Highlights of Union Budget 2023-24

2023-02-01 | Rituraj

Union Finance Minister Nirmala Sitharaman presented the Union Budget 2023-24 in Parliament on 1 February 2023. It is the first budget of ‘Amrit Kaal’.

Since 2016, the budget is being presented on first day of February. Union Budget is referred to as the Annual Financial Statement in Article 112 of the Indian Constitution.

Despite the global slowdown due to COVID-19 pandemic and Russia-Ukraine war, India's economic growth is estimated at 7%, which is the highest among all major economies.

Since 2014, the per capita income has more than doubled to Rs 1.97 lakh.

Seven Priorities of Budget 2023-24

The Budget adopted seven priorities which will act as ‘Saptarishi’ through the Amrit Kaal. The seven priorities are given below:

1) Inclusive Development

2) Reaching the Last Mile

3) Infrastructure and Investment

4) Unleashing the Potential

5) Green Growth

6) Youth Power

7) Financial Sector

(Source: PIB)

Priority 1: Inclusive Development

The government is focused on the Inclusive Development of farmers, women, youth, OBCs, Scheduled Castes, Scheduled Tribes, divyangjan and economically weaker sections and underprivileged.

A. Agriculture and Cooperation

An Agriculture Accelerator Fund will be set up to encourage agri-startups by young entrepreneurs in rural areas. It will bring innovative solutions for the problems of farmers and also bring modern technology to transform agriculture practices.

The Government will adopt a cluster-based and value-chain approach through Public Private Partnerships (PPP). It will increase the productivity of extra-long staple cotton and enhance collaboration between farmers and industry.

The Government will launch an Atmanirbhar Clean Plant Programme with an outlay of Rs 2200 crore to increase the disease-free and quality planting material for horticultural crops.

The government will support the Indian Institute of Millet Research, Hyderabad as the Centre of Excellence for making India a global hub for 'Shree Anna’.

The agriculture credit target will be increased to Rs 20 lakh crore with a focus on animal husbandry, dairy and fisheries.

The government will also launch a new sub-scheme of PM Matsya Sampada Yojana to further enable activities of fishermen, fish vendors, and micro & small enterprises.

In the next five years, the government will facilitate the setting up of a large number of multipurpose cooperative societies, primary fishery societies and dairy cooperative societies.

B. Health, Education and Skilling

The government will build 157 new nursing colleges in co-location with the existing 157 medical colleges established since 2014.

A Mission to eliminate Sickle Cell Anaemia by 2047 will be launched.

Joint Public and Private Medical Research will be encouraged via selected ICMR labs.

The government will also launch a new programme to promote research and innovation in pharmaceuticals.

District Institutes of Education and Training will be developed as vibrant institutes of excellence for this purpose.

National Digital Library for children and adolescents will be set up to facilitate the availability of quality books. The state government will be encouraged to set up libraries at Panchayat and ward levels.

More teachers will be recruited for 740 Eklavya Model Residential Schools.

(Source: PIB)

Priority 2: Reaching the Last Mile

The government is focused on the objective of ‘reaching the last mile’.

A. Aspirational Districts and Blocks Programme

Aspirational Blocks Programme has been recently launched in 500 blocks to provide essential government services across multiple domains such as health, nutrition, education, agriculture, water resources, etc.

B. Pradhan Mantri PVTG Development Mission

The government will launch Pradhan Mantri PVTG Development Mission to improve the socio-economic conditions of the particularly vulnerable tribal groups (PVTGs).

Under this mission, basic facilities such as safe housing, clean drinking water and sanitation, improved access to education, etc. will be provided to PVTGs.

C. Water for Drought Prone Region

Central assistance of Rs 5,300 crore will be given to the Upper Bhadra Project of Karnataka for sustainable micro irrigation and filling up of surface tanks for drinking water.

D. PM Awas Yojana

Government has allocated Rs 79,000 crore to PM Awas Yojana.

Priority 3: Infrastructure & Investment

Investments in Infrastructure have multiplier impact on growth and employment. Capital investment outlay has increased for the third year in a row by 33% to Rs 10 lakh crore.

A. Support to State Governments for Capital Investment

The government has decided to continue the 50-year interest free loan to state governments for one more year to increase investment in infrastructure.

B. Railways

Government has allocated a capital outlay of Rs 2.40 lakh crore for Railways. It is the highest-ever outlay.

100 critical transport infrastructure projects have been identified for last and first-mile connectivity.

An Urban Infrastructure Development Fund (UIDF) will be established. It will be managed by the National Housing Bank, and will be used by public agencies to create urban infrastructure in Tier 2 and Tier 3 cities.

(Source: PIB)

Priority 4: Unleashing the Potential

Government has reduced more than 39,000 compliances and decriminalized 3400 legal provisions to enhance ease of doing business.

Government has brought the Jan Vishwas Bill to amend 42 Central Acts.

A. Centres of Excellence for Artificial Intelligence

Three centers of excellence for Artificial Intelligence will be set up in top educational institutions.

Industry players will partner for conducting interdisciplinary research, developing cutting-edge applications and scalable problem solutions for an effective AI ecosystem.

B. National Data Governance Policy

A National Data Governance Policy will be introduced to help academia and start-ups with anonymised data.

An Entity DigiLocker will be set up for use by MSMEs, large businesses and charitable trusts for storing and sharing documents online securely.

100 labs for developing applications using 5G services will be set up in engineering institutions.

To harness the potential of Lab Grown Diamond (LGD) or synthetic diamond segment, research & development will be promoted.

Priority 5: Green Growth

Government has allocated Rs. 35,000 crore for priority capital investments towards energy transition and net zero objectives, and energy security.

PM PRANAM (Promotion of Alternate Nutrients for Agriculture Management) scheme will incentivise states to reduce the use of chemical fertilisers.

Government will promote mangrove plantations along the coastline under the new MISHTI scheme- Mangrove Initiative for Shoreline Habitats & Tangible Incomes.

Battery Energy Storage Systems with a capacity of 4,000 MWH will be supported with Viability Gap Funding.

Government will set up 500 new ‘waste to wealth’ plants under GOBARdhan scheme (Galvinising Organic Bio Agro Resource Dhan) for promoting the circular economy.

Amrit Dharohar scheme to be implemented over the next 3 years to encourage optimal use of wetlands.

Promotion of coastal shipping through PPP mode with viability gap funding.

Finance Minister said that the government will support one crore farmers to adopt natural farming over the next three years.

Government will set 10,000 Bio-Input Resource Centres and create a national-level distributed micro-fertilizer and pesticide manufacturing network for supporting the adoption of natural farming.

Priority 6: Youth Power

Government will launch Pradhan Mantri Kaushal Vikas Yojana 4.0 to provide skill training to youth in the next three years. PMKVY 4.0 will also cover new age courses like coding, AI, robotics, mechatronics, IoT, 3D printing, drones, and soft skills.

Government will set up 30 Skill India International Centres across different States.

Unified Skill India Digital Platform will be launched.

A. National Apprenticeship Promotion Scheme

A Direct Benefit Transfer under a pan-India National Apprenticeship Promotion Scheme will be implemented. 47 lakhs youth will receive stipend under this in the next 3 years.

B. Unity Mall

For the promotion and sale of ODOPs (one district, one product), GI products and other handicraft products, states will be encouraged to set up a Unity Mall at their capital or most prominent tourism centre or financial capital.

Priority 7: Financial Sector

Last year, the revamping of the credit guarantee scheme was proposed for MSMEs. The revamped scheme will be implemented with effect from 1st April 2023 with an investment of Rs 9,000 crore.

Finance Minister announced that a National Financial Information Registry will be set up. It will act as the central repository of financial and ancillary information.

Delegation of powers under SEZ act to IFSCA to avoid dual regulation. Data embassies will be set up in GIFT IFSC.

SEBI will be empowered to develop, regulate, maintain and enforce norms and standards for education in the National Institute of Securities Markets and to recognize award of degrees, diplomas and certificates.

A Central Processing Centre will be established for faster handling of administrative work under the Companies Act.

A one-time new small savings scheme, Mahila Samman Savings Certificate, will provide a deposit facility of up to Rs 2 lakh for women for two years with fixed interest of 7.5%. There is also partial withdrawal option.

Government has enhanced the maximum deposit limit for Senior Citizen Savings Scheme from Rs 15 lakh to Rs 30 lakh.

The maximum deposit limit for Monthly Income Account Scheme has been increased-

- from Rs 4.5 lakh to Rs 9 lakh for a single account and

- from Rs 9 lakh to Rs 15 lakh for a joint account

Fiscal Deficit for States- 3.5% of GSDP- 0.5% tied to power sector reforms.

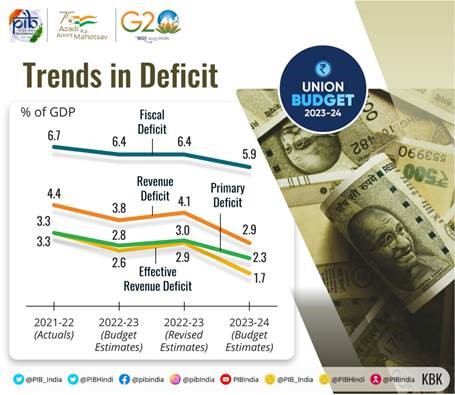

Revised Estimates 2022-23

The total receipts other than borrowings is Rs 24.3 lakh crore, of which the net tax receipts are Rs 20.9 lakh crore.

The total expenditure is Rs 41.9 lakh crore, of which the capital expenditure is about Rs 7.3 lakh crore.

Fiscal deficit for FY23 is 6.4% of GDP.

Budget Estimates 2023-24

The total expenditure in Budget 2023-24 is estimated at Rs 45,03,097 crore. It is more than from Rs 41,87,232 crore of the revised estimates for 2022-23.

The total receipts other than borrowings is estimated at Rs 27.2 lakh crore. The net tax receipts are estimated at Rs 23.3 lakh crore.

The fiscal deficit is estimated to be 5.9% of GDP in BE 2023-24.

Government is planning to follow the path of fiscal consolidation and will try to reach a fiscal deficit of less than 4.5 % by 2025-26.

The net market borrowings from dated securities are estimated at Rs11.8 lakh crore while the gross market borrowings are estimated at Rs 15.4 lakh crore.

(Source: PIB)

Fiscal Policy statements

- The real GDP is projected to grow by 7% year-on-year (Y-o-Y) as against 8.7% in 2021-22.

- India’s agriculture exports reached to $50.2 Bn in FY 2022-23.

- The industry sector and service sector will grow by 4.1% and 9.1%, respectively.

- The export share in GDP has increased to 22.7% in FY 2022-23.

- In FY 2022-23, private consumption and Exports will grow by 7.7% and 12.5%, respectively.

Fiscal Management

- The central government will fifty-year interest-free loans to states for capital expenditure in 2023-24.

- A part of the amount will be given to the state on the condition of increasing their capital expenditure.

- A part of the amount will be linked for the different purpose like Scrapping old government vehicles, urban planning reforms and actions, financing reforms in urban local bodies, etc.

- A fiscal deficit of 3.5% of GSDP has been allowed for states.

Personal Income Tax

- The rebate limit in the new tax regime has been increased from ₹5 lakh to ₹7 lakh.

- The tax slab in the new tax regime has been decreased to five and the tax exemption limit has been increased to ₹3 lakh.

- Under the new tax regime, the benefit of standard deduction has been extended to the salaried class and the pensioners including family pensioner.

- The new income tax regime will now become the default option, but people will still have the option to choose the old tax regime.

- The limit of tax exemption on leave encashment on the retirement of non-government salaried employees has been increased from ₹3 lakh to ₹25 lakh.

- The highest surcharge levied under personal income tax has been reduced significantly from 37% to 25% in the new tax regime (not applicable under the old regime).

|

Total income (Rs.) |

Rate (%) |

|

Upto 0-3 lakh |

Nil |

|

From 3-6 lakh |

5 |

|

From 6-9 lakh |

10 |

|

From 9-12 lakh |

15 |

|

From 12-15 lakh |

20 |

|

Above 15 lakh |

30 |

Indirect Tax Proposals

- The government has reduced the number of basic customs duty rates on goods, other than textiles and agriculture, from 21 to 13.

- The government has extended the Customs duty exemption on the import of capital goods and machinery required for the manufacturing of lithium-ion cells for batteries used in electric vehicles.

- Customs duty on the import of certain parts and inputs like camera lens for mobile phones has been reduced.

- Basic customs duty on certain goods:

- Parts of open cells of TV panels- 2.5%

- Electric kitchen chimney- 15% (earlier 7.5%)

- Heat coil for electric kitchen chimney- reduced to 15% from 20%

- Denatured ethyl alcohol- Exempted

- Acid grade fluorspar- 2.5%

- Crude glycerin- 2.5%

- The basic customs duty rate on compounded rubber has been increased from 10% to 25%.

- The budget proposed to increase National Calamity Contingent Duty for certain cigarettes by 16%.

- The import duty on silver dore, bars and articles has been increased.

- The custom duties on articles made from gold and platinum have been increased.

- Custom duty has been reduced on key inputs for the domestic manufacture of shrimp feed.

Other proposals in Budget 2023-24

- The deduction from capital gains on investment in the residential house has been capped at ₹10 crore.

- Conversion of gold into electronic gold receipts and vice versa will not be treated as capital gain.

- The budget has increased the limits for micro-enterprises and certain professionals for availing the benefit of presumptive taxation.

- New cooperative that start manufacturing activities till 31st March 2024 will get the benefit of a lower tax rate of 15%.

- The Budget has extended the date of incorporation for income tax benefits to start-ups from 31.03.2023 to 31.03.2024.

- The payment received from the Agniveer Corpus Fund by the Agniveers enrolled in Agnipath Scheme, 2022 is proposed to be exempt from taxes.

- The budget proposed to amend CGST Act to raise the minimum threshold of tax amount for launching prosecution under GST from ₹1 crore to ₹2 crore.

- The entire expenditure of about Rs 2 lakh crore will be borne by the Central Government to provide free food grain to all Antyodaya and priority households for the next one year under PM Garib Kalyan Anna Yojana (PMGKAY).

Major Achievements

- Indian economy is the fifth largest economy in the world.

- More than 7,400 crore digital payments of Rs 126 lakh crore have been done through UPI in 2022.

- 9.6 crores LPG connection have been provided under Ujjawala Yojana.

- 47.8 crore PM Jan Dhan Bank Accounts have been opened.

- Insurance cover for 44.6 crore persons has been provided under the PM Suraksha Bima and PM Jeevan Jyoti Yojana.

- Cash transfer of Rs 2.2 lakh crore to over 11.4 crore farmers has been provided under PM Kisan Samman Nidhi (PM KISAN).

Watch Union Budget 2023 Highlights - Budget 2023 Summary

Frequently Asked Questions (FAQs) about Union Budget 2023-24

What are the seven priorities that have been adopted in Budget 2023-24?

Which crop has been named as "Shree Anna" in union budget 2023-24?

What is the target of government regarding elimination of sickle cell anaemia?

What is the personal income tax rebate limit under the new tax regime?

How much amount has been allocated to PM Awas Yojana in Budget 2023-24?

Share Blog

Comments