Daily Current Affairs and GK | 2 February 2023

Main Headlines:

- 1. India and United States are keen to sign a $3 billion MQ-9B predator drone deal.

- 2. The revamped credit guarantee scheme for MSMEs is to be effective from 01st April 2023.

- 3. “Exercise Trishakti Prahar” was carried out in North Bengal from 21 January 2023 to 31 January 2023.

- 4. World Wetlands Day: 2 February

- 5. Manuela Roka Botey has been appointed as first female Prime Minister of Equatorial Guinea.

- 6. US-India Initiative on Critical and Emerging Technologies launched in Washington.

- 7. Rs 44,094 crore has been allocated for higher education in Union Budget 2023.

- 8. India and US have agreed to form a task force to boost cooperation in the semiconductor industry.

- 9. Rs 5.94 lakh crore has been allocated for Defense in the Budget 2023-24.

- 10. Manmohan Singh conferred with Lifetime Achievement Honour in UK.

- 11. Union Budget for 2023-24 presented by Finance Minister Nirmala Sitharaman in Parliament on 1 February.

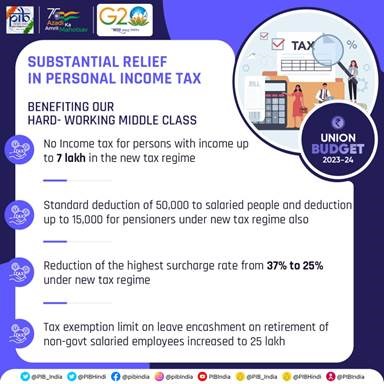

- 12. Rs 2.4 lakh crore capital outlay provided for Indian Railways.

- 13. FM Nirmala Sitharaman made five major announcements regarding personal income tax while presenting Union Budget 2023-24.

- 14. Nominal GDP is projected to grow at 15.4% Y-o-Y in FY2022-23 according to the Fiscal Policy statements.

Happy February get 35% Off

Use Coupon code FEB26

Topic: Defence

1. India and United States are keen to sign a $3 billion MQ-9B predator drone deal.

- India and the United States are eager to sign a deal of 30 MQ-9B predator-armed drones at a cost of over $3 billion.

- It will help India to strengthen its surveillance apparatus near the Line of Actual Control (LAC) and the Indian Ocean.

- The MQ-9B predator-armed drones will be acquired for all three services. Each service of defence will get 10-10 drones.

- The deal for the MQ-9B predator-armed drones was announced in 2017.

- The Biden administration is also eager to sign the deal as soon as possible. It will create more jobs and would be politically beneficial ahead of the next year's presidential elections.

- MQ-9B predator-armed drone:

- It has two variants — SkyGuardian and SeaGuardian.

- It can operate at a height of more than 40,000 feet and has a maximum endurance of 40 hours.

- MQ-9B SeaGuardian can support land, maritime surveillance, anti-submarine warfare, anti-surface warfare.

- SkyGuardian and SeaGuardian can deliver full-motion video in any condition, day or night.

- It can carry a wide variety of specialist payloads for a specific mission.

Topic: Indian Economy

2. The revamped credit guarantee scheme for MSMEs is to be effective from 01st April 2023.

- While presenting the Union Budget 2023-24, FM Nirmala Sitharaman announced that this scheme would be effective from 01st April 2023 through the infusion of ₹ 9000 crore in the corpus.

- She said that this will enable additional collateral-free guaranteed credit of ₹ 2 lakh crore.

- She said that the cost of credit will come down by about 1%.

- She proposed that if MSMEs failed to execute contracts during the Covid period, 95% of the forfeited amount relating to the bid will be returned to them by government and government undertakings.

- She proposed that a voluntary settlement scheme with standardized terms will be introduced to settle contractual disputes of government and government undertakings.

- This proposal will apply to disputes, wherein an arbitral award is under challenge in a court.

- Finance Minister proposed that micro-enterprises with turnover up to ₹2 crore can avail the benefit of presumptive taxation.

- Certain professionals with turnover of up to ₹50 lakh can also avail the benefit of presumptive taxation.

- She also proposed to provide enhanced limits of ₹3 crore and ₹75 lakh to the tax payers whose cash receipts are no more than 5%.

- She proposed to extend the date of incorporation for income tax benefits to start-ups from 31 March 2023 to 31 March 2024.

- She proposed to provide the benefit of carry forward of losses on change of shareholding of start-ups from 7 years of incorporation to 10 years.

- Budget 2023-24 also proposed establishing a subsidiary of EXIM Bank for trade re-financing and recognizing offshore derivative instruments as valid contracts.

(Source: PIB)

Topic: Defense

3. “Exercise Trishakti Prahar” was carried out in North Bengal from 21 January 2023 to 31 January 2023.

- It is a joint training exercise aimed at synergizing firepower assets of the Indian Armed Forces and Central Armed Police Forces (CAPF).

- Its aim was to practice battle preparedness of the security forces using the latest weapons and equipment.

- It involved all arms and services of the Army, the Indian Air Force and CAPFs.

- It culminated on 31 January 2023 with an Integrated Fire Power Exercise in Teesta Field Firing Ranges.

- Lt Gen RP Kalita, Army Commander, Eastern Command reviewed the firepower exercise.

- The exercise enabled rehearsal and coordination among various agencies for the quick movement of forces across North Bengal.

- The exercise was conducted in North Bengal close to the Siliguri corridor.

- Siliguri corridor is also called Chicken’s neck. Located in West Bengal, it is a stretch of land bordering Bangladesh, Bhutan and Nepal.

Topic: Important Days

4. World Wetlands Day: 2 February

- World Wetlands Day is observed annually on 2 February to raise awareness about wetlands.

- It marks the anniversary of the Convention on Wetlands, which was adopted on 2 February 1971 in Ramsar, Iran.

- On 30 August 2021, the UN General Assembly adopted a resolution that established 2 February as World Wetlands Day.

- The theme of World Wetlands Day 2023 is “It's Time for Wetlands Restoration”.

- Wetland is an area of land that is either covered with water or saturated with water. It includes mangroves, deltas, floodplains, rice-fields, coral reefs, etc.

Topic: International Appointments

5. Manuela Roka Botey has been appointed as first female Prime Minister of Equatorial Guinea.

- She is the first woman to hold the position in the country.

- On 31 January, President Teodoro Obiang Nguema Mbasogo made this announcement in a decree on state television.

- Teodoro Obiang is serving as the President of Equatorial Guinea since August 1979.

- Previously, Ms Rotey was the education minister and joined the government in 2020.

- She succeeded former Prime Minister Francisco Pascual Obama Asue, who has held the position since 2016.

(Source: News on AIR)

Topic: International News

6. US-India Initiative on Critical and Emerging Technologies launched in Washington.

- US-India initiative on Critical and Emerging Technology (iCET) was formally launched by NSA Ajit Doval and his US counterpart Jake Sullivan in Washington.

- US-India iCET meeting has been concluded by the United States and India and also decided to launch a new Innovation Bridge.

- In May 2022, iCET was announced by Prime Minister Narendra Modi and President Biden.

- It elevates and expands their strategic technology partnership and defense industrial cooperation between the governments, businesses and academic institutions of the two countries.

- The Innovation Bridge will connect defense startups of both the countries.

- Both countries affirmed that the ways in which technology is designed, developed, governed and used should be shaped by our shared democratic values and respect for universal human rights.

| Monthly Current Affairs eBooks | |

|---|---|

| December Monthly Current Affairs | November Monthly Current Affairs |

| October Monthly Current Affairs | September Monthly Current Affairs |

Topic: Indian Economy

7. Rs 44,094 crore has been allocated for higher education in Union Budget 2023.

- In the Budget 2023, Education Ministry has been allocated the highest ever Rs 112899.47 crore.

- In 2022-23, budgetary allocation for higher education was Rs 40,828.35 crore.

- 100 labs for developing apps using 5G services will be set up in higher education institutions.

- The apps like Smart Classrooms, Precision Farming, Intelligent Transport Systems and Healthcare will be developed in labs.

- Finance Minister proposed that a research and development grant for indigenous production of Lab Grown Diamond seeds and machines will be provided to one of the IITs for 5 years.

- Lab Grown Diamonds (LGD) are environment-friendly diamonds. They have optically and chemically the same properties as natural diamonds.

- The best institutions and universities in the country have been given an additional Rs 4235.74 crore to implement the National Education Policy 2020.

- This is an increase of 12.8% over their allocation last year.

- In 2023-24, the grant for the UGC has been increased by 9.37%. The grants to Central Universities have been increased by 17.66%.

- An amount of Rs 400 crore has been provided for the Prime Minister Research Fellowship (PMRF) in 2023-24. In 2022-23, Rs 200 crore was provided.

- According to the Ministry of Education, three Centres of Excellence will be established in educational institutions to "Make AI in India and Make AI work for India".

- Prime Minister Research Fellowship (PMRF) was announced in the Budget 2018-19. It has been designed for improving the quality of research in various higher educational institutions in the country.

Topic: Committees/ Commissions/Taskforces

8. India and US have agreed to form a task force to boost cooperation in the semiconductor industry.

- They have agreed to form a task force involving India’s Semiconductor Mission, India Electronics Semiconductor Association and the US Semiconductor Industry Association.

- The aim is to develop a readiness assessment in order to identify near-term opportunities and help in the longer-term development of semiconductor ecosystems.

- India and US also set up a quantum coordination mechanism with participation from industry and academia.

- They agreed to focus on the shared production of key items of mutual interest in the field of defense manufacturing.

- A new innovation Bridge will be established to connect defense startups on both sides.

- India and US agreed to launch a public-private dialogue that will cover 5G and 6G and Open Radio Access Network (ORAN).

Topic: Indian Economy

9. Rs 5.94 lakh crore has been allocated for Defense in the Budget 2023-24.

- Government has allocated Rs 5.94 lakh crore for Defense, 13% more than the previous year’s allocation. It is 13.18 % of the total budget.

- Non-Salary revenue outlay has increased from Rs 62,431 crore in Budget Estimates (BE) 2022-23 to Rs 90,000 crore in BE 2023-24.

- The Budget has emphasized upon the modernisation and Infrastructure Development of the Defence Services.

- The capital budget of the Border Roads Organisation (BRO) has been increased by 43% to Rs 5,000 crore in FY 2023-24.

- The budget allocation to DRDO has increased by 9%. Rs 23,264 crore will be allocated to DRDO in BE 2023-24.

- To encourage technology development and strengthen the Defence Industrial ecosystem, 116 crores and Rs 45 crores have been allocated to iDEX and DTIS respectively.

- Rs 1.38 lakh crore has been allocated for Defence Pensions. The Defence Pension Budget registers a jump of 15.5 % in FY 2023-24.

Topic: Awards and Prizes

10. Manmohan Singh conferred with Lifetime Achievement Honour in UK.

- Former Prime Minister Dr Manmohan Singh conferred a Lifetime Achievement Honour by the India-UK Achievers Honours in London.

- He received the honour for his economic and political contributions.

- National Indian Students and Alumni Union (NISAU) UK will hand over the award to Dr Singh in New Delhi at a later date.

- The India-UK Achievers Honours by NISAU UK in association with the British Council in India and the UK’s Department for International Trade (DIT) honours the achievements of Indian students who studied at British universities.

- Over the years, many Indian leaders went to the United Kingdom for their studies. The educational partnership is very important for the India-UK relationship.

- To mark 75 years of India’s independence, India UK Achievers will honour 75 high achievers and some Outstanding Achievers, who strengthen India-UK ties.

- British-Indian Karan Bilimoria received the Living Legend Honour at the awards ceremony on January 25.

- Parineeti Chopra, Aam Aadmi Party (AAP) spokesperson Raghav Chadha, Serum Institute of India CEO Adar Poonawalla and Indian women’s football team goalkeeper Aditi Chauhan are among the Outstanding Achievers.

Topic: Indian Economy

11. Union Budget for 2023-24 presented by Finance Minister Nirmala Sitharaman in Parliament on 1 February.

- Presenting the last full budget of the second term of the Narendra Modi government, Sitharaman said that this is the first budget of Amrit Kaal.

- The vision of Amrit Kaal includes strong public finances and a technology-driven and knowledge-based economy with a strong financial sector.

- She said that this year's budget fulfills the vision of a prosperous and inclusive India.

- She stated that the economic growth rate is estimated to be 7% in the current year.

- Capital investment outlay will be increased by 33% to Rs 10 lakh crore, which will be 3.3% of GDP.

- The Government has decided to continue the 50-year interest free loan to state governments for one more year to spur investment in infrastructure, with a significantly enhanced outlay of Rs 1.3 lakh crore.

- The Agriculture Accelerator Fund will be set-up to encourage agri-startups by young entrepreneurs in rural areas to focus on the agriculture sector.

- Agriculture credit target will be increased to Rs 20 lakh crore with focus on animal husbandry, dairy and fisheries.

- Under the PM Garib Kalyan Anna Yojana (PMGKAY), the government will bear an expenditure of about Rs 2 lakh crore for the supply of free food grains to all Antyodaya and priority households for the next one year.

- The outlay for the Pradhan Mantri Awas Yojana would be increased by 66% to over Rs 79,000 crore, furthering the government's target of Housing for All.

- Pradhan Mantri PVTG Development Mission will be launched with an aim to improve socio-economic conditions of the Particularly Vulnerable Tribal Groups (PVTGs).

- For the implementation of this mission, an amount of Rs 15,000 crore has been earmarked over the next three years.

- The Upper Bhadra Project in the "drought-prone" central region of Karnataka will be given central assistance of Rs 5,300 crore to provide sustainable micro irrigation and filling up of surface tanks for drinking water.

- In the new tax regime, the exemption limit has been raised to Rs 7 lakh from the existing Rs 5 lakh per annum.

- In the new tax regime, the highest surcharge on personal income tax has been reduced from 37% to 25%.

- Under the Citizen Savings Scheme, a provision has been made to increase the maximum deposit amount from Rs 15 lakh to Rs 30 lakh.

- In the Monthly Income Scheme, the maximum deposit limit on single account will be increased from Rs.4.5 lakh to Rs.9 lakh and for joint account this limit will be increased from Rs.9 lakh to Rs.15 lakh.

- To boost manufacturing of mobile phones in the country, customs duty relief has been given on the import of some parts and inputs like camera lenses, and the concessional duty on lithium-ion cells for batteries has been extended for another year.

- The basic customs duty on open sale parts of TV panels has been reduced to 2.5% to promote value addition in the manufacture of televisions.

- The import duty on silver dore, bars and articles has been increased to align them with that on gold and platinum.

- The rate of basic customs duty on compound rubber has been increased from 10 per cent to 25 per cent or Rs 30 per kg, whichever is less, to prevent duty rigging.

- The National Calamity Contingent Duty (NCCD) has been increased on specified cigarettes by about 16%.

- The government has increased the limit for cash deposits and loans in cash to Primary Agricultural Cooperative Societies (PACS) and Primary Cooperative Agriculture and Rural Development Banks (PCARDBs) to 2 lakh per member.

- Payments received by Agniveers from Agniveer Corpus Fund has been exempted from taxes.

Topic: Indian Economy

12. Rs 2.4 lakh crore capital outlay provided for Indian Railways.

- On 1 February, Finance Minister Nirmala Sitharaman made a record allocation of 2.4 lakh crore rupees for the Indian Railways in her budget.

- Sitharaman allocated Rs 1,40,367.13 crore for the rail industry in the previous budget.

- This is the highest ever outlay in the history of Railways, nearly nine times the outlay made in 2013-14.

- Indian Railways plans to build at least 500 Vande Bharat Express trains, achieve 100% electrification, and implement an ambitious station redevelopment plan.

- Apart from the Vande Bharat Express, the Railways also plans to refurbish the coaches of major trains like Rajdhani, Shatabdi, Duronto, Humsafar and Tejas.

- Indian Railways will come up with 35 hydrogen-fuel-based trains to focus on clean energy.

- Apart from this, the manufacture of 4,500 newly designed automobile carrier coaches with side entry, 5,000 LHB coaches and 58,000 wagons is also expected to get a boost.

- The government plans to start at least 75 Vande Bharat trains by August 2023.

- In 2016, the Narendra Modi government merged the Rail Budget with the Main Budget, which was earlier a separate Rail Budget.

Topic: Indian Economy

13. FM Nirmala Sitharaman made five major announcements regarding personal income tax while presenting Union Budget 2023-24.

- FM Nirmala Sitharaman proposed to raise the rebate limit to Rs. 7 lakh in the new tax regime.

- A person in the new tax regime with income up to Rs. 7 lakh will not pay any tax.

- In both old and new tax regimes, persons with income up to Rs. 5 lakh currently do not pay any income tax.

- Finance Minister also proposed a change in the tax structure in the new personal income tax regime.

- The number of slabs has been reduced to five and the tax exemption limit has been increased to Rs. 3 lakh. New tax rates are given below.

|

Total income (Rs.) |

Rate (per cent) |

|

Upto 0-3 lakh |

Nil |

|

From 3-6 lakh |

5 |

|

From 6-9 lakh |

10 |

|

From 9-12 lakh |

15 |

|

From 12-15 lakh |

20 |

|

Above 15 lakh |

30 |

- FM Nirmala Sitaraman proposed to extend the benefit of the standard deduction to the new tax regime.

- This provides relief to the salaried class and the pensioners including family pensioners.

- Each salaried person having an income of Rs. 15.5 lakh or more will benefit by Rs. 52,500/-.

- A standard deduction of Rs. 50,000/- to salaried persons and a deduction from family pension up to Rs. 15,000/- is currently allowed only under the old regime.

- Finance Minister proposed to cut the highest surcharge rate from 37% to 25% in the new tax regime for income above Rs. 2 crore.

- This would reduce the maximum tax rate to 39% from the present 42.74%.

- Finance Minister did not propose change in the surcharge for those who choose to be under the old regime in this income group.

- An extension of the limit of tax exemption on leave encashment to Rs. 25 lakh on the retirement of non-government salaried employees has been proposed.

- The maximum amount which can be exempted presently is Rs. 3 lakh.

- The budget proposed to make the new income tax regime as the default tax regime.

- However, the citizens have the option to avail the benefit of the old tax regime.

(Source: PIB)

Topic: Indian Economy

14. Nominal GDP is projected to grow at 15.4% Y-o-Y in FY2022-23 according to the Fiscal Policy statements.

- The real GDP is projected to grow by 7% year-on-year (Y-o-Y) as against 8.7% in 2021-22.

- As per the Fiscal policy statements, the Indian agriculture sector is projected to grow by 3.5% in FY2022-23.

- India has rapidly emerged as the net exporter of agricultural products in recent years. India’s agriculture exports reached $50.2 Bn in FY 2022-23.

- The total kharif food grain production is estimated at 149.9 million tonnes.

- This is higher than the average Kharif food grain production of the last five years.

- The industry sector and service sector are projected to show growth of 4.1% and 9.1%, respectively, in FY 2022-23.

- Private consumption is estimated to grow at 7.7% in FY 2022-23. Exports are estimated to grow at 12.5% in FY 2022-23.

- The share of exports in GDP (at 2011-12 prices) also increased to 22.7% in FY 2022-23.

- According to the Statement of Fiscal Policy, growth in FY 2023-24 will be supported by solid domestic demand and an improvement in capital investment.

- ‘Statements of Fiscal Policy’ were presented by Union Minister of Finance Nirmala Sitharaman along with Union Budget 2023-24 in Parliament on 01 February 2023.

- Real GDP is the GDP calculated at constant prices, nominal GDP is the GDP calculated at current prices.

1 February 2023 Current Affairs

1 February 2023 Current Affairs

Comments