Daily Current Affairs and GK | 4 September 2025

Main Headlines:

- 1. Teachers’ Day: 5 September

- 2. The armies of India and Thailand began the 14th edition of Joint Exercise Maitree-XIV in Meghalaya.

- 3. The new drug and clinical trial regulations will be revised by the Health Ministry for easier compliance.

- 4. The Kapas Kisan App for cotton farmers launched by Union Minister Giriraj Singh.

- 5. Oscar Piastri won the 2025 Dutch Grand Prix.

- 6. Rajit Punhani took charge as CEO of FSSAI.

- 7. Prime Minister Narendra Modi attended a high-level CEOs’ roundtable during the Semicon India 2025 event.

- 8. Sharjah will host the 18th World Congress on Inclusion from September 15 to 17, 2025.

- 9. The GST Council has introduced a major revision of tax rates.

- 10. The Union Cabinet, led by Prime Minister Narendra Modi, has approved a ₹1,500 crore scheme to promote Critical Mineral Recycling.

Happy February get 35% Off

Use Coupon code FEB26

Topic: Important Days

1. Teachers’ Day: 5 September

- Every year on 05 September, Teachers’ Day or Shikshak Divas is celebrated in India.

- It is celebrated on the birthday of educationist and former President Dr. Sarvepalli Radhakrishnan.

- Dr Sarvepalli Radhakrishnan was the first Vice President of India (1952–1962).

- He became the second President of India (1962-1967). He was born on 05 September 1888.

- Dr. Sarvepalli Radhakrishnan was awarded Bharat Ratna in 1954 and Templeton Prize in 1975.

- His philosophy was based on Advaita Vedanta and he wrote books such as the philosophy of Rabindranath Tagore, The Hindu View of Life, Recovery of Faith.

- Teacher’s Day is celebrated to honour contributions of teachers.

Topic: Defence

2. The armies of India and Thailand began the 14th edition of Joint Exercise Maitree-XIV in Meghalaya.

- On September 1, the 14th edition of the joint military exercise between the armies of India and Thailand, MAITREE-XIV, commenced at the Joint Training Node in Umroi, Meghalaya.

- The exercise is scheduled to be conducted from September 1 to September 14, 2025.

- The exercise is part of the regular military-to-military exchange program between the two countries with the aim of enhancing interoperability and mutual understanding.

- The last edition of Exercise MAITREE was conducted at Fort Vachiraprakan in Tak Province, Thailand.

- A contingent of 120 Indian Army personnel from a battalion of the Madras Regiment has been deployed for the exercise.

- Participation has also been ensured by 53 soldiers of the Royal Thai Army’s 1st Infantry Battalion, 14th Infantry Brigade.

- This year, the exercise has been designed to focus on company-level counter-terrorist operations in semi-urban terrain under Chapter VII of the UN Charter.

- Training modules are being carried out on tactical drills, joint planning, weapon skills, physical endurance, and raiding operations, concluding with a 48-hour validation phase.

- Instituted in 2006, Exercise MAITREE has been regarded as an important element of bilateral defense cooperation, reaffirming the shared commitment of India and Thailand to regional peace, security, and stability.

| Monthly Current Affairs eBooks | |

|---|---|

| July Monthly Current Affairs 2025 | June Monthly Current Affairs 2025 |

| May Monthly Current Affairs 2025 | April Monthly Current Affairs 2025 |

Topic: Indian Polity

3. The new drug and clinical trial regulations will be revised by the Health Ministry for easier compliance.

- The New Drugs and Clinical Trials Rules, 2019, will be amended by the Union Health Ministry to simplify compliance processes.

- The amendments have been aimed at reducing regulatory requirements in test license applications and bioavailability or bioequivalence study submissions.

- The rule will be amended by the ministry to reduce regulatory compliance and promote ease of doing business in the pharmaceutical and clinical research sectors.

- A notification and intimation system has been introduced in place of the existing test license mechanism.

- Applicants will now be required to only inform the Central Licensing Authority instead of waiting for test licenses.

- Additionally, the overall statutory processing time for test license applications will be reduced from 90 days to 45 days.

- These proposed amendments will reduce the number of license applications by approximately 50%.

- The proposed amendments have already been published in the Gazette of India for public comments.

- These steps are expected to increase India's attractiveness for clinical research, thereby strengthening India's position as a global hub for pharmaceutical research and development.

Topic: Government Schemes and Initiatives

4. The Kapas Kisan App for cotton farmers launched by Union Minister Giriraj Singh.

- On 2 September, the Kapas Kisan mobile application was launched by Union Minister of Textiles Shri Giriraj Singh under the Ministry of Textiles.

- The app has been developed by the Cotton Corporation of India (CCI) to streamline MSP-based cotton procurement.

- Through the application, farmers have been enabled to register themselves digitally for selling cotton under the Minimum Support Price scheme.

- The new mobile app will help farmers to self-register, book slots, and track payment status.

- This app will also provide information about payments to farmers, bringing more speed, transparency, and ease to the cotton procurement process.

- The Union Minister stated that this farmer-first mobile app is a significant step towards making it easier for cotton-producing farmers to sell their produce.

- This app will help cotton farmers to avoid any distress sale by ensuring procurement at MSP.

- This will reduce paperwork and increase transparency along with saving time at procurement centers.

- Farmers will also benefit from digital scheduling of designated procurement centers to reduce waiting time and crowds, real-time updates of quality assessment, approved quantity, payment process, and information in multiple Indian languages.

Topic: Sports

5. Oscar Piastri won the 2025 Dutch Grand Prix.

- Oscar Piastri won the Dutch Grand Prix 2025 held at Circuit Zandvoort in the Netherlands.

- Piastri's McLaren teammate Lando Norris was forced to retire from the race with mechanical difficulties with seven laps remaining.

- With the win, Piastri earned 25 points, while Norris earned zero points, as he could not finish the race.

- Piastri now leads Norris by 34 points in the Drivers' Championship with nine races left in the season.

- Rookie driver Isack Hadjar of Racing Bulls secured his first-ever F1 podium with a third-place finish.

- Red Bull’s Max Verstappen finished second, while Mercedes’ George Russell secured the fourth position.

- The Formula 1 Heineken Dutch Grand Prix 2025, popularly called the 2025 Dutch Grand Prix, took place on 31 August 2025 at Circuit Zandvoort in Zandvoort, Netherlands.

Topic: National Appointments

6. Rajit Punhani took charge as CEO of FSSAI.

- Rajit Punhani assumed charge as the Chief Executive Officer of the Food Safety and Standards Authority of India (FSSAI).

- He is a 1991-batch IAS officer belonging to the Bihar cadre.

- Punhani brings with him over three decades of administrative experience across various levels.

- He earlier served as Secretary in the Ministry of Skill Development and Entrepreneurship.

- He has also worked as Secretary of the Rajya Sabha and Chief Executive Officer of Sansad TV.

- Food Safety and Standards Authority of India (FSSAI):

- The FSSAI is a statutory body under the Ministry of Health and Family Welfare, Government of India.

- Its headquarters is in New Delhi.

- It was constituted on September 5, 2008, under the provisions of the Food Safety and Standards Act, 2006.

- This authority regulates the manufacture, storage, distribution, sale, and import of food items while setting standards to ensure food safety.

Topic: Summits/ Conferences/ Meetings

7. Prime Minister Narendra Modi attended a high-level CEOs’ roundtable during the Semicon India 2025 event.

- The event was held on September 3 at Yashobhoomi in New Delhi.

- The roundtable brought together top executives from leading global semiconductor companies.

- They explored opportunities for industry collaboration and innovation.

- On the second day of Semicon India 2025, PM Modi held discussions with semiconductor experts.

- He also visited an exhibition showcasing the latest technologies and projects in the semiconductor field.

- Union Electronics and IT Minister Ashwini Vaishnaw was also present at the event.

- PM Modi inaugurated the three-day Semicon India 2025 conference on September 2.

- The conference aims to strengthen India’s position as a trusted player in the global semiconductor supply chain.

- It represents a major step toward making India a hub for semiconductor design, manufacturing, and innovation.

Topic: Summits/ Conferences/ Meetings

8. Sharjah will host the 18th World Congress on Inclusion from September 15 to 17, 2025.

- The event will take place at the Expo Centre Sharjah.

- It will be the first time the congress is held in the Middle East and North Africa region.

- Delegates from over 70 countries are expected to participate.

- The congress will focus on global inclusion-related challenges and solutions.

- Key discussion areas include inclusive education, healthcare, legal rights, employment, advocacy, and community involvement.

- The role of research and innovation in building fairer societies will be a central theme.

- The event supports the UAE’s national efforts to expand inclusion for persons with disabilities.

- Across the UAE, more than 80 public and private institutions now offer specialised education, training, and rehabilitation.

- The congress is being held at a time when full inclusion remains a global concern.

- According to the World Health Organisation, persons with disabilities face higher rates of poverty, discrimination, and reduced life expectancy.

- The congress aims to remove systemic barriers and push for inclusive legislation.

- It promotes the principle of “health and dignity for all.”

- The event reinforces the idea that inclusion is vital to sustainable global development.

Topic: Indian Economy

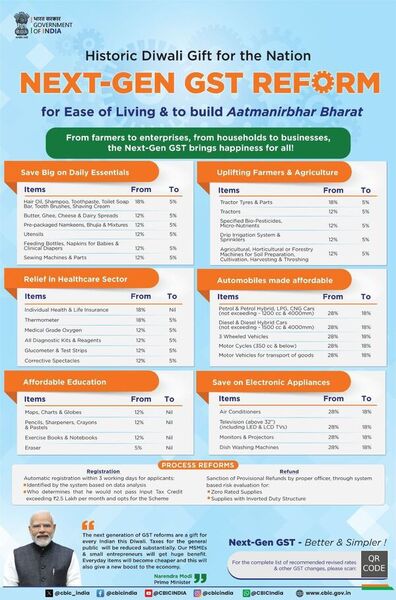

9. The GST Council has introduced a major revision of tax rates.

-

This move is aimed at supporting common citizens, key industries, farmers, and the overall economy.

- Taxes on many middle-class and household items have been reduced.

- The previous rates of 12% or 18% are now brought down to 5%.

- All personal life and health insurance policies are now exempt from GST. This includes senior citizen and family floater plans.

- Thirty-three essential life-saving drugs will now attract zero GST. These were earlier taxed at 12%.

- Three critical medicines for cancer, rare diseases, and chronic conditions are also now tax-free. They were earlier under the 5% slab.

- General medicines will now be taxed at 5% instead of the earlier 12%.

- Medical equipment used in healthcare and diagnostics will now attract only 5% GST. Earlier, these were taxed at 18%.

- Daily-use items like shampoo, soap, toothpaste, toothbrushes, bicycles, and kitchen utensils will now fall under the 5% GST rate.

- GST on ultra-high temperature (UHT) milk, paneer, chena, and Indian breads has been removed. These items now have zero GST.

- Food products such as snacks, noodles, chocolates, sauces, cornflakes, butter, ghee, and preserved meat will now be taxed at 5%. Earlier, they were taxed at 12% or 18%.

- Appliances like air conditioners, large TVs, and dishwashers will now attract 18% GST. This is a reduction from the previous 28%.

- GST on small cars and motorcycles has also been reduced from 28% to 18%.

- All types of agricultural equipment will now be taxed at 5% instead of 12%.

- The GST Council has simplified the tax system. It has reduced the number of tax slabs from four to two.

- The 12% and 28% slabs have been removed. Only the 5% and 18% slabs will remain.

- The expected financial impact of these changes is ₹48,000 crore per year.

- However, the government considers this cost sustainable.

- The 56th meeting of the GST Council took place in New Delhi.

- It was chaired by Finance Minister Nirmala Sitharaman.

- The meeting included Chief Ministers, Deputy Chief Ministers, and Finance Ministers from various states and union territories.

- All new GST rates will take effect on September 22nd. This date marks the beginning of Navratri.

(Source: News on AIR)

Topic: Government Schemes and Initiatives

10. The Union Cabinet, led by Prime Minister Narendra Modi, has approved a ₹1,500 crore scheme to promote Critical Mineral Recycling.

-

The scheme is aimed at enhancing the recycling of critical minerals in India.

- It focuses on recovering key minerals from waste sources such as e-waste and used batteries.

- This initiative is part of the National Critical Mineral Mission (NCMM).

- NCMM aims to strengthen domestic supply chains and reduce dependency on imports.

- The scheme will run for six years, from FY 2025-26 to FY 2030-31.

- Eligible waste includes e-waste, lithium-ion battery scrap, and other high-value materials.

- Scrap like catalytic converters from end-of-life vehicles is also covered.

- Both large companies and new recyclers, including start-ups, can benefit.

- One-third of the scheme’s funds are set aside for small and emerging players.

- Support will be offered for building new units. It will also cover expansion, modernisation, and diversification of existing recycling facilities.

- Only units involved in actual mineral extraction are eligible. Units that only process black mass are not covered.

- Capital incentives include a 20% subsidy on plant, machinery, and utilities.

- This applies if production begins within a specified timeframe.

- Delayed production will receive a reduced subsidy.

- An operating expense (Opex) subsidy will also be provided.

- This will be based on increased sales over the base year, FY 2025-26.

- The Opex subsidy will be released in two parts.

- 40% will be given in the second year, and 60% in the fifth year.

- Subsidies are tied to achieving specific sales growth targets.

- Large entities can receive up to ₹50 crore in total incentives.

- Smaller units can receive up to ₹25 crore.

- The Opex subsidy is capped at ₹10 crore for large firms.

- For small entities, the Opex subsidy cap is ₹5 crore.

- The scheme aims to develop 270 kilotonnes of recycling capacity per year.

- It targets the annual production of 40 kilotonnes of critical minerals.

- It is expected to attract investments worth ₹8,000 crore.

3 September 2025 Current Affairs

3 September 2025 Current Affairs

Comments