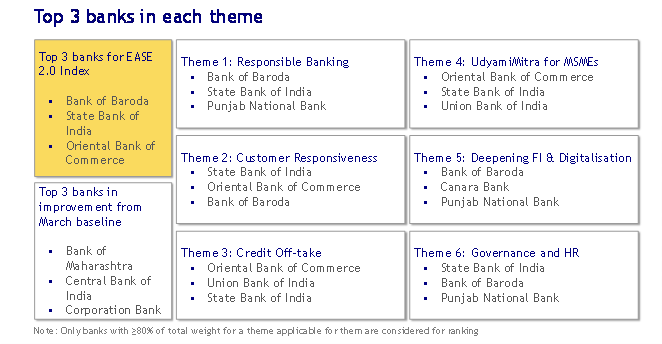

- Bank of Baroda, State Bank of India, and erstwhile Oriental Bank of Commerce have achieved top three ranks in EASE 2.0 index.

- Bank of Maharashtra, Central Bank of India & erstwhile Corporation Bank are top three banks in improvement from March baseline.

- EASE (Enhanced Access and Service Excellence) reforms for PSBs were launched in January 2018. EASE 3.0 reform agenda for tech-enabled banking has been launched in February 2020.

- EASE 2.0 index has more than 120 objective criteria spread across six themes. Top 3 performer banks across each theme are given below.

(Source: PIB)

- Since the introduction of EASE reforms, gross NPAs of PSBs have reduced from Rs.8.96 lakh crore in March 2018 to Rs 6.78 lakh crore in March 2020 and net NPA ratio reduced from 7.97% in March 2018 to 3.75% in March 2020.

- The number of PSBs under Prompt Corrective Action (PCA) framework has come down to three during implementation of EASE reforms.

- CRAR has reached 197 bps above the regulatory minimum and provision coverage ratio has reached at highest level of 80.9% in eight years.

8. Dailyhunt launches Josh app

- Indian local language content discovery platform, Dailyhunt has launched Josh a short video app.

- The Josh app has been launched after the government banned Chinese app, TikTok.

- The app is driven by Artificial Intelligence (AI) and available in 10 Indian languages.

- In June 2019, Dailyhunt has acquired LocalPlay, a hyperlocal video content and news content platform.

- Virendra Gupta and Umang Bedi are co-founders of Dailyhunt. It is based in Bengaluru. Its parent company is Verse Innovation.

9. 227th Meeting of Central Board of Trustees of EPF

- 227th Meeting of Central Board of Trustees of EPF has been chaired by Labour and Employment Minister Santosh Kumar Gangwar.

- Central Board of Trustees has approved amendment to Employees’ Deposit Linked Insurance Scheme (EDLI) of 1976. Central Board of Trustees administers the scheme.

- The amendment has been approved to enhance maximum assurance benefit from present 6 lakh rupees to 7 lakh rupees.

- The minister introduced virtual hearing facility in quasi-judicial cases under Employees Provident Fund and Miscellaneous Provisions Act, 1952.

- Central Board of Trustees of Employees' Provident Fund (EPF) is a statutory body having tenure of 5 years and comprising of chairman, vice chairman, central provident fund commissioner and representatives of central government, state government, employers and employees.

Previous

Previous

Latest

Latest

Comments