Daily Current Affairs and GK | 24 July 2024

Main Headlines:

- 1. European Space Agency will launch a mission to study Apophis asteroid.

- 2. IRCTC has been upgraded from 'Schedule B' to 'Schedule A' category Central Public Sector Enterprises by the Government of India.

- 3. Climate Minister Kristen Michal received approval from Estonia's parliament as the country's next prime minister.

- 4. KV Subramanian has been appointed MD & CEO of Federal Bank.

- 5. Mizoram's Aizawl will become the fourth state capital in the Northeast to be connected by rail link by next year.

- 6. Five schemes with an outlay of Rs 2 lakh crore are proposed in the budget to generate employment for the youth.

- 7. The Ministry of Defence has been given Rs 6,21,940.85 crore in Union Budget for the Financial Year (FY) 2024–2025.

- 8. Presenting the Union Budget 2024–25, Finance Minister Nirmala Sitharaman proposed to abolish angel tax for all investor classes.

- 9. Government announced a venture capital fund of Rs 1,000 crore for expanding the space economy.

- 10. Bhartiya Bhasha Anubhag will be established by the government for translations to and from Hindi.

- 11. Fiscal deficit target reduced to 4.9% in Budget 2024.

- 12. In the Budget 2024, Rs 2 lakh crore allocated to provide employment to 4.1 crore youth in the next 5 years.

- 13. Government gave relief to the salaried class on tax slabs and standard deductions.

- 14. Government announced rehabilitation and irrigation projects and monetary assistance for flood-affected states.

Happy February get 35% Off

Use Coupon code FEB26

Topic: Space and IT

1. European Space Agency will launch a mission to study Apophis asteroid.

- The European Space Agency (ESA) will launch a mission to study the Apophis asteroid when it passes very close to Earth in 2029.

- ESA is the second major space agency to launch a space mission to study Apophis asteroid.

- Apophis will pass within 32,000 km of the Earth in 2029. It will opportunity to space agencies to study an asteroid from such a close distance.

- An asteroid of such a large size comes this close to the Earth only once in about 5,000 to 10,000 years.

- The Ramses spacecraft would approach the asteroid before it comes to the closest distance to Earth.

- Indian Space Research Organisation (ISRO) has also expressed its intention of sending a mission to study Apophis.

- The main aim of the study of the asteroids is to develop capabilities to protect the Earth from possible collisions.

Topic: Corporates/Companies

2. IRCTC has been upgraded from 'Schedule B' to 'Schedule A' category Central Public Sector Enterprises by the Government of India.

- The Ministry of Railways announced the upgrade of IRCTC from 'Schedule B' to 'Schedule A' Category CPSE.

- IRCTC has shown a CAGR of 50.63 per cent between Fiscal 2022 and Fiscal 2024 in total income.

- It declared dividend of Rs 280 crores, Rs 440 and Rs 520 crores for 2021-22, 2022-23 and 2023-24, respectively.

- Indian Railway Catering and Tourism Corporation (IRCTC) is in its 25th year of incorporation. It is a Mini-Ratna PSU under the Ministry of Railways.

- Indian Railway Catering and Tourism Corporation was established in 1999.

- It is headquartered in New Delhi. Sanjay Kumar Jain is its chairman and MD.

- It provides ticketing, catering, and tourism services for Indian Railways.

Topic: International News

3. Climate Minister Kristen Michal received approval from Estonia's parliament as the country's next prime minister.

- Kristen Michal replaces Kaja Kallas. Kallas recently resigned to become the foreign policy chief of European Union.

- Michal like Kallas is from the liberal Reform party.

- Michal will lead the same centre-right majority coalition as his predecessor, along with the liberal Estonia 200 party and the Social Democrats.

- Estonia is a country in Northern Europe. It borders the Baltic Sea and Gulf of Finland. Tallinn is its capital.

Topic: National Appointments

4. KV Subramanian has been appointed MD & CEO of Federal Bank.

- Krishnan Venkat Subramanian will be MD & CEO of Federal Bank with effect from September 23.

- Shyam Srinivasan is the current and longest-serving MD and CEO of the bank.

- The term of the current managing director & CEO expires on September 22, 2024.

- According to RBI norms, a non-promoter CEO can serve in a bank for a maximum of 15 years.

- Subramanian was the joint managing director of Kotak Mahindra Bank till April 30, 2024.

Topic: State News/ Mizoram

5. Mizoram's Aizawl will become the fourth state capital in the Northeast to be connected by rail link by next year.

- Mizoram state capital Aizawl will be the fourth capital city in the northeastern region to be connected by rail by July 2025, as the Northeast Frontier Railway (NFR) is laying a new broad gauge (BG) track up to Sairang near Aizawl.

- Guwahati, the main city of Assam (adjacent to the capital Dispur), Agartala, the capital of Tripura and Naharlagun of Arunachal Pradesh (adjacent to the capital city Itanagar) are already connected by the railway network.

- The new broad-gauge line is being laid in the Bhairabi (near Hailakandi district of Assam) Sairang in Aizawl district of Mizoram (52 km) section.

- The Rs 8,213.72-crore Bhairabi-Sairang railway project will become operational in July 2025.

- Under the Capital Connectivity Projects of the Ministry of Railways, construction of new railway lines is underway to connect the capitals of all the states of the North-Eastern Region.

- The 51.38 km line is divided into four sections: Bhairabi-Hortoki, Hortoki-Kawnpui, Kawnpui-Mualkhang, and Mualkhang-Sairang.

Topic: Indian Economy

6. Five schemes with an outlay of Rs 2 lakh crore are proposed in the budget to generate employment for the youth.

- Amid rising unemployment rate, job and salary losses, the first budget of the third Narendra Modi government has proposed a priority approach to employment and skills.

- Five schemes with an outlay of Rs 2 lakh crore have been proposed in the Union Budget to create employment for the youth.

- Government will implement 3 schemes for ‘Employment Linked Incentive’ to be implemented. These are as follows:

- First Scheme: First Timers

- One-month salary of up to Rs 15,000 will be provided in 3 installments to first-time employees.

- Second Scheme: Job Creation in Manufacturing

- Incentive will be provided directly to both employee and employer with respect to their EPFO contribution in the first 4 years of employment.

- Thirds Scheme: Support to Employers

- The government will reimburse up to Rs 3,000 per month for 2 years towards EPFO contribution of employers, for each additional employee.

- Other Two Schemes:

- Fourth Scheme:

- Its aims to skill 20 lakh youth over five years. 1,000 Industrial Training Institutes will be upgraded in a hub-and-spoke arrangement with an outcome orientation.

- Fifth scheme: Internship scheme

- It will provide one crore youth with 12-month internship opportunities in 500 top companies over the next five years, with the government offering a ₹5,000 monthly internship allowance and ₹6,000 one-time assistance. The companies will bear 10% of the training cost and internship cost from their CSR funds.

- Fourth Scheme:

| Monthly Current Affairs eBooks | |

|---|---|

| June Monthly Current Affairs 2024 | May Monthly Current Affairs 2024 |

| April Monthly Current Affairs 2024 | March Monthly Current Affairs 2024 |

Topic: Indian Economy

7. The Ministry of Defence has been given Rs 6,21,940.85 crore in Union Budget for the Financial Year (FY) 2024–2025.

- Among the Ministries, this is the highest. Through the Acing Development of Innovative Technologies with iDEX (ADITI) program, the government has allocated an additional Rs 400 crore for innovation in defence.

- According to current iDEX criteria, grants of up to 50% of product development budget, with an enhanced cap of Rs 25 crore per applicant, would be given.

- The Ministry of Defence has received an allocation for FY 2024–25 that is approximately Rs one lakh crore (18.43%) greater than that of FY 2022–2023 and 4.79% higher than that of FY 2023–2024.

- The entire amount allotted equals around 12.90% of India's budgetary estimate.

- The Defence Forces would receive a budgetary allocation of Rs 1.72 lakh crore under the capital head for FY 2024–2025.

- This is a 20.33% increase over FY 2022–2023 actual expenditures and a 9.40% increase above FY 2023–2024 Revised Allocations.

- 75% of the modernisation budget, or Rs 1,05,518.43 crore, has been set aside by the Ministry of Defence for procurement through domestic industries in this fiscal year.

- The Ex-Servicemen Contributory Health Scheme (ECHS) has been allocated Rs 6,968 crore, a 28% increase over the previous year's amount.

- For the Budget Estimates (BE) 2024–2025, Border Roads Organisations (BRO) have been allocated a capital budget of Rs 6,500 crore.

- This represents a 160% increase over the FY 21–22 budget and a 30% increase over the FY 2023–24 allocation.

- The Defence Research and Development Organisation (DRDO) would receive a financial allocation of Rs 23,855 crore in FY 2024–25, up from Rs 23,263.89 crore in FY 2023–24.

- The Technology Development Fund (TDF) plan has been allocated a sum of Rs 60 crore.

- The budget for defence pensions has been raised to Rs 1.41 lakh crore.

Topic: Indian Economy

8. Presenting the Union Budget 2024–25, Finance Minister Nirmala Sitharaman proposed to abolish angel tax for all investor classes.

- In order to reduce uncertainty and disputes, she also suggested that the I-T regulations be completely streamlined for reopening and reevaluation.

- Reopening an assessment after three years is possible only if the evaded income is at least Rs 50 lakh, and this can happen for a maximum of five years from the assessment year's conclusion.

- It is proposed to shorten the current ten-year time limit in search cases to six years prior to the search year.

- Currently, 1,17,000 registered startups are recognised by the Department for Promotion of Industry and Internal Trade under the Startup India program.

- The angel tax was first implemented in 2012 by Pranab Mukherjee, the finance minister at the time.

- It was imposed at a tax rate of about 31% (30.9%) on money raised by companies from angel investors when that money exceeded the company's fair market value.

- The initial purpose of the angel tax was to prevent money laundering.

- The purpose of this measure was to combat the abuse of exaggerated valuations that are frequently linked to shell companies and fraudulent startups.

Topic: Indian Economy

9. Government announced a venture capital fund of Rs 1,000 crore for expanding the space economy.

- In the budget, a venture capital fund of Rs 1,000 crore has been announced to expand the space economy by five times in the next 10 years.

- This venture fund is a step toward addressing the issue of funding faced by nascent ventures in this capital-intensive domain.

- The government’s vision is to increase India’s share in the global commercial space economy to 10% by 2030.

- At present, India contribute only 2 per cent to the global space market.

- India is aiming to set up ‘Bharatiya Antariksha Station’ by 2035 and is planning to send the first Indian to the Moon by 2040.

- The Anusandhan National Research Fund will support research and development.

- Government has committed of setting up a corpus of Rs 1 lakh crore to provide long-term, interest-free loan to encourage research and development by private sector.

Topic: Indian Economy

10. Bhartiya Bhasha Anubhag will be established by the government for translations to and from Hindi.

- Union Budget has allocated ₹56 crore to establish the ‘Bhartiya Bhasha Anubhag’ (Indian Languages Department) for the development of a platform to facilitate the translation of various languages into Hindi and vice-versa.

- According to the Official Languages Act, 1963, Hindi and English language are used between Ministries and State governments.

- For the first time, proceedings of the Lok Sabha has become available in 10 languages in real time.

- About ₹88 crore has been allocated for the holistic development of islands in Union Territories.

- 700 crore and ₹150 crore have been allocated for the ‘Modernisation of Forensic Capacity’ and ‘National Forensic Infrastructure Enhancement’ respectively.

- The allocation to the Crime and Criminal Tracking Network Systems has been increased from ₹264 crore to ₹520 crore in 2024-25.

- Border Infrastructure Maintenance and Capital Outlay has seen an increase of ₹211 crore.

- ₹1,050 crore has been allocated for the Vibrant Villages Programme (VVP).

Topic: Indian Economy

11. Fiscal deficit target reduced to 4.9% in Budget 2024.

- The fiscal deficit target for the current financial year at 4.9% of GDP announced by Union Finance Minister Nirmala Sitharaman.

- This is lower than the 5.1% target set in the interim budget presented on February 1, and also the 5.9% target set for 2023-24.

- The fiscal deficit, which represents the difference between total revenue and total expenditure, reflects the extent of government borrowing required.

- Sitharaman emphasized the government's commitment to fiscal consolidation, aiming to bring down the deficit to below 4.5% of GDP by fiscal year 2025-26.

- A lower fiscal deficit will improve India's sovereign rating update prospects as it will bring the country closer to its target of reducing the deficit to below 4.5% of GDP by fiscal year 2025/26.

- A record surplus transfer of 2.11 trillion rupees ($25.3 billion) from the Reserve Bank of India, more than double the amount estimated in February, has helped the government reduce the fiscal deficit.

Topic: Indian Economy

12. In the Budget 2024, Rs 2 lakh crore allocated to provide employment to 4.1 crore youth in the next 5 years.

- On July 23, Union Finance Minister Nirmala Sitharaman in her budget speech proposed to generate employment for about 4.1 crore youth over the next five years.

- The Finance Minister has allocated Rs 2 lakh crore to support this initiative.

- She allocated Rs 1.48 crore for imparting skills to citizens to create employment opportunities, with a target to skill 20 lakh youth over a period of five years.

- She announced that a total of 1,000 industrial training institutes would be upgraded.

- Sitharaman also proposed a one-time pay for all first-time employees across all sectors, with the incentive provided through direct benefit transfer (DBT).

- Internship opportunities in 500 companies will be started for one crore youth in five years by the government.

- The trainees will get the experience of real life environment and will get an allowance of Rs 5000 per month.

- The companies will bear the training cost, 10% of which will be borne from CSR funds.

(Source: News on AIR)

Topic: Indian Economy

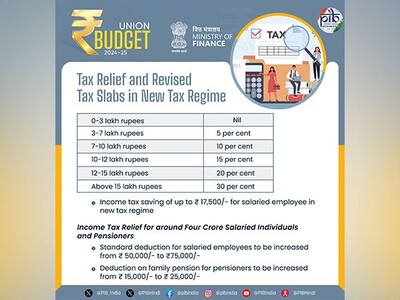

13. Government gave relief to the salaried class on tax slabs and standard deductions.

-

A number of income tax reforms have been introduced by the government in the Union Budget 2024-25.

- Its main aim is to simplify income tax laws and promote compliance, and support economic growth.

- Earlier, a taxable income between Rs 3-6 lakh was taxed with an income tax rate of 5%.

- In this budget, this slab has been changed to Rs 3-7 lakh.

- The tax slab for the 10% tax rate has been changed from Rs 6-9 lakh to Rs 7-10 lakh.

- The tax slab for the 15% rate has also been changed from Rs 9-12 lakh to Rs 10-12 lakh.

- Tax rates for income between Rs 12-15 lakh will remain at 20%, and income above Rs 15 lakh will be taxed at 30%.

- The standard deduction has been increased from 50,000 to Rs 75,000.

- The deduction on family pensions has been raised from Rs 15,000 to Rs 25,000 under the new tax regime.

- The TDS rate for e-commerce operators has been reduced from 1% to 0.1%.

- In this budget, the deduction on employers' National Pension System (NPS) contribution to employees' basic salary has been raised from 10 percent to 14 percent.

- The NPS Vatsalya scheme has been announced in this budget. This scheme will allow parents and guardians to invest on behalf of children.

- This initiative will facilitate long-term savings for minors.

(Source: DD News)

Topic: Indian Economy

14. Government announced rehabilitation and irrigation projects and monetary assistance for flood-affected states.

- In the budget, Union Finance Minister Nirmala Sitharaman announced financial assistance for states severely impacted by floods and other natural calamities.

- This financial assistance will benefit Bihar, Himachal Pradesh, Assam, Uttarakhand, and Sikkim.

- The financial assistance includes an allocation of Rs 11,500 crore for various projects, such as the Kosi-Mechi intra-state link and 20 additional schemes focused on barrages, river pollution control, and irrigation.

- The central government will provide support for flood management and related initiatives in Assam.

- Uttarakhand and Sikkim, which have also been affected by cloudbursts and landslides, will also receive financial assistance.

- The 'Purvodaya' scheme has also been launched to enhance the all-round development of the eastern region, including Bihar, Jharkhand, West Bengal, Andhra Pradesh, and Odisha.

- An Rs 26,000 crore package to support the development of road connectivity projects has been announced for Bihar.

23 July 2024 Current Affairs

23 July 2024 Current Affairs

Comments