Key Highlights of Union Budget 2022 - 2023

2022-02-04 | Priyanka Chaudhary

On 01 February 2022, Finance Minister Nirmala Sitharaman presented Union Budget 2022-23 in Parliament. This was her second successive paperless budget. In her budget speech, Finance Minister has outlined four priorities given next:

- PM GatiShakti

- Inclusive Development

- Productivity Enhancement & Investment, Sunrise opportunities, Energy Transition, and Climate Action

- Financing of investments

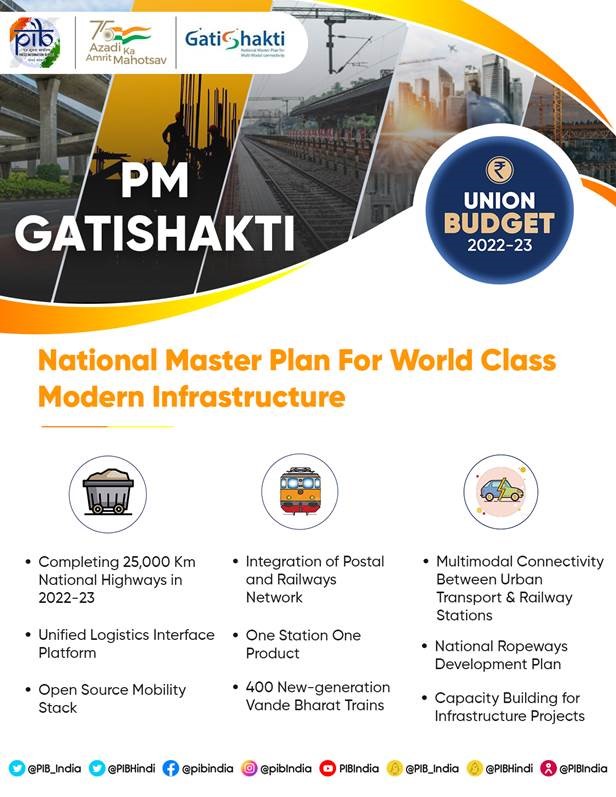

1. PM GatiShakti

PM GatiShakti is driven by seven engines (Roads, Railways, Airports, Ports, Mass Transport, Waterways and Logistics Infrastructure).

- PM GatiShkati National Master Plan: PM GatiShkati National Master Plan will encompass the seven engines. The projects connected with 7 engines in the National Infrastructure Pipeline will be aligned with the PM GatiShakti framework.

- Road Transport: With regard to Road Transport, Union Budget 2022-23 proposes that National Highways Network will be expanded by 25000 Km in 2022-23 and Rs 20000 Crore will be mobilized for National Highways Network expansion.

- Multimodal Logistics Parks: Union Budget 2022-23 announces that contract will be awarded through PPP mode in 2022-23 for implementation of Multimodal Logistics Parks at four locations.

- Railways:

- One Station-One Product: Government will popularize the One Station-One Product concept to help local businesses and supply chains.

- Railway network under Kavach: 2000 Km long railway network will be brought under Kavach in 2022-23. Kavach is the indigenous world-class technology for safety and capacity augmentation.

- Vande Bharat Trains and PM GatiShakti Cargo terminals: In the next 3 years, 400 new generation Vande Bharat Trains will be manufactured and 100 PM GatiShakti Cargo terminals for multimodal logistics will be developed.

- Parvatmala: National Ropeways Development Program, Parvatmala will be taken up on PPP mode. Contracts will be awarded in 2022-23 for 8 ropeway projects of 60 Km length.

(Source: PIB)

Read the Highlights of Union Budget 2021-22

2. Inclusive Development

- Agriculture:

- Chemical-free Natural farming: In Union Budget 2022-23, it has been proposed that chemical-free Natural farming will be promoted throughout the country.

- In the starting, the focus will be on farmer’s lands in 5 Km wide corridors along river Ganga.

- Kisan Drones: Use of ‘Kisan Drones’ will be promoted for crop assessment, digitization of land records, spraying of insecticides, and nutrients.

- Scheme for production of oilseeds: A comprehensive scheme to increase domestic production of oilseeds will be implemented.

- Ken Betwa project and Other River Linking Projects:

- The government will take up the implementation of the Ken-Betwa Link Project.

- The Centre will support the implementation of five river link projects, namely Damanganga-Pinjal, Par-TapiNarmada, Godavari-Krishna, Krishna-Pennar and Pennar-Cauvery.

(Source: PIB)

- MSME:

- Interlinking of portals: The government has announced that Udyam, e-shram, NCS and Aatamanirbhar Skilled Employee Employer Mapping (ASEEM) portals will be interlinked.

- ECLGS:

- 130 lakh MSMEs have been provided additional credit under Emergency Credit Linked Guarantee Scheme (ECLGS).

- ECLGS will be extended up to March 2023.

- Guarantee cover under ECLGS will be increased by Rs 50000 Crore to a total cover of Rs 5 Lakh Crore.

- RAMP programme: Raising and Accelerating MSME performance (RAMP) programme will be launched. It will have an outlay of Rs 6000 Crore.

- CGTMSE scheme: Credit Guarantee Trust for Micro and Small Enterprises (CGTMSE) scheme will be revamped.

(Source: PIB)

- Skill Development: Digital Ecosystem for Skilling and Livelihood (DESH-Stack e-portal) will be launched and startups will be promoted to facilitate Drone Shakti and for Drone-As-A-Service (DrAAS).

- Education:

- ‘One class-One TV channel’ programme: In Budget 2022-23, the government has proposed the expansion of the ‘One class-One TV channel’ programme of PM eVIDYA from 12 to 200 TV channels.

- Virtual labs and skilling e-labs: 750 Virtual labs and 75 skilling e-labs will be set up to promote critical thinking skills and a simulated learning environment.

- Digital University: Digital University for world-class quality universal education will be set up.

(Source: PIB)

- Health:

- An open platform for NDHE: An open platform for the National Digital Health Ecosystem (NDHE) will be launched.

- National Tele Mental Health Programme: National Tele Mental Health Programme will be launched for quality mental health counselling.

- Tele-mental health centres of excellence: In Budget 2022-23, it is proposed that 23 tele-mental health centres of excellence will be set up. National Institute of Mental Health and Neuro Sciences (NIMHANS) will be the nodal centre. International Institute of Information Technology Bangalore (IIITB) will provide technical support.

- Saksham Anganwadis: Two lakh Anganwadis will be upgraded to Saksham Anganwadis.

- Integrated benefits: Integrated benefits will be provided to women and children through Mission Shakti, Mission Vatsalya, Saksham Anganwadi and Poshan 2.0.

(Source: PIB)

- Har Ghar, Nal Se Jal:

- Budget 2022-23 allocates Rs. 60,000 crore to cover 3.8 crore households in 2022-23 under Har Ghar, Nal se Jal.

- The current coverage is 8.7 crores. 5.5 crore households were provided tap water in the last 2 years.

- Housing for All:

- In Budget 2022-23, the government allocated Rs. 48,000 crore for completion of 80 lakh houses in 2022-23 under PM Awas Yojana.

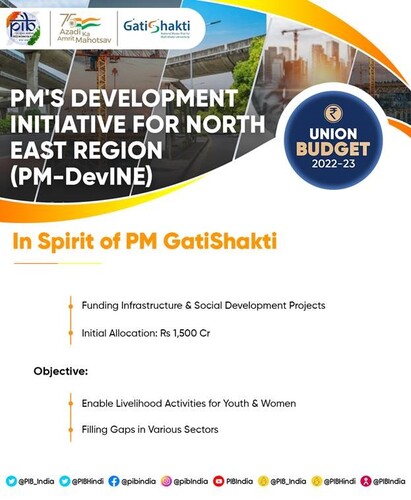

- Prime Minister’s Development Initiative for North-East Region (PM-DevINE):

- Finance Minister Nirmala Sitharaman announced Prime Minister’s Development Initiative for North-East (PM-DevINE) scheme while presenting the Union Budget 2022-23.

- The PM-DevINE scheme will be implemented through the North-Eastern Council.

- The government has allocated Rs 1,500 crores for this new scheme.

- The PM-DevINE scheme will fund infrastructure and social development projects in the North East.

- NECTAR Livelihood Improvement Project (Multi-State), Construction of Aizawl by-pas, Pilot Project for Construction of Bamboo Link Road, etc. will receive the funds under this scheme.

(Source: PIB)

- Aspirational Blocks Programme:

- Finance Minister announced that in 2022-23, Aspirational Districts Programme will focus on blocks that continue to lag in Aspirational Districts.

- Vibrant Villages Programme:

- Vibrant Villages Programme will cover those villages on the northern border that are with a sparse population, limited connectivity and infrastructure and often get left out from the development gains.

- Banking:

- Entire network of 1.5 lakh post offices will be brought under the core banking system.

- Scheduled Commercial Banks will set up 75 Digital Banking Units (DBUs) in 75 districts across the country to mark 75 years of independence.

3. Productivity Enhancement & Investment, Sunrise Opportunities, Energy Transition, and Climate Action

Productivity Enhancement & Investment

- e-Passport: e-Passports using embedded chips and futuristic technology will be rolled out in 2022-23.

- Battery Swapping Policy: Battery swapping policy will be brought out for setting up charging stations at scale in urban areas.

- Land Records Management:

- The government will encourage states to adopt Unique Land Parcel Identification Number to facilitate IT-based management of records.

- ‘One-Nation One-Registration Software’ will be promoted under National Generic Document Registration System (NGDRS).

- The government will also roll out a facility for transliteration of land records across any of the Schedule VIII languages.

- C-PACE: Centre for Processing Accelerated Corporate Exit (C-PACE) will be established to speed up the voluntary winding-up of companies from the currently required 2 years to less than 6 months.

- AVGC Promotion Task Force: An animation, visual effects, gaming, and comic (AVGC) promotion task force will be set up.

- Telecom Sector:

- The government will conduct spectrum auctions in 2022 to facilitate the roll out of 5G within 2022-23 by private telecom providers.

- The government will launch a scheme for design-led manufacturing to build a strong ecosystem for 5G as part of the Production Linked Incentive Scheme.

- 5% of annual collections under the Universal Service Obligation Fund (USOF) will be allocated for affordable broadband and mobile service proliferation.

- The contracts for laying optical fiber in all villages will be awarded under the Bharatnet project through PPP in 2022-23. Completion is expected in 2025.

- Export Promotion: Government will replace Special Economic Zones Act with new legislation. This legislation will enable the states to become partners in ‘Development of Enterprise and Service Hubs’.

- AtmaNirbharta in Defence:

- The government has announced that it will earmark 68% of the capital procurement budget for the domestic defence industry in 2022-23. In 2021-22, 58% was earmarked.

- It will reduce imports and promote AtmaNirbharta in equipment for the Armed Forces.

- Defence R&D will be opened up for industry, startups and academia.

Sunrise Opportunities

Government contribution will be provided for R&D in Sunrise Opportunities like Artificial Intelligence, Geospatial Systems and Drones etc.

Energy Transition, and Climate Action

- Government has allocated additional 19,500 crore rupees for Production Linked Incentive (PLI) for the manufacture of high efficiency solar modules.

- This allocation has been done to achieve the goal of 280 Gigawatt of installed solar capacity by 2030.

- 5 to 7% biomass pellets will be co-fired in thermal power plants. This will result in CO2 savings of 38 MMT annually and help avoid stubble burning in agriculture fields.

- Four pilot projects will be established for coal gasification and conversion of coal into chemicals for the industry.

4. Financing of investments

Public Capital Investment:

- Outlay for capital expenditure increased by 35.4% to Rs. 7.50 lakh crore in 2022-23 from Rs. 5.54 lakh crore in the current year. The outlay in 2022-23 will be 2.9% of GDP.

- ‘Effective Capital Expenditure’ of Central Government has been estimated at Rs. 10.68 lakh crore in 2022-23. This is about 4.1% of GDP.

Digital Rupee: In 2022-23, RBI will issue Digital Rupee using blockchain and other technologies.

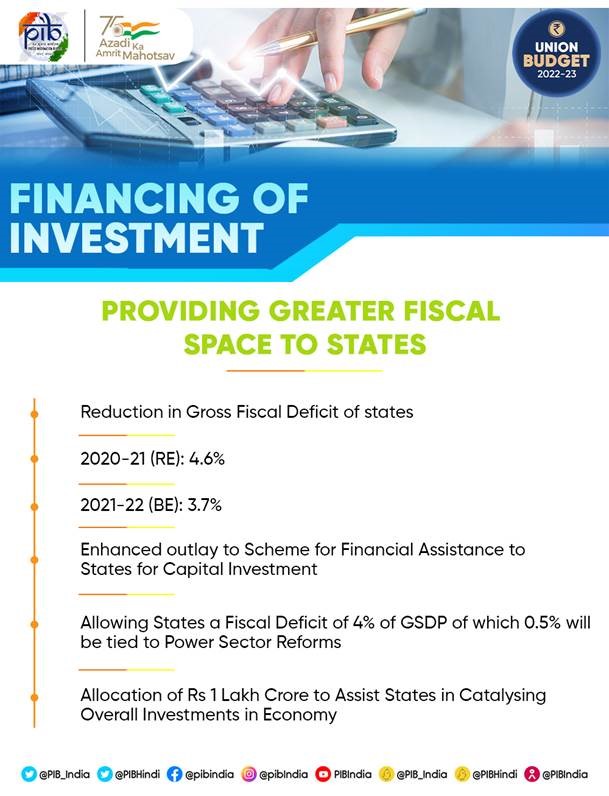

Providing Greater Fiscal Space to States:

- The outlay for ‘Scheme for Financial Assistance to States for Capital Investment’ is being enhanced from Rs 10,000 crore in the Budget Estimates to Rs 15,000 crore in the Revised Estimates for the current year.

- In 2022-23, States will be allowed a fiscal deficit of 4% of Gross State Domestic Product (GSDP). Out of this, 0.5% will be tied to power sector reforms.

- Rs. 1 lakh crore will be allocated in 2022-23 to assist the states in catalysing overall investments in the economy.

(Source: PIB)

Fiscal Management:

- Budget Estimates 2021-22: Rs. 34.83 lakh crore

- Revised Estimates 2021-22: Rs. 37.70 lakh crore

- Total estimated expenditure in 2022-23: Rs 39.45 lakh crore

- Total estimated receipts other than borrowings in 2022-23: Rs 22.84 lakh crore

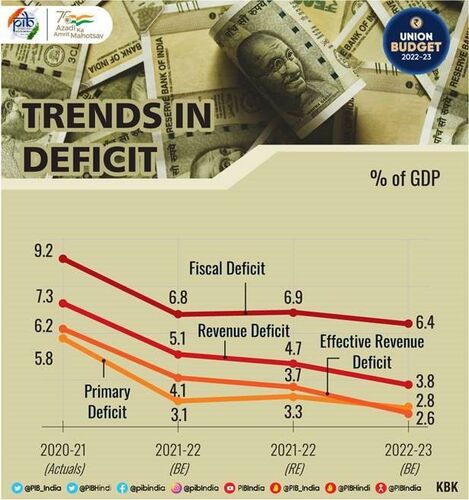

- Fiscal deficit in the current year: 6.9% of GDP (6.8% in Budget Estimates)

- Fiscal deficit in 2022-23 estimated at 6.4% of GDP

(Source: PIB)

Direct Tax Proposals

- Introducing new ‘Updated return’:

- Finance Minister proposed a new provision permitting taxpayers to file an updated return on payment of additional tax.

- The updated return can be filed within two years from the end of the relevant assessment year.

- Cooperative societies:

- The government proposed to reduce the minimum alternative tax (MAT) for cooperative societies from the current 18.5 % to 15 %.

- At present, the cooperative societies pay MAT at the rate of 18.5 %, while the companies pay at the rate of 15 %.

- The government also proposed to reduce the surcharge from 12 % to 7 % on cooperative societies having a total income of more than Rs 1 crore and up to Rs 10 crores.

- Tax relief to persons with disability: Payment of annuity and lump sum amount from insurance scheme will be allowed to differently-abled dependent during the lifetime of parents/guardians.

- Parity in National Pension Scheme Contribution: Government has proposed to increase the tax deduction limit from 10 % to 14% on employer’s contribution to the National Pension System (NPS) account of State Government employees.

- Incentives for Start-ups:

- Eligible start-ups established before 31.3.2022 get tax incentives for three consecutive years out of ten years from incorporation.

- The period of incorporation of the eligible start-up is extended by one more year (up to 31.03.2023) for providing tax incentives.

- Scheme for taxation of virtual digital assets:

- Any income from the transfer of any virtual digital asset is to be taxed at 30 %.

- While computing such income, no deduction in expenditure or allowance will be allowed except the cost of acquisition.

- The gift of virtual digital assets will be taxed in the hands of the recipient.

- TDS will be provided on payment made in relation to the transfer of virtual digital assets.

- Rationalization of Surcharge:

- The government has capped the surcharge on AOPs at 15%. AOPs are consortiums formed to execute a contract.

- The government has also capped surcharge on long-term capital gains on transfer of any type of assets capped at 15%.

- Health and Education Cess: Government has clarified that any surcharge or cess on income and profits is not allowable as business expenditure.

Indirect Tax Proposals

- Special Economic Zones: Budget says that customs administration of SEZs will be fully IT-driven and function on the Customs National Portal. This reform shall be implemented by 30th September 2022.

- Project imports and capital goods: Budget proposes gradual phasing out of concessional rates in capital goods and project imports. It proposes applying a moderate tariff of 7.5 %. The aim of the National Capital Goods Policy, 2016 is to double the production of capital goods by 2025.

Sector-specific proposals

- Gems and Jewellery:

- The budget reduces customs duty on cut and polished diamonds and gemstones to 5 % to give a boost to the Gems and Jewellery sector.

- The budget says customs duty of at least Rs 400 per Kg to be paid on imitation jewellery import.

- Chemicals: Budget reduces customs duty on methanol, acetic acid and heavy feedstocks for petroleum refining. It increases customs duty on sodium cyanide.

- MSME:

- The budget increases customs duty on umbrellas to 20% and withdraws exemption to parts of umbrellas.

- The budget extends customs duty exemption given to steel scrap last year for one more year.

- Exports: The budget reduces duty on certain inputs for shrimp aquaculture to promote its exports.

- Tariff measure to encourage the blending of fuel: From 1 October 2022, unblended fuel will attract an additional differential excise duty of Rs 2/ litre.

Frequently Asked Questions (FAQs) about Union Budget 2022

What are the four priorities outlined by Union Finance Minister Nirmala Sitharaman in her speech for Union Budget 2022-2023?

Union Budget 2022-23 proposes 2000 Km long railway network will be brought under Kavach in 2022-23. What is Kavach?

How many Vande Bharat Trains will be manufactured in the next three years as per Union Budget 2022-2023?

In Union Budget 2022-2023, it has been proposed that RAMP programme will be launched with an outlay of Rs 6000 crore. What does RAMP stands for?

What are the government’s proposals for education sector in Budget 2022-23?

What are the proposals made by government for the health sector in Union Budget 2022-2023?

Share Blog

Comments